June 30, 2017

What is a personal loan?

What is a personal loan?

Personal loans are unsecured loans. A lack of collateral, like a car of house, is what makes unsecured loans different from secured loans. Unlike a mortgage or student loans, a personal loan is personal. And unlike like other loans, it can be used at your discretion.

Personal loans are most ideal for long-term purchases. Which is unlike something like a payday loan that is more short-term. Personal loans can also be used for debt consolidation, to finance vacations, or even unexpected expenses like home repairs. They can even be used towards real estate, like one of those forest beach homes for sale.

A personal loan, that you can use at your discretion, sounds good. But there are some things to consider before taking out such a loan.

Does it make sense for me?

Before you consider a personal loan, you need to ask yourself why you need the loan. And if a personal loan is the type of loan you need. As mentioned above, a personal loan is ideal for more long-term purchases or consolidating high-interest debt. If you’re not looking to consolidate debt, or need a little help purchasing one of those forest beach homes for sale, it might not be worth it.

Do I qualify?

After you’ve considered whether a personal loan is right for you, next is to determine if you qualify for one. These qualifications can vary by lender. For example, credit ratings, maximum debt-to-income, and interest rate. Typically requirements can be:

A credit rating between 640 and 750

A maximum debt-to-income ratio of up to 45% (depending on loan amount, income, and credit rating)

An interest rate from 8.5% to 18% (which also depends on your credit rating)

What are the Interest Rates?

A personal loan could be a great way to save on high-interest debt from credit cards. Depending on your credit rating you could be eligible for low interest rates on your personal loan. A lower interest rate could save you a lot of money in the long term. It might even be beneficial for you to shop around, to find the best deal available to you.

Are the fees and terms associated with the loan?

When a applying for a loan, it’s important to do your research. Before you sign to anything, make sure you’ve read and understood everything outlined in the loan agreement. Is there a term agreement? Or are there any fees associated with the loan?

A personal is debt!

A personal loan sounds great on paper, and in the grand scheme of things. It has the potential to offer you a great solution to a problem. But it’s important to remember that it’s still a loan, and therefore a form of debt. Debt that eventually needs to be paid off.

How do you plan to pay it off?

As mentioned above as great a solution a personal loan sounds, it’s important to remember that it’s still a form of debt. And like all debt, it can easy for it to get out of hand. When you’re looking into getting a personal loan, it’s important to have a plan for paying it off. A personal loan has the potential to simplify a sticky situation, and if not used appropriately it could make a sticky situation stickier.

Tags:

budgeting,

Debt Consolidation,

Debts,

economy,

financial planning,

investments,

money,

personal finance

June 28, 2017

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Whether you’re renewing or buying insurance for the first time, be aware of some mistakes. Below, you can find out about things to avoid and possible solutions.

Incorrect coverage amount

Most people choose a wrong coverage because they replace the real and market value of their home. Others are prone to overestimate the coverage amount. Those people identify home insurance with dwelling coverage. It pays in case of a damage caused by a covered danger like hail, storm, fire, and so on. The amount of dwelling coverage has an effect on limits for other coverages. For example, the limit for the contents coverage is set at 50%-70% of the dwelling coverage. So, how to evaluate the right dwelling coverage? There are various online home insurance calculators that address this issue.

Insufficient coverage for home rebuild

The majority of houses are not valued for insurance purpose. What would happen if those houses get destroyed beyond repair? The homeowners will not have enough insurance coverage to rebuild their homes.

How to avoid this mistake? It’s a good idea to hire a cost estimator who specializes in home replacement. You may also contact your contractor or a local builder. This is a cheaper option, but the assessment is not that precise as you get by a professional cost estimator. Once you’ve found out how much it costs to rebuild your house, you need to determine insurance coverage. Make sure to include all the valuables and improvements you have recently made.

Failing to look around

There are a lot of insurance providers and agencies today. They vary widely in how they estimate risk and how they determine the costs of home insurance. Some companies offer notably higher premiums than others. Don’t stop at the first insurance agency you run into. You should look around for the best deals instead. Try to find a quality yet affordable coverage that you are comfortable with.

Wrong deductible

Many people make mistake when setting the deductible. This is the amount of money that an insured pays before his/her insurance kicks in. This amount is paid toward a claim. Many insurance buyers set a wrong amount – either too high or too low. You can save a lot of money on your premiums by manipulating your deductible. As a rule of thumb, the lower the deductible, the higher the premium. But your finances could be left “askew” if the amount of deductible is too high. And if you are not able to come up with it when your home gets damaged by a disaster. You will pay more in premiums if the deductible is too low. Consult an insurance expert to hit the right balance.

As you can see, these issues are pretty complex. So even the most experienced insureds can make mistakes. Your best choice would be to consult an experienced insurance broker, though. Insurance brokers milton can help you get a quality home insurance products.

Tags:

Claims,

Coverage,

economy,

Finance Advisor,

Home Insurance,

insurance,

money,

personal finance,

Premiums,

Returns

June 17, 2017

Whether you’re getting ready to rent your first apartment, buy your forever home, thinking of renovating your current one, or anywhere in between, there are many ways in which you can still save money.

Whether you’re getting ready to rent your first apartment, buy your forever home, thinking of renovating your current one, or anywhere in between, there are many ways in which you can still save money.

Statistics show that more and more people are choosing to rent rather than buy a home. This may be due to financial issues or the desire to remain mobile. However, it does not mean you can’t still use your money wisely.

Consider a professional advisor. They can sit down with you and examine your finances, help you decide whether to rent, or – often for the same cost – invest in a house with a mortgage.

If you choose to rent, you can also save money by selecting a property that comes furnished. This will allow you to recoup some costs by selling your furniture, and lowers moving costs, as a van and movers can be a significant expenditure.

Before you sign any contracts, make sure to conduct a walk-through with the landlord. Point out seemingly minor details such as chipped paint and broken appliances. By taking photos and videos, you could be saving yourself money in the future if the landlord were to claim you were the cause of the damage.

Purchasing your first house or moving into your forever home can be an exciting time. You have scrimped and saved for months or years, but that doesn’t mean your saving work is done.

Research is your best friend. There are a plethora of comparison sites such as Colleton River Real Estate that are easy-to-use and allow you to search based on specific criteria. These include: location, price range, property type, and amenities, to name a few. Most of these sites also provide material such as photographs and video; local information on schools, transport, and house prices; and in some cases, the ability to receive price change updates.

For those who feel capable, you can also save money by giving up the traditional agent. Though it is still a new avenue, when done right it can end up saving your thousands of dollars.

If you are already close to living in the house of your dreams, sometimes renovating can be the right choice. Once again, research will be your saving grace.

Get multiple quotes, make sure everything is in writing (including differentiating between labor and material costs), and don’t be afraid to haggle or ask for a price-match. Always use a company that is fully registered and licenced. Check with your local laws and regulations before beginning any work, to avoid your work being demolished at your own expense.

At a time when anxiety is high and all of this might be going over your head, it’s important to remember that, whichever route you choose, there are ways to save money. Take your time, and enjoy this new stage in your life.

Tags:

budgeting,

economy,

expenses,

money,

personal finance,

Property,

real estate,

savings

June 10, 2017

No matter who you are and where you are, you can never fully repay your parents for all the care, love and sacrifices that they have made. Isn’t it?

No matter who you are and where you are, you can never fully repay your parents for all the care, love and sacrifices that they have made. Isn’t it?

But increasingly, many people who have already taken care off their financial responsibilities (like buying a house, paying for children’s education, etc.), are honoring their parents by gifting them a house. Also, father’s day is around the corner.

This is indeed a great gesture that shouldn’t be only evaluated from the financial angle.

Gift or not, there is no doubt that house purchases are major decisions. And they cost a lot of money. But if you too are planning to gift your parents a house, then it shouldn’t be a problem as home loans are easily available at very low rates. Ofcourse you need to have a good credit history and a reasonably good repayment capacity to avail home loans.

But even before getting into the financial aspect of the house purchase, you need to be careful before selecting a house for your parents. More so if they would be living in that house.

Any house that is to be occupied by senior people should be built keeping in mind the ease-of-use from seniors’ angle. Like if you are looking to buy a flat, then it should have the lift facility or it should be on the ground floor. To ensure proper ventilation and lighting, its better to opt for a house/flat that has more open windows/balconies.

Security is another factor while selecting a property for parents. If the flat being considered is in a residential society, then security aspect is taken care off. But if it’s a standalone house, then you need to think about how secure would the property be, if the parents were to live there alone. Of course all these factors will reduce the number of options (properties) that fit all your criteria. But that is necessary considering the limitations that seniors have.

So all in all, once you have taken care of most of your financial responsibilities, go ahead and surprise your parents with the biggest gift of their lives.

Tags:

Assets,

economy,

home loans,

Interest Rates,

money,

Mortgages,

personal finance,

Property,

real estate

June 1, 2017

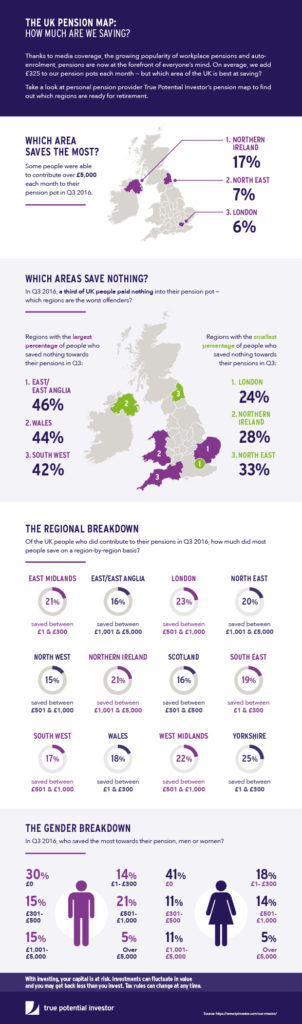

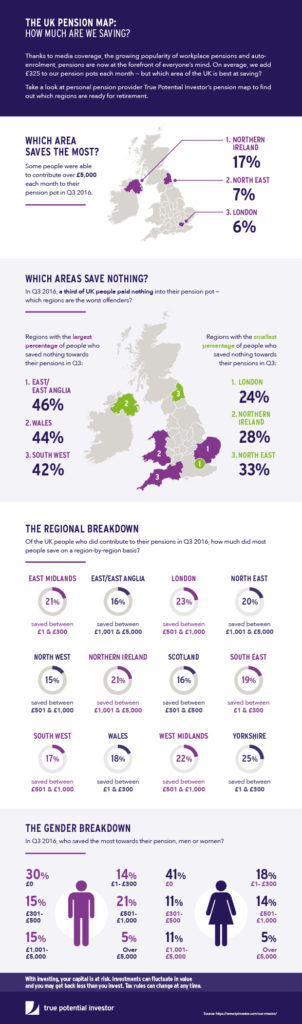

On average, we add £325 to our pension pots every month, but which area of the UK is best at saving? Find out more from the infographic below from personal pension provider, True Potential.

Created by online investment service company, True Potential

Tags:

economy,

investments,

money,

Pensions,

personal finance,

Retirement,

Returns

Recent Comments