March 11, 2014

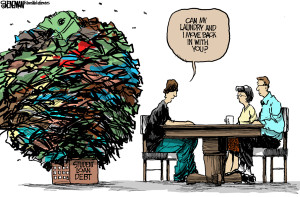

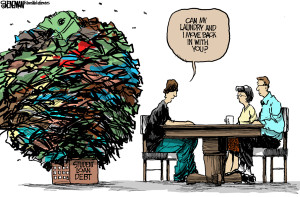

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

Checking essential registration

You must be aware that several agencies operate without proper licensure. Either they do not have the registration at all, or they have an invalid document. Working with dubious services can land you in deep troubles you do not want. Many identity theft services do rounds in the debt market. You can identify them by the unrealistic claims. It is impossible for a company to make a person debt-free within one week. You cannot just make thousands of dollars in debt disappear overnight! Money is not an illusory magic trick! It is the realest thing in defining a society. You need to be superbly realistic in facing money issues. Never forget to discuss the consequences and penalties of missing an installment. Always ask whether the service can provide their verifiable registration number. Follow this approach even when you apply online.

Identifying the right service

Of course, a company can facilitate consolidation within a week. It requires efforts, but a well-connected service can easily accomplish the task. Call the customer service in verifying whether they have the necessary systemic contacts. Check if they maintain stable connections with the bank and credit card services. The debt relief service must negotiate your consolidation with lenders. You may follow the official protocol of bankruptcy. Many services also offer consolidation on a one-to-one basis, without filing a bankruptcy claim. You have two claim options, the chapter 7 and the chapter 13. Discuss the appropriateness of both parameters with the debt rescue customer support.

Convenient loan provisions

The relief service essentially arranges the most convenient loan package. However, you need to verify whether the assigned conditions are compatible with your personal finance. Start with checking your monthly budget balance sheet. You can also use amazing online accounting resources to develop a balance sheet. See whether the credit repair agency has the necessary tools such as debt calculator and budget balance sheet. They may or may not have it. You can find many free online software solutions for the purpose. You must check the loan interest rate total value. Services also levy additional fees on the final amount. Inquire to interpret the exact amount you need to allocate every month for repayment.

You must find a service with the most helpful attitude. Their genuine helpfulness must reflect in different aspects of their service. See if they can adjust the service fees with the loan monthly installments. Understandably, it is extremely difficult for you to pay in lump-sum at the first. The convenient payment packages simplify things. The company should be able to present a clear blueprint of debt freedom. However, you may need to make some personal adjustments. Consider shifting to a debit card or a secured credit card. These can effectively assist in managing your credit bills. You do not even receive a bill with the debit card purchases. However, you need to look up legal options for certain specific loans that do not fall under the bankruptcy plea even.

Tags:

budgeting,

credit,

Credit Card,

debt,

debt freedom,

economy,

financial planning

March 10, 2014

Selecting a car finance service involves different aspects. You need to be sure on different levels. First, you have to find the best car meeting your preferences. Next, you must choose a good dealer who handles both buying and selling of cars. Finally, the customer has to select a suitable car financing service. Look up a website where all three parameters converge and transmute in a fluent system. You can find good sites where they connect you to the dealer after you provide the necessary inputs. You just need to type in your area zip code, and get dealer addresses right away. The financing packages should be convenient. The company should have a good customer support department. See if the support staff can help you in choosing a new automobile. Always ensure the loan service adheres with the golden guidelines of transparency, smartness, and helpfulness.

Selecting a car finance service involves different aspects. You need to be sure on different levels. First, you have to find the best car meeting your preferences. Next, you must choose a good dealer who handles both buying and selling of cars. Finally, the customer has to select a suitable car financing service. Look up a website where all three parameters converge and transmute in a fluent system. You can find good sites where they connect you to the dealer after you provide the necessary inputs. You just need to type in your area zip code, and get dealer addresses right away. The financing packages should be convenient. The company should have a good customer support department. See if the support staff can help you in choosing a new automobile. Always ensure the loan service adheres with the golden guidelines of transparency, smartness, and helpfulness.

Clarity in lending parameters

The company should maintain optimum clarity in lending parameters. Vague agreement conditions imply risky financial transactions. A simple car loan can ruin your life if you sign in to the wrong agreement. Always make sure you look critically to the terms and conditions. Connect with the support staffs if you find any part difficult to interpret. It is their usual job responsibility to explain all aspects lucidly. Evaluate the helpfulness of the professional at the other end of the phone. Ask whether the advertised rate is tax-exclusive. Inquire if the service levies additional charges. Verify the fixedness of the agreement during a loan tenure. Assess the practicality of the loan window. See whether you can accommodate the expense easily in your monthly budget plan.

The down-payment issue

The primary down-payment is vital. The best professionals always suggest clearing as much as you can in the first installment. If you deliver a lump-sum amount in the beginning, the loan value decimates significantly. The monthly responsibility becomes easily bearable. You can procure a handy amount by selling your old unit. Contact the dealer in seeing the price he can offer. Market conditions are such that you cannot expect a very high value on used units. Due to the mass-production factor mainly, the costs of used cars depreciate drastically nowadays.

The value drops to less than half the original amount in only a couple of years. You should research on used car rates. Find the reigning industry trends at automobile forums and review websites. You can easily negotiate with the dealer when you have a clear idea on the standard rates. Consider verifying whether the agency handles car salvation. The salvage automobile dealers are better payers than the junkyard agencies are.

The credit score issue

You may have a dismal credit rating. It is unnatural to have a good credit rating nowadays. You can confirm this from any random person on the road. The ambiguity and complexity of credit rating parameters bring down the values to drastically low amounts. You cannot help it because the economy is in a difficult state. The Government needs to compensate the huge national debt aspects. Your debt payments contribute in solving the crisis. So, you should not feel guilty because of a low score. Instead, you must celebrate your free spirit on the new cars. The lending service must have a similar attitude to credit ratings. A good service delivers on financial help promises irrespective of the credit ratings.

Evaluating all essential aspects soon ensures you are behind the steering wheels of your shining car. The dealer should hand over the keys right on the spot when you make the first installment payment. You chose the car after a test drive. You like how it moves. The overall feeling is immensely gratifying. Enjoy your new life in the transit cocoon. The car will be all yours only after a few convenient monthly payments.

Tags:

Auto Finance,

Car Finance,

Debts,

economy,

financial planning,

loans,

money

February 25, 2014

Business loans are leverage to help your company grow. You can expand in ways otherwise not possible. Business lines of credit improve your cash flow to meet expenses and pounce on opportunities. Meanwhile, equipment financing boosts productivity to meet customer demand.

Business loans are leverage to help your company grow. You can expand in ways otherwise not possible. Business lines of credit improve your cash flow to meet expenses and pounce on opportunities. Meanwhile, equipment financing boosts productivity to meet customer demand.

There are common questions to ask before applying for any business loan. Your chances of approval and ROI will improve with a basic checklist. Being realistic and organized also saves time, which is your most precious asset.

Here is a business loan checklist to consider:

Have Documentation Ready:

Organizing your financials is important for loans or otherwise. A periodic review of your statements gives insight to make informed decisions.

Assume that business lenders will ask for the following:

- Previous 2 years of Business and Personal Tax Returns

- 6 months of Bank Statements

- Current Income Statement

- Balance Sheet

- Business and Personal Credit Checks

Best Practice: Ask upfront what paperwork is needed. Providing excess paperwork can slow turnarounds and raise questions. However, having docs ready often has the opposite effect.

Connection between loan and financial review: A restaurant may notice that capital equipment no longer has useful life, in accounting terms. The loss of a write-off (depreciation expense) plus the need to make more food may show the need for equipment loans.

Similarly, youmay notice that a single company accounts for most of A/R. To improve cash flow, you may apply for a business line of credit and renegotiate terms with the client.

Understand the Lending Criteria Upfront:

You can spare time, fees and frustration by knowing what is needed to qualify.At minimum, get a sense of how likely it is your loan will be approved. If you’re a startup and 2 years of business tax returns are required, simply ask about alternatives. A good loan officer will refer you to other lenders who can help.

Be Realistic and Know Your Strengths:

What makes your business a strong loan candidate? Think in tangible terms of what can be documented and proved.

How profitable is your company? Banks like lending money to leverage as growth, rather than last ditch efforts to stay afloat. Businesses have different strengths. A manufacturer may have collateral in terms of equipment, or you may have stellar personal credit to get a business loan.

Know Your Alternatives:

As small business lending expands, loan options for those with challenged credit or unique needs has become more available.

If you were denied, determine the reasons for this. Was it lack of business credit? Your industry? (Bars or nightclubs can be difficult to finance) Not enough business history or income? You can find suitable alternatives based on the answers.

Alternatives:

Business Credit Cards: A business credit card is often easier to qualify for than a LOC. The credit limit is likely smaller, but you establish business credit history for future line of credit needs. Your strong personal credit may qualify for a business credit card. The card will be under your business Tax ID, but backed by a personal guaranty.

Equipment Loans: Capital equipment loans reduce concerns over collateral, which makes qualifying easier. Restaurants, manufacturers and offices may all turn to equipment financing.

Business Cash Advances:An alternative if you don’t qualify for lines of credit or credit cards.

Industry Specific Financing: Lenders who specialize in specific industries may offer options. Bar and Nightclub loans or medical financing are examples.

Best Practice: Ask if there are prepayment penalties, in case the loan is no longer needed or refinancing options become available. It is important to understand fees, interest rates and terms for all loans.

Tags:

Business,

Cash Flow,

Credit Score,

Debts,

economy,

financial planning,

loans

February 10, 2014

Debt consolidation loan is a big loan by which the borrower settles the existing smaller loans. The offer is highly beneficial to the borrower. However, the program has negative factors as well. It is necessary to understand the pros and cons of the offer before you opt for a debt consolidation program. The plan is good for certain situations. By consolidating your debts, you are relieved of the stress due to the need to follow different payment schedules. Concentrating on a single payment will help in finding better ways to clear the existing debts quickly.

Debt consolidation loan is a big loan by which the borrower settles the existing smaller loans. The offer is highly beneficial to the borrower. However, the program has negative factors as well. It is necessary to understand the pros and cons of the offer before you opt for a debt consolidation program. The plan is good for certain situations. By consolidating your debts, you are relieved of the stress due to the need to follow different payment schedules. Concentrating on a single payment will help in finding better ways to clear the existing debts quickly.

How does the program help to ease out your stress?

The monthly payments due to the loans get decreased when you choose a good debt consolidation program. The term of the loan is extended and so the amount that you pay is reduced significantly. It is possible to manage the debts that are beyond control. The poor credit loans with high interest rates can be cleared with the use of debt consolidation program. If an individual has various credit card dues with extremely high rates of interest, you can bring your debts under control by accessing a debt consolidation program with lower rate of interest.

With reduced monthly payments, you can make the payments comfortably and avoid penalties for late payments. Since the late payments also affect the credit report it is necessary that you make the payments on time which could be possible with lesser interest rates on loan consolidation programs. You need to take time to search for a program that comes with lower interest rates or else the purpose of the plan cannot be served. It cannot be always easy to get access to a good offer. Before you commit to a debt consolidation loan, you should understand that with extended term, you end up paying more on the loan than it is worth.

An important factor that you should understand the risk involved in the program. Mostly, the debts are consolidated with a home equity line of credit or home equity loan. Since the loan amount can be huge and there are some tax benefits, the offer might seem impressive. But defaulting on loans will result in the loss of the home. Though the credit card loans are very costly, there is no risk for the property as nothing is needed as security for the loans. But the loan consolidation is possible only with some collateral.

With a variety of loan consolidation programs, you have to shop around to find one of the best debt consolidation programs. The offers from the banks or the credit unions are highly reliable sources of debt consolidation loans and you can get good deals. Person to person no credit check payday loans lending sites and online lenders are some of the sources that can give you the offer that you need. If you are not able to decide whether you really need a debt consolidation program, you can consult your financial adviser to understand your exact needs and also to know about the offer that could help you ease out your financial situation.

Tags:

budgeting,

Debt Consolidation,

Debts,

economy,

financial planning,

money

February 9, 2014

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Tags:

budgeting,

debt,

financial planning,

money,

mortgage,

Students Loan

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

Recent Comments