October 5, 2016

It is one of those timeless conundrums which has tested the thinking of man for centuries. If you had to, would you do something you know was very dangerous.

It is one of those timeless conundrums which has tested the thinking of man for centuries. If you had to, would you do something you know was very dangerous.

If you saw a child about to be run over, would you step in front of a car to save them? If you are dying of thirst, would you drink filthy water to survive? If you house is on fire, would you jump out of the window to escape.

We have all pondered these kinds of questions at some point, but fortunately most of us never have to contemplate the dilemma in reality.

But there are other everyday dilemmas that we do have to confront which, whilst perhaps not involving the same danger, can still expose us to significant risk.

One such example of this is when we use online banking. We know online banking is insecure. It doesn’t matter which bank you use, and how many trendy keypads and other gadgets they give you, we all know there is still a risk when we log into our online account which isn’t there if we want into a branch.

The popularity of online banking suggests two things about this. Either we don’t fully understand the extent of the risk, or we have decided it is a risk we are willing to take. For most of us, it is a combination of both.

But make no mistake, online banking does pose a significant risk. The level of security used by all banks is extremely weak and the techniques of online hackers gets ever more sophisticated. And often we don’t help ourselves, making basic errors like using easy-to-break passwords or logging on while connected to public Wi-Fi networks.

The ramifications if you are hacked can be significant too. Of course, you can lose a lot of money. However, as most banks will compensate you in those circumstances that is sometimes not a big worry. But going into overdraft or losing a sizable amount of money can affect things like your credit cards, and premium accounts you may hold, and of course run up charges with your bank that can take months to sort out.

Then there is your credit score. If you are hacked and miss payments as a result, it can affect your credit score which might cause you to be unable to get credit and secure mortgages and other financial services.

So, the question I am often asked is whether there is a way to protect ourselves when using Online Banking. Is it possible to make the process more secure?

Encouragingly, the answer is yes. And in this article I will give you my tips as to the top 3 ways to keep your online banking secure in 2016:

1. Use an ‘Anti-Spy Privacy Screen:

For all the high-tech ways that people get hacked these days, there are still a significant number of incidents where data is stolen simply by watching over people’s shoulder as they use their online banking account in public.

It might seem silly, but it happens a lot and it is unnecessary because there is a cheap and simple bit of kit which can prevent it: an Anti-Spy Privacy Screen.

There are available for all devices these days and work in the same way as a regular screen protector. However, they are a little thicker and a little darker, and this means that when you look at the screen of a device from an angle, you can see nothing.

Only the person directly facing the screen can make out what is there, so when you log onto your online banking on the go, you can be sure that the only person looking, is you.

2. Change your Password Regularly:

Passwords are another big vulnerability of online banking. Often they are easy to guess, simple to crack, and offer little or no real protection.

One way around this is to use a Password Manager such as Last Pass which can make it easy for you to use complicated passwords without having to remember them all.

But another relatively effective approach is just to change your password on a regular basis. If you are an occasional user, making a password change every few months is a sensible precaution, but if you are logging into your account regularly and from different locations, every few weeks would be more sensible.

3. Use a VPN:

Perhaps the most important tip on this list is to use a VPN. A VPN can help ensure your online banking is secure in a variety of different ways.

Encryption is vital to keep your data secure online and whilst all banks will encrypt their online banking data, some are more secure than others. A good VPN will ensure all of your online activity, including online banking is encrypted securely.

They also protect you when you are using public Wi-Fi. Again the encryption they offer means even the weakest of Wi-Fi connections becomes secure.

Indeed, VPNs are so good at encrypting your online activity that you can even access otherwise inaccessible online services, like being able to log onto Gmail while in China, where it is usually blocked.

With a VPN in place, and using these other precautions as well, you can be pretty confident that your online banking will be secure, no matter who you bank with.

Tags:

economy,

Financial Securities,

investments,

money,

Online Banking,

savings

September 19, 2016

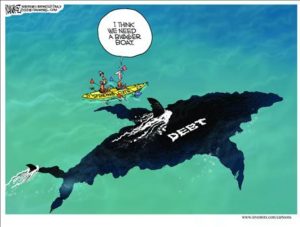

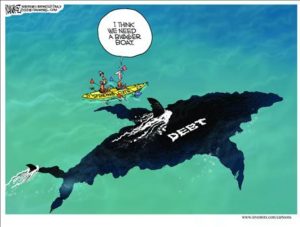

Home Debt is one of the most common occurrences you may face. A Home debt occurs when the borrower is unable to pay back the amount within his due time. Home Debt, in the beginning, may be a little confusing to you, but you have to find a way out of it. Home debt has pretty simple solutions, which if followed is bound to yield results. During the time you are in debt, you have to keep a tab on expenses, income, savings and different budgets.

Home Debt is one of the most common occurrences you may face. A Home debt occurs when the borrower is unable to pay back the amount within his due time. Home Debt, in the beginning, may be a little confusing to you, but you have to find a way out of it. Home debt has pretty simple solutions, which if followed is bound to yield results. During the time you are in debt, you have to keep a tab on expenses, income, savings and different budgets.

Supervision of your capitals

Management of funds during a debt is of utmost importance. The first step to that is to form a budget. You should assign a certain amount as your designated monthly budget and have to be careful in maintaining it. No matter what happens, you cannot allow yourself to go beyond the budget. Make a list of things of your Needs and Wants. This way, you will have an idea about your immediate requirements. You can keep you wants on hold for some time till your finance stabilizes. Make a list so that you pay off your bills by the end of the month. It will prevent a Home backlog at the starting of the next month.

Alternative Funds and Coverage

Insurance and some monetary benefit policy for you and your family turns out to be very advantageous for a debt. In the event of medical emergency, you can use your health insurance to cover the expenses. Hence, something as unpredictable as illness or accidents will not put a sudden strain on your finance. It is also vital for you to make an emergency fund. An emergency fund is something where you out in a portion of your salary for emergency purposes. Having an emergency fund and a health insurance during a debt makes it simpler for you to save during a crisis. A financial policy is something that you can use if the household debt situation worsens.

Paying back your obligations

To pay back your debts, you have to use a part of your income and part savings to maintain the balance. You can take up an extra job. It will help increase the revenue and make it easier to pay. You can make a plan of paying your debts. The smaller debts, you can pay back first. For the bigger debts, you can opt for a debt consolidation loan for bad credit; Debt consolidation is where all your large amount debts are converted into one loan. This loan has a lower interest rate than other loans. Lower interest rate means lower interest amount. You can also take help from non-governmental debt relief firms. They have the expertise as well as experience for all sorts of debt management. To know more about these, check out the various sites on net by tapping the click here icon.

Knowing your privileges

It is important for you to be aware of your rights during a debt crisis. You have the legal right to ask for the change in the payment arrangement for debts. You cannot go to prison on the eve of your inability to pay the dues. If the creditors feel that you have deliberately denied their payment even while you could afford it, they would ask for a negotiation. Many of your creditors are legally obliged to consider your request for a special payment arrangement during your Home hardship. Being aware of your rights will help you deal better with a stressful situation like these.

Tags:

budgeting,

debt,

financial planning,

Interest Rate,

loans,

money,

savings

September 15, 2016

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

Personal loans are unsecured form of loans. This means that lenders do not have any recourse on any security in case the borrow defaults. As a result, lenders give personal loans at higher interest rates to compensate themselves for higher default risk that they are taking.

So how do lenders decide what rate to charge from different personal loan customers?

Everything for lenders boils down to a simple concept, higher the risk, higher the interest rate. So from a borrower who is considered safe, lenders will charge lower interest rates.

There are several factors that are used to assess the risk – current income, income stability, profession, age, existing loan EMIs, past loan repayment history, etc.

So if you are in a stable job, have a good income and do not have too many existing loans, the lender will lend to you at a lower interest rate as you are considered a safe borrower with lower default risk. However, if you have too many loan EMIs and have not be regular in your repayments, then you will be considered a risky borrower and lender will increase interest rate at which personal loan will be give to you.

Your past loan repayment history, as depicted by your credit score plays a major role in your risk assessment. So if you are unsure about your perceived riskiness as a borrower, to get in touch with lenders to understand the interest rate ranges that are applicable to different types of borrowers. Once you know the possible interest rates, you can use personal loan EMI calculators to find out much you EMI will be.

Tags:

budgeting,

Debts,

loans,

money,

personal finance,

savings

June 30, 2016

As you’re leaving school, finishing university and getting your first job, retirement is most likely the last thing on your mind. But taking a few steps to set yourself up in your 20s can go a long way to avoiding financial stress in later life. It’s never too early to start preparing for your future.

As you’re leaving school, finishing university and getting your first job, retirement is most likely the last thing on your mind. But taking a few steps to set yourself up in your 20s can go a long way to avoiding financial stress in later life. It’s never too early to start preparing for your future.

Set some goals

It’s much easier to get what you want, if you’re clear about what exactly it is you want. We all want to have feel fulfilled, but what does this mean to you and how are you going to achieve it. Of course these goals may change but the planning will be the same.

Consider setting yourself some short, medium and long term goals.

Short term goals might be taking a holiday or buying a car. These are the things you should be putting money towards now, on a regular basis.

Medium term goals can set you up for the next stage in life. Will you want to buy a house, raise a family? You might not want to put all your money towards these right now but they will require planning and saving.

Long term goals will most likely your retirement. You superannuation fund will go a long way to determining this, so it’s important to ensure your employer is contributing correctly.

Pay down your debt

Putting aside savings for a car is all well and good, but any debts you have may affect your ability to reach your financial goals in the short to medium, or even long term. Don’t forget to include any debt repayments as part of your budget.

Budgeting

Budgeting doesn’t mean living on baked beans while you’re friends are out eating at a nice restaurant. What it does mean is being realistic about exactly how much money you are earning and spending. Creating a budget is the best way to track your expenses and avoid living beyond your means. Try some of these great budgeting apps to help you manage the process.

Automatic savings

Once you have created your budget and know exactly how much you have available, you can start saving for your goals. Setting up an automatic payment to a separate savings account will help keep you on track and stop the temptation to dip into your funds.

Sort your Super

For any job you hold over the age of 18 and earn more than $450 a month, or any job in which you work 30 hours or more per week, your employer pays out superannuation. Unless you specify otherwise, these workplaces pay your super to an account with their chosen super fund. Which means if you have had four different jobs, you could have as many as four different superannuation accounts, and be paying four sets of fees.

Combining these funds into the one superannuation account means you only pay one set of account fees, but also means it’s easier to track how much money you have to set you up for your retirement.

Tags:

budgeting,

economy,

financial planning,

Financial Retirement,

money,

savings

March 15, 2016

In 2005, I began working with a new client. She just got divorced after over 30 years of marriage. Like many women, she had been content to allow her husband to take care of their finances. However, circumstances changed. In her late 50s, this woman found herself in uncharted waters: managing significant financial matters with zero prior experience.

In 2005, I began working with a new client. She just got divorced after over 30 years of marriage. Like many women, she had been content to allow her husband to take care of their finances. However, circumstances changed. In her late 50s, this woman found herself in uncharted waters: managing significant financial matters with zero prior experience.

While insurance, investments and financial planning have traditionally been “a man’s game,” there are many statistics that predict a different story. Women are living significantly longer than men and are more likely to become widows. Like it or not, it’s imperative for women stay on top of all things financial, for themselves and their families.

There are many aspects to financial planning: savings, retirement, day-to-day expenses, student loans, college savings, estate management, building a comprehensive stock market portfolio, life insurance, and more! It can get overwhelming trying to keeping track of every aspect of your broad financial plan. Here are four tips to get started:

1) Make it fun. Financial planning is not something that brings an immediate smile to one’s face. Try to take the stress out of it by making your conversations fun. Plan a “date night” where you cook together and go over one aspect of the finances over dinner. Don’t try to go out: restaurants are wonderful for romance, but not great for private financial conversations. Whatever it is you enjoy, try to mix that in so you can associate something positive with this new learning adventure.

2) Don’t get defensive. Your goal is to become more educated and involved in your family’s finances. This doesn’t have to be a cause for alarm or fighting! Remind whoever is currently in charge that this is not a criticism of what they have been doing. You are not going to change things overnight or perhaps even at all, so do not start out on the defensive.

3) Start with cash flow. In terms of where to start, I recommend beginning with the basics: cash flow. Where are funds currently being spent and allocated? How are new expenses prioritized? This is a good time to analyze expenses both from a high level and then more detailed. We get busy with our daily lives and while a $100/year item may not be significant—how many of them are there? Those can really add up.

4) Meet and engage with your team. Do you personally know your CPA, attorney, and financial professionals? Start to build a relationship with them. Make sure you understand how they make decisions, how they bill, and how they can help you and your partner reach your goals.

Starting the process is half the battle,and there is no wrong answer when deciding which area to approach first. Remember that this is a team effort between you and your family, spouse, or partner, so don’t try to go it alone. By following these steps,I believe you will become more empowered to make smart financial decisions in good times and in bad.

Meghann McKenna is Owner & Financial Adviser at McKenna Financial in Bozeman MT, a family owned financial firm serving clients since 1949. She also is a Registered Representative offering securities through NYLIFE Securities LLC, Member FINRA/SIPC a Licensed Insurance Agency, and a Financial Adviser offering investment advisory services through Eagle Strategies LLC, a Registered Investment Adviser. McKenna Financial is not owned or operated by Eagle Strategies LLC or its affiliates. This article is offered for general information purposes only. It does not set forth solutions to individual situations. Consult your professional advisor(s) before implementing any planning strategies. SMRU 1683868 (exp. 2.18.2018)

Tags:

budgeting,

Earnings,

economy,

financial planning,

money,

personal finance,

savings

It is one of those timeless conundrums which has tested the thinking of man for centuries. If you had to, would you do something you know was very dangerous.

It is one of those timeless conundrums which has tested the thinking of man for centuries. If you had to, would you do something you know was very dangerous.

Recent Comments