December 9, 2014

Ahmedabad is the seventh largest metropolitan city of India, and has been the epicentre of Narendra Modi’s plans for Gujarat’s developments over the past years in which the city has seen tremendous rise in its infrastructural growth. New projects in Ahmedabad were just the start of city’s plans to over-power other metropolitan cities and to increase its rank. With Ahmedabad being the home various national and multinational organizations it is no brainer for Ahmedabad to possess a blooming Real Estate – commercial as well as residential. Ahmedabad is not only a mushrooming real estate and commercial centre but originally an industrial sector; the reason it is known as the Manchester of India is due to the presence of mills and other industries in Ahmedabad.

Ahmedabad is the seventh largest metropolitan city of India, and has been the epicentre of Narendra Modi’s plans for Gujarat’s developments over the past years in which the city has seen tremendous rise in its infrastructural growth. New projects in Ahmedabad were just the start of city’s plans to over-power other metropolitan cities and to increase its rank. With Ahmedabad being the home various national and multinational organizations it is no brainer for Ahmedabad to possess a blooming Real Estate – commercial as well as residential. Ahmedabad is not only a mushrooming real estate and commercial centre but originally an industrial sector; the reason it is known as the Manchester of India is due to the presence of mills and other industries in Ahmedabad.

What’s in store for you in Ahmedabad?

Ahmedabad has a huge variety and a budget efficient real estate market for an investor or buyer. Previously, Ahmedabad’s real estate dominantly consisted of individual bungalows and plots with no real property development. But with the new Gujrat model in the basket and other improvised plans to make the city bigger than ever this system has changed to construction of apartments with the most high tech facilities at the most moderate rates. This has resulted in various nationalized builders picking Ahmedabad as an ideal destination for construction of residential complexes and privatized cities. With facilities like: playing area, private swimming pools, high securitized complexes, theatres, religious places within the complexes, halls where events can be take place. In short, these facilities just indicate the desire of builders to provide modern and new flats in Ahmedabad but also see the comfort of the people and design modern houses according their convenience and affordability. With TATA affordable housing a new introduction to increasing list of developers in Ahmedabad, their names caries more facilities than just trust, their work has been phenomenal in other cities where state of the art facilities are available at “affordable” rates. New projects in Ahmedabad and change from individual housing to complexes have resulted in a huge increase in number of investors in the city.

Property Areas:

Properties are available at various prices for every end user. From a property worth 25 lakhs to 5 crores, for example. These new projects are planned on a wider scale and aren’t just constructed anywhere, making Ahmedabad are very planned and organized city. The satellite area is considered as one the most costly of areas in Ahmedabdad, though rightly it provides with the best of facilities considering the fact it is inside the city. Mostly all the areas a bit away from the city and takes maximum of an hour’s ride via rickshaw or bus to the main city. Transportation isn’t a problem; proper busses and rickshaw with well-maintained roads makes the ride smoother than ever.

Ahmedabad’s Real Estate in a nutshell:

Ahmedabad’s mixture of industrial, educational and commercial sector makes Ahmedabad an ideal residential real estate hub which has a huge growing demand. For example: just 5 months before, a friend of mine shifted to Ahmedabad from Mumbai because, property rates in Ahmedabad is less than Mumbai and they provide better facilities at the same rate with a much cleaner and calmer environment. With state of the art infrastructure and various national and multinational firms and educational institutes in store Ahmedabad is not short of a paradise.

Flats in Ahmedabad are all value for their money as the facilities that are provided with the apartments. The city’s been on a tremendous rise in the past 20 years or so, making the city an educational, industrial, commercial and most recently a residential power-hub.

Tags:

economy,

investment,

money,

mortgage,

Property,

property investments,

real estate

February 27, 2014

Venturing into property investment can be exciting, volatile and daunting. It can also be very profitable. Ron Bakir is the CEO of HomeCorp, a large Australian urban planning company that has developed more than 1,500 residential lots across the country since its genesis in 2004. Using his wisdom, here are five reasons why you should purchase an investment property.

Venturing into property investment can be exciting, volatile and daunting. It can also be very profitable. Ron Bakir is the CEO of HomeCorp, a large Australian urban planning company that has developed more than 1,500 residential lots across the country since its genesis in 2004. Using his wisdom, here are five reasons why you should purchase an investment property.

Rental Income

One of the biggest benefits of getting into the property investment game is the receipt of rental income. Many property owners rent out their apartment, house or office space to tenants and then simply use the rent money to help pay off the mortgage. Remember to do the maths before you invest and ensure that you will receive an adequate amount of rental income to offset the cost. Ron Bakir and the team at HomeCorp also know the importance of creating supply where there is demand; is your property’s location popular with renters?

Diversification

If you’re a smart, dedicated investor, chances are that you have a diversified portfolio. This means investing your money in different asset classes, such as defensive instruments (fixed interest and cash) and growth instruments (property and shares). By doing this, you are minimising the risk that comes with investing. Think about it: if you have invested solely in shares and the market takes a dive, where does that leave you?

Freedom

Sometimes the simple things in life are the best. When you own an investment property, much like owning your own home, you are completely in control. You get to choose which type of property you will have, which tenants to lease to, what the property will look like and you can always move into the property yourself if need be. Unlike a homeowner, however, you receive the benefit of having tenants to help you make mortgage repayments instead of shouldering the entire burden alone.

Tax Benefits

Depending on your country’s tax system, there may be significant tax benefits if you purchase an investment property. Often, deductions can be claimed for expenses such as interest from any loans you paid, agent fees, depreciation, council rates, advertising, and repairs and maintenance. Ensure that you research this well in order to fully take advantage of any potential gains.

Appreciation

When you purchase something such as a car, over time it will naturally depreciate in value due to wear and tear. Similarly, the furniture and appliances within your investment property will decrease in worth as your tenants use them. Your property may even need repairs or renovations from time to time. The unique thing about property, however, is that it can increase its value or appreciate. This is, of course, if you have chosen your property wisely; if you’re in a property hotspot, your property’s value will skyrocket before you!

Will you be taking the plunge and investing in a property? Or are you a seasoned investor with tips to share? Share your thoughts now by commenting in the box below.

Tags:

economy,

Interest Rates,

investments,

loans,

money,

mortgage,

Property

February 9, 2014

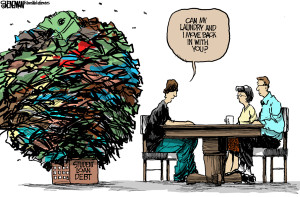

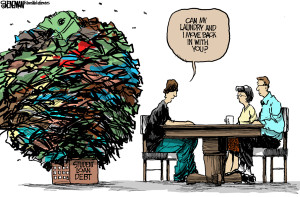

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Tags:

budgeting,

debt,

financial planning,

money,

mortgage,

Students Loan

October 24, 2013

The recent proposal by UAE Central Bank to introduce a mortgage loan-to-value (LTV) cap – 75% for expats and 80% for UAE nationals – is one of the many measures that the government is working on to deter excessive borrowing, check the proliferation of cash buyers in the market who make up the majority of property purchasers in Dubai. Cash purchases have long since dominated Dubai’s real estate market – with cash-rich buyers usually acquiring properties to lease them out or sell them at an immediate profit – in contrast with end users who buy homes to live in.

The recent proposal by UAE Central Bank to introduce a mortgage loan-to-value (LTV) cap – 75% for expats and 80% for UAE nationals – is one of the many measures that the government is working on to deter excessive borrowing, check the proliferation of cash buyers in the market who make up the majority of property purchasers in Dubai. Cash purchases have long since dominated Dubai’s real estate market – with cash-rich buyers usually acquiring properties to lease them out or sell them at an immediate profit – in contrast with end users who buy homes to live in.

Today, with sale prices and rents accelerating, people looking to are looking for better value for money – not just lower interest rates, but terms and conditions and exit fees. Mortgage companies are also ensuring that clients are thoroughly vetted before lending to them. While further information regarding the mortgage cap is expected to be announced in the fourth quarter of this year, industry professionals have shown skepticism regarding the negative effects the decree may have on the real estate and mortgage industry. Hence, it is imperative that a balance is achieved between keeping mortgage opportunities attractive enough to encourage end users to buy Dubai property and at the same time act cautiously to keep speculators at bay.

In another turn of events, Dubai Islamic Bank (DIB) announced in August that it would offer UAE nationals mortgages worth 100% of their property’s value with regard to the Mohammad Bin Rashid Housing Establishment for a 25-year period. On a similar note, the government-owned Tourism Development and Investment Company partnered with Abu Dhabi Islamic Bank to offer investors 100% mortgages for luxury residences on Saadiyat Island.

This year also saw for the first time, home financing of select off-plan properties to non-residents who wish to buy a property in Dubai as a holiday home or simply invest in a second home. Mortgage providers have also been extra cautious, examining and checking all aspects of a customer’s credibility and that of the developer’s as well. However, with the number of off-plan property purchases on the decline as compared to figures before 2008, this doesn’t seem to be a cause for concern.

Throughout the course of his year, the government has made tenacious efforts to build checks and balances into the system and arm mortgage providers with the information they need to make sound lending decisions. A good example would be the recent proposal by the Dubai government to set up a judicial panel to oversee the liquidation of stalled property projects in the emirate. Such a move will offer investors a viable alternative to time consuming and expensive court procedures and enhance investor confidence.

At the end of the day, people like to invest in a market where they know their rights are protected. While there is no doubt that Dubai’s property market is maturing and the double-digit growth a reason to cheer, the 2008 downturn has surely taught us that slower and steadier progress is far better than faster, unsustainable growth.

Tags:

Home Finance,

Interest Rates,

loans,

mortgage,

Property

August 16, 2013

Home owners are able to cash in on the value of their property through an equity release scheme. They can do this without actually having to sell their property and find a new home. Two schemes exist to make this possible:

Home owners are able to cash in on the value of their property through an equity release scheme. They can do this without actually having to sell their property and find a new home. Two schemes exist to make this possible:

- Reversion schemes

- Lifetime mortgages

When you decide to release the equity of your home, deciding which option to go for is but one of many decisions you will have to make. This is why comparing equity release schemes is so important. You should seek not just financial advice, but legal advice as well. When you take money out of the value of your home, this could have a serious financial consequence and you have to be prepared for that.

Equity Release

Equity is surplus value in your property. A home that is worth £200,000 with a £100,000 mortgage has £100,000 in equity. However, equity release schemes aren’t available for anybody, but usually only to older people (over 55 for a lifetime plan and over 60 for a revision plan), who are unlikely to have a regular income.

Most people choose a lifetime mortgage. Here, you essentially take a loan out on the property, which remains yours. The debt has to be repaid when you die or go into long term care, meaning no monthly payments are needed. However, the interest does accumulate, which means you will owe a lot more than you originally owned. So, a £45,000 loan could turn into £152,387 after 25 years.

The drawdown version is the most popular lifetime mortgage. This is for those who don’t need a huge lump sum straight away. Instead, they can dip into a pot of money as and when needed. No interest is paid on the money that is not released.

The other option is the revision scheme. Only very few people use this. Here, you sell your home or part of it to a company, but you retain the right to live in that home. When you die or go into a home and sell the property, you only receive money on the percentage of the home you still own, which is often nothing. You also generally have to pay rent to the company that has purchased your home or part of your home from you.

Do bear in mind that releasing equity in your home can be costly. Usually, you will have to make at least a £1,500 fee and your financial adviser and solicitor will have fees as well.

Tags:

Assets,

economy,

Equity,

Home,

Interest Rates,

money,

mortgage,

Owners,

Property,

real estate

Ahmedabad is the seventh largest metropolitan city of India, and has been the epicentre of Narendra Modi’s plans for Gujarat’s developments over the past years in which the city has seen tremendous rise in its infrastructural growth. New projects in Ahmedabad were just the start of city’s plans to over-power other metropolitan cities and to increase its rank. With Ahmedabad being the home various national and multinational organizations it is no brainer for Ahmedabad to possess a blooming Real Estate – commercial as well as residential. Ahmedabad is not only a mushrooming real estate and commercial centre but originally an industrial sector; the reason it is known as the Manchester of India is due to the presence of mills and other industries in Ahmedabad.

Ahmedabad is the seventh largest metropolitan city of India, and has been the epicentre of Narendra Modi’s plans for Gujarat’s developments over the past years in which the city has seen tremendous rise in its infrastructural growth. New projects in Ahmedabad were just the start of city’s plans to over-power other metropolitan cities and to increase its rank. With Ahmedabad being the home various national and multinational organizations it is no brainer for Ahmedabad to possess a blooming Real Estate – commercial as well as residential. Ahmedabad is not only a mushrooming real estate and commercial centre but originally an industrial sector; the reason it is known as the Manchester of India is due to the presence of mills and other industries in Ahmedabad.

Recent Comments