January 1, 2017

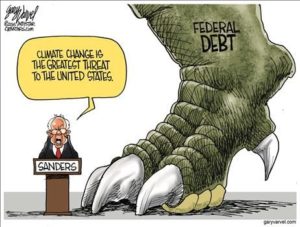

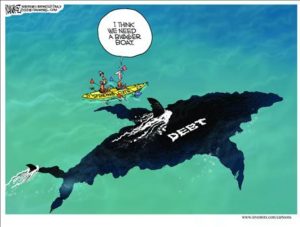

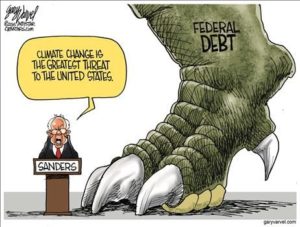

Most families have accumulated a significant amount of debt due to auto loans or credit cards that have been used over the years. Acquiring debt can make it easy to feel limited with your finances, which can make it difficult to make ends meet. To become debt-free and obtain financial freedom, there are a few important steps to take.

Most families have accumulated a significant amount of debt due to auto loans or credit cards that have been used over the years. Acquiring debt can make it easy to feel limited with your finances, which can make it difficult to make ends meet. To become debt-free and obtain financial freedom, there are a few important steps to take.

1. Create a Budget

Creating a budget will allow you to determine how much money you can afford to put towards your debt each month. Calculate your household income and write down your expenses, which will allow you to get an idea of how much debt you will pay off with each paycheck.

2. Establish Goals

Establishing goals to pay off your debt in a specific time frame will make it easier to stay on track and avoid losing focus with paying off the debt in full.

3. Cut Coupons

You can save more money each month to put towards your debt by cutting coupons in the newspaper for food and household items that you already purchase. Combine manufacturer coupons and store coupons to double your savings.

4. Pay Off Lowest Balances First

Paying off the accounts that have the lowest balance first, which will allow you to stay motivated and will reduce the amount of money that you pay in interest each month. There are some credit repair companies that can help you consolidate and repay your loans.

5. Avoid Eating Out

Reduce the money that you spend each month by making your meals at home and avoid dining out when you’re on the go. Prepare meals and have easy snacks on hand to take to work and stay within your food budget.

6. Shop at Secondhand Stores

Shopping for clothing or goods at secondhand stores can allow you to avoid paying full price for products that your family may need when it comes to purchasing school clothes or work attire.

7. Use the Envelope System

Convert your paycheck into cash and transfer it into different envelopes to avoid overspending and track how much you have left to spend. This will allow you to become more conscious of how much money you spend without relying on a credit or debit card.

Although it can be challenging to pay off debt as a family, there are several lifestyle changes that can be made to make progress with the money that you owe. By establishing rules with your finances and making goals, you can track the money that you pay off to ensure that you obtain freedom in a realistic time frame.

Tags:

budgeting,

credit,

debt,

financial planning,

loans,

money

November 26, 2016

Low credit ratings often increase the interest rates on various financial products, such as home loans or credit cards. Borrowers with higher credit scores are able to save significant amounts on their loans when compared to individuals with lower credit scores.There are several ways that help people to improve their credit scores given by credit rating agencies like Credit Information Bureau (India) Limited (CIBIL). The agencies do not treat all types of debts in the same way while calculating the credit score. The ratings are affected negatively if the outstanding balance on the card increases.

Low credit ratings often increase the interest rates on various financial products, such as home loans or credit cards. Borrowers with higher credit scores are able to save significant amounts on their loans when compared to individuals with lower credit scores.There are several ways that help people to improve their credit scores given by credit rating agencies like Credit Information Bureau (India) Limited (CIBIL). The agencies do not treat all types of debts in the same way while calculating the credit score. The ratings are affected negatively if the outstanding balance on the card increases.

Here are five ways that help improve credit scores.

1. Lower the Credit Card Balance

The best way to improve credit rating is to lower the outstanding balance on the card. The rating agencies make a downward revision to the score if the credit utilization ratio exceeds a certain percentage. This ratio is the amount used by the cardholders as a percent of the overall credit limit. Reducing card balance may seem to be a difficult task but is achievable with the help of discipline. Users must adhere to stringent limits to reduce the balance and improve the credit score. If possible, individuals may ask the issuing company to increase the limit on their cards. This may also help improve the credit score provided the users do not increase their spending because of the higher limit.

2. Convert Card Debt to Personal Loan

With some diligent planning, card users may be able to improve their credit ratings even before paying off the debt. They are advised to consider converting the card debt to a personal loan. Higher outstanding balance on card reduces the credit score much more than personal loans. Loans with fixed installments are not considered by the agencies while calculating the credit ratings. Therefore, availing a personal loan instead of maintaining a high balance on the credit card is advisable. In addition, to improve credit score, such conversion is beneficial in reducing the cash outflows. The interest rates on personal loans are often lower than the card interest rates. It is important that the cardholders discontinue the use of their credit cards after such conversion to ensure the ratings are not affected.

3. Selective Accelerated Debt Payments

Repaying loans in a timely manner has several benefits. However, individuals who want to improve their credit scores must consider postponing such pre-payments. The money should instead be used to pay off the card outstanding because this kind of debt affects the scores more than loans.

4. Keep Regular Checks on Credit Report

Research shows that a significant percent of individuals have errors on their credit reports. It is possible that errors have severe results on the credit scores. This further impacts their borrowing capability and rate of interest that is levied on their loans. It is recommended that borrowers check their credit report prior to applying for any kind of loan. If any errors are found, they must immediately contact the rating agency and seek rectifications. This would help improve their credit score and enable them to borrow at a lower rate of interest.

5. Make Timely Repayments

Credit scores are significantly affected due to delayed payments. Lenders report delays to the agencies after 30 days from the payment due date. Such late payment reports are reflected in the credit score for many years, which impacts the individuals negatively. To avoid this, making timely payments is recommended.

Unfortunately, several people in India are not aware of the importance of good credit ratings. They fail to understand that even a slight improvement in their credit score may help them save huge amounts and get a lower interest rate on their borrowings.

Tags:

budgeting,

credit,

Debts,

economy,

loans,

money,

personal finance

October 19, 2016

Budgeting doesn’t need to be hard. It can be as simple as you want to make it. However, there are a few things that you can do to make sure you have a positive experience with your budget. Here are four tips to make sure you have a great experience and start to feel the “magic” of budgeting.

Budgeting doesn’t need to be hard. It can be as simple as you want to make it. However, there are a few things that you can do to make sure you have a positive experience with your budget. Here are four tips to make sure you have a great experience and start to feel the “magic” of budgeting.

Tip #1 – Write it Down

Budgets can come in many shapes and sizes. They can be created for individuals, families, and households. You can even create them to help you find the funds to go on a service mission, have a wedding, or have another specific event. The biggest issue, however, is not that people don’t want to do a budget…it’s that they never write it down. Writing it down brings a level of commitment. Putting it out on paper or a spreadsheet, or even using an app of software allows you to see it and commit to it. So take a second and write your budget down, if you haven’t already!

Tip #2 – Create a Savings Plan

Along with a budget, consider having a separate document that goes along with your budget that will work hand in hand. That document is a savings plan. Creating a specific savings plan will enable you to keep your mind on the long game… that is saving for the future and for future emergencies. It doesn’t need to be hard. Just specify how much you want to save and then make specific, action goals so that you can make sure and accomplish what you are striving for.

Tip #3 – Make Goals

Speaking of goals…while you are writing down your budget and savings plan, make sure that you make S.M.A.R.T. goals. Specific, Measurable, Attainable, Relevant, and Time oriented. Setting goals allows you to look into the future and make plans. It will also become a benchmark and allow you to feel successful when you hit those goals. Look at the next six months or a year and make some goals and then do everything that you can to strive to hit them!

Tip #4 – Keep the Long Term in Mind

We all have times when we have an emergency or situation in which we need to spend money to survive. Whether it’s medical bills, or the car breaks down, we all have times when this happens. Don’t let it bother you. Pay what you need to pay, and then get back up and keep striving to hit your goals. If you can keep the long term in mind, then you will forever be able to accomplish your goals (even if it takes a bit longer than you thought).

If you can keep these four tips in mind, then you will have a positive budgeting experience. Put it out on paper, create a savings plan that compliments your budget, and make specific goals to help you get where you want to go. If something happens in the middle of your plans, keep the long term in mind. Following these four tips will increase your level of financial confidence and ultimately help you find financial peace in the months and years to come.

Tags:

budgeting,

Earnings,

financial planning,

investments,

money,

personal finance,

savings

September 19, 2016

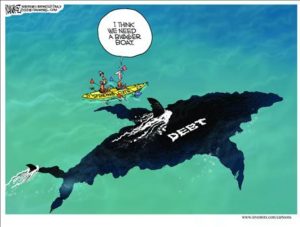

Home Debt is one of the most common occurrences you may face. A Home debt occurs when the borrower is unable to pay back the amount within his due time. Home Debt, in the beginning, may be a little confusing to you, but you have to find a way out of it. Home debt has pretty simple solutions, which if followed is bound to yield results. During the time you are in debt, you have to keep a tab on expenses, income, savings and different budgets.

Home Debt is one of the most common occurrences you may face. A Home debt occurs when the borrower is unable to pay back the amount within his due time. Home Debt, in the beginning, may be a little confusing to you, but you have to find a way out of it. Home debt has pretty simple solutions, which if followed is bound to yield results. During the time you are in debt, you have to keep a tab on expenses, income, savings and different budgets.

Supervision of your capitals

Management of funds during a debt is of utmost importance. The first step to that is to form a budget. You should assign a certain amount as your designated monthly budget and have to be careful in maintaining it. No matter what happens, you cannot allow yourself to go beyond the budget. Make a list of things of your Needs and Wants. This way, you will have an idea about your immediate requirements. You can keep you wants on hold for some time till your finance stabilizes. Make a list so that you pay off your bills by the end of the month. It will prevent a Home backlog at the starting of the next month.

Alternative Funds and Coverage

Insurance and some monetary benefit policy for you and your family turns out to be very advantageous for a debt. In the event of medical emergency, you can use your health insurance to cover the expenses. Hence, something as unpredictable as illness or accidents will not put a sudden strain on your finance. It is also vital for you to make an emergency fund. An emergency fund is something where you out in a portion of your salary for emergency purposes. Having an emergency fund and a health insurance during a debt makes it simpler for you to save during a crisis. A financial policy is something that you can use if the household debt situation worsens.

Paying back your obligations

To pay back your debts, you have to use a part of your income and part savings to maintain the balance. You can take up an extra job. It will help increase the revenue and make it easier to pay. You can make a plan of paying your debts. The smaller debts, you can pay back first. For the bigger debts, you can opt for a debt consolidation loan for bad credit; Debt consolidation is where all your large amount debts are converted into one loan. This loan has a lower interest rate than other loans. Lower interest rate means lower interest amount. You can also take help from non-governmental debt relief firms. They have the expertise as well as experience for all sorts of debt management. To know more about these, check out the various sites on net by tapping the click here icon.

Knowing your privileges

It is important for you to be aware of your rights during a debt crisis. You have the legal right to ask for the change in the payment arrangement for debts. You cannot go to prison on the eve of your inability to pay the dues. If the creditors feel that you have deliberately denied their payment even while you could afford it, they would ask for a negotiation. Many of your creditors are legally obliged to consider your request for a special payment arrangement during your Home hardship. Being aware of your rights will help you deal better with a stressful situation like these.

Tags:

budgeting,

debt,

financial planning,

Interest Rate,

loans,

money,

savings

September 16, 2016

Personal loan interest rates are not as low as home or education loan interest rates. So if there was a way to get a personal loan on rates lower than what are actually available, it can significantly help reduce the interest burden on the borrower.

Personal loan interest rates are not as low as home or education loan interest rates. So if there was a way to get a personal loan on rates lower than what are actually available, it can significantly help reduce the interest burden on the borrower.

There is indeed a way to reduce the interest rates on personal loans. This way is to take a loan against your fixed deposits. There are quite a few benefits of this. First of all, you don’t have to liquidate your deposits. Second is that generally, personal loan eligibility is dependent on your credit history, current income and ability to repay the loan. But in case of loan against FD, the lender won’t bother much about your credit history as he already has your fixed deposit as collateral.

The biggest benefit of loan against FDs is the lower rate of interest. Personal loan interest rates can easily exceed 15%. But a loan taken against fixed deposit charge interest rate that is just 3-4% more than the rate of fixed deposit. And this can significantly reduce your EMIs.

Let’s take an example.

Suppose you need Rs 3 lac as loan. You have a FD (earning 8% interest) but you don’t want to liquidate. So you decide to take a loan against it. Your lender is giving your regular personal loan at 16%. But as soon as you show intent to borrow against FD, the rates reduce to 11%. How does it impact your EMI given the repayment period is 3 years?

Your normal personal loan EMI will be Rs 10,547.

Your EMI for loan against FD will be Rs 9822.

Though this difference of few hundreds might look small, it can give you significant savings over the 3 year period. Calculations show that you can save more than Rs 26,000 in lower interest costs.

Do not forget that in case of default in loan repayment, the lender can foreclose your deposit to recover the outstanding amount. So do consider taking a loan against FD, if you want to lower your EMIs and also don’t want to liquidate your savings.

Tags:

budgeting,

car title loans,

cash,

Debts,

economy,

Interest Rates,

loans,

money,

Retirement Savings

Most families have accumulated a significant amount of debt due to auto loans or credit cards that have been used over the years. Acquiring debt can make it easy to feel limited with your finances, which can make it difficult to make ends meet. To become debt-free and obtain financial freedom, there are a few important steps to take.

Most families have accumulated a significant amount of debt due to auto loans or credit cards that have been used over the years. Acquiring debt can make it easy to feel limited with your finances, which can make it difficult to make ends meet. To become debt-free and obtain financial freedom, there are a few important steps to take.

Recent Comments