September 21, 2016

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Long Term Investing

The most important part of binary trading is to learn which of the available strategies best meets your needs and risk tolerance. Once you have established this you will be able to refine and improve your technique and obtain consistent, favorable results. When first starting in this industry it is best to stick to an area you already know something about and to stick to one asset type:

Trading with the Trend

One of the most straightforward approaches is to look at a price chart and see which direction the price is current moving in. If the general trend is up then place a call option, if down go with a put. Most traders place a trend line alongside the chart; from this you should be able to pick a price that the asset will not reach and utilize the no touch trade strategy.

Pinocchio

When the market is particularly volatile you may be expecting some rapid rises and falls in price. This chart will highlight when these events are likely to happen and allow you to trade accordingly. Alongside the usual price movement trades you can opt for a one touch trade where the asset drops (or rises) significantly and hits your expected price. This is higher risk but can be lucrative.

Sitting on the Fence

This is also known as straddling and is another good technique for a volatile market. Instead of trying to decode which direction a market is likely to move in you place two trades; one for it to go up and one for it to go down. The profit on either of these trades should cover the costs of both trades and generate a small profit. You are effectively decreasing your risk.

Reversed Risk

This is very similar to the straddling technique. However, with this strategy you need to place both trades, up and down, at the same time. You are guaranteed to get one of the trades right, but unlike the straddling technique you do not have a chance of getting both right.

The Hedge

This technique is very similar to the reversed risk approach, and serves to protect your funds and reduce risk whilst still generating a small profit.

Fundamental

An important strategy which should never be overlooked and works well in conjunction with any other technique is the analysis of the general economy and the specific situation of your chosen company. You will then be able to assess what the price is likely to do on the strength of the company and the economy.

We also suggest you to check 15 minute binary options strategy in order to rise the profitability of your trading.

Tags:

Best Forex Trade,

Currency,

Foreign Exchange,

Forex,

investments,

money,

Trading

February 16, 2016

It may surprise many to know that nearly eighty percent people who go for forex trading burn their fingers badly before deciding to quit trading of forex currencies. So, you’ll need to be extremely careful when trading forex, lest you should also fall in the category of those who failed. The causes of failure are many, though some of those are common among those who failed. Despite this abnormally high failure rate, forex trading presents the opportunity of making considerable sums of money. Nevertheless, it is quite challenging to become successful trader. It demands plenty of hard work, dedication and appropriate learning. Some traders at XFR Financial fail to devote the required amount of time and the type of hard work it necessarily requires for being successful. Forex trading is not the way of making money for you if you aren’t willing to invest the time and hard work it entails.

It may surprise many to know that nearly eighty percent people who go for forex trading burn their fingers badly before deciding to quit trading of forex currencies. So, you’ll need to be extremely careful when trading forex, lest you should also fall in the category of those who failed. The causes of failure are many, though some of those are common among those who failed. Despite this abnormally high failure rate, forex trading presents the opportunity of making considerable sums of money. Nevertheless, it is quite challenging to become successful trader. It demands plenty of hard work, dedication and appropriate learning. Some traders at XFR Financial fail to devote the required amount of time and the type of hard work it necessarily requires for being successful. Forex trading is not the way of making money for you if you aren’t willing to invest the time and hard work it entails.

Essential Qualities of any successful trader

Here, hard work implies studying and learning various aspects of trading for being a successful trader at XFR Financial. You can’t take this type of trading as a hobby. Consider this like any other professional job that needs to be taken seriously. It should be pointed out here that during the early stages you should aim at learning the tricks of trade and not at making money easily and quickly. You should know it is a very volatile market. So, instead of experimenting and killing time, you need to understand its fundamentals and gain confidence before entering this market. Make sure to draw your plan and stick to that. You are most likely to become successful in due course of time provided you continue to consistently put in hard work.

Money Management through XFR Financial

The two most important things that you have to learn include managing your funds and emotions. One of the most important factors causing most traders to fail is lack of control over emotions like greed and fear. Often, after having suffered financial loss in the market, traders start believing that they have the capability of making the market reimburse the loss they suffered. This type of approach frequently causes them further losses and they fail miserably. Managing your funds or remaining financially disciplined is another essential feature for becoming a successful forex trader and you’ll find XFR Financial helpful in this regard.

Financial discipline simply means setting firm limits for your trades as per the volume of finances available with you. The plan should be to gain money without undue exposure to risks. This limit for good traders is up to two percent, though a number of traders stretch it up to 10% of their finances. You should understand that a significant advantage of exercising financial discipline is that you are always left with some money for trading the next day or in future because you don’t lose all that money in making a few trades on the same day.

If you take care to follow the above mentioned steps given by XFR Financial, you are most likely to succeed in your efforts of making decent amount of money through forex trading. You should understand that it takes time to become successful. You would know there are no short cuts to become successful in any profession and forex trading is no exception. You should continue to be disciplined at all times and don’t try escaping hard work if you like to be a successful trader by making considerable gains through this form of trading.

Tags:

Business,

Currency Trading,

economy,

Foreign Exchange,

Forex,

investments,

Trading

January 5, 2016

Clued up Brokers

Clued up Brokers

Because of the changing nature of our world, also the way we do business, new innovations are necessary to show us the way we trade stocks, forex, commodities and bonds. Using trading platforms, which are computer software programs used by traders and brokers, investors no longer have to place telephonic orders; these days web-based and mobile trading platforms allow the trader to place his orders with the broker.

Instant Response

It goes without saying that you want a trading platform that provides real-time data from the markets you trade in, a trading platform that connects you to your broker instantly. Check with him/her that the trading platform he/she offers, is compatible with your computer/mobile system. Many brokers today understand the need to inform their clients about the best mobile apps for trading, apps that employ advanced trading tools to make the traders’ experience so much easier and up to the minute.

Fees

Online trading is becoming more and more popular as technology advances and can be used with great ease for any form of trading and from anywhere in the world. When you deal with a reputable broker, he/she will offer you a trading platform either for free or at a discount, provided you keep a funded account with him or her, an account which requires of you to execute a specific number of transactions every month.

Always Compare

Always compare what is available in the market. Be sure you get the best trading platform for your needs by talking to experienced professionals such as CMC Markets .

Ask yourself the following important questions:

If, for instance, your preferred trading is in forex, the platform must allow you every detail relating to issues such as real-time as well as historical data. The trader wants to have all information at his fingertips when he places his order with his broker.

Latest Technology

It all really boils down to comparison, finding the broker that offers you the most reasonable, advanced platform to trade. You want to deal with a broker that has his/her fingers on all the pulses. Also when it comes to innovation, someone who will let you trade from anywhere, at any time, from whatever device you are using.

Tags:

Business,

economy,

Foreign Exchange,

Forex,

investments,

money,

stock,

Trading

January 2, 2016

Charting is very important in any form of trading in the financial market. It ensures that trade is carried out analytically. Charting technique is also used in Binary options’ trading. Anyone who wants to trade forex and make a good sum of money must make use of charting techniques. Thus, a decent knowledge of charting techniques is very essential if you must succeed as a forex trader. Trading binary options can serve as your sole means of income and employment and yield enough for your sustenance if you know how to make use of charting techniques.

For you to be able to chart in binary option, you must have thorough knowledge of charting technique. This article talks about candle stick charting technique and how you can use your knowledge of candle charting techniques to trade profitably.

What are Candle stick charts?

What are Candle stick charts?

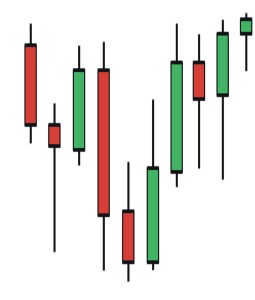

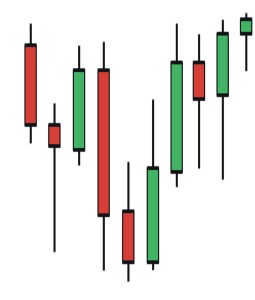

Candlestick chart are made up of collection of candle sticks. Every one of the candlesticks stands for a price action for a particular time period as shown in the example below. Our example illustrates the daily price action for EUR/USD currency pairs for 10 days trading time period.

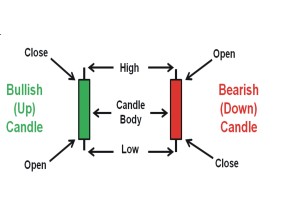

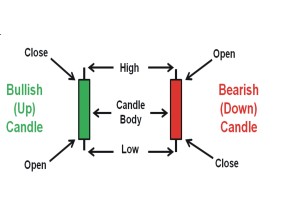

Candlestick chart colours

Each candle stick of the candlestick chart is colored. The color depends on whether there is a rise or fall in price action between its opening or closing time. The widespread color used for a rise in price also known as the bullish (up) candles is the green color while the most frequently used color for a fall in price also known as a bearish (down) candles are the black and red colors.

The coloring system makes it easier to see in an instance if there is rise or fall in price action on any particular day. It also lets us know the degree of rise or fall of the price action for ach particular day. Apart from providing this information, the candlestick chart also offers the trader a few more aid to successful trading.

The candle stick tells the trader the open price; the high and low price and the close price also known as the (OHLC) for each specific time period. This varies a bit. It depends on if the candle is bullish (up) or Bearish (Down)

Why Candle Stick chart is very effective

Why Candle Stick chart is very effective

The candlestick chart provides more information than the basic chart. It is made up of nodes which indicate either the opening time or the closing time of a unit. It can as well tell the trader if the time period is positive or negative. Red color on the candle chart shows negative while green color on the other hand indicates positive time period. Candle stick charting is an excellent and highly effective binary options trading technique.

To be successful in binary option trading with candle stick chart, you need to understand that the Binary options trading with candle stick method is completely different to trading with other trading options like the Forex or commodity market or stock market trading.

Candlestick Charting gives you a good start

Binary option trading is very good but unless you make good predictions, you won’t be able to make money with binary option. This is exactly what the candle stick chart will do for you. The candlestick charting is a good help to traders both those who are new in binary trading and experienced traders. It can help experienced traders to make a fresh start. It thus helps you to make use of the modern charting technique for trading. Candle stick charting as well possess a number of the best tools of technical analysis. With candlestick charting you can also make use of a few mathematical tools like the moving averages or stochastic.

Candlestick Charting is a stepping stone for successful trading

Take your time to learn and understand chart candlestick patterns. It is the most helpful analysis. It offers a trader some secrets to successful trading like a multiple indicator system, a price indicator system for supply and demand, a successful trading skill in addition to a system that evens out a risk.

A good number of the trading signals obtained by these systems have been established to be roughly 80% to 100% precise and correct. It is not all trading platform that has the software used in candlestick analysis. Thus, you can decide to choose charting software that can be used to track the unit you are trading on.

Why software is essential in binary Option trading

Trading binary option does not require buying and selling. A good number of traders of Binary option are of the opinion that binary option trading is much more different from trading from other platforms. The one most significant part of binary option trading is the trader’s ability to predict price movement of a specific equity. The use of software in trading comes in handy here. It assists the trader to make predictions of price actions.

Tags:

Business,

Currency,

economy,

Foreign Exchange,

Forex,

investments,

money,

stock,

Trading

October 26, 2015

If you’ve decided to make contract-for-difference trading your investment strategy of choice, picking out a good trading platform can be tricky. You need to make a well-rounded decision that accounts for more factors than just the commission fees imposed by a given broker. Take a look at the advice XFR Financial Limited gives below to educate yourself on what’s available out there in the CFD trading platforms market.

If you’ve decided to make contract-for-difference trading your investment strategy of choice, picking out a good trading platform can be tricky. You need to make a well-rounded decision that accounts for more factors than just the commission fees imposed by a given broker. Take a look at the advice XFR Financial Limited gives below to educate yourself on what’s available out there in the CFD trading platforms market.

Regulatory Necessities

Before you pick out a trading platform, it’s important that you make sure you’re not engaging in trading behaviour that will have adverse legal consequences. Difference trading is not legal in all countries, and it’s regulated differently in the ones where it is allowed.(CFD trading is particularly heavily-regulated in the United States.) Do a little research to confirm that the CFD platform you’re looking at is fully compliant with the laws of your home country.

CFD Trading Platforms Required Features

As with a lot of products aimed at the small-scale “retail” investor, CFD trading platforms have exploded in popularity in recent years. This has led to a burgeoning market that presents you with a lot of different options. Before you commit to using a particular platform, make sure it offers you the bare necessities you need to make effective trades.

Stability and reliability — in terms of both hardware and software — are extremely important. This will be relatively difficult to judge based on a platform operator’s claims; obviously all of the brokerages offering CFD platforms want to emphasize the reliability of their products. Reading reviews from other traders will give you a better idea of how reliable a platform XFR Financial Limited has actuallyis.

Good platforms need to give you excellent execution control, especially if you plan to concentrate on short-term trading. Look for CFD platforms that feature automated execution, which allows you to complete orders even when trade volume is very high. You’ll also need a full suite of execution features (e.g. boundary setting) to ensure that you retain full control of your trading activity.

Attractive Bonuses At XFR Financial Limited

Even after narrowing your search down to regulatory-compliant brokerages which offer platforms with a decent set of basic features, you’ll still probably have a wide field to choose from. This is when you should look more closely at the extra functions included in various platforms.

Most platforms come with built-in analytic tools like automated charting, risk management functions, and predictive tools. Once again, the actual operators of a platform will tend to state the value of these extras as positively as they can. Look to reviews from past users to get a more realistic sense of how helpful these features can be.

It can take some time to properly evaluate the features of CFD trading platforms and decide whether or not it will make a good fit with your trading strategy. Don’t rush this decision! It can have a profound impact on your overall effectiveness in the difference-trading market. Demo account at XFR Financial Limited will give you a decent feel for how a single trading platform performs, but you need to shop around and consider multiple options before you commit to one and entrust it with your live trades.

Tags:

Business,

Capital,

Currency,

economy,

investments,

money,

stock,

Trading

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Experience is an important ingredient to success in any kind of investment trading. However, it is not the only thing that will enable you to trade successfully. Even if you have never trading in any financial market before, you will be able to quickly understand what is involved in this type of trading and start making successful trades. In essence all you need to do is calculate whether the price of an item will go up or down. Some of the best traders use the simplest strategies for binary options trading and have excellent results.

Recent Comments