March 12, 2014

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

Instead of buying a new TV or going on a clothes shopping spree, it’s often much wiser for Americans to concentrate any tax refund money on improving their financial standing overall. Perhaps the best method for doing this, in a number of ways, is to pay down outstanding debt of almost any kind. This will have the dual purpose of both reducing the cost of monthly payments faced for having such balances outstanding, but also improving their credit scores. Usually, it’s the wisest idea to pay off the debt that comes with the highest interest rate (usually credit card balances) because of the ways in which big rates can tack on additional debt in a shorter period of time. The larger the refund, the more substantially debt can be cut, and thus the pressure on a household budget can be reduced.

What about consumers who don’t have big debts?

Of course, not everyone has thousands of dollars worth of credit card bills to deal with, or might be constrained by parts of mortgage or auto loan agreements which state they cannot pay them off before a certain date. For those people, it might be wise to simply put a tax refund into savings, instead. This, though, can be approached in a number of different ways. It could be used to build emergency savings, in the event of a problem that arises down the road, or they could simply put them into retirement accounts that will help to secure their financial futures.

For those who haven’t yet filed their returns but want to maximize their refunds, it might be wise to speak with a tax professional who may be able to help identify some potential deductions that could help to increase the amount of money they receive back from the IRS.

Tags:

budgeting,

economy,

financial planning,

Income Tax,

investments,

money,

tax,

Tax Returns

March 11, 2014

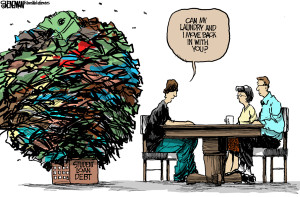

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

Checking essential registration

You must be aware that several agencies operate without proper licensure. Either they do not have the registration at all, or they have an invalid document. Working with dubious services can land you in deep troubles you do not want. Many identity theft services do rounds in the debt market. You can identify them by the unrealistic claims. It is impossible for a company to make a person debt-free within one week. You cannot just make thousands of dollars in debt disappear overnight! Money is not an illusory magic trick! It is the realest thing in defining a society. You need to be superbly realistic in facing money issues. Never forget to discuss the consequences and penalties of missing an installment. Always ask whether the service can provide their verifiable registration number. Follow this approach even when you apply online.

Identifying the right service

Of course, a company can facilitate consolidation within a week. It requires efforts, but a well-connected service can easily accomplish the task. Call the customer service in verifying whether they have the necessary systemic contacts. Check if they maintain stable connections with the bank and credit card services. The debt relief service must negotiate your consolidation with lenders. You may follow the official protocol of bankruptcy. Many services also offer consolidation on a one-to-one basis, without filing a bankruptcy claim. You have two claim options, the chapter 7 and the chapter 13. Discuss the appropriateness of both parameters with the debt rescue customer support.

Convenient loan provisions

The relief service essentially arranges the most convenient loan package. However, you need to verify whether the assigned conditions are compatible with your personal finance. Start with checking your monthly budget balance sheet. You can also use amazing online accounting resources to develop a balance sheet. See whether the credit repair agency has the necessary tools such as debt calculator and budget balance sheet. They may or may not have it. You can find many free online software solutions for the purpose. You must check the loan interest rate total value. Services also levy additional fees on the final amount. Inquire to interpret the exact amount you need to allocate every month for repayment.

You must find a service with the most helpful attitude. Their genuine helpfulness must reflect in different aspects of their service. See if they can adjust the service fees with the loan monthly installments. Understandably, it is extremely difficult for you to pay in lump-sum at the first. The convenient payment packages simplify things. The company should be able to present a clear blueprint of debt freedom. However, you may need to make some personal adjustments. Consider shifting to a debit card or a secured credit card. These can effectively assist in managing your credit bills. You do not even receive a bill with the debit card purchases. However, you need to look up legal options for certain specific loans that do not fall under the bankruptcy plea even.

Tags:

budgeting,

credit,

Credit Card,

debt,

debt freedom,

economy,

financial planning

February 10, 2014

Debt consolidation loan is a big loan by which the borrower settles the existing smaller loans. The offer is highly beneficial to the borrower. However, the program has negative factors as well. It is necessary to understand the pros and cons of the offer before you opt for a debt consolidation program. The plan is good for certain situations. By consolidating your debts, you are relieved of the stress due to the need to follow different payment schedules. Concentrating on a single payment will help in finding better ways to clear the existing debts quickly.

Debt consolidation loan is a big loan by which the borrower settles the existing smaller loans. The offer is highly beneficial to the borrower. However, the program has negative factors as well. It is necessary to understand the pros and cons of the offer before you opt for a debt consolidation program. The plan is good for certain situations. By consolidating your debts, you are relieved of the stress due to the need to follow different payment schedules. Concentrating on a single payment will help in finding better ways to clear the existing debts quickly.

How does the program help to ease out your stress?

The monthly payments due to the loans get decreased when you choose a good debt consolidation program. The term of the loan is extended and so the amount that you pay is reduced significantly. It is possible to manage the debts that are beyond control. The poor credit loans with high interest rates can be cleared with the use of debt consolidation program. If an individual has various credit card dues with extremely high rates of interest, you can bring your debts under control by accessing a debt consolidation program with lower rate of interest.

With reduced monthly payments, you can make the payments comfortably and avoid penalties for late payments. Since the late payments also affect the credit report it is necessary that you make the payments on time which could be possible with lesser interest rates on loan consolidation programs. You need to take time to search for a program that comes with lower interest rates or else the purpose of the plan cannot be served. It cannot be always easy to get access to a good offer. Before you commit to a debt consolidation loan, you should understand that with extended term, you end up paying more on the loan than it is worth.

An important factor that you should understand the risk involved in the program. Mostly, the debts are consolidated with a home equity line of credit or home equity loan. Since the loan amount can be huge and there are some tax benefits, the offer might seem impressive. But defaulting on loans will result in the loss of the home. Though the credit card loans are very costly, there is no risk for the property as nothing is needed as security for the loans. But the loan consolidation is possible only with some collateral.

With a variety of loan consolidation programs, you have to shop around to find one of the best debt consolidation programs. The offers from the banks or the credit unions are highly reliable sources of debt consolidation loans and you can get good deals. Person to person no credit check payday loans lending sites and online lenders are some of the sources that can give you the offer that you need. If you are not able to decide whether you really need a debt consolidation program, you can consult your financial adviser to understand your exact needs and also to know about the offer that could help you ease out your financial situation.

Tags:

budgeting,

Debt Consolidation,

Debts,

economy,

financial planning,

money

February 9, 2014

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Tags:

budgeting,

debt,

financial planning,

money,

mortgage,

Students Loan

February 8, 2014

Every car insurance company promises you their very best rate. They also promise to make you an offer that their competition can’t top. In other words, insurance providers make promises they can’t keep. So, what can you do to make sure you get the best deal on the market? Make your own.

Every car insurance company promises you their very best rate. They also promise to make you an offer that their competition can’t top. In other words, insurance providers make promises they can’t keep. So, what can you do to make sure you get the best deal on the market? Make your own.

Consumers know that it pays to shop around. Smart buyers compare quotes from several insurers before purchasing a policy. However, even the savviest shoppers probably don’t know that after they’ve found the best coverage at the lowest rate there are ways to save even more.

How? It’s all about research. Car insurance companies will be quick to talk you into their most comprehensive coverage. On the surface, the old adage—more is better—appears to ring true. What these companies won’t tell you, though, is that these top-tier policies are excessive for everyday drivers. And in this case, excess is expensive. By taking a thorough look at your driving habits, vehicular assets, and overall financial situation, you can determine how much coverage you actually need.

Do you drive every day, or just occasionally? Is your commute 15 minutes, or 50? The answers to these questions matter. The more time you spend behind the wheel, the more likely you are to be involved in a collision, statistically speaking. Naturally, the converse is true. If you only net 15 road miles each week, you aren’t as likely to cash in on your policy. Many insurance representatives are trained to ask these questions when providing a quote. If yours never did, it’s time to make a phone call. And if you recently changed jobs and are now working closer to home, you should update your insurance provider; it’s likely that they will lower your rate.

What you drive matters just as much as how you drive. Unless your vehicle is new or you’re still making payments on an auto loan, you might be carrying more insurance than you need. Check the Kelley Blue Book value of your car. If this figure is significantly lower than your comprehensive or collision coverage, it may be time to adjust your policy accordingly. In some cases, as for those who drive old (but not collectible) cars, it could be worth dropping collision coverage entirely.

Choosing a plan with a higher deductible might not sound like a good way to save money. However, drivers with a great safety record can cash in big with this strategy. Here’s the logic: safe drivers are involved in fewer accidents. By raising your deductible, your insurance costs drop—sometimes an increase of just a few hundred dollars means a 15% to 40% reduction in overall policy fees. A portion of the money saved on premiums can be set aside to cover the deductible in the event you need to file a claim. The remainder of this money is then free for investment or can be put towards purchases you actually want to make.

Having your financial ducks in a row pays off. Many auto insurance providers will now review your credit score and reward fiscal responsibility with discounts. When you’re looking to spend less on car insurance, be sure to inventory your other expenses. Check for duplicate coverage. For example, AAA membership offers roadside assistance and towing. There’s no sense in carrying policy add-ons for these services if you’re already getting them elsewhere. This is also true for bodily coverage. If you carry a fairly comprehensive medical insurance policy, it is likely that any bills resulting from accident-related injuries will be taken care of.

Tags:

budgeting,

Car Finance,

Car insurance,

financial planning,

insurance,

investments

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

Recent Comments