June 22, 2013

A secured loan is a lending product which can be obtained by leveraging an asset against the value of the loan amount. They’re a great choice for people who are asset rich, but cash poor. They’re can also be very helpful in an emergency, when you need to access cash quickly. But what does taking out a secured loan actually entail? And how can you tell if it is the right product for you?

A secured loan is a lending product which can be obtained by leveraging an asset against the value of the loan amount. They’re a great choice for people who are asset rich, but cash poor. They’re can also be very helpful in an emergency, when you need to access cash quickly. But what does taking out a secured loan actually entail? And how can you tell if it is the right product for you?

Assessing Your Needs

Before applying for a secured loan, it’s important to make sure that you are fully aware of your needs beforehand.

• Do you really need a loan?

• Are you able to make the repayments?

• Is a secured loan the right type of loan for you?

• Do you meet the criteria to qualify for an unsecured loan?

If the answer to all of these questions is yes, then a secured loan is the right option for you. But secured loans come in all shapes and sizes, so it’s a good idea to shop around before settling on one. For example, 1st Stop secured loans are the perfect choice for people with bad credit, who need to borrow any amount between £1500 and £15,000.

Finding the Right Loan Provider

If you’re thinking about taking out a secured loan, it’s important to find the right provider. There are many providers of secured loans, but not all of them are as reputable as they might first appear. When shopping for a lender, you should always check to see if they have any affiliations with regulatory bodies such as the FCA (formerly the FSA). If they do, this is a good indicator of trust.

The Risks of Taking a Secured Loan

Just as with any financial product, there are risks involved in taking out a secured loan. But as long as you are aware of these risks, and know how to manage them, you should find that your secured loan is very beneficial.

Because a secured loan requires that you leverage an asset against it as collateral, if you default on your loan this asset may become forfeit. If the asset in question is your car, or even your home, this loss can be devastating. So it’s important that, before you take out an unsecured loan, you are aware of the repercussions and fully able to make your repayments.

Tags:

Assets,

Debts,

financial planning,

loans,

money,

secured loans

May 14, 2013

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Cheap personal loans

Cheap personal loans like that of the ordinary personal loans are of two types. One is the unsecured form of personal loan and the other is the secured form of personal loan. The unsecured personal loans are the ones in which you are not required to keep any collateral. Thus, the interest rates on such loans are high in comparison. Visit following news http://www.prlog.org/11911362-bad-credit-personal-loans-up-to-5000-now-available.html for more information.

On the other hand, in case of the secured loans you need collateral and as the security is high, the interest rate charged is comparatively low.

Taking out a cheap personal loan

In order to obtain a cheap personal loan, you will be required to:

- Have good credit rating – Cheap personal loans will have to be the ones which have low rate of interest. So, it is extremely important for you to have good credit rating like a good credit score and clean credit report. That can help you obtain a loan with really low interest rate. That is the only way you can obtain a low cost loan.

- Have low debt to income ratio – If you have low debt to income ratio, it can help you in getting a loan at low rate or a cheap personal loan. Debt to income ratio is the percentage with regards to the amount you make towards debt payment against your gross income per month.

- Have high affordability – You need to have high affordability so that you can get the best and cheap personal loans. If you have high affordability, the lenders consider that you may easily be able to pay down the loan. Therefore, the interest rate charged may be low too.

- Have high rate of income – High affordability is related to high rate of income, so, it so obvious that if you have high income, it becomes easier for you to obtain a cheap personal loan.

Usage of the cheap personal loans

Such personal loans can be beneficial if you are planning to make a big purchase or may be even pay down your debts. You can use one such loan to even repair your car or for the purpose of home improvement or may be consolidate your debts. There are various options and you can choose from any one of those options as per your needs and affordability.

However, as there are numerous offers even if you are getting cheap offers, it is important for you to make sure that you are obtaining one that you can make payments on. Read here for more information.

Tags:

debt,

economy,

financial planning,

Interest Rates,

loans,

money

May 12, 2013

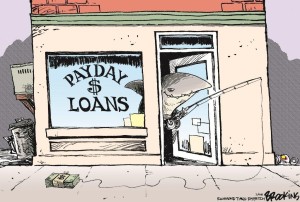

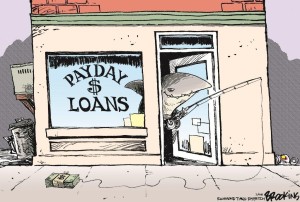

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

Making investment with the payday loan :

The following ways can be adopted to make investments with the payday loan:

Joint venture investment : there are some business projects which offer joint venture investment plans to the people. There, you will need to invest a partial amount. And after the profit generation, that will be distributed among the investors according to their investment balance. So, you can certainly generate some money with these businesses. For more information you can visit http://www.prnewswire.com/news-releases/offering-2500-bad-credit-personal-loans-for-borrower-in-financial-trouble-175015681.html

Stock market investment : the stock market investments are very famous business idea in the world. But, not all the companies are reliable. You will need to make investment on the company which is generating profit constantly and which in on the track. In this way, you can make your stock investment. Basically, this is a profitable business, if you can choose to pick the right company for you. Nevertheless, the risks are always there. But, you will need to carry on with the risk if you want to gain something. So, you can get the idea of making investment on the stock market.

Online entrepreneur : the online world offers people with a lot of facility to generate a lot of money. Today, many people are expecting to generate a lot of money with online business. You can certainly make investment with the online sources by being an online entrepreneur. You can choose to purchase a domain and start your own website to generate money. Or, there are a various internet marketing ideas available which can be easily adoptable by you. So, in this way, you can generate a lot of money. In fact, you will not need to carry on with the business as a side income. Rather, you can build up your career with this. And a payday loan is enough to start up the business.

FOREX investment : you can make investments on FOREX trading as well. In fact, the FOREX trading is the one which has a look like stock market. But, this stock market exists in the virtual world. Many people are generating a lot of money with the FOREX trading. But, the risks are also existing in this filed. Nevertheless, it is up to you how you handle the business. If you can get to a bit smart, you can certainly generate a lot with it. Read here for more information.

Tags:

Debt Problems,

financial planning,

Interest Rates,

investments,

loans,

money,

Payday Loans

May 8, 2013

Your credit card, while serving as a powerful tool for all your financial needs, can lead you to a world of trouble if you don’t use it the right way. Credit cardholders must avoid getting trapped in a deep hole called debt. However, they often find it hard to consider the immense amount of expenses, especially if a bank already gave them enough credit to just charge these costs. Moreover, this powerful financial tool can oftentimes be considered as the worst form of finance because of the fact that incurred debts are classified as unsecured. Also, they carry an interest rate that is higher than a home or car loan. Compared to other types of loans such as home mortgage or student loan, credit card debts are not tax deductible.

Your credit card, while serving as a powerful tool for all your financial needs, can lead you to a world of trouble if you don’t use it the right way. Credit cardholders must avoid getting trapped in a deep hole called debt. However, they often find it hard to consider the immense amount of expenses, especially if a bank already gave them enough credit to just charge these costs. Moreover, this powerful financial tool can oftentimes be considered as the worst form of finance because of the fact that incurred debts are classified as unsecured. Also, they carry an interest rate that is higher than a home or car loan. Compared to other types of loans such as home mortgage or student loan, credit card debts are not tax deductible.

If you have a credit card, you don’t want to use it on certain things or events that could definitely spell disaster on your financial and economic standing. In fact, many experts say that you should not use it in these situations:

- Paying for your college tuition. Using the credit card while in college is never good to begin with, because of the consequences that doing so may bring. Many college graduates have experienced dealing with credit card debt during their time at school, and their financial woes continue to pile up as they advance in age. For one, upon graduation from college, you might not be able to find a job at the soonest possible time, which would make it hard for you to earn income to pay off your credit card debt.

- Paying for your wedding costs. In such a prolific event like a wedding, planning is a key priority. Saving for years with your soon-to-be wife or husband for the significant day is a very important way if you want it to be extra special and start your married life on the right track. However, you shouldn’t use your credit card in financing your wedding costs, as this will backfire, causing you newlyweds to deal with debt during your first few years of marriage.

- Going on a vacation spree. If you are planning for a vacation, it is best that you save on cash money for your out-of-pocket expenses rather than using your credit card all throughout your out-of-state or out-of-country trip. Financing your trips through the use of your credit card will just create a mountain of debt upon your return.

- Paying for your medical expenses. Dealing with the costs of your medical treatment can be very daunting, but that does not mean you should resort to using your credit card to finance them. Some health providers offer rate adjustments and payment plans that might be suitable for you.

Using your credit card is still important, but using at frequently and as a means of covering much of your finances is not good at all. Next time you encounter the abovementioned situations, think twice before dealing with your finances. Use your credit card in moderation, or suffer consequences along the way.

Tags:

credit,

Credit Card,

Credit Card Debt,

debt,

economy,

financial planning,

money

April 5, 2013

What springs to mind when you think of the perfect wedding? If you’re a woman, it may be your dress, the flowers or your first dance. If you’re a man it might be the car you’ll arrive in, the colour of your cummerbund, or not falling over during your first dance. But one thing that no-one likes to think about – but which no-one can ultimately avoid dealing with – is figuring out how much your dream wedding is going to cost.

What springs to mind when you think of the perfect wedding? If you’re a woman, it may be your dress, the flowers or your first dance. If you’re a man it might be the car you’ll arrive in, the colour of your cummerbund, or not falling over during your first dance. But one thing that no-one likes to think about – but which no-one can ultimately avoid dealing with – is figuring out how much your dream wedding is going to cost.

The Increasing Costs of UK Weddings

Weddings in the UK have a long history of being a big affair, however this doesn’t mean that the cost of a wedding was always as high as it is now.

In 2013, the average cost of a wedding in the UK is approximately £18,000 . This is a significant increase on the average cost of a wedding in the 1950s of just £70 – which would be the equivalent of approximately £2,000 by today’s standards. To put it further into perspective, the cost of a wedding in 1950 was approximately seven times a person’s weekly wage, whereas the average UK wedding in 2013 is more than 30x the average weekly wage.

Portrayal of weddings in the media – including televised Royal weddings – as well as changing fashions and an increased importance being placed on extravagance, are all factors which have contributed to the rising costs of UK weddings.

How to Finance Your Big Day on a Budget

For many couples, the thought of spending up to £25,000 on a wedding is simply unthinkable. However pressures from friends and family to have a big wedding, unexpected costs, or simply the effort of trying to recreate the dream wedding scenario you’ve had in your head since you were little, can all conspire to escalate the costs of your wedding without you realising.

Thankfully there are many ways in which weddings can be financed, quickly and easily, so you don’t have to compromise on having the day you’ve always wanted. From trimming unnecessary guests to having a friend do the photos, there are plenty of ways in which costs can be cut from every corner. And when you make many little savings, you’ll soon find that you’re able to save a decent sum of money overall.

Of course, if you’ve made all the savings you possibly can but still come in over budget, there are many other ways of gaining additional financing for your wedding. From asking relatives for help to applying for secured homeowner loans, sourcing additional funds can be quick, easy and headache-free. Just remember to sort out your finances well in advance of your wedding, so the only thing you’ll have to worry about on the day will be the groom’s dancing.

Tags:

Ceremoney,

expenses,

financial planning,

Marriage,

money

A secured loan is a lending product which can be obtained by leveraging an asset against the value of the loan amount. They’re a great choice for people who are asset rich, but cash poor. They’re can also be very helpful in an emergency, when you need to access cash quickly. But what does taking out a secured loan actually entail? And how can you tell if it is the right product for you?

A secured loan is a lending product which can be obtained by leveraging an asset against the value of the loan amount. They’re a great choice for people who are asset rich, but cash poor. They’re can also be very helpful in an emergency, when you need to access cash quickly. But what does taking out a secured loan actually entail? And how can you tell if it is the right product for you?

Recent Comments