September 20, 2016

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

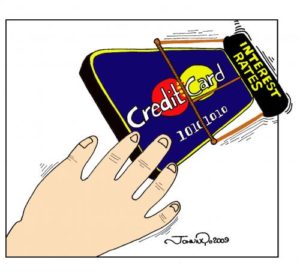

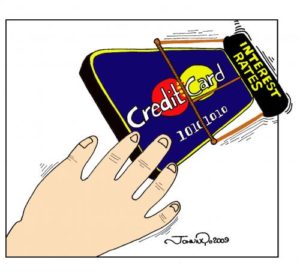

Taking control of your cards

Credit cards are sure going to offer you with the lucrative options of buying products, without carrying cash. Well, it becomes difficult, as you have to be aware of the reputed packages, over here. Moreover, when you are using credit cards, you are not aware of the money you are spending on it. Therefore, at the end of each month, when the generated bill reaches your address, you feel like facing some problems with it. With the help of reliable experts, you can be out of this problem.

Controlling the usage of cards

To get rid of credit card debts, you are most welcome to take help o home equity services. You will not just get the feeling of taking control of credit cards, but your auto loans are other forms of debts, with the help of this package. Using the home equity loans for debt consolidation is likely to enjoy lower interest rates, which are flexible and not static. All you need to do is just make single payment on a monthly basis, and you have the liberty to consolidate your debt.

Some services to work into

Now, you must be thinking about the reasons to choose debt consolidated forums through home equity loans. Well, you are about to pay less every month. You just need to lower your current monthly payment, and it will lower your interest rates, automatically. Moreover, you have the right to make simple payment, once. Here, the experts are going to combine the high interest debts and turn them into one fixed payment ratio, on each monthly basis. You will further enjoy peace of mind, with experts to be your help.

Simplify your life with ease

With the help of home equity, you have all the liberty to simplify your life, and enjoy it without facing any problem or hustle. You will further get into the path of brighter side around here, by managing your current debts. You have the liberty to borrow any money, from $25,000 to even $150,000. It solely depends on the loan package you are willing to choose. However, make sure to check out the amount first and see if you can repay it back, on time.

If you are struggling with credit card debt issues then it’s better to seek for credit card consolidation loans first. It will help you in making things better for you and you can go ahead with peace of mind.

Tags:

credit,

Credit Cards,

Debts,

Interest Rates,

loans,

money

September 15, 2016

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

Personal loans are unsecured form of loans. This means that lenders do not have any recourse on any security in case the borrow defaults. As a result, lenders give personal loans at higher interest rates to compensate themselves for higher default risk that they are taking.

So how do lenders decide what rate to charge from different personal loan customers?

Everything for lenders boils down to a simple concept, higher the risk, higher the interest rate. So from a borrower who is considered safe, lenders will charge lower interest rates.

There are several factors that are used to assess the risk – current income, income stability, profession, age, existing loan EMIs, past loan repayment history, etc.

So if you are in a stable job, have a good income and do not have too many existing loans, the lender will lend to you at a lower interest rate as you are considered a safe borrower with lower default risk. However, if you have too many loan EMIs and have not be regular in your repayments, then you will be considered a risky borrower and lender will increase interest rate at which personal loan will be give to you.

Your past loan repayment history, as depicted by your credit score plays a major role in your risk assessment. So if you are unsure about your perceived riskiness as a borrower, to get in touch with lenders to understand the interest rate ranges that are applicable to different types of borrowers. Once you know the possible interest rates, you can use personal loan EMI calculators to find out much you EMI will be.

Tags:

budgeting,

Debts,

loans,

money,

personal finance,

savings

September 7, 2016

This article was wrote by US Business Funding, a company that provides Small Business Loans, Working Lines of Credit, Equipment Financing and much more.

This article was wrote by US Business Funding, a company that provides Small Business Loans, Working Lines of Credit, Equipment Financing and much more.

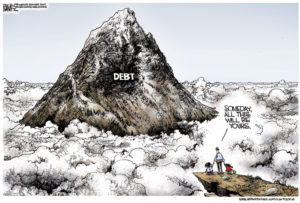

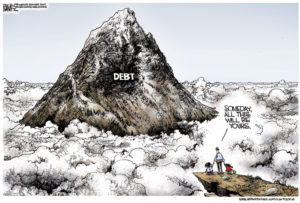

Whether it’s the shopper obligation on Visas, understudy advances or a home loan, a great many people get themselves weighed around obligation eventually in the shopper’s lives. This can have us working employments we detest just to compensate the debts and stay up our minds above water. It is by figuring out how to kill obligation quick you can discharge this weight and expel a portion of the anxiety from your fancy life.

Today this article will demonstrate how to kill your obligations as quick as would be prudent utilizing the Method of Stacking.

Stop New Debt Creation

The vast majority doesn’t get preparing in taking care of cash and live inside their methods. In case you’re in the red then you’re likely any of these individuals and it’s a great opportunity to chomp the truth projectile. It will be difficult to escape obligation except you reorient your money related propensities at this moment.

You should persevere against every one of the advertisers attempting to take away your well-deserved cash or offering simple account. You needn’t bother with more stuff that will make you cheerful. What you actually need is monetary genuine feelings of serenity.

So stop using your Visas or cut them up. This is literal. Placed them in holder of liquid and pile them in the cooler. At that point when there’s a chance to expend, you have sufficient energy to defrost (the owner and the charge cards) and truly choose in the event that you require that buy.

Interest Rate Ranking Your Debts

Make a rundown of everything of your obligations with sums and the loan fee. The most astounding loan fee ought to be the best for this is the thing that you’ll settle first. Settling your high intrigue obligation is the way to the method of stacking and paying off obligation as quick as could reasonably be expected.

Premium is a capable weapon and right now the bank or other monetary organizations are utilizing it against you. Intrigue fundamentally builds the sum you have to pay back and frequently we’re totally ignorant of the amount of that.

For instance, on the off chance that you have $10,000 Visa obligation at a 20% interest where you expend a base installment of $200 per month, this means that you will wind up spending 9 years 8 months to settle the genuine measure of about $21,680 incorporating $11,680 of interest!

Lower Your Rates of Interest

You can regularly bring down your charge card financing costs by doing an equalization exchange. This implies moving your Master Card to another lending company and that they will bring down the loan fee to take your company or business. Search around and attempt to take the least financing cost for the unbelievable longest possible term (ideally until it’s settled totally).

Simply ensure you’re perusing the terms and circumstances painstakingly so you will not get hurt by the fresh bank in different ways. Until you’ve completed this you may now arrange your rundown of obligation again if some stuff has changed.

Spending Plan:Creating a Strategy

This is the place we enhance your money related regulator from the first step. Take a bit of sheet of paper then record your salary after duty and every one of the costs that you consume. This will incorporate the base installments on your every obligation.

Take a gander at your costs and afterward rank them all together of significance to you. Take a gander at the things on the base of your rundown and choose whether you would rather have gander or be fiscally steady. The goal is to make a Spending Plan that is strategic, where your costs are below your salary.

You likewise choose the amount you will spend on every part of your whole life. You may apportion sums for rent, basic supplies, eating out, purchasing garments and different exercises however understand that once you have spent your designated cash there’s no plunging into different territories. It additionally has some good times,say that you can spend on what you like and an Emergency Account in the event that your auto separates and so forth.

You likewise need to incorporate into your Spending Plan that is very strategic as additional sum you are going to utilize to settle your obligations. Can you bear the cost of $20 per week? $50? $100? $200 or even more? It’s essential that you take a sensible number which you can focus on every week without fall flat and now this is Repayment Stacking of yours.

Repayment Schedule Creation

The initial segment of the method of stacking is to protect the base installment on each and every obligation you have. At whatever period you miss an installment, you cause charges and these include rapidly. This additionally incorporates making the base installment on the obligation with the most astounding loan cost.

At that point for the obligation with the most noteworthy loan cost (your Aim Debt) you are going to include the repayment stacking from your Plan of Strategic Spending. You should apply this Repayment Stacking and the base installment until that obligation is forked over the required funds.

As your formal least installment diminishes you say that additional sum to your Repayment Stacking. So like your base reimbursement drops your Repayment Stacking increments similarly. This will compose how quick you settle the Debt Target by adding much further to the reimbursements that you are making.

Progress Reward

You need to monitor your Debt Target so you will be able to see your improvement along the process. You can likewise settle on points of reference that you are going to rejoice and compensate yourself. A prize doesn’t need to cost cash however in the events that it does then it originates from your already distributed Plan of Strategic Spending.

This is a critical stride as it is going to keep your inspiration going just when you sense your self-control blurring. Much the same as you’ve prepared yourself to wash your hands and shower.Also, you can prepare yourself to deal with your cash. Feel awesome that you’re currently in going the 10% to 20% of individuals who are really dependable with cash.

Results Compounding

When you settle your Debt Target you have colossal festival and salute yourself. At that point you move your Repayment Stacking (which incorporates the past least installment also) to the following obligation with the most elevated loan fee. This turns into the new Debt Target that you are utilizing your Repayment Stacking sum in addition to the base installment for a new obligation.

This is the reason the Method of Stacking is so strong and capable. As you reduction an obligation you really expand your Repayment Stacking sum. This implies the second obligation will get settled off considerably speedier, the third significantly quicker than that, thus on thus on unless you are totally obligation free.

Be Kind to Yourself

Amid this procedure your resolution will be tried numerous times. Perhaps you’ll have a crisis like your auto separating or the necessity to go for a wiped out relative. The essential thing is not to hurl your lovely hands in despondency while backtracking to your past propensities.

Life will try your dedication to your fresh mindful cash state of mind and it’s dependent upon you how will you react. At the point when things turn out badly (and I promise they are) you have to disregard it and get yourself back to the track. Show sympathy when you coincidentally review your Plan of Strategic Spending and choose to improve one week from now.

The Method of Stacking is an effective apparatus however it’s dependent upon you whether or not you utilize it. On the off chance that you truly need comes about then get a hard copy of this article instantly and begin getting through the strides. It’s just by the choice you make at this moment that you won’t regret that an obligation free forthcoming and carry on with a monetarily mindful life.

Pay Debts Fast from a Low Income

When you initially began understanding this post, you may have trusted where it counts that obligation free living is for other individuals however not for you. This conviction was truly the main thing that was keeping you away from escaping obligation.

In any case, I trust eventually along the way you went to the acknowledgment that you can’t stay where you are at this moment without surrendering some of your greatest dreams and that in actuality (as in the inverse of disavowal you may have been living in as of recently) you need to roll out an improvement.

You now have every one of the apparatuses readily available to figure out how to improve a financial plan, get insane with sparing cash, and winning more cash to toss at your obligation.

Presently I need to abandon you with a couple more stories to get you significantly more persuaded that you can pay off your obligation quick regardless of the fact that you’re beginning with a low pay.

Knowing these things that are not taught in schools will make your business financial management easier for it will be a blessing to pay debts with just simple tips and techniques. All you have to do is to follow these tips and start paying your debs so that your business financial health will never be endangered again.

Tags:

budgeting,

Cashflow,

credit,

Debts,

financial planning,

money

July 21, 2016

When taking out a personal loan, opening up a credit card or even taking up a mortgage, many often sign a PPI. However reality is that many are usually unaware of this fact, until they are unable to make the needed payments as scheduled. But what is a PP1?

When taking out a personal loan, opening up a credit card or even taking up a mortgage, many often sign a PPI. However reality is that many are usually unaware of this fact, until they are unable to make the needed payments as scheduled. But what is a PP1?

What Is PPI?

Short for payment protection insurance, PPI is normally sold by financial institutions to their customers as a means to protect them in the event they are unable to pay their loans. This is whether the reason behind it is sickness or loss of job. The insurance sometimes goes by the name unemployment coverage, sickness coverage or accident coverage but can broadly be referred to as credit protection insurance.

How to Get PPI money back?

In the event you have coverage and intend on getting your money back as the need has arisen, getting your claim submitted is the first step. This way information regarding just how much PPI has been sold to you on your loan and the amount payable will be revealed. In the end after the necessary paperwork has been completed, you will receive your PPI refund money back.

How much can one claim?

The amount of PPI you can claim largely depends on the amount of loan and credit card balance you have. This simply means the larger the loan and credit card balance, the bigger the PPI refund. However to know the exact amount you will need to make and offer and add the interest to know just how much you are entitled to. Take into account where you have gotten your mortgage from, all places you have taken loans from and credit cards that you have signed up for over the years. This way if you have ever signed up for PPI, the retrieval process will begin.

How far back can you claim?

In this case also there is usually no set limit. With some, register claims can be made as far back as 12 years with many having a maximum of 15 years. However you will only know whether you can get your funds back by making a claim as far back as you can. This way ensure you gather all your paperwork on the accounts you bought PPI.

How Soon Can You get your money back?

There is usually no set limit on how long it will take to return the funds to customers. However on average the time usually takes about 8 weeks. This still depends on the bank, its procedures and your history with the bank.

Filing a claim

The process of making a claim to get a PPI refund is no doubt long and tiring. In this case to make the process easy using iSmart is ideal. With the services being particularly free, you will not be charged to check whether you have a PPI on your loans. In addition no charges will be brought to you in case you chose another company to file a claim, even after knowing how much you can get as refund. Still with some lenders taking as many as 2 months to respond whether your claim can be made or not, leaving it to the professionals is better saving you time and money. As if that is not enough with PPI scandals affecting many people in the past decade, ppirefund.co.uk will ensure that even after your complaint has been rejected, you get the needed advice on what to do next.

Tags:

Business,

Credit Card,

Funds,

insurance,

investments,

money,

mortgage,

Payments

December 15, 2015

The statisticians may tell us that the recession has been over for three or four years and that incomes have returned to pre-crisis levels. But for millions of people in the UK, the reality is that times are still hard and money short.

The statisticians may tell us that the recession has been over for three or four years and that incomes have returned to pre-crisis levels. But for millions of people in the UK, the reality is that times are still hard and money short.

The good news, however, is that while you may have had a difficult year financially during 2015, there is no reason why you can’t make a New Year’s resolution to get your finances back on track in 2016. The situation is rarely hopeless, particularly if you are in work or have some other regular income. Even if you have large unsecured debts, there is usually a way for you to start reducing them and increase your disposable income at the same time.

If you want to tackle your financial issues in the year ahead, then you’re going to need some discipline and some determination to change the way that you may have behaved over the last few years. Getting your finances back on track may not be easy but it is probably simpler than you think:

1. Stop beating yourself up

This is a prerequisite if you want to reduce your anxiety levels and make a start on tackling whatever financial problems you may currently be facing. It’s human nature to keep going over past mistakes and blaming oneself for silly decisions but what is done is done and now is the time to drop the blame and start concentrating on the future. Learn to accept what has happened and move on, concentrating instead on implementing positive steps to improve your financial outlook.

2. Make a financial inventory

Do you actually know how much you owe banks, mortgage companies and other financial organisations? It’s important to have a grasp of your total liabilities so that you can put in place long-term plans to repay this debt entirely. That means making an inventory of everything you owe – both secured and unsecured – as well as the remaining loan terms and the interest rates which you are being charged on each loan and credit card.

3. Prioritise credit with higher interest rates

If you’re going to make inroads into your debts in 2016 and relieve the pressure you’re under, then you should start increasing the amounts you repay on the mortgages, loans and credit cards that charge the higher amounts of interest. This is the only way that you’ll be able to increase the speed that you reduce your total amount of debts.

4. Make a list of everything you spend for a month

If you’ve got Excel or other spreadsheet software and know how to use it, then this is a brilliant tool for doing this important task. Make sure you list all of your income and all of your expenditures. Don’t be tempted to miss out things like coffees from the coffee shop or the odd treat – you need to be completely honest with yourself about where your money is going before you progress onto the next step.

5. Make a household budget

Once you’ve worked out everything you spend for a month, you’ll be in a good position to set a household budget. Using your spreadsheet program, list all outgoings (with the fixed ones at the top) and all of your income. Let the software work out totals (if you know how) and then calculate whether you should have money left over or if you are spending more than you earn. If it’s the latter, look at the non-essentials on your list and consider what to cut. Think about your food budget – could this be reduced either by using a cheaper supermarket or by cutting out some of the items which might be considered luxuries? The household budget will make it much easier to see where you can save money and divert that into reducing your household debt.

6. Consider consolidating debt

If the amount you’re paying in interest, fees and other charges is overwhelming you, you might want to make 2016 the year when you consolidate all those cards and other loans into a single, monthly repayments. Plenty of companies beyond the high street banks offer consolidation loans and the amount of interest you’ll pay may be surprisingly lower than you’re currently used to. The amounts on offer go all the way up to £25,000 for unsecured loans and even higher if you consider secured lending.

7. When you’ve paid off a card, close it

If you’ve got unused credit available, there is always going to be the temptation to start buying things that you probably can’t afford. The easiest way to stop yourself doing this is to close card accounts when you have paid off the outstanding balance. Always leave yourself one to cover financial emergencies but get rid of the rest and use the money you are saving to pay off further debt.

8. Debt repayment is a snowball – learn how to use it

When a snowball rolls downhill, it not only gathers speed but it grows larger and larger as it picks up more snow. Debt repayment is exactly the same if you are disciplined about it. When you start paying back debt, you reduce the amount of interest that you’re paying and so release money to pay off even more debt and so on. If you hit the loans and cards with the highest interest rates first, you’ll be tackling the biggest source of your financial worries and releasing more and more money to pay off other debts more quickly.

Article provided by Mike James, an independent content writer in the financial sector – working with a selection of companies including Solution Loans, a technology-led finance broker with many years experience – who were consulted over the information contained in this piece.

Tags:

budgeting,

Credit Card Debts,

Debt Problems,

Debts,

economy,

financial planning,

personal finance

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

Recent Comments