May 14, 2013

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Cheap personal loans

Cheap personal loans like that of the ordinary personal loans are of two types. One is the unsecured form of personal loan and the other is the secured form of personal loan. The unsecured personal loans are the ones in which you are not required to keep any collateral. Thus, the interest rates on such loans are high in comparison. Visit following news http://www.prlog.org/11911362-bad-credit-personal-loans-up-to-5000-now-available.html for more information.

On the other hand, in case of the secured loans you need collateral and as the security is high, the interest rate charged is comparatively low.

Taking out a cheap personal loan

In order to obtain a cheap personal loan, you will be required to:

- Have good credit rating – Cheap personal loans will have to be the ones which have low rate of interest. So, it is extremely important for you to have good credit rating like a good credit score and clean credit report. That can help you obtain a loan with really low interest rate. That is the only way you can obtain a low cost loan.

- Have low debt to income ratio – If you have low debt to income ratio, it can help you in getting a loan at low rate or a cheap personal loan. Debt to income ratio is the percentage with regards to the amount you make towards debt payment against your gross income per month.

- Have high affordability – You need to have high affordability so that you can get the best and cheap personal loans. If you have high affordability, the lenders consider that you may easily be able to pay down the loan. Therefore, the interest rate charged may be low too.

- Have high rate of income – High affordability is related to high rate of income, so, it so obvious that if you have high income, it becomes easier for you to obtain a cheap personal loan.

Usage of the cheap personal loans

Such personal loans can be beneficial if you are planning to make a big purchase or may be even pay down your debts. You can use one such loan to even repair your car or for the purpose of home improvement or may be consolidate your debts. There are various options and you can choose from any one of those options as per your needs and affordability.

However, as there are numerous offers even if you are getting cheap offers, it is important for you to make sure that you are obtaining one that you can make payments on. Read here for more information.

Tags:

debt,

economy,

financial planning,

Interest Rates,

loans,

money

May 12, 2013

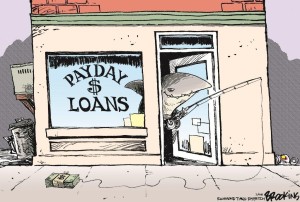

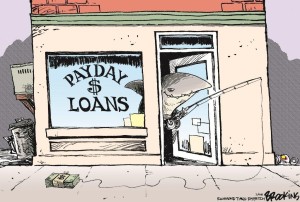

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

Making investment with the payday loan :

The following ways can be adopted to make investments with the payday loan:

Joint venture investment : there are some business projects which offer joint venture investment plans to the people. There, you will need to invest a partial amount. And after the profit generation, that will be distributed among the investors according to their investment balance. So, you can certainly generate some money with these businesses. For more information you can visit http://www.prnewswire.com/news-releases/offering-2500-bad-credit-personal-loans-for-borrower-in-financial-trouble-175015681.html

Stock market investment : the stock market investments are very famous business idea in the world. But, not all the companies are reliable. You will need to make investment on the company which is generating profit constantly and which in on the track. In this way, you can make your stock investment. Basically, this is a profitable business, if you can choose to pick the right company for you. Nevertheless, the risks are always there. But, you will need to carry on with the risk if you want to gain something. So, you can get the idea of making investment on the stock market.

Online entrepreneur : the online world offers people with a lot of facility to generate a lot of money. Today, many people are expecting to generate a lot of money with online business. You can certainly make investment with the online sources by being an online entrepreneur. You can choose to purchase a domain and start your own website to generate money. Or, there are a various internet marketing ideas available which can be easily adoptable by you. So, in this way, you can generate a lot of money. In fact, you will not need to carry on with the business as a side income. Rather, you can build up your career with this. And a payday loan is enough to start up the business.

FOREX investment : you can make investments on FOREX trading as well. In fact, the FOREX trading is the one which has a look like stock market. But, this stock market exists in the virtual world. Many people are generating a lot of money with the FOREX trading. But, the risks are also existing in this filed. Nevertheless, it is up to you how you handle the business. If you can get to a bit smart, you can certainly generate a lot with it. Read here for more information.

Tags:

Debt Problems,

financial planning,

Interest Rates,

investments,

loans,

money,

Payday Loans

May 10, 2013

Obtaining zero down auto loans might seem impossible if you have bad credit but it can be done. You’ll just have to work a little harder when it comes to finding a perfect dealership that accepts bad credit. There could be 2-4 dealerships in your city that will accept bad credit so it’s always a good idea to call around. Ask some of your friends where they got their first car when they were younger and didn’t have good credit. They’ll give you a few places that you can use so cross your fingers that they are still in business.

Obtaining zero down auto loans might seem impossible if you have bad credit but it can be done. You’ll just have to work a little harder when it comes to finding a perfect dealership that accepts bad credit. There could be 2-4 dealerships in your city that will accept bad credit so it’s always a good idea to call around. Ask some of your friends where they got their first car when they were younger and didn’t have good credit. They’ll give you a few places that you can use so cross your fingers that they are still in business.

In order to obtain a zero down auto loans, you can always get a co-signer. This is basically a person who will take responsibility for the vehicle if you do not pay. Being a co-signer is a huge job and most people will not want to sign because they don’t want to take the risk. So seriously, how can you get someone to sign for you? This is fairly easy – just ask one of your family members or a very close friend. There are some people who are willing to sign and they know where to find you in case you don’t pay up. This is why you should make sure you can get a car you can afford.

There are many cars available on the lot. Remember that you will have to pay monthly so the car can be anywhere from $150 to even $500. We don’t recommend paying $500 a month for a vehicle because most of the time, this will be out of your budget. Low payments are considered to be anywhere from $150 to $250. Middle range goes up to $350 while anything more than that might seem ridiculous for someone who is not expecting to pay a lot of money. Most cars that are brand new will be on the high end and this is why a used car is best.

To get zero down auto loans, you should be able to show a good proof of income. Since you have bad credit, the dealership will need to prove that you are working each day and that your income is more than the car payments are each month. Remember to write everything down accurately on your application, otherwise you could be denied. You obviously don’t want to purchase a car that you are not able to pay for. A car salesman will only show you cars that fit your budget and if you want something that is a little better like GPS or some car that is upgraded, this may be difficult to get.

Almost everyone pays a down payment at the dealership. Those with good credit don’t have to. Since you are a liability, you probably will have to put a down payment on the car. Now, you can always talk your way out of this. If you have an old junk car, you can always trade this for the down payment. Most dealerships will be able to accept these car and sometimes sell them for parts to other companies. They will look over your car and see if it’s worthwhile.

No one wants to give a down payment most of the time and some people will try to get around it when it comes to zero down auto loans. You can simply say to the dealer that you have good credit so you won’t be a problem in case something were to happen. They can work with you and even lift the down payment so you’ll be only paying for the car each month. A down payment is only used to protect the dealership in case anything happens to the car. People with bad credit will almost always have to pay a down payment before they actually get to drive the car anywhere but this is not the case for you so don’t let a car salesman push you for a down payment. Most dealerships can do without.

Overall, it is always a good idea to get everything organized before you walk into the dealership and demand cars with zero down auto loans. Gather up all of your income stubs and a recent credit report if you don’t want to wait for the credit approval process. You can also call them to give them your details and they can run the credit approval beforehand. Otherwise, you will need to wait a few days and this will delay the process of getting a vehicle so if you need a car quickly, always make sure you are prepared. By showing them all of your documents, they can give you a car without any down payment.

Tags:

budgeting,

credit,

economy,

loans,

money,

personal finance

February 23, 2013

There’s a lot of buzz about the implications of bad credit and the importance of maintaining good credit, but many of us are still unclear about certain aspects of our credit reports. How long does a bad payment last on your record? Can you receive a loan with no credit history? And what about your job, is it really legal for an employer to snoop at your credit report? The following top three things you should understand about your credit report will answer all of those pressing questions and more.

There’s a lot of buzz about the implications of bad credit and the importance of maintaining good credit, but many of us are still unclear about certain aspects of our credit reports. How long does a bad payment last on your record? Can you receive a loan with no credit history? And what about your job, is it really legal for an employer to snoop at your credit report? The following top three things you should understand about your credit report will answer all of those pressing questions and more.

1. Bad Credit Will Hang Around

Your credit history from today and two years back accounts for around 70% of your credit report, while the other 30% dates back seven to ten years. Good credit can hang around for around ten years while your last payment delinquency may show up for seven years. This is important to keep in mind, because one bad payment can haunt you for years, despite the fact that you’ve maintained a clean record ever since.

With that being said, your credit score can change on a day-to-day basis for various reasons such as if you apply for a new credit card, declare bankruptcy, or miss a payment. Generally though, your score will not change more than 30 points in one quarter. In addition, your credit score may vary depending on which of the credit bureaus reports your score, as each has their own scoring methods.

2. You Can Still Receive Loans With Bad or No Credit

If you have poor or no credit, there are options available that may prevent banks and lenders from turning down your loan request. eCredable.com, for example, offers you an All My Payments (AMP) credit rating, which takes into account your monthly payment obligations such as rent, utility, and cell phone bills to help establish your creditworthiness. These kinds of payments generally do not show up on the traditional credit bureau reports, but they can provide proof of your payment history. Some, but not all lenders will accept this form of nontraditional credit worthiness.

In the case of an emergency, you can apply for loans for people with bad credit. Typically, these bad credit lenders do not ask to see your credit report, so it usually does not matter if you have bad or no credit. But because payday lenders are taking a risk by supplying you with a loan, they do charge high interest rates and fees. Only apply for a cash advance if it is an emergency situation and if you are capable of paying back the loan in short order. Also, read and understand all of the loan terms before applying.

3. Your Future Employer May Judge Your Credit Score

While it’s not uncommon for credit card companies and landlords to check out your credit report, now potential employers are gathering around to sneak a peek too. And yes, it is perfectly legal for them to do so. A 2010 Society for Human Resource Management survey revealed that 60 percent of employers conduct credit checks on prospective job candidates.

These employers are using your credit score as a judgement of your character and financial reputation. Employers, especially those in financial fields, want to determine your level of monetary responsibility before allowing you to handle company finances.

Even though a bad payment can stick around on your credit record for a while, this should not discourage you from taking strides to improve it. And regardless of whether you can still borrow money from a lender with poor credit, your future employer may want to see your score, so you should always build your score to the best possible number to help prevent any possible obstacles. If you’re still experiencing uncertainty when it comes your credit score, do not hesitate to contact a financial advisor or credit counseling organization.

Tags:

credit,

Credit Score,

Debts,

economy,

financial planning,

loans

January 9, 2013

For some reason, most of the marketing behind home ownership leads you to believe that you should be paying off your home for the next 20-30 years. People even have ‘mortgage-burning parties’, where they (symbolically or actually) burn their mortgage documents at the same time that they retire.

For some reason, most of the marketing behind home ownership leads you to believe that you should be paying off your home for the next 20-30 years. People even have ‘mortgage-burning parties’, where they (symbolically or actually) burn their mortgage documents at the same time that they retire.

If it sounds crazy to take over 20 years to pay for something, don’t worry, it’s absolutely possible to pay off your home faster.

Interest Rates Are Important

A lot of people assume if you’ve been dealing with a bank for most of your life that they will be the best option for getting your mortgage. This is not always the case and it’s imperative that you shop around. Even a 0.05% difference on the interest rate will mean thousands of dollars over the life of your mortgage.

Websites like http://mortgagerates.ca are fantastic for comparing lenders (even those you’ve never heard of) and making sure you’re getting the best rate. Don’t be afraid to negotiate with your bank. If you prefer to keep your accounts in the same place, at least explain to your rep at the bank that you have better options and ask if they can match them.

Your Mortgage – Pre-payment Options

Interest rates aren’t the only consideration for your mortgage. If you want to pay this off aggressively you’re going to need some pre-payment options. There are typically two ways you can pay down your home faster.

- Monthly payment options – most mortgage lenders allow you to modify the amount you’re paying every month. This is usually listed as a percentage of your payment. For example, if a lender allows you to bump up your payment by 25% and your current payment is $1,000 a month, you’ll be allowed to increase that to $1,250. You can get mortgages that allow up to a full 100% increase.

- Lump-sum payments – You should also have the option to contribute lump-sum payments whenever you want. These are great for things like tax refunds, bonus cheques, and other found money. These are typically offered again as a percentage, this time of your total mortgage amount, and range from 10% to 25%. So if you owe $300,000 on your mortgage, you’d be able to contribute up to $75,000 a year (at 25%) on top of your regular payments.

Finding The Money

You might be laughing at the idea of having an EXTRA $75,000 a year kicking around, and yes, it’s probably not going to be that much. What it does is give you options.

If you really decide to get serious about paying off your home, it’s time to prioritize. Remember that every dollar you put towards it now will save you all of that compounding interest in the future, so the time to make the most sacrifices is right now.

Make cuts wherever you can. Use an online mortgage payment calculator to calculate how much every extra payment will save you in the long run – this will keep you motivated.

Tags:

Calculator,

Home,

home loans,

loans,

money,

mortgage,

personal finance

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Recent Comments