February 8, 2014

Every car insurance company promises you their very best rate. They also promise to make you an offer that their competition can’t top. In other words, insurance providers make promises they can’t keep. So, what can you do to make sure you get the best deal on the market? Make your own.

Every car insurance company promises you their very best rate. They also promise to make you an offer that their competition can’t top. In other words, insurance providers make promises they can’t keep. So, what can you do to make sure you get the best deal on the market? Make your own.

Consumers know that it pays to shop around. Smart buyers compare quotes from several insurers before purchasing a policy. However, even the savviest shoppers probably don’t know that after they’ve found the best coverage at the lowest rate there are ways to save even more.

How? It’s all about research. Car insurance companies will be quick to talk you into their most comprehensive coverage. On the surface, the old adage—more is better—appears to ring true. What these companies won’t tell you, though, is that these top-tier policies are excessive for everyday drivers. And in this case, excess is expensive. By taking a thorough look at your driving habits, vehicular assets, and overall financial situation, you can determine how much coverage you actually need.

Do you drive every day, or just occasionally? Is your commute 15 minutes, or 50? The answers to these questions matter. The more time you spend behind the wheel, the more likely you are to be involved in a collision, statistically speaking. Naturally, the converse is true. If you only net 15 road miles each week, you aren’t as likely to cash in on your policy. Many insurance representatives are trained to ask these questions when providing a quote. If yours never did, it’s time to make a phone call. And if you recently changed jobs and are now working closer to home, you should update your insurance provider; it’s likely that they will lower your rate.

What you drive matters just as much as how you drive. Unless your vehicle is new or you’re still making payments on an auto loan, you might be carrying more insurance than you need. Check the Kelley Blue Book value of your car. If this figure is significantly lower than your comprehensive or collision coverage, it may be time to adjust your policy accordingly. In some cases, as for those who drive old (but not collectible) cars, it could be worth dropping collision coverage entirely.

Choosing a plan with a higher deductible might not sound like a good way to save money. However, drivers with a great safety record can cash in big with this strategy. Here’s the logic: safe drivers are involved in fewer accidents. By raising your deductible, your insurance costs drop—sometimes an increase of just a few hundred dollars means a 15% to 40% reduction in overall policy fees. A portion of the money saved on premiums can be set aside to cover the deductible in the event you need to file a claim. The remainder of this money is then free for investment or can be put towards purchases you actually want to make.

Having your financial ducks in a row pays off. Many auto insurance providers will now review your credit score and reward fiscal responsibility with discounts. When you’re looking to spend less on car insurance, be sure to inventory your other expenses. Check for duplicate coverage. For example, AAA membership offers roadside assistance and towing. There’s no sense in carrying policy add-ons for these services if you’re already getting them elsewhere. This is also true for bodily coverage. If you carry a fairly comprehensive medical insurance policy, it is likely that any bills resulting from accident-related injuries will be taken care of.

Tags:

budgeting,

Car Finance,

Car insurance,

financial planning,

insurance,

investments

February 7, 2014

Hands up if you’ve got your tax act together! What? No hands up? Well then, grab a seat and listen up!

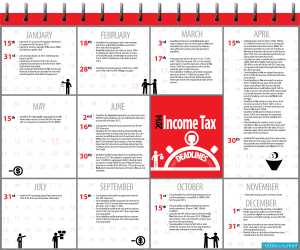

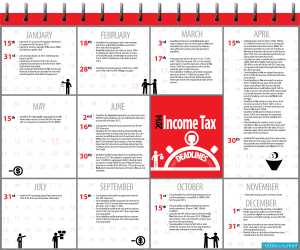

The State and Federal governments have set up certain due dates for filing or e-filing your taxes. To some, understanding taxes and meeting tax deadlines is the first among many horrifying aspects of filing tax returns. But once you understand when and what needs to be filed, it will be the first big step you’ve taken towards de-horrifying the process of tax filing and returns.

April 15th is a big date to remember. Not only must you file your taxes by this day but you also need to pay an estimate of any taxes due. 11.59 pm on that day is the deadline. Miss that and you’ll need to request an extension from the IRS. And even if you do request an extension, remember you still need to pay the taxes you owe.

In addition to that big date, there are several due dates to keep in mind depending on your status – whether you’re individual tax payer, a business (S corporation, C Corporation or LLC) or a charity. The infographic below will help you keep a track of those dates. Remember, if a filing date falls on a weekend or a national holiday, the date will be moved forward to the next working day. It’s important not to miss these dates because if there’s one thing you don’t want, is the IRS on your back, right?

What happens if you don’t meet the deadline?

Brace yourself! This is the next horrifying part of filing taxes. A lot. A lot of bad things can happen if you don’t meet that deadline. For one thing, the fee for not filing is a lot harsher than it is for late filing. In addition, there are penalties which you can check out on the IRS website.

What Not to Forget

You’d be surprised at the common mistakes people make when filing their taxes. Before you send those papers to the IRS double check whether you’ve:

• Put a stamp on the envelope

• Signed the documents (Don’t laugh. It happens more often than you’d think)

• Included the social security numbers of their children and adult dependents

• Annual limits and tax tables can change from year to year. Make sure you’re using the right.

If you run a small business, there’s a never-ending string of dates that you have to keep in mind. Make entries in your PDAs, your laptop and any other devices you use to keep your appointments to help you stay on top of things.

What to Remember

Remember to take advantage of tax deductions. These may change from year to year as well and I sometimes suspect it is in the IRS’s best interests to confuse us folks! It may help to hire professional accounting firms whose job it is to prepare and file your returns while maximizing your earnings. Firms, like 1800accountant, designate a personal accountant to your case and offer 24/7 access the whole year round. It’s worth looking into such services and enjoy the peace of mind that comes from knowing you’ve got your taxes taken care of and managed to make some tax savings. Now that’s what I’m talking about. 🙂

Tags:

budgeting,

economy,

Income Tax,

money,

tax

February 6, 2014

Car title loans are a viable option for people who need money fast. This type of secured loan is convenient and easy to obtain. All you have to do is to use your car title as collateral. Even those with bad credit or no credit history at all can qualify for these short term loans. Most lenders require customers to pay off their debt within one month. If the borrower is unable to pay, the lender can repossess his vehicle.

Car title loans are a viable option for people who need money fast. This type of secured loan is convenient and easy to obtain. All you have to do is to use your car title as collateral. Even those with bad credit or no credit history at all can qualify for these short term loans. Most lenders require customers to pay off their debt within one month. If the borrower is unable to pay, the lender can repossess his vehicle.

In general, customers who apply for auto title loans receive $500 to $25,000. How much money you will get depends on the value of your car as well as on the lender. LoanMart’s online auto title loans are flexible and easy to qualify for. The application process takes only a few minutes. Borrowers must provide a valid driver’s license, a copy of the auto title, proof of income, and contact information. If your application is approved, you will receive the money within one hour.

When you apply for a car title loan, the lender won’t check your credit or ask you to prove employment. As long as you have a steady source of income and a car, you will get the funds needed. The best part is that you get to keep the car and still drive it while you have the loan out. It’s no wonder why these loans are so popular among customers. If you’re too busy to go to a title loan shop, you can submit your application online.

Tags:

Car Loan,

Debts,

financial planning,

loans,

money

February 1, 2014

If you are the leader of a business, you’d like to always hope that your staff come to work day-in-day-out ready for action. You and I both know this isn’t the case; your employees are not robots and even the most self-driven employees need a little motivational nudge from time to time. Money is always a nice incentive, but money isn’t everything if your workplace is an unpleasant environment. Here are some ways to motivate your employees through creating a positive place to work.

If you are the leader of a business, you’d like to always hope that your staff come to work day-in-day-out ready for action. You and I both know this isn’t the case; your employees are not robots and even the most self-driven employees need a little motivational nudge from time to time. Money is always a nice incentive, but money isn’t everything if your workplace is an unpleasant environment. Here are some ways to motivate your employees through creating a positive place to work.

Support new ideas

Employers often see a worker coming to them with an issue as them complaining and shut them down before they’ve even begun to explain. This mentality needs to stop. If an employee comes to you with an idea or solution to a problem they believe is hindering the company, it means that they care about the direction of the company. Supporting their new idea and letting them run with it is motivating in itself, regardless of whether it works out in the end.

Break up the monotony

They call it three-thirtyitis for a reason. Almost every employee feels a bit lazier in the afternoon not to mention sitting at a desk all day is incredibly tiring. So how do you excite everyone (besides coffee of course)? There are a couple of ways to induce a sense of liveliness, and one of them is to have a ten minute yoga break. Just ten minutes, everyone gets up, and does yoga together. It will clear their mind and create a culture that people will love. Other ideas include hosting a bake-off, happy hour to work on a creative project, or a push up contest.

Celebrate Milestones

Celebrating birthdays and company anniversaries never gets old, it brings your team together acknowledging milestones in the form of a celebration reminds them that the hard work they are putting in is paying off and is being acknowledged.

Keep Them Informed

CEO’s generally have a clearer picture of the in’s and out’s of their business, including when you are going through hard times or when new products are in the pipeline. It pays to keep the people below you in the loop with what’s happening right throughout the company as it makes them feel as though they are an integral part of the organization.

Give Credit Where Credit is Due

Even though your employees have appointed tasks, it’s still an accomplishment if they finish it on time and at a high standard. While you expect them to complete these projects, don’t forget to recognise their hard work by giving them a compliment or shouting them out on an awesome job to the rest of the company.

Act on Feedback

Someone’s come to you asking for improved lunchroom facilities or a second monitor to complete big tasks. Make sure you make every effort possible to go out of your way and meet their needs. However don’t mistake this for wants – not every employee needs a Playstation, X-Box and Wii at their disposal in the lunch room.

Encourage Further Training

Times are always changing, and if you’re employees skills are becoming outdated, ensure that they have every opportunity to learn and grow. This might be through a training program like http://axcelerate.com.au/, upgraded technology or through attending industry conferences. Not only will it motivate them, but it will benefit the company moving forward.

Keep it light amongst the seriousness

No one can be serious all day, it hinders creativity and makes your workers feel as though they’ve just attended a funeral. Encourage laughter, organise themed days, or use gags/gimmicks to inspire performance increases. The sillier the better, so you may give someone a plastic phonograph for setting a new company record, or a kids drum for the person that drums up the most business.

Are you a manager? How do you keep your employees motivated? Tell us your tips in the comments below.

Tags:

Buienss,

Deal,

Incentive,

Increment,

money,

Salary

Every car insurance company promises you their very best rate. They also promise to make you an offer that their competition can’t top. In other words, insurance providers make promises they can’t keep. So, what can you do to make sure you get the best deal on the market? Make your own.

Every car insurance company promises you their very best rate. They also promise to make you an offer that their competition can’t top. In other words, insurance providers make promises they can’t keep. So, what can you do to make sure you get the best deal on the market? Make your own.

Recent Comments