July 27, 2024

Imagine coming home to find your roof caved in from a heavy snowstorm or walking into a flooded basement after a burst pipe. These nightmares can happen to anyone. That’s why multi risk home insurance matters. Your house is probably the biggest purchase you’ll ever make. It’s where you build memories and feel safe. But disasters don’t care about that. They strike without warning.

Imagine coming home to find your roof caved in from a heavy snowstorm or walking into a flooded basement after a burst pipe. These nightmares can happen to anyone. That’s why multi risk home insurance matters. Your house is probably the biggest purchase you’ll ever make. It’s where you build memories and feel safe. But disasters don’t care about that. They strike without warning.

A good insurance policy can be a lifesaver when things go wrong. It’s not just about protecting your things. It’s about peace of mind. No one likes to think about bad things happening. But being prepared makes all the difference.

In Toronto, where weather can be harsh and unpredictable, having the right coverage is crucial. Multi risk home insurance offers a safety net for all sorts of problems. It’s an investment in your future and your family’s security.

What is Multi Risk Home Insurance?

Multi risk home insurance covers many types of damage. It’s more comprehensive than basic policies. A standard policy might only cover fire or theft. Multi risk plans go beyond that. They can include protection for:

● Water damage

● Falling trees

● Vandalism

● Earthquakes

● Ice and snow damage

These policies give you broader protection. They’re a good fit for Toronto’s varied weather and urban risks. Multi risk insurance costs more than basic coverage. But it can save you money if disaster strikes.

Top Multi Risk Insurance Providers in Toronto

The insurance industry in Toronto is competitive. It has millions of residents and a booming real estate market. There’s high demand for quality coverage. Dozens of companies vie for customers and each trying to stand out. This competition is good news for homeowners. It leads to better prices and more innovative products.

In this crowded field, several providers stand out for their multi risk home insurance offerings.

Here’s a look at some top choices:

1. Multi Risk Insurance Brokerage: They are a reputed local company. They specialize in tailored policies for Toronto’s unique needs. The best part is they work with multiple insurers to find the best fit.

2. TD Insurance: It is known for customizable plans that let you pick and choose coverage options.

3. Intact Insurance: This company has a wide range of coverage options to suit different homes and budgets.

4. Aviva Canada: Has strong customer service ratings and a reputation for quick claim handling.

5. The Co-operators: Co-operators have comprehensive policies with a focus on community values.

Each company has its strengths. Multi Risk Insurance Brokerage leverages local knowledge. TD lets you tailor your coverage to your specific needs. Intact gives you lots of choices. Aviva is known for helping customers when they need it most. The Co-operators offer thorough protection with a personal touch.

When shopping for insurance, don’t just look at the price. Consider what’s covered. The company’s reputation.And how well they handle claims. Read reviews from other Toronto homeowners. Ask friends and family about their experiences. It’s worth taking the time to find the right fit. Your home is too important to settle for subpar protection.

Key Features to Look For

It’s crucial to understand what you’re getting. Policies can vary widely in terms of coverage and cost. Don’t rush the process. Take time to compare options and ask questions. A good policy should protect you from a wide range of potential issues without breaking the bank.

Here are key features to look for:

Coverage limits: Make sure they’re high enough to rebuild your home if needed. Don’t underestimate replacement costs.

Deductible: This is how much you’ll pay out of pocket before insurance kicks in. A higher deductible often means lower premiums, but make sure you can afford it if you need to make a claim.

Additional living expenses: If you can’t live at home during repairs, this covers hotel stays or rental costs. It’s a lifesaver after major damage.

Personal liability: Protects you if someone gets hurt on your property. It can cover legal fees and settlements.

Flood coverage: Important in some Toronto neighborhoods. Especially near rivers or in low-lying areas. Standard policies often don’t include this so ask about it specifically.

Sewer backup protection: Toronto’s aging infrastructure makes this a smart add-on for many homes.

Read the fine print carefully. Insurance policies can be confusing, so don’t be afraid to ask for clarification. A good agent should be able to explain everything in simple terms.

Some companies offer extras like identity theft protection or coverage for high-value items. Think about what matters most to you and your home. These add-ons can be worth it for peace of mind. But they’ll increase your premium. You should balance the cost against the potential benefits.

Tips for Saving Money on Multi Risk Insurance

There are many ways to save multi risk insurance which can be costly. Bundling your home and automobile will make good sense. Most discounts are given when doing so. When one increases their deductible it is less the monthly payments made by them. However, ensure you can bear higher out-of-pocket costs in case of claiming them.

Discounts for security systems are given by many insurance companies. It is worth asking about. Long-term customers sometimes benefit from less expensive premiums too. Each year reread your policy to avoid becoming over-insured as 40% of homeowners were found out in a certain research.

Never eliminate necessary coverage to save money because this may not be worth the risk. Inquire from your insurance agent regarding discounts available since they might know of some savings that never crossed your mind. Also always shop around before renewing so that you may discover other better deals. The residents of Toronto have to acquire multi-risk home insurance policies because they are very important.

These policies safeguard against several dangers including extreme weather conditions and burglaries thus making it comprehensive. Spend some time examining various options on offer if at all you want to see how different policies and providers compare against each other thereby allowing fair pricing without sacrificing good coverage.

Getting the right multi risk home insurance means relaxing knowing that your house is protected.

Tags:

budgeting,

Claims,

Home Insurance,

insurance,

investments,

money,

Policies,

Returns

November 10, 2020

In most cases, buyers’ offers have home inspections contingencies included. This means that, in making a deal, you have the right to inspect the property and, if needed, back out of the deal if the results are unsatisfactory.

In most cases, buyers’ offers have home inspections contingencies included. This means that, in making a deal, you have the right to inspect the property and, if needed, back out of the deal if the results are unsatisfactory.

Wanting an inspection shows you are a serious buyer so it can never be a bad idea.

Located in Šibenik, Terra Dalmatica offers you a hand in finding your perfect home! Giving every client an individual approach, we can together discover an ideal solution for you.

The condition of a home

Before the final answer, you have to be aware of repairs and costs your future home may require. Safety comes first, right?

Detecting problems such as carbon monoxide, radon or mould can be crucial in cancelling your offer.

Thinking ahead can save you from surprises and unforeseen legal problems.

Every room in your house needs a proper permit, otherwise, it can affect your taxes and insurance.

A space for improvement

Exercising your right for a home inspection leaves you the space to negotiate for a better deal or price reduction. Diagnosing the current condition of water heater, plumbing, and other installations helps you make budget plans.

Stick to your criteria and determine a cost over which you are not willing to go. Don’t purchase a home that is in the condition you are not personally satisfied with!

Trust a home inspector

A home inspector is your person of trust. He or she is a professional who can help and suggest some future actions – saving time and money, maintaining your home etc.

Buying a home can be one of the biggest steps in your life so don’t underestimate the importance of all the nuances of your home’s picture.

Be aware of the chance that, even though your home has the perfect colour walls and is in the perfect distance from your work, it may hide a lot deeper problems.

Insurance

By skipping a home inspection you can find yourself in a position in which you may not get some certification or documentation needed for home insurance.

This is why a home inspector plays an important role in your future!

Be responsible

If you buy a home without previously inspecting it, there is not much to do about it at this point.

Home inspections cost around 200-500$ – paying this amount can protect you from potentially a lot bigger costs in the future.

Should you skip a home inspection? No!

The reasons above give you an unambiguous answer – never skip a home inspection!

The risk from setting your money for home inspection aside, even if it turns out everything in your home is in a perfect condition, is much smaller than the risk of not being prepared for greater amounts of money you may pay for repairs your home might need.

The decision you make should be based on your wishes and standards – the professionals in Terra Dalmatica are always at your disposal. Find your perfect home – make all your wishes come true!

Tags:

budgeting,

economy,

Home Insurance,

loans,

money,

mortgage,

real estate

June 28, 2017

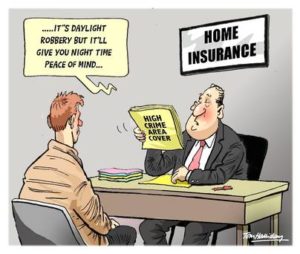

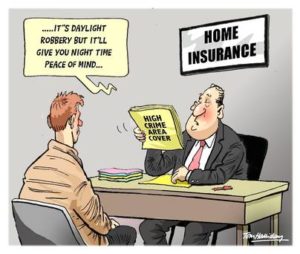

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Whether you’re renewing or buying insurance for the first time, be aware of some mistakes. Below, you can find out about things to avoid and possible solutions.

Incorrect coverage amount

Most people choose a wrong coverage because they replace the real and market value of their home. Others are prone to overestimate the coverage amount. Those people identify home insurance with dwelling coverage. It pays in case of a damage caused by a covered danger like hail, storm, fire, and so on. The amount of dwelling coverage has an effect on limits for other coverages. For example, the limit for the contents coverage is set at 50%-70% of the dwelling coverage. So, how to evaluate the right dwelling coverage? There are various online home insurance calculators that address this issue.

Insufficient coverage for home rebuild

The majority of houses are not valued for insurance purpose. What would happen if those houses get destroyed beyond repair? The homeowners will not have enough insurance coverage to rebuild their homes.

How to avoid this mistake? It’s a good idea to hire a cost estimator who specializes in home replacement. You may also contact your contractor or a local builder. This is a cheaper option, but the assessment is not that precise as you get by a professional cost estimator. Once you’ve found out how much it costs to rebuild your house, you need to determine insurance coverage. Make sure to include all the valuables and improvements you have recently made.

Failing to look around

There are a lot of insurance providers and agencies today. They vary widely in how they estimate risk and how they determine the costs of home insurance. Some companies offer notably higher premiums than others. Don’t stop at the first insurance agency you run into. You should look around for the best deals instead. Try to find a quality yet affordable coverage that you are comfortable with.

Wrong deductible

Many people make mistake when setting the deductible. This is the amount of money that an insured pays before his/her insurance kicks in. This amount is paid toward a claim. Many insurance buyers set a wrong amount – either too high or too low. You can save a lot of money on your premiums by manipulating your deductible. As a rule of thumb, the lower the deductible, the higher the premium. But your finances could be left “askew” if the amount of deductible is too high. And if you are not able to come up with it when your home gets damaged by a disaster. You will pay more in premiums if the deductible is too low. Consult an insurance expert to hit the right balance.

As you can see, these issues are pretty complex. So even the most experienced insureds can make mistakes. Your best choice would be to consult an experienced insurance broker, though. Insurance brokers milton can help you get a quality home insurance products.

Tags:

Claims,

Coverage,

economy,

Finance Advisor,

Home Insurance,

insurance,

money,

personal finance,

Premiums,

Returns

April 27, 2012

The world is an unpredictable place and even the most careful person can happen upon unforeseen events that can turn their existence upside down. That is why it is increasingly important for homeowners to purchase home insurance and for anyone with a family to look after to consider purchasing life insurance.

The world is an unpredictable place and even the most careful person can happen upon unforeseen events that can turn their existence upside down. That is why it is increasingly important for homeowners to purchase home insurance and for anyone with a family to look after to consider purchasing life insurance.

Taking out these two policies will provide peace of mind and more importantly, will make things so much easier to deal with in case of an unexpected, unfortunate incident.

Home insurance

Home insurance policies — which can also be known as hazard insurance or homeowners insurance — are property insurance that cover private residences. These policies typically cover the physical structure of the house as well as personal belongings inside the house, and liability. Since all of this is covered under one policy, the homeowner pays just a single premium. Home insurance and life insurance policies have some similar history.

Home insurance is a relatively new type of insurance in the United States, where the first official policy was available in 1950 — shortly after World War II and the subsequent boom in middle class home ownership. Home insurance was available in Great Britain before that year, and was available in other forms in parts of the United States, but it was not known as home insurance and did not do quite the same thing.

Life insurance

While home and life insurance both give peace of mind, life insurance has been providing that relief for far longer, as it has been available in varying forms for centuries. Life insurance is currently available in two forms: term — or temporary — insurance, and permanent insurance. There are also policies available that cover just accidental death and do not cover such things as suicide or health problems, and are typically sold for a much lower premium because of this fact.

Why choose insurance?

Any homeowner who does not get home insurance is playing a very risky game — one where the consequence for losing can be the loss of hundreds of thousands of dollars. Anyone who owns a home should have a home insurance policy. Life insurance is a bit more tricky, but it still makes sense to have some sort of policy so that in case of death, loved ones are taken care of and the cost of a funeral is covered.

Both of these policies provide something priceless: the ability to go to sleep at night with less worries and more security.

Tags:

financial planning,

Home Insurance,

insurance,

Insurance Advice,

money,

personal finance,

Policy

March 13, 2012

The need for home insurance is critical. The risk of losing one’s home or the myriad of valuable items inside it can be both mentally and financially catastrophic. However, at the very least the financial burden can be minimized by having proper home insurance. While you may feel the risk is minimal, an incident need only occur once to have serious consequences on the rest of your life.

The need for home insurance is critical. The risk of losing one’s home or the myriad of valuable items inside it can be both mentally and financially catastrophic. However, at the very least the financial burden can be minimized by having proper home insurance. While you may feel the risk is minimal, an incident need only occur once to have serious consequences on the rest of your life.

Nevertheless, paying a high monthly insurance premium may be its own headache when considering the multitude of expenses already attached to your home. Thankfully, there are plenty of ways to reduce the cost of home insurance, while still having the protection you need. The following are 5 such tips for saving money on your home insurance:

1. Increase Your Deductible

Naturally, the easiest way to reduce your insurance premium is to increase the amount you are liable for. If your environment is low risk, and the items you wish to ensure are expensive, it makes sense to have a high deductible. Most home insurance deductibles begin at $500. Raising that figure to $1000 or even $3000 could result in saving about 20 to 25 percent on your rate, based on recent statistics.

This will mean you will be responsible for slightly more of the cost should a disaster occur. However, raising your deductible is an excellent way to lower the cost of monthly premiums, while still providing the security of being protected from financial ruin. The difference between $500 and $3000 may seem large, but both are paltry sums compared to the cost of your home.

2. Buy Insurance Bundles

These days, many insurance companies offer products that cover multiple industries, such as homeowners, commercial, and automotive insurance. Purchasing your insurance through the same carrier can result in a hefty discount on both premiums. Although you will lose some flexibility in terms of being able to shop around, generally if you are satisfied with a company with regard to one service, you will have little trouble utilizing their other insurance products. Research which companies have the best home and auto insurance bundles before you commit.

3. Insure Only Your Home and Not the Land Beneath It

Often times homeowner’s do not realize that the most valuable part of their property is not the home, but the land it sits on. Moreover, they conflate the two when they apply for insurance, using the sale price of their property to calculate their premium.

This is a mistake, especially when you consider that the land will likely not be damaged in the event of a disaster. Only the cost of rebuilding the home should be factored when calculating your insurance premium, a number which is precipitously less than the sale price. Doing so should lower your premiums substantially as opposed to insuring the land and the house.

4. Discounts

There are an abundance of home insurance discounts that you may not be aware of, such as reductions for being a senior, not smoking in the home, or remaining a loyal customer. Asking your insurance agent about such packages could be useful in lowering your insurance.

5. Preventative Measures

Taking safety measures in the home will lower your overall risk, and lower risk to the insurer means better premiums. Some of the security and preventative measures you can take are adding additional smoke detectors, installing a high-end security system, installing storm shutters, deadbolt locks, and fire-retardant roofing.

Tags:

Business,

finance,

Home Insurance,

insurance,

money,

Money Saving

Imagine coming home to find your roof caved in from a heavy snowstorm or walking into a flooded basement after a burst pipe. These nightmares can happen to anyone. That’s why multi risk home insurance matters. Your house is probably the biggest purchase you’ll ever make. It’s where you build memories and feel safe. But disasters don’t care about that. They strike without warning.

Imagine coming home to find your roof caved in from a heavy snowstorm or walking into a flooded basement after a burst pipe. These nightmares can happen to anyone. That’s why multi risk home insurance matters. Your house is probably the biggest purchase you’ll ever make. It’s where you build memories and feel safe. But disasters don’t care about that. They strike without warning.

The world is an unpredictable place and even the most careful person can happen upon unforeseen events that can turn their existence upside down. That is why it is increasingly important for homeowners to purchase home insurance and for anyone with a family to look after to consider purchasing life

The world is an unpredictable place and even the most careful person can happen upon unforeseen events that can turn their existence upside down. That is why it is increasingly important for homeowners to purchase home insurance and for anyone with a family to look after to consider purchasing life

Recent Comments