February 12, 2018

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

5 key advantages of ULIPs over all conventional life insurance policies:

Identify the right blend of investment

Picking the market entities in the right blend often depends on your investment risk appetite. For those of you that are low-risk takers, investing in debt funds is a good ploy. Likewise the moderate risk-takers can invest in balanced funds, while the high-risk bearers can think of equity funds. Balanced funds are a good option lying between equity funds and debt funds. You’ll be able to switch funds once you gain considerable market outlook.

Investment Flexibility

With an ULIP, you’ll gain the right to invest your entire premium value besides gaining opportunities to allocate additional amounts on the policy. Other investment plans don’t yield so much of flexibility. Depending on your risk appetite and your financial profile, you may choose between these two investment strategies:

Life-Stage Strategy: The years remaining towards your policy maturity and your age help in asset allocation.

Self-Managed Strategy: Your fund choice helps in allocating your money. This option safeguards the financial future of your child even when you aren’t there.

Long term investment

ULIPs prove to be a great option for fulfilling long-term investment goals e.g. launching a start-up, buying your new car, and buying a property. ULIPs are designed to yield more returns and that too for a longer duration; they owe this power to their compounding nature. Even if you decide on quitting the ULIP policies after a period of 5 years, you’ll be amazed to see how much more you’ve saved than what you’d see with other investment options. Your money will grow with a much greater momentum and for a longer duration than how you usually see it grow in your savings bank or with your fixed deposits. All you need to do is to determine the amount of investment with the help of an online premium calculator.

Life coverage

Life insurance companies are only known to offer ULIPs in the form of a product. Besides yielding financial protection, ULIPs are known to fulfill your investment needs. Compared to a term plan, the life cover attached to ULIPs may be smaller but they do come with life cover. When it comes to fulfilling your financial goals in the long run, ULIPs constitute a strong investment opportunity. Prior to investing in ULIPs, you must check out the performance of all individual funds in great details. This is likely to provide more insight into investment options with quality returns.

Tax Rebates

Tax benefits aren’t always attached to investment option that you come across in the market. ULIPs come with a combination of tax benefits and life coverage. Under section 80C of the Income Tax Act, you’ll be entitled to receive tax rebates on all paid up premiums. Likewise, all of the payouts that you receive are entitled to tax exemption under section 10D. Besides seeing your money grow, you’ll be happy with how much you’ll save in the end.

Tags:

banks,

Debts,

Financial Assistance,

Funds,

Income Tax,

insurance,

investments,

money,

personal finance,

Premiums,

Stocks

August 20, 2017

The Internet has revolutionized modern lifestyles. You may use various online facilities like booking cabs, flights, movie tickets, and grocery shopping. Several individuals also find their life partners online.

The Internet has revolutionized modern lifestyles. You may use various online facilities like booking cabs, flights, movie tickets, and grocery shopping. Several individuals also find their life partners online.

The primary reason for the increasing popularity of the Internet is its convenience. This same convenience is also available if you choose to avail of an insurance policy online. Here are five advantages of opting for insurance policies online.

1. Lower costs

When you avail of a term insurance plan online, you eliminate the need for agents and brokers. This reduces the expense for the insurance company. In addition, the entire online procedure is paperless, which further reduces the cost for the insurer. These costs savings are beneficial in reducing the premium you pay for purchasing the insurance plan.

2. Informed decisions

Online platforms allow you to compare different types of life insurance policies offered by various insurers. You may compare the terms and conditions, premium amount, and other features of the policies. Furthermore, you may refer to the reviews and comments given by past users. This allows you to make an informed decision while acquiring insurance coverage.

3. Automated services

An online platform not only expedites the process but also enables efficient and quick servicing. You may easily download product brochures, procure estimates from various insurance companies, pay the renewal premiums, and track your payments online. This ensures you do not have to depend on anybody and the entire procedure is quick and hassle-free.

4. Efficient online assistance

Most insurance companies offer live chat assistance to help you understand more about the different policies. You may also call their helpline numbers to resolve your queries and clarify all your doubts. Once you have made your decision, you may either choose to complete the procedure online or request a meeting. The insurance company will send a representative to help you complete the procedure.

5. Customization

These days, several insurance companies offer customized products to suit the distinct requirements of individual buyers. When you opt to apply for a term plan online, you may compare different offerings and choose the plan that suits your preferences. You may also pay the premium online on a monthly, quarterly, bi-annually, or an annual basis as per your financial situation.

Availing of an insurance policy online is a cost-efficient and quick option. Insurance companies understand the benefits of this distribution channel and offer special products covering different types of insurance policies. By opting for the online platform, you may avail of the best term insurance plan in India from the comfort of your home or office.

Tags:

budgeting,

Coverage,

economy,

insurance,

investments,

life insurance,

personal finance,

Premiums,

Returns

August 8, 2017

Life is unpredictable!

Life is unpredictable!

Although we are all aware of this, very few people actually think about the uncertainty of life and take practical measures to protect their loved ones, in case their life unexpectedly comes to an end.

Such wise people usually buy a comprehensive insurance policy to secure their family’s financial future.

Have you decided to be among those who are always prepared for the uncertain future?

Buy a life insurance!

What to Consider Before Buying a Life Insurance?

Searching and buying the right insurance policy can become a daunting task. But, not when you know what things to consider while weighing different insurance policies at hand. To help you do that, here we are highlighting some of the key factors that need to be considered when it comes to buying a life insurance:

• Make Sure That the Company Is Reliable

The foremost thing to consider before you decide to buy insurance is the reliability of the company you are buying from. Ask around for references and always go for the company that enjoys a good reputation. You can also check the company’s social media page to read reviews. This is important because frauds by insurance companies are highly common. Often, buyers find out about the hidden terms and conditions with regard to charges and coverage after buying the insurance.

Therefore, to prevent yourself from becoming a victim of an insurance scam, make sure you do a detailed research and seek references and reviews before choosing an insurance company. The task is quite tedious, but it is worth making the effort.

• Assess Your Needs

One of the many benefits of finding a reliable company is that the insurance agent can really help you in evaluating and assessing your needs and then choosing an insurance policy accordingly, to cover all your specific needs. The process entails evaluating factors such as the number of dependants, family wealth and assets, and whether the family will be able to pay off any remaining debts and bear the cost of funeral services or not?

Your answers to all these questions will help decide what things are more important for you and how much coverage you really need. For example, for some people the most important thing is to make sure their children’s education does not get negatively affected in any scenario and they want it to be covered by the insurance policy. On the other hand, there are people who do not want their family to pay for their burial services.

• Compare Different Policies

Decide your needs based on what things are important for you. For example, if you only want to make sure that your family receives money to pay for your funeral, ask different companies for quotes for funeral insurance. But, if you want multiple factors to be covered, look for a comprehensive life insurance policy.

Also, never settle for the first company you come across. Always compare different aspects of various insurance policies to make sure you find the best or you will end up regretting it later. In addition to your needs, your financial status also plays an important role in choosing a life insurance policy.

Tags:

Claims,

Coverage,

economy,

insurance,

investments,

life insurance,

money,

Premiums,

Returns

June 28, 2017

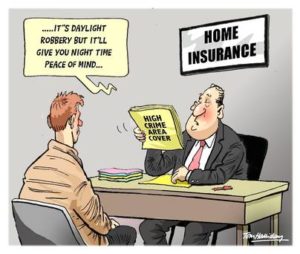

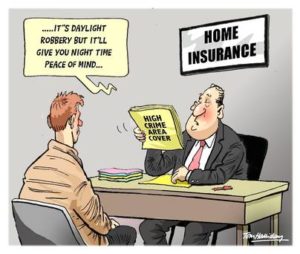

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Whether you’re renewing or buying insurance for the first time, be aware of some mistakes. Below, you can find out about things to avoid and possible solutions.

Incorrect coverage amount

Most people choose a wrong coverage because they replace the real and market value of their home. Others are prone to overestimate the coverage amount. Those people identify home insurance with dwelling coverage. It pays in case of a damage caused by a covered danger like hail, storm, fire, and so on. The amount of dwelling coverage has an effect on limits for other coverages. For example, the limit for the contents coverage is set at 50%-70% of the dwelling coverage. So, how to evaluate the right dwelling coverage? There are various online home insurance calculators that address this issue.

Insufficient coverage for home rebuild

The majority of houses are not valued for insurance purpose. What would happen if those houses get destroyed beyond repair? The homeowners will not have enough insurance coverage to rebuild their homes.

How to avoid this mistake? It’s a good idea to hire a cost estimator who specializes in home replacement. You may also contact your contractor or a local builder. This is a cheaper option, but the assessment is not that precise as you get by a professional cost estimator. Once you’ve found out how much it costs to rebuild your house, you need to determine insurance coverage. Make sure to include all the valuables and improvements you have recently made.

Failing to look around

There are a lot of insurance providers and agencies today. They vary widely in how they estimate risk and how they determine the costs of home insurance. Some companies offer notably higher premiums than others. Don’t stop at the first insurance agency you run into. You should look around for the best deals instead. Try to find a quality yet affordable coverage that you are comfortable with.

Wrong deductible

Many people make mistake when setting the deductible. This is the amount of money that an insured pays before his/her insurance kicks in. This amount is paid toward a claim. Many insurance buyers set a wrong amount – either too high or too low. You can save a lot of money on your premiums by manipulating your deductible. As a rule of thumb, the lower the deductible, the higher the premium. But your finances could be left “askew” if the amount of deductible is too high. And if you are not able to come up with it when your home gets damaged by a disaster. You will pay more in premiums if the deductible is too low. Consult an insurance expert to hit the right balance.

As you can see, these issues are pretty complex. So even the most experienced insureds can make mistakes. Your best choice would be to consult an experienced insurance broker, though. Insurance brokers milton can help you get a quality home insurance products.

Tags:

Claims,

Coverage,

economy,

Finance Advisor,

Home Insurance,

insurance,

money,

personal finance,

Premiums,

Returns

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

Recent Comments