February 7, 2014

Hands up if you’ve got your tax act together! What? No hands up? Well then, grab a seat and listen up!

The State and Federal governments have set up certain due dates for filing or e-filing your taxes. To some, understanding taxes and meeting tax deadlines is the first among many horrifying aspects of filing tax returns. But once you understand when and what needs to be filed, it will be the first big step you’ve taken towards de-horrifying the process of tax filing and returns.

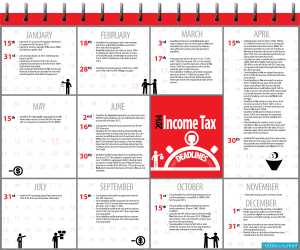

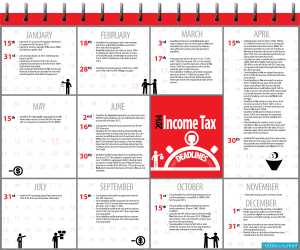

April 15th is a big date to remember. Not only must you file your taxes by this day but you also need to pay an estimate of any taxes due. 11.59 pm on that day is the deadline. Miss that and you’ll need to request an extension from the IRS. And even if you do request an extension, remember you still need to pay the taxes you owe.

In addition to that big date, there are several due dates to keep in mind depending on your status – whether you’re individual tax payer, a business (S corporation, C Corporation or LLC) or a charity. The infographic below will help you keep a track of those dates. Remember, if a filing date falls on a weekend or a national holiday, the date will be moved forward to the next working day. It’s important not to miss these dates because if there’s one thing you don’t want, is the IRS on your back, right?

What happens if you don’t meet the deadline?

Brace yourself! This is the next horrifying part of filing taxes. A lot. A lot of bad things can happen if you don’t meet that deadline. For one thing, the fee for not filing is a lot harsher than it is for late filing. In addition, there are penalties which you can check out on the IRS website.

What Not to Forget

You’d be surprised at the common mistakes people make when filing their taxes. Before you send those papers to the IRS double check whether you’ve:

• Put a stamp on the envelope

• Signed the documents (Don’t laugh. It happens more often than you’d think)

• Included the social security numbers of their children and adult dependents

• Annual limits and tax tables can change from year to year. Make sure you’re using the right.

If you run a small business, there’s a never-ending string of dates that you have to keep in mind. Make entries in your PDAs, your laptop and any other devices you use to keep your appointments to help you stay on top of things.

What to Remember

Remember to take advantage of tax deductions. These may change from year to year as well and I sometimes suspect it is in the IRS’s best interests to confuse us folks! It may help to hire professional accounting firms whose job it is to prepare and file your returns while maximizing your earnings. Firms, like 1800accountant, designate a personal accountant to your case and offer 24/7 access the whole year round. It’s worth looking into such services and enjoy the peace of mind that comes from knowing you’ve got your taxes taken care of and managed to make some tax savings. Now that’s what I’m talking about. 🙂

Tags:

budgeting,

economy,

Income Tax,

money,

tax

January 23, 2014

The commonly held perception of retirement living is rapidly changing. No longer are older adults settling down after leaving the workforce. Today’s retirees are more focused on active living, whether in the form of exercise, volunteering or picking up a new skill. These new trends will certainly have an impact on the financial strategies of the nearly 10,000 baby boomers turning 65 each day. Here’s a look at how the latest generation of retirees plan on spending their golden years.

Tags:

budgeting,

Interest Rates,

money,

Retirement,

Retirement Savings,

savings

November 19, 2013

Over time credit cards have become one of the most popular finance options. Their flexibility means that they can be used in almost any financial situations; whether you’re looking to spread the repayments of a large purchase, spend money overseas, build your credit history or earn loyalty points or rewards on transactions.

Over time credit cards have become one of the most popular finance options. Their flexibility means that they can be used in almost any financial situations; whether you’re looking to spread the repayments of a large purchase, spend money overseas, build your credit history or earn loyalty points or rewards on transactions.

Unfortunately though, when they are not managed properly credit cards can cause real financial problems – and because of their relatively high interest rates; the longer you leave it the worse it gets. Throughout this article we are going to run through a 5 step guide to how you can overcome credit card debt and get your finances back on track:

Step One: Calculate how much you owe

Although it may be tough to face the reality of your problems, this is ultimately the first step to overcoming your debt. So, find your most recent statements and see how much you have outstanding on each card. Until you are debt free it’s definitely a good idea to stay away from spending anymore on your cards.

When noting down all outstanding balances it may also be a good idea to include the interest you’re being charged highlighting any interest free deals or bonuses that you are currently benefiting from.

Step Two: Create/ recreate your budget

There are three possible reasons you got into debt in the first place:

1. You overspent month on month

2. Your budget wasn’t effective

3. You didn’t have a budget

Whatever the root cause of your problems, you need to draw a line underneath it and work on putting things right. The single most effective way of doing this is by creating an effective monthly budget.

To do this you firstly need to note down all sources of income that you’re receiving month-on-month. This will include your mainsalary, any other jobs you may have, anything you may be earning on savings or investments and finally any benefits or tax credits you may earn. Having added all of these together you now need to calculate your level of outgoings.

In order to determine how much you are spending throughout the month you firstly need to gather as many recent bank statements as you can. Arguably the most effective way of listing your outgoings is to split them into compulsory, essential and luxuries. Your compulsory outgoings will be payments that you make each month without fail, so things like: your rent or mortgage, utilities, council tax, loan repayments and insurance costs. Your essentials are things that you couldn’t get by without but often differ in cost each month, such as food, petrol, mobile phone and broadband bills, car maintenance costs, TV licence and parking costs. Finally, you luxuries are things that you don’t necessarily need such as entertainment costs, night outs, dining out, gym memberships, holidays and gifts.

It will be evident by simply looking at your bank statements whether each expense differs on a monthly basis or stays the same. For those expenses that differ, take an average from the past three months and if you’re in any doubt always overcompensate.

Your final step is to calculate your disposable income; this simply involves deducting your total monthly outgoings from your total monthly income.

Step Three: Adjust your budget

Now it’s time to make some adjustments to your budget in order to increase your level of disposable income. There are two ways of doing this; increase your income or decrease your outgoings. Decreasing your level of outgoings will be the simplest way of doing this, and your first stop should always be the luxuries section. By simply reducing the amount you spend on eating out, takeaways and seasonal gifts you could find yourself £100 better off over the course of the month.

Always assess your subscriptions too; do you get the most out of your gym membership? Do you really watch TV enough to warrant having Sky TV? Remember, the more you can save the more you can put towards credit card repayments and subsequently the quicker you can get debt free.

Step Four: Calculate how much you can afford to contribute each month

Now that you know how much money you have left over at the end of each month you can start to calculate how much you can contribute to repayments. Often the most effective way of getting debt free is by snowballing your debts. Snowballing is basically just the process of paying off debt in order of interest rate (from highest to lowest). So while you may only be paying the minimum payment on three of your cards, you are taking large chunks off the balance of your highest interest card.

It may be tough at first, but you need to condition yourself to churn any additional disposable income into your credit card debt. So, if you get a bonus at work or do some overtime then this needs to go towards your credit card repayments. The lower your level of debt gets the easier it will become.

Step 5: Keep your eye on the prize

There are temptations to spend every day you just need to ensure that you keep your eyes firmly on the prize of getting debt free. The rewards of being debt free will feel so much better than the five minutes of joy you get from an impulse buy.

Tags:

budgeting,

Credit Card,

Credit Card Debt,

Debts,

economy,

Financial Problem,

money

November 15, 2013

Are you stuck under a pile of credit card bills, student loans or a mortgage? You are not the only one. Across the world, people are struggling to come to terms with and control their debt. The worst part is when all your debt accounts are handed over to a collections agency and they come calling at your door. With all their harassment and insults, they make you feel like it’s the end of the world. Don’t worry and remember that it’s all a part of the game they play to get their job done.

Are you stuck under a pile of credit card bills, student loans or a mortgage? You are not the only one. Across the world, people are struggling to come to terms with and control their debt. The worst part is when all your debt accounts are handed over to a collections agency and they come calling at your door. With all their harassment and insults, they make you feel like it’s the end of the world. Don’t worry and remember that it’s all a part of the game they play to get their job done.

Before all this starts happening, the best thing to do is take a reality check. The moment you realise that your debt situation is out of control, start thinking of ways to control it. There are ways and means on how to negotiate debt settlement.

Deal with the collectors

Face up to these guys and come to a settlement. What are some of the considerations while dealing with the collectors?

- Get the priorities right. When you decide on giving money to your creditors, first make sure that all your basic needs are covered. After keeping aside money for food, lodging, medicines, etc, then you start prioritizing the debt that you need to pay off. Never get intimidated by the collectors.

- Keep records. When it comes to money matters, make sure you have records of every deal and interaction along the way. All the letters, the e-mails, must be saved. Try and avoid voice interactions as much as possible and keep the correspondence written. Whenever any agreement is made, make sure it’s all in black and white and signed by the appropriate authorities.

- Again, don’t be coerced into paying more than what you can realistically afford. Don’t be taken in by the demands of the collectors and always offer to pay less than what you can actually afford. Always appear to be in control of the situation. If you show your vulnerability, they will zone in and try to take advantage of your weakness. This is one of the prime rules in how to negotiate a debt settlement.

Getting the services of a debt settlement company

Do you feel that confronting credit sharks is not in your style? Then you can always hire a company to deal with your creditors and do the negotiations. Again, step very carefully when you are hiring a company. Only hire a company with a good, solid reputation. Always go by referrals and recommendations. Remember that a respectable company wont need to solicit services through telemarketing and email blasts. They will rely on their good reputation through a steady clientele.

One important question to ask yourself before hiring a firm is whether their fees will add to your existing debt or actually sort out your debt problems? Be sure to get a clear picture of what their fees are and how those are being charged. Get it in writing to avoid grey areas.

Be well informed and aware

Make sure you are protected by knowing your rights. The more informed you are, the stronger your position will be. No one will be able to take you for a ride. You can get free data on debt settlement firms and collectors, from bodies like the state attorney general’s office, the FTC and so on. Then you will know what these people are allowed to do and not, with your debts. Get information about the debt settlement firms from your local Better Business Bureau before taking any definitive steps.

Act on time, and your future will be a steady one.

Ashton is a reputed freelance writer on topics like finance, debt and real estate. He has been published in internationally known publications over the past five years, where he has written articles on how to negotiate debt settlement. Ashton loves watching fantasy movies.

Tags:

budgeting,

Debt Negotiation,

Debts,

economy,

financial planning,

money

October 5, 2013

Considering our invest goals is our very first step towards a successful investment. In order to choose your best investment option, you must determine the investment type that suits your requirements. Both investing and saving need to be defined ahead of all other things; in comparison to a long term engagement like investing, saving is an engagement for a short period.

Considering our invest goals is our very first step towards a successful investment. In order to choose your best investment option, you must determine the investment type that suits your requirements. Both investing and saving need to be defined ahead of all other things; in comparison to a long term engagement like investing, saving is an engagement for a short period.

Expenses like going out on vacations, paying fees for college tuitions, making a down payment for your home and buying a car are included within your saving goals. When it comes to savings, certain conventional investments may seem inappropriate as their value tend to fall with time. For successful asset management, you may seek guidance from an experienced financial adviser. CDs or online savings accounts that yield high returns may be considered as good options to secure your long time savings. You must compare various interest rates offered by online banks.

A proper financial planning takes all long term goals into accounts e.g. college tuition, inflation, retirement and other common investment objectives. Investing and saving are two categories that college tuition listed under them. The time frame you’ve selected will determine the group under which you’ll place each of them. Investments worth an intermediate length may demand more risks. For instance, you may take more risk towards investing money saved on your daughter’s college fund when he’s 10 years old than when she turns 18.

Pick the right investment vehicle

Your asset management plans turn successful once you pick the right investment vehicle after considering all major goals of investment. Remember, it’s not about jumping to the most lucrative offer that comes your way. You may begin with options that seem more interesting and funny like brokerage accounts, college saving funds, 401k plans and IRAs. Investment plans are usable only when they possess certain incentives or tax breaks for your benefit. Through your retirement years, you may enjoy tax breaks only when you choose retirement plans with tax advantages initially e.g. 401k and IRAs. For college savings you may opt for Coverdell ESAs and 529 College Savings Plans.

Open your investment account

An investment accounts needs to be opened as soon as you pick your investment vehicle and analyze your investment goals. It will just take a few minutes for you to start an IRA or get enrolled your 401k; it’s almost that simple. Opening your brokerage account could just be another option for you. It’s really simple to open your investment account; all you need to do is to fill out your information, sign it and shift funds to the account. Picking the best investment option often depends on identifying your investment types correctly!

Tags:

budgeting,

financial planning,

Funds,

investments,

money,

Returns,

savings

Recent Comments