October 21, 2017

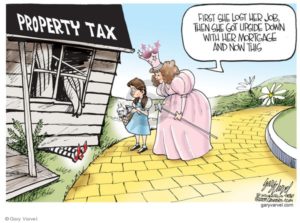

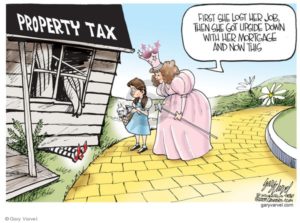

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

October 20, 2017

We always try to increase our assets. If we are earning more than we also save more. Sometimes we are investing in gold; we are purchasing new bonds even we are investing in stock market. But I have observed that people love to purchase new land or will increase their property. Here a real estate agency takes place.

We always try to increase our assets. If we are earning more than we also save more. Sometimes we are investing in gold; we are purchasing new bonds even we are investing in stock market. But I have observed that people love to purchase new land or will increase their property. Here a real estate agency takes place.

Now many business houses expanding their business in real estate so we are finding more real estate projects everywhere. Even these real estate agencies are giving more offers to their clients. Every country has their different real estate laws. While choosing your real estate company you can take guidance from your financial advisor regarding where to go & how. Following are the points which you need to keep in mind & I am sure these points will help you.

1. Market reputation

While choosing your real estate agency for new apartment or property you need to check what market reputation your agency has. If that real estate company is very new in the market try to avoid those companies. Go with the experienced one.

2. Previous completed projects

When you will select the experienced agency then check their previous completed projects. Check how many clients they have got for the same. Is all their created properties have been sold or not. If possible go to that completed projects & check how those are.

3. Take existing clients feedback

When you will visit to the live completed projects try to talk with their existing clients who has purchased from that real estate agency. Existing customers can give the actual views about their business because they have experienced their created properties.

4. About their competitors

Every business does have their competitors. Real estate business does have more competitors in terms of this. So, check your agencies competitors, if they are also big then go for this company. It means your agency do have some good position in this field.

5. Your specifications

While searching for your property you can set your specifications or expectations earlier. This will help your real estate agency to find the ideal property or apartment for you. If you want beach properties then specify your requirements. Here I can strike an example, recently I have visited Florida, USA & there I have found many rich beach side properties like Icon south beach, Aria on the bay, Santa maria brickell, Icon brickell etc. If you are the citizen of Florida & looking for beach property then you can search in this manner. I am sure you will get the ideal one as per your needs. In the same way you can search in the other countries also.

Before concluding the matter would like to tell you that think twice before you just jump for any real estate company because this would be a long term investment for you & the investment amount is also huge here. So, take proper assistance from your financial advisor & then go ahead. These real estate investments not only increase our property/assets it also includes more comfort in our life if your property or apartments are like that. Finally good luck from my end I hope these information will help you somewhere.

Tags:

Assets,

economy,

Financial Assistance,

investments,

Laws,

money,

Mortgages,

Property,

real estate

October 19, 2017

With so many startup companies, the competition is fierce. It doesn’t matter what field you’re in. It’s likely that there are many other entrepreneurs in your niche. The trick is finding a way to make your company stand out above the rest. For some companies, that means working with a startup accelerator.

With so many startup companies, the competition is fierce. It doesn’t matter what field you’re in. It’s likely that there are many other entrepreneurs in your niche. The trick is finding a way to make your company stand out above the rest. For some companies, that means working with a startup accelerator.

What is it?

A startup accelerator is an experience that supports the growth of an early company. To accomplish this growth, they provide education, mentoring, and financing. They give you a way to build your company from the ground up. The accelerator only lasts for a certain amount of time; it’s a rapid growth process. While the time period might be short, you can see a great deal of growth in the process. In only a few months, you can see the same growth that you would expect in years of hard work.

Start-up accelerators work for almost any type of industry you can imagine. For example, new insurance companies can benefit from Insurance accelerators. An insurance accelerator would specifically focus on growing a start-up insurance company. Meanwhile, a new clothing brand could find an appropriate accelerator to give them intense growth. There’s something for every company.

What makes them so special?

There are many different ways to cultivate a start-up. However, an accelerator is particularly effective. There are a few reasons for this. For one, there’s the fixed time frame. Instead of having an open-ended agreement with no true end date, you have a set time frame. It’s easier to analyze your results and predict your company’s future when you have strict time frame. You get results, and you get them before your time is up.

There’s also the fact that an accelerator uses mentorship to get results. Unlike crowd-funding campaigns and other types of investors, accelerators give you advice. While that advice helps your company in the present, it also helps your company in the future. You can learn invaluable business skills through mentorship. Additionally, you can gain insight into your industry and use that insight for years to come.

Finally, accelerators are cohort-based. For years, educators have seen the benefits of an education cohort-based environment. Those same benefits translate to business education. Being part of a larger group is a great way to grow your company.

Do accelerators really work?

While the concept of accelerators is sound, it’s important to ask yourself if they really work. It seems so, considering that many entrepreneurs would be happy to relive the experience. About 90% of entrepreneurs in a survey said that they would do the accelerator program again. Similarly, 95% of them said that the accelerator was worth equity stake that they lost. The time and equity lost in an accelerator program seems well-worth the gain.

An accelerator program might not be the right option for everyone. However, it could be the right option for your company. If you’re looking for a way to gain insight and knowledge while gaining momentum in your business, an accelerator is a great option. You could see huge business growth in only a short time.

Tags:

Business Insurance,

Capital,

Coverages,

economy,

insurance,

investments,

Law,

Legal,

money,

Returns

October 18, 2017

You and your family have made the decision to move out of your house and sell it. Or, perhaps you are wanting to sell an office building or a piece of vacant land. Most people think that there are only two ways that a potential buyer could pay for that property. Either the buyer has to have a load of cash or they must be able to get a loan from their friendly, neighborhood bank (or a less friendly mega-bank, but that is a discussion for another time).

You and your family have made the decision to move out of your house and sell it. Or, perhaps you are wanting to sell an office building or a piece of vacant land. Most people think that there are only two ways that a potential buyer could pay for that property. Either the buyer has to have a load of cash or they must be able to get a loan from their friendly, neighborhood bank (or a less friendly mega-bank, but that is a discussion for another time).

What is Owner Financing?

A third way of selling a property – one which has been used for centuries – is to offer owner financing. You could use owner financing to sell a used car, an appliance, or just about anything else of value, but using owner financing for real estate is the safest and most profitable way to do it. So, what is it? Owner financing means that you are acting in some ways like a small bank, albeit a nicer and easier-to- work-with bank. When selling the property, you receive a down payment from the buyer and set up a real estate note stating the interest rate, term, and monthly payments.

Let’s try an example in which you are wanting to sell a house valued at $100,000. You and Betty Buyer agree that she will give you a $10,000 down payment and make payments to you on the first of every month at an interest rate of 6% and a loan term of 30 years. An attorney or title company would normally prepare the needed documents, including the real estate note, a deed of trust (or mortgage, in some states), and a title commitment. Each side signs in the appropriate places, the deed of trust or mortgage is recorded with the county, and you are done.

Advantages of Owner Financing

- There are a number of positives from offering owner financing, which include:

Can be completed much more quickly than with a bank loan, and you have the flexibility to set up the note however you want, subject to state and national laws.

- The pool of potential buyers becomes much larger. They may be good credit risks but perhaps do not qualify for a bank loan.

- More income for you since you are recovering the original profit plus interest from the note.

4. It helps the buyer to purchase a property that they probably could not have otherwise have bought.

When Not to use Owner Financing

- Of course, owner financing is not appropriate for any of the following situations:

You, as the property owner, still owe a lot of money on the property to a bank or other financial entity.

- You need all of the cash from the property right away.

- You need the cash from the incoming payments to survive. If the payer ever defaults, you may need to pay for a foreclosure and go without the note income for several months.

What’s Next

You successfully sold the house to Betty Buyer and all of the documents were properly created and signed. The hard work is done, so you can mostly wait for the monthly payments to come in. However, at least once per year, you will want to make sure that the property has adequate fire insurance (with you as the primary beneficiary), that property taxes are kept current, and that the property is kept in good condition.

If, down the road, you decide that you need some cash out of the note right away, you can contact a note buyer. Good note buyers will explain that you can sell all of the note or just some of the payments, how the process works, and when you can expect to receive funds.

There are a lot of note buyers out there, with varying levels of expertise and integrity. Be sure to work with a real estate note buyer with whom you feel comfortable, that is a licensed real estate broker, and that has a high rating from the Better Business Bureau or a comparable entity.

Alan Noblitt is the owner of Seascape Capital Inc., which buys real estate notes and business notes. He may be reached at (858) 672-4678 or toll-free at 1-800-634-4697. If you would like to learn more about real estate notes and read informational articles, visit www.seascapecapital.com.

Tags:

Assets,

budgeting,

economy,

financial planning,

investments,

loans,

money,

Property,

real estate

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

Recent Comments