You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

Personal loans are unsecured form of loans. This means that lenders do not have any recourse on any security in case the borrow defaults. As a result, lenders give personal loans at higher interest rates to compensate themselves for higher default risk that they are taking.

So how do lenders decide what rate to charge from different personal loan customers?

Everything for lenders boils down to a simple concept, higher the risk, higher the interest rate. So from a borrower who is considered safe, lenders will charge lower interest rates.

There are several factors that are used to assess the risk – current income, income stability, profession, age, existing loan EMIs, past loan repayment history, etc.

So if you are in a stable job, have a good income and do not have too many existing loans, the lender will lend to you at a lower interest rate as you are considered a safe borrower with lower default risk. However, if you have too many loan EMIs and have not be regular in your repayments, then you will be considered a risky borrower and lender will increase interest rate at which personal loan will be give to you.

Your past loan repayment history, as depicted by your credit score plays a major role in your risk assessment. So if you are unsure about your perceived riskiness as a borrower, to get in touch with lenders to understand the interest rate ranges that are applicable to different types of borrowers. Once you know the possible interest rates, you can use personal loan EMI calculators to find out much you EMI will be.

Tags:

budgeting,

Debts,

loans,

money,

personal finance,

savings

This article was wrote by US Business Funding, a company that provides Small Business Loans, Working Lines of Credit, Equipment Financing and much more.

This article was wrote by US Business Funding, a company that provides Small Business Loans, Working Lines of Credit, Equipment Financing and much more.

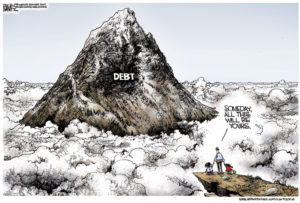

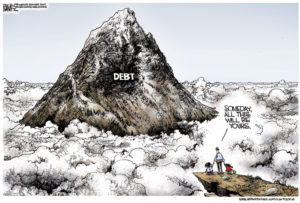

Whether it’s the shopper obligation on Visas, understudy advances or a home loan, a great many people get themselves weighed around obligation eventually in the shopper’s lives. This can have us working employments we detest just to compensate the debts and stay up our minds above water. It is by figuring out how to kill obligation quick you can discharge this weight and expel a portion of the anxiety from your fancy life.

Today this article will demonstrate how to kill your obligations as quick as would be prudent utilizing the Method of Stacking.

Stop New Debt Creation

The vast majority doesn’t get preparing in taking care of cash and live inside their methods. In case you’re in the red then you’re likely any of these individuals and it’s a great opportunity to chomp the truth projectile. It will be difficult to escape obligation except you reorient your money related propensities at this moment.

You should persevere against every one of the advertisers attempting to take away your well-deserved cash or offering simple account. You needn’t bother with more stuff that will make you cheerful. What you actually need is monetary genuine feelings of serenity.

So stop using your Visas or cut them up. This is literal. Placed them in holder of liquid and pile them in the cooler. At that point when there’s a chance to expend, you have sufficient energy to defrost (the owner and the charge cards) and truly choose in the event that you require that buy.

Interest Rate Ranking Your Debts

Make a rundown of everything of your obligations with sums and the loan fee. The most astounding loan fee ought to be the best for this is the thing that you’ll settle first. Settling your high intrigue obligation is the way to the method of stacking and paying off obligation as quick as could reasonably be expected.

Premium is a capable weapon and right now the bank or other monetary organizations are utilizing it against you. Intrigue fundamentally builds the sum you have to pay back and frequently we’re totally ignorant of the amount of that.

For instance, on the off chance that you have $10,000 Visa obligation at a 20% interest where you expend a base installment of $200 per month, this means that you will wind up spending 9 years 8 months to settle the genuine measure of about $21,680 incorporating $11,680 of interest!

Lower Your Rates of Interest

You can regularly bring down your charge card financing costs by doing an equalization exchange. This implies moving your Master Card to another lending company and that they will bring down the loan fee to take your company or business. Search around and attempt to take the least financing cost for the unbelievable longest possible term (ideally until it’s settled totally).

Simply ensure you’re perusing the terms and circumstances painstakingly so you will not get hurt by the fresh bank in different ways. Until you’ve completed this you may now arrange your rundown of obligation again if some stuff has changed.

Spending Plan:Creating a Strategy

This is the place we enhance your money related regulator from the first step. Take a bit of sheet of paper then record your salary after duty and every one of the costs that you consume. This will incorporate the base installments on your every obligation.

Take a gander at your costs and afterward rank them all together of significance to you. Take a gander at the things on the base of your rundown and choose whether you would rather have gander or be fiscally steady. The goal is to make a Spending Plan that is strategic, where your costs are below your salary.

You likewise choose the amount you will spend on every part of your whole life. You may apportion sums for rent, basic supplies, eating out, purchasing garments and different exercises however understand that once you have spent your designated cash there’s no plunging into different territories. It additionally has some good times,say that you can spend on what you like and an Emergency Account in the event that your auto separates and so forth.

You likewise need to incorporate into your Spending Plan that is very strategic as additional sum you are going to utilize to settle your obligations. Can you bear the cost of $20 per week? $50? $100? $200 or even more? It’s essential that you take a sensible number which you can focus on every week without fall flat and now this is Repayment Stacking of yours.

Repayment Schedule Creation

The initial segment of the method of stacking is to protect the base installment on each and every obligation you have. At whatever period you miss an installment, you cause charges and these include rapidly. This additionally incorporates making the base installment on the obligation with the most astounding loan cost.

At that point for the obligation with the most noteworthy loan cost (your Aim Debt) you are going to include the repayment stacking from your Plan of Strategic Spending. You should apply this Repayment Stacking and the base installment until that obligation is forked over the required funds.

As your formal least installment diminishes you say that additional sum to your Repayment Stacking. So like your base reimbursement drops your Repayment Stacking increments similarly. This will compose how quick you settle the Debt Target by adding much further to the reimbursements that you are making.

Progress Reward

You need to monitor your Debt Target so you will be able to see your improvement along the process. You can likewise settle on points of reference that you are going to rejoice and compensate yourself. A prize doesn’t need to cost cash however in the events that it does then it originates from your already distributed Plan of Strategic Spending.

This is a critical stride as it is going to keep your inspiration going just when you sense your self-control blurring. Much the same as you’ve prepared yourself to wash your hands and shower.Also, you can prepare yourself to deal with your cash. Feel awesome that you’re currently in going the 10% to 20% of individuals who are really dependable with cash.

Results Compounding

When you settle your Debt Target you have colossal festival and salute yourself. At that point you move your Repayment Stacking (which incorporates the past least installment also) to the following obligation with the most elevated loan fee. This turns into the new Debt Target that you are utilizing your Repayment Stacking sum in addition to the base installment for a new obligation.

This is the reason the Method of Stacking is so strong and capable. As you reduction an obligation you really expand your Repayment Stacking sum. This implies the second obligation will get settled off considerably speedier, the third significantly quicker than that, thus on thus on unless you are totally obligation free.

Be Kind to Yourself

Amid this procedure your resolution will be tried numerous times. Perhaps you’ll have a crisis like your auto separating or the necessity to go for a wiped out relative. The essential thing is not to hurl your lovely hands in despondency while backtracking to your past propensities.

Life will try your dedication to your fresh mindful cash state of mind and it’s dependent upon you how will you react. At the point when things turn out badly (and I promise they are) you have to disregard it and get yourself back to the track. Show sympathy when you coincidentally review your Plan of Strategic Spending and choose to improve one week from now.

The Method of Stacking is an effective apparatus however it’s dependent upon you whether or not you utilize it. On the off chance that you truly need comes about then get a hard copy of this article instantly and begin getting through the strides. It’s just by the choice you make at this moment that you won’t regret that an obligation free forthcoming and carry on with a monetarily mindful life.

Pay Debts Fast from a Low Income

When you initially began understanding this post, you may have trusted where it counts that obligation free living is for other individuals however not for you. This conviction was truly the main thing that was keeping you away from escaping obligation.

In any case, I trust eventually along the way you went to the acknowledgment that you can’t stay where you are at this moment without surrendering some of your greatest dreams and that in actuality (as in the inverse of disavowal you may have been living in as of recently) you need to roll out an improvement.

You now have every one of the apparatuses readily available to figure out how to improve a financial plan, get insane with sparing cash, and winning more cash to toss at your obligation.

Presently I need to abandon you with a couple more stories to get you significantly more persuaded that you can pay off your obligation quick regardless of the fact that you’re beginning with a low pay.

Knowing these things that are not taught in schools will make your business financial management easier for it will be a blessing to pay debts with just simple tips and techniques. All you have to do is to follow these tips and start paying your debs so that your business financial health will never be endangered again.

Tags:

budgeting,

Cashflow,

credit,

Debts,

financial planning,

money

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

Recent Comments