June 30, 2012

Hiding and attempting to hide assets from a spouse is more common than most people think. While most people have a tendency to think that the husband is the one that may attempt to hide marital assets, women also attempt to hide assets, and both parties arrive at divorce court thinking that they should have more of the marital assets than they are entitled. In actuality, in divorce situations where one spouse is attempting to hide marital assets, it is usually the husband who is trying to commit this sneaky, unethical and illegal behavior.

Hiding and attempting to hide assets from a spouse is more common than most people think. While most people have a tendency to think that the husband is the one that may attempt to hide marital assets, women also attempt to hide assets, and both parties arrive at divorce court thinking that they should have more of the marital assets than they are entitled. In actuality, in divorce situations where one spouse is attempting to hide marital assets, it is usually the husband who is trying to commit this sneaky, unethical and illegal behavior.

The spouse who may suspect that the other partner is attempting to hide assets can take some precautions to expose the guilty party of any wrongful deceit. It begins with hiring a competent professional divorce team. One of the tools at the disposal of such professional team is a lifestyle analysis. The analysis process takes the married couple through a process where total living expenses are calculated and compared with stated and/or reported income. If there is a deficit between outgoing cash and income, it is usually an indication that one of the parties is attempting to hide income.

Other attempts to conceal assets include the following:

- Stashing money in a safety deposit box or some secret hiding place

- Purchasing items that are easy to conceal or overlook the value

- Deferment of salary, bonuses and commissions

These are just a few tricks that one party may try in order to conceal assets or hide income. Any time a spouse starts changing behavior patterns; this should trigger a red flag. Such changes may include additional and sudden “business trips”, opening additional bank accounts and being secretive about income and expenses, especially when it appears that exaggerations of expenses and significant decreases in revenue for the business owner. The spouse who is attempting to hide assets may have safeguards on his or her computer and is secretive concerning passwords to various online accounts.

The key to ensuring that one spouse is not attempting to hide assets is by being involved in all financial aspects within the household and any business, if applicable. Attempting to expose a spouse who has systematically been hiding assets over a lengthy period may be a difficult task, if not impossible. Failure to share in all financial matters should alert one to the fact that his or her spouse may not be honest.

It is also important to not only show interest but become involve with any interests or hobbies your spouse may have, especially at the beginning of the relationship. One of the parties may have an interest in collecting things of significant value that most people are not aware of, such as art, antiques, coins, stamps and other collectibles. Some of these assets, such as coins, are readily transported away from the marital residence and easily sold for cash, without leaving any type of paper trail.

Both parties need to have at least some idea of what types and amounts of assets that either or both of the individuals have purchased. In situations where a collection may have significant value, each party should have some type of documentation to support any claim they may have concerning such assets within the marriage.

The best stance that either spouse should take is that they do not deserve to be treated unfairly and that neither has to become a victim in a divorce situation. If one suspects the other of attempting to conceal marital assets, he or she should seek the advice of his or her forensic accountant so that proper actions may be taken.

Tags:

Assets,

Divorce,

financial planning,

Law,

Legal,

Spouse

June 29, 2012

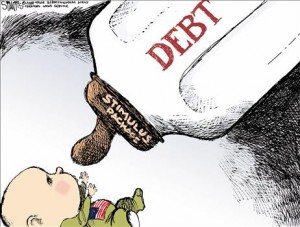

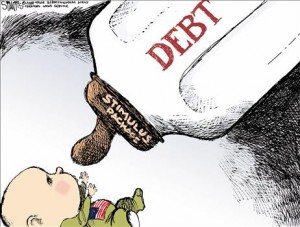

Not so long ago, ‘debt’ would have been a dirty word for many people. The financial crisis in Britain presently has led to people speaking about it candidly. Many will use an IVA to help extricate themselves from debt.

Not so long ago, ‘debt’ would have been a dirty word for many people. The financial crisis in Britain presently has led to people speaking about it candidly. Many will use an IVA to help extricate themselves from debt.

Debt has long been regarded as a taboo subject and people were decidedly reticent to talk about it. The current financial climate, however, has led to record numbers experiencing debt problems of one form or another. As a result of this, it is no longer considered controversial to discuss our debt problems with our friends and family. Debt management can be a particularly difficult due to spiralling living costs but many are beginning to see an IVA (individual voluntary arrangement) as a viable means of tackling financial arrears. Debt management in the UK is becoming increasingly difficult and the Citizen Advice Bureau views the current situation as ‘worrying’. Many in debt will use an individual voluntary arrangement with licensed insolvency practitioners to tackle their debt arrears.

Why are We in Debt?

There are a number of contributory factors to the current financial crisis that grips the nation. From the credit crunch to spiralling living cost, all are having a profound impact upon consumer’s finances and financial experts predict that insolvencies will hit record levels. One of the primary reasons that debt management is proving so tricky for many consumers across the UK is spiralling living costs. Energy bills, cost of food, petrol prices and all sorts of price hikes are hitting consumers in the wallet and those threatened with insolvency or bankruptcy are turning to an individual voluntary arrangement to help them out of their financial hole. Teresa Perchard of the Citizen Advice Bureau stated, “These latest figures paint a worrying picture, suggesting a significant number of households are struggling to meet their most basic living costs.”

IVA – A problem shared

Part of the problem with debt is the loneliness that is associated with it but many are finding that the increasingly accepting attitude surrounding debt is making it easier to get their finances back on track. Many financial experts believe that, when it comes to debt management, an IVA is an excellent means of tackling debt problems head on. An IVA is a legally binding contract between creditors and those in debt and it allows them to pay back their outstanding arrears at a level that is financially feasible for them. Research conducted by Alliance & Leicester found that people are now more likely to talk about debt issues than they are about sport or celebrities.

IVA – Growing debt concerns

The primary reason that people are seemingly more amenable to discussing debt is the fact that money matters and financial concerns are on the mind of the majority of consumers in the UK. Ewan Edwards of Alliance & Leicester states, “Our survey reveals money matters have a firm place at the forefront of people’s minds at the moment.” With insolvency set to reach record levels, many consumers who are swamped in debt are looking for a financial solution to appease their creditors and increasing numbers are opting for an IVA in order to do this.

Tags:

budgeting,

debt,

Debt Consolidation,

economy,

financial planning,

money,

personal finance

June 27, 2012

Recent data from Swinton Car Insurance reveals the makes and models of cars which have recorded the lowest number of speeding convictions in the UK. The research compiled from Swinton Car Insurance covers 545 from over 60 manufacturers. Input your car make and model into the app and discover whether you are a speed demon or a road angel.

Recent data from Swinton Car Insurance reveals the makes and models of cars which have recorded the lowest number of speeding convictions in the UK. The research compiled from Swinton Car Insurance covers 545 from over 60 manufacturers. Input your car make and model into the app and discover whether you are a speed demon or a road angel.

Research suggests that the safest road users include drivers of the Volvo 360, Hyundai I40 and the Datsun Cherry. On the opposite end of the spectrum we have the speed demons including the Chrysler Ypsilon, Daewoo Lacetti and TVR Griffith 500 Convertible. What type of driver could you be? The Swinton Speedometer is linked to Facebook and Twitter allowing you to share your result with your friends and followers.

When looking at new car insurance policy it is vital to ensure that all eventualities are covered so that you are protected. Car insurance policies vary dependent on your needs. Classic car insurance for example may have extra emphasis on maintaining the bodywork of your vintage car in pristine condition. Car insurance for young drivers also varies; it can be a long process to find a great deal if you have only recently passed your test.

If you are looking for a great deal on your car insurance why not contact the specialist team at Swinton Car insurance who search the UKs top car insurance companies on your behalf to ensure that you get the best cover for your needs.

Tags:

Car,

Car insurance,

Coverage,

financial planning,

insurance,

investments

June 26, 2012

No one ever wants to think that something terrible might befall them or their family, or even their car, flat or home, but unfortunately, these things do happen. Many wind up in quite large amounts of debt, or even bankruptcy, simply because something that they were unprepared for happened, be it an illness, a car accident, or even a home repair disaster.

No one ever wants to think that something terrible might befall them or their family, or even their car, flat or home, but unfortunately, these things do happen. Many wind up in quite large amounts of debt, or even bankruptcy, simply because something that they were unprepared for happened, be it an illness, a car accident, or even a home repair disaster.

In most cases, insurance will cover the necessary damages, but not always, and that is where the concept of having an emergency fund comes into play. An emergency fund, also called a rainy day fund by some, is basically just as it sounds a stash of money which has been saved and is to be used in the event of an emergency.

Many people stockpile their emergency fund for things like sudden car repairs, say on the way to the office the brakes on your automobile start squeaking, unless you have planned for brake replacements, or have your rainy day fund in place, it could be quite difficult to just reach into the wallet and fork over hundreds of pounds for an unexpected issue. Home repair problems are another big source of uses for any emergency fund, a flooded shower, a termite infestation, a hole in the roof, are all things that can put any sort of emergency fund to use quickly.

And in this volatile economy, building up an emergency fund is an intelligent idea for if another deep market fluctuation occurs and jobs are made redundant, getting sacked, while certainly an unexpected disappointment, might not be quite as terrible if a few months mortgage were sitting in the rainy day fund.

So how to get started, right then, first things first, take a look at your budget and determine just how much funds you will be able to put away. Next, set up an automatic withdrawal from your account, preferably right at the same time you might receive each pay check, then you won’t even know the money was ever there. Set up these withdrawals each month, or even every two weeks. After six months or so of saving, you will be pleasantly surprised to find such a tidy sum sitting in your emergency fund.

The goal of this fund is really to never use it. Do not borrow from the emergency fund to go on holiday, or buy the family Christmas gifts, the funds in that account are only be used in case of an emergency. Once this fund is set up, you will be able to rest easily that if any unexpected crisis were to occur, you would be able to finance it with the money in your emergency fund (or at least partially finance it), and not skip much of a beat in your regular financial life. It is a piece of mind that is relatively painless to set up and get going.

Tags:

Business,

Cash Flow,

economy,

financial planning,

Funds,

money,

real estate

June 25, 2012

It might seem counterintuitive to some, but having a few credit cards in your wallet to be used in a smart manner is an excellent way to improve your credit score. As you know, having a high credit score is one of the keys to a financially successful life, if your score is mediocre to low then you will have a harder time acquiring loans, and the payments that you will make will pretty much always cost you more in the long run.

It might seem counterintuitive to some, but having a few credit cards in your wallet to be used in a smart manner is an excellent way to improve your credit score. As you know, having a high credit score is one of the keys to a financially successful life, if your score is mediocre to low then you will have a harder time acquiring loans, and the payments that you will make will pretty much always cost you more in the long run.

Millions upon millions of people get trapped by credit card debt every year, simply because they do not use the cards in a fiscally responsible way, and this not only causes a large debt, but it also can have quite a few personal implications as well.

The first way a credit card can help is that it shows a credit history. Always try not to cancel any credit cards because you have decided not to use them anymore, a long credit history, even for a card that has little use is far better than one that is only a few months or a year along because you decided to close all your old cards from five years ago. Anything that is new will show up with an inquiry on your credit report, which will bring your score down a bit for at least a few months and maybe up to a year, so try to hang on to as many older cards as you can.

If you do have some of these old credit cards, focus on using them every few months to buy something, for example fill up your tank with petrol using one of these cards every 2-3 months. This way the card appears to be active on your credit history, but it will not cause you any sort of undue burden to pay off when the bill comes due.

Another way you can use a credit card to your advantage is to ask for higher limits. Especially on those cards that are older. Higher unused limits will always help increase your score, especially if you keep your credit card debt at or below about 35% of the limit amount. It also shows that the credit card company has found you to be a trustworthy customer who is capable of paying bills and not racking up large amounts of debt.

The most important thing, however, is to always pay your bill on time. The very best option is to pay your bill in full and on time, but at the very least always aim to pay above the minimum balance and before it’s due. Nothing will be able to improve your credit score if you have consistently late payments each month; that will actually hurt your chances of getting any sorts of loans or other credit cards in the future.

Tags:

budgeting,

credit,

Credit Cards,

Credit Schore,

Debts,

financial planning,

money,

personal finance

Hiding and attempting to hide assets from a spouse is more common than most people think. While most people have a tendency to think that the husband is the one that may attempt to hide marital assets, women also attempt to hide assets, and both parties arrive at divorce court thinking that they should have more of the marital assets than they are entitled. In actuality, in divorce situations where one spouse is attempting to hide marital assets, it is usually the husband who is trying to commit this sneaky, unethical and illegal behavior.

Hiding and attempting to hide assets from a spouse is more common than most people think. While most people have a tendency to think that the husband is the one that may attempt to hide marital assets, women also attempt to hide assets, and both parties arrive at divorce court thinking that they should have more of the marital assets than they are entitled. In actuality, in divorce situations where one spouse is attempting to hide marital assets, it is usually the husband who is trying to commit this sneaky, unethical and illegal behavior.

Recent Comments