September 21, 2016

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Long Term Investing

The most important part of binary trading is to learn which of the available strategies best meets your needs and risk tolerance. Once you have established this you will be able to refine and improve your technique and obtain consistent, favorable results. When first starting in this industry it is best to stick to an area you already know something about and to stick to one asset type:

Trading with the Trend

One of the most straightforward approaches is to look at a price chart and see which direction the price is current moving in. If the general trend is up then place a call option, if down go with a put. Most traders place a trend line alongside the chart; from this you should be able to pick a price that the asset will not reach and utilize the no touch trade strategy.

Pinocchio

When the market is particularly volatile you may be expecting some rapid rises and falls in price. This chart will highlight when these events are likely to happen and allow you to trade accordingly. Alongside the usual price movement trades you can opt for a one touch trade where the asset drops (or rises) significantly and hits your expected price. This is higher risk but can be lucrative.

Sitting on the Fence

This is also known as straddling and is another good technique for a volatile market. Instead of trying to decode which direction a market is likely to move in you place two trades; one for it to go up and one for it to go down. The profit on either of these trades should cover the costs of both trades and generate a small profit. You are effectively decreasing your risk.

Reversed Risk

This is very similar to the straddling technique. However, with this strategy you need to place both trades, up and down, at the same time. You are guaranteed to get one of the trades right, but unlike the straddling technique you do not have a chance of getting both right.

The Hedge

This technique is very similar to the reversed risk approach, and serves to protect your funds and reduce risk whilst still generating a small profit.

Fundamental

An important strategy which should never be overlooked and works well in conjunction with any other technique is the analysis of the general economy and the specific situation of your chosen company. You will then be able to assess what the price is likely to do on the strength of the company and the economy.

We also suggest you to check 15 minute binary options strategy in order to rise the profitability of your trading.

Tags:

Best Forex Trade,

Currency,

Foreign Exchange,

Forex,

investments,

money,

Trading

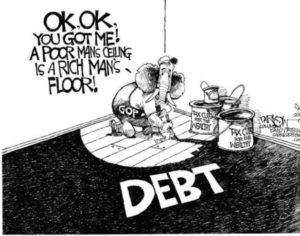

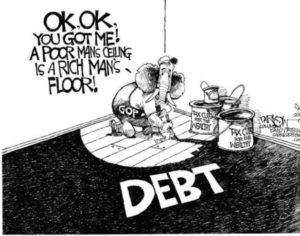

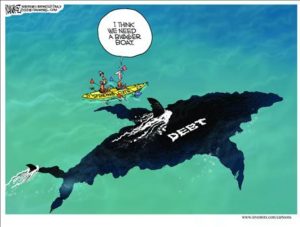

On a study made on debt, households are found more tensed in repaying their home debt. Home loan problems are found in almost all houses. However, since the problems are common in all section of people, there are solutions for everyone as well. That is, there are same types of home loans available for everyone, but the rate of interest depends on your income and the property you are buying. The real estate boon and people wanting to live in better areas with better facilities led to an increase in the various home loan policies.

On a study made on debt, households are found more tensed in repaying their home debt. Home loan problems are found in almost all houses. However, since the problems are common in all section of people, there are solutions for everyone as well. That is, there are same types of home loans available for everyone, but the rate of interest depends on your income and the property you are buying. The real estate boon and people wanting to live in better areas with better facilities led to an increase in the various home loan policies.

Have a well cut out blueprint

Creating a strong financial plan may help you to prevent falling in debt. It is like giving a blueprint to you. The realistic goals in you may help in paying off the debts that you may come across suddenly. Save for the future and set yourself a goal to reduce the excess payment if you are in debt. A proper budget may help you to attain this blueprint. The huge increase in cost of house furnishings and important miscellaneous expenses, this is essentially needed for the earning members. Save from your regular earnings and a part of savings.

Amalgamate your loans

If you are currently overpowered by debt and have no easy alternative to pay them back, then the only way is to consolidate your loans. This will make the management easier. This will also help you to know the exact amount, as in how much you are paying for your debt. Consolidation of debts brings debt smaller as it is more constructive and helpful in saving for the future repayment as well. Consolidation also sets in with a lower interest rate and hence, this will lower your total budget. The interest rate keeps on changing this will also be advantageous for your repayment.

Have an emergency person

To go through with consolidation, the person whose help you will need is the guidance of an expert. He may suggest you with the different schemes and schedules that have been regulated. These regulations are often beneficiary as they may lead you to help in repaying a lesser amount. The experts are aware of the rates that can be imposed on the total amount of debt. This will also help you to make an understanding about the total amount you need to save for your pay off. Consolidating experts may also help you in evading few home debts as there are such schedules. Home debts are started off interest free and have low rates presently. You can check out websites and click here to get the information.

Choose an authorized firm

Make sure to work with federally licensed firms to maintain legitimacy. When you are sharing your debt problems to any agencies, you are actually giving them your financial details. In this case you need to be aware about their legal expanse. This will only help you in reaching your financial goals. Home debts are such that often make people depressed from within and this can be avoided if you essentially have an authentic and licensed company to help you in managing your debts.

Tags:

Debt Problems,

economy,

financial planning,

loans,

money

September 20, 2016

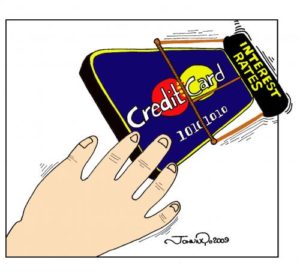

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

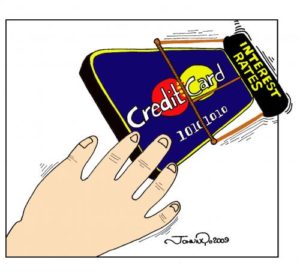

Taking control of your cards

Credit cards are sure going to offer you with the lucrative options of buying products, without carrying cash. Well, it becomes difficult, as you have to be aware of the reputed packages, over here. Moreover, when you are using credit cards, you are not aware of the money you are spending on it. Therefore, at the end of each month, when the generated bill reaches your address, you feel like facing some problems with it. With the help of reliable experts, you can be out of this problem.

Controlling the usage of cards

To get rid of credit card debts, you are most welcome to take help o home equity services. You will not just get the feeling of taking control of credit cards, but your auto loans are other forms of debts, with the help of this package. Using the home equity loans for debt consolidation is likely to enjoy lower interest rates, which are flexible and not static. All you need to do is just make single payment on a monthly basis, and you have the liberty to consolidate your debt.

Some services to work into

Now, you must be thinking about the reasons to choose debt consolidated forums through home equity loans. Well, you are about to pay less every month. You just need to lower your current monthly payment, and it will lower your interest rates, automatically. Moreover, you have the right to make simple payment, once. Here, the experts are going to combine the high interest debts and turn them into one fixed payment ratio, on each monthly basis. You will further enjoy peace of mind, with experts to be your help.

Simplify your life with ease

With the help of home equity, you have all the liberty to simplify your life, and enjoy it without facing any problem or hustle. You will further get into the path of brighter side around here, by managing your current debts. You have the liberty to borrow any money, from $25,000 to even $150,000. It solely depends on the loan package you are willing to choose. However, make sure to check out the amount first and see if you can repay it back, on time.

If you are struggling with credit card debt issues then it’s better to seek for credit card consolidation loans first. It will help you in making things better for you and you can go ahead with peace of mind.

Tags:

credit,

Credit Cards,

Debts,

Interest Rates,

loans,

money

September 19, 2016

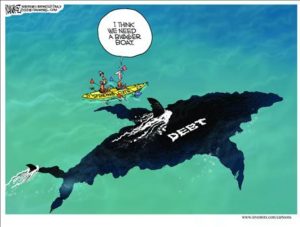

Home Debt is one of the most common occurrences you may face. A Home debt occurs when the borrower is unable to pay back the amount within his due time. Home Debt, in the beginning, may be a little confusing to you, but you have to find a way out of it. Home debt has pretty simple solutions, which if followed is bound to yield results. During the time you are in debt, you have to keep a tab on expenses, income, savings and different budgets.

Home Debt is one of the most common occurrences you may face. A Home debt occurs when the borrower is unable to pay back the amount within his due time. Home Debt, in the beginning, may be a little confusing to you, but you have to find a way out of it. Home debt has pretty simple solutions, which if followed is bound to yield results. During the time you are in debt, you have to keep a tab on expenses, income, savings and different budgets.

Supervision of your capitals

Management of funds during a debt is of utmost importance. The first step to that is to form a budget. You should assign a certain amount as your designated monthly budget and have to be careful in maintaining it. No matter what happens, you cannot allow yourself to go beyond the budget. Make a list of things of your Needs and Wants. This way, you will have an idea about your immediate requirements. You can keep you wants on hold for some time till your finance stabilizes. Make a list so that you pay off your bills by the end of the month. It will prevent a Home backlog at the starting of the next month.

Alternative Funds and Coverage

Insurance and some monetary benefit policy for you and your family turns out to be very advantageous for a debt. In the event of medical emergency, you can use your health insurance to cover the expenses. Hence, something as unpredictable as illness or accidents will not put a sudden strain on your finance. It is also vital for you to make an emergency fund. An emergency fund is something where you out in a portion of your salary for emergency purposes. Having an emergency fund and a health insurance during a debt makes it simpler for you to save during a crisis. A financial policy is something that you can use if the household debt situation worsens.

Paying back your obligations

To pay back your debts, you have to use a part of your income and part savings to maintain the balance. You can take up an extra job. It will help increase the revenue and make it easier to pay. You can make a plan of paying your debts. The smaller debts, you can pay back first. For the bigger debts, you can opt for a debt consolidation loan for bad credit; Debt consolidation is where all your large amount debts are converted into one loan. This loan has a lower interest rate than other loans. Lower interest rate means lower interest amount. You can also take help from non-governmental debt relief firms. They have the expertise as well as experience for all sorts of debt management. To know more about these, check out the various sites on net by tapping the click here icon.

Knowing your privileges

It is important for you to be aware of your rights during a debt crisis. You have the legal right to ask for the change in the payment arrangement for debts. You cannot go to prison on the eve of your inability to pay the dues. If the creditors feel that you have deliberately denied their payment even while you could afford it, they would ask for a negotiation. Many of your creditors are legally obliged to consider your request for a special payment arrangement during your Home hardship. Being aware of your rights will help you deal better with a stressful situation like these.

Tags:

budgeting,

debt,

financial planning,

Interest Rate,

loans,

money,

savings

September 16, 2016

Personal loan interest rates are not as low as home or education loan interest rates. So if there was a way to get a personal loan on rates lower than what are actually available, it can significantly help reduce the interest burden on the borrower.

Personal loan interest rates are not as low as home or education loan interest rates. So if there was a way to get a personal loan on rates lower than what are actually available, it can significantly help reduce the interest burden on the borrower.

There is indeed a way to reduce the interest rates on personal loans. This way is to take a loan against your fixed deposits. There are quite a few benefits of this. First of all, you don’t have to liquidate your deposits. Second is that generally, personal loan eligibility is dependent on your credit history, current income and ability to repay the loan. But in case of loan against FD, the lender won’t bother much about your credit history as he already has your fixed deposit as collateral.

The biggest benefit of loan against FDs is the lower rate of interest. Personal loan interest rates can easily exceed 15%. But a loan taken against fixed deposit charge interest rate that is just 3-4% more than the rate of fixed deposit. And this can significantly reduce your EMIs.

Let’s take an example.

Suppose you need Rs 3 lac as loan. You have a FD (earning 8% interest) but you don’t want to liquidate. So you decide to take a loan against it. Your lender is giving your regular personal loan at 16%. But as soon as you show intent to borrow against FD, the rates reduce to 11%. How does it impact your EMI given the repayment period is 3 years?

Your normal personal loan EMI will be Rs 10,547.

Your EMI for loan against FD will be Rs 9822.

Though this difference of few hundreds might look small, it can give you significant savings over the 3 year period. Calculations show that you can save more than Rs 26,000 in lower interest costs.

Do not forget that in case of default in loan repayment, the lender can foreclose your deposit to recover the outstanding amount. So do consider taking a loan against FD, if you want to lower your EMIs and also don’t want to liquidate your savings.

Tags:

budgeting,

car title loans,

cash,

Debts,

economy,

Interest Rates,

loans,

money,

Retirement Savings

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Recent Comments