January 15, 2017

Try, for a moment, to think of a corporation that compares to Apple. What company has the name recognition, branding, and carefully constructed image that Apple has built over the last decade of total technological dominance?

Try, for a moment, to think of a corporation that compares to Apple. What company has the name recognition, branding, and carefully constructed image that Apple has built over the last decade of total technological dominance?

The Leader of the Pack

The answer, of course, is that Apple has no real competition. Their rise to power has been slow and steady, but the cell phone industry analysis is indisputable. As of mid-2015, CNet reports that about 100 million Americans use iPhones. That’s roughly 1/3 of the population of the United States.

If you walk into your local coffee shop, you’ll immediately note the dominance of the MacBook as the preferred notebook computer for telecommuters across the US. Want a tablet? The iPad is the obvious choice.

The popularity of a product is one of the most important variables in determining whether there is money to be made in servicing and repairing that product. Consider other household goods, appliances, or even vehicles? If a car manufacturer produces a dominant model, and that model is purchased and driven by 1/3 of the US population, how many other services professionals can benefit from that popularity? Mechanics will exclusively service the model. Aftermarket part manufacturers will build and distribute exclusively for the model and re-sellers will benefit from exclusively carrying the model, since such a huge percentage of the population will purchase it.

Using the auto analogy helps to demonstrate the significant opportunity that exists for an iPhone repair franchise. Sure, cars cost more. But the impact of Apple’s popularity is difficult to comprehend without thinking in terms of other, similarly valuable products.

Apple Franchise Markets are Everywhere

One of the secrets to successful franchising is selecting an appropriate market in which to operate a new business. For some franchises, that decision can be tricky. Food preferences can depend on region. Educational and fitness needs are largely dependent on demographics like age and income. But Apple products, with their complete market domination, are present in every metro area and suburb, every college campus and retirement community. Uses vary, certainly. The average MacBook pro user will differ significantly from the average owner of an iPhone manufactured three years ago. Their repair needs, however, are universal.

Refreshed Apple Products as an Income Stream

Making money with an iPhone repair franchise is possible in part because of the multiple income streams that are generated by a familiarity with the products and the capacity to fix them. One of those income streams is the sale of refreshed products, which come in as trades for customers in search of an upgrade. Although we’re accustomed to hearing about how high-tech goods are out of date as soon as they are purchased, there are several reasons that consumers have proven to be quite interested in purchasing used or refurbished Apple electronics.

- Upgrades are largely software based. From one generation to the next, cell phones, tablets, and computers no longer change physically by leaps and bounds so that they quickly become obsolete. Instead, Apple (along with its competitors), rolls out downloadable software updates that keep even older hardware running for many years.

- New products are prohibitively expensive. Thousands of dollars for laptops. Hundreds of dollars for even the cheapest cell phone in the lineup. Apple products are extremely expensive, but that has done nothing but whet the public’s appetite for them. Middle-income consumers have kept the prices of used and refurbished Apple products steadily high for years, with online and iPhone repair franchise profits significantly greater, as a percentage of original retail pricing, than any other comparable goods. A car driven off the lot loses a third of its value immediately. A brand new iPhone does no such thing.

- Many repairs are easy. Broken screens and dead home buttons are often enough to send consumers—accustomed to instant gratification from their expensive devices—running to order a new tablet or phone. But the repairs are often simple and largely cosmetic, which means excellent profit margins on refreshed items. Frustrations with non-working features or broken exteriors often mean upgrades for buyers, but for an iPhone repair franchise they mean quick turnover, minimal investment, and exceptional profits.

Selling refreshed Apple products is worth investigating for any savvy entrepreneur as a personal experiment—list an item online for sale—something in a desk drawer that you’ll never use again—and look how quickly buyers flock to purchase your used electronics. It’s a lesson that warrants reflection.

Tags:

Business,

Capital,

Earnings,

economy,

Funds,

money,

Profits,

stock

August 10, 2016

Many homeowners have a considerable amount of cash tied up in the equity of their homes – that is, the value of the amount of the home they own, less any outstanding mortgage or loan.

Many homeowners have a considerable amount of cash tied up in the equity of their homes – that is, the value of the amount of the home they own, less any outstanding mortgage or loan.

Not only is it possible to release that equity – to enjoy its present cash value – but more homeowners than ever before appear to be choosing to do so. This is a conclusion drawn in a story published in the Guardian newspaper on the 25th of January 2016.

During the course of 2015, a record 22,500 equity release agreements were made, representing a return to the nation’s homeowners of a total of some £1.61 billion.

How do I know if equity release is right for me?

Probably the single most informative source is an online equity release calculator. It might be the best step to gaining some idea of what equity there may be in your home that may be released, depending on the value of the property and your age (you need to be 55 or over to qualify for any equity release scheme).

Combine an equity release calculator with a comparison website which shows the various interest rates currently offered by equity release providers and you may get a pretty clear idea of whether to take things further. There is generally no limit on the number of times you may use the same calculator.

There are any number of such online calculators and it might be difficult knowing which one to choose. Some of the things to look out for when choosing one, therefore, might include:

- how much equity you might be able to release, the interest rates governing the various schemes on offer and what the impact is likely to be upon your estate;

- whether the provider is a member of the Equity Release Council – since this guarantees a certain number of safeguards built into any agreement; and

- whether the site providing the calculator also offers a detailed guide on how equity release works and the arrangements that might be made to answer your queries and discuss your concerns directly with any provider.

Types of equity release

Using an equity release calculator is only the first step in what is invariably a complicated process, involving very serious decisions about the home in which you live, the funds it might unlock and the impact any agreement has on the estate you may pass on to your surviving dependents and relatives.

This makes it important that you seek the advice and guidance of a specialist in the provision of equity release agreements and embark on a learning curve that might lead to your understanding of the two principal vehicles for equity release:

- home reversion – this involves the sale of a proportion of your home to the equity release provider, so that you become a co-owner, but may continue to live in the dwelling until your share of the property is sold upon your death or when you move into long-term care; or

- lifetime mortgage – this is probably a more popular arrangement than home reversion and allows you to make a more reliable calculation of the costs involved. A lifetime mortgage is similar to a regular mortgage, but you make no repayments on the advance, which continues to attract interest in the normal way. The mortgage is repaid from the sale proceeds of the property when you die or move into long-term care.

The use of an equity release calculator may be enough to set you off on the road to unlocking some of the wealth tied up in your home.

Tags:

Business,

Equity,

financial planning,

investments,

money,

stock

February 20, 2016

Traditional assets consist of stocks, bonds, or money. Individuals capitalize in such products with the expectation of capital appreciation, surplus on the original investment, and earnings on interest. For many years, people have been limited to financing only these asset products.

Traditional assets consist of stocks, bonds, or money. Individuals capitalize in such products with the expectation of capital appreciation, surplus on the original investment, and earnings on interest. For many years, people have been limited to financing only these asset products.

Alternative investments have created a broader field for individuals to capitalize in. This type of investment relies upon asset classes that have little to no correlation with more traditional forms of ventures.

Types of Alternate Financing

Private equity: there are a greater number of private corporations than there are public ones. These private companies tend to take on investor capital. Private equity firms are essentially ones that raise the necessary funds from a variety of investors. These resources will then be placed with favorable private corporations. The money is then returned to investors once an IPO or acquisition has taken place.

Venture capital: this is a division of private equity. Here the investment takes place among companies that are just beginning, before they have had a chance to grow. Venture capital firms gather funds from various groups. They then disperse these reserves to a variety of companies that are just starting out. This type of financing is usually more of a gamble. In the event that these start-up corporations succeed, however, the investors can expect an impressive return of their capital.

Hedge funds: these funds consist of a compilation of several investments. These are then placed in a variety of schemes and assets. The difference between hedge funds and private equity is that hedge funds will also place ventures with public companies. There is also more liquidity offered with hedge funds. This way investors have more access to their money and can withdraw it with greater ease. Some of the more typical hedge fund strategies are distressed investments, arbitrage, and macro-trends.

Advantages of Alternate Financing

The inclusion of alternative financing asset classes in a portfolio will greatly increase its diversification. This is because they have very little or no association with more traditional asset classes such as stocks. This means that your investments are less likely to be affected by the performance of the stock market. Thus, the inclusion of this type of investment reduces the overall volatility of the portfolio.

Alternatively, this type of investment has a good correlation with inflation. This property ensures that it serves well as a hedge against inflation. This indicates that it would provide a solid return rate on a long-term investment.

In certain instances, alternate investments can actually produce greater returns than traditional investment. One of the advantages afforded to this non-traditional form of investment is the wider range of financing opportunities. The investors can choose to invest in both public and private corporations. They also face less constraints and are subject to fewer regulations. This can result in better returns subsequent to long-term performances.

Typically, these types of investments have always been considered more of a risk than stocks, bonds, or cash. It is, however, this increased gamble that can ensure that the return against the venture is also impressive.

Tags:

Assets,

Cash Flow,

economy,

Equity,

financial planning,

investments,

money,

stock

January 5, 2016

Clued up Brokers

Clued up Brokers

Because of the changing nature of our world, also the way we do business, new innovations are necessary to show us the way we trade stocks, forex, commodities and bonds. Using trading platforms, which are computer software programs used by traders and brokers, investors no longer have to place telephonic orders; these days web-based and mobile trading platforms allow the trader to place his orders with the broker.

Instant Response

It goes without saying that you want a trading platform that provides real-time data from the markets you trade in, a trading platform that connects you to your broker instantly. Check with him/her that the trading platform he/she offers, is compatible with your computer/mobile system. Many brokers today understand the need to inform their clients about the best mobile apps for trading, apps that employ advanced trading tools to make the traders’ experience so much easier and up to the minute.

Fees

Online trading is becoming more and more popular as technology advances and can be used with great ease for any form of trading and from anywhere in the world. When you deal with a reputable broker, he/she will offer you a trading platform either for free or at a discount, provided you keep a funded account with him or her, an account which requires of you to execute a specific number of transactions every month.

Always Compare

Always compare what is available in the market. Be sure you get the best trading platform for your needs by talking to experienced professionals such as CMC Markets .

Ask yourself the following important questions:

If, for instance, your preferred trading is in forex, the platform must allow you every detail relating to issues such as real-time as well as historical data. The trader wants to have all information at his fingertips when he places his order with his broker.

Latest Technology

It all really boils down to comparison, finding the broker that offers you the most reasonable, advanced platform to trade. You want to deal with a broker that has his/her fingers on all the pulses. Also when it comes to innovation, someone who will let you trade from anywhere, at any time, from whatever device you are using.

Tags:

Business,

economy,

Foreign Exchange,

Forex,

investments,

money,

stock,

Trading

January 2, 2016

Charting is very important in any form of trading in the financial market. It ensures that trade is carried out analytically. Charting technique is also used in Binary options’ trading. Anyone who wants to trade forex and make a good sum of money must make use of charting techniques. Thus, a decent knowledge of charting techniques is very essential if you must succeed as a forex trader. Trading binary options can serve as your sole means of income and employment and yield enough for your sustenance if you know how to make use of charting techniques.

For you to be able to chart in binary option, you must have thorough knowledge of charting technique. This article talks about candle stick charting technique and how you can use your knowledge of candle charting techniques to trade profitably.

What are Candle stick charts?

What are Candle stick charts?

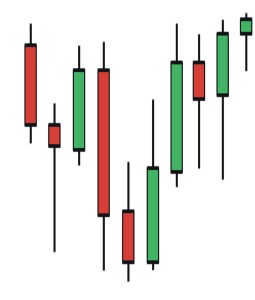

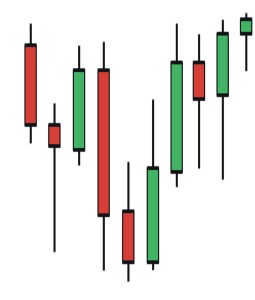

Candlestick chart are made up of collection of candle sticks. Every one of the candlesticks stands for a price action for a particular time period as shown in the example below. Our example illustrates the daily price action for EUR/USD currency pairs for 10 days trading time period.

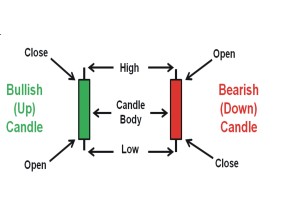

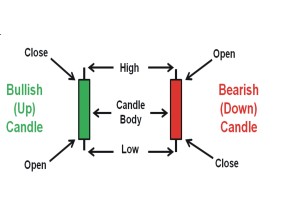

Candlestick chart colours

Each candle stick of the candlestick chart is colored. The color depends on whether there is a rise or fall in price action between its opening or closing time. The widespread color used for a rise in price also known as the bullish (up) candles is the green color while the most frequently used color for a fall in price also known as a bearish (down) candles are the black and red colors.

The coloring system makes it easier to see in an instance if there is rise or fall in price action on any particular day. It also lets us know the degree of rise or fall of the price action for ach particular day. Apart from providing this information, the candlestick chart also offers the trader a few more aid to successful trading.

The candle stick tells the trader the open price; the high and low price and the close price also known as the (OHLC) for each specific time period. This varies a bit. It depends on if the candle is bullish (up) or Bearish (Down)

Why Candle Stick chart is very effective

Why Candle Stick chart is very effective

The candlestick chart provides more information than the basic chart. It is made up of nodes which indicate either the opening time or the closing time of a unit. It can as well tell the trader if the time period is positive or negative. Red color on the candle chart shows negative while green color on the other hand indicates positive time period. Candle stick charting is an excellent and highly effective binary options trading technique.

To be successful in binary option trading with candle stick chart, you need to understand that the Binary options trading with candle stick method is completely different to trading with other trading options like the Forex or commodity market or stock market trading.

Candlestick Charting gives you a good start

Binary option trading is very good but unless you make good predictions, you won’t be able to make money with binary option. This is exactly what the candle stick chart will do for you. The candlestick charting is a good help to traders both those who are new in binary trading and experienced traders. It can help experienced traders to make a fresh start. It thus helps you to make use of the modern charting technique for trading. Candle stick charting as well possess a number of the best tools of technical analysis. With candlestick charting you can also make use of a few mathematical tools like the moving averages or stochastic.

Candlestick Charting is a stepping stone for successful trading

Take your time to learn and understand chart candlestick patterns. It is the most helpful analysis. It offers a trader some secrets to successful trading like a multiple indicator system, a price indicator system for supply and demand, a successful trading skill in addition to a system that evens out a risk.

A good number of the trading signals obtained by these systems have been established to be roughly 80% to 100% precise and correct. It is not all trading platform that has the software used in candlestick analysis. Thus, you can decide to choose charting software that can be used to track the unit you are trading on.

Why software is essential in binary Option trading

Trading binary option does not require buying and selling. A good number of traders of Binary option are of the opinion that binary option trading is much more different from trading from other platforms. The one most significant part of binary option trading is the trader’s ability to predict price movement of a specific equity. The use of software in trading comes in handy here. It assists the trader to make predictions of price actions.

Tags:

Business,

Currency,

economy,

Foreign Exchange,

Forex,

investments,

money,

stock,

Trading

Try, for a moment, to think of a corporation that compares to Apple. What company has the name recognition, branding, and carefully constructed image that Apple has built over the last decade of total technological dominance?

Try, for a moment, to think of a corporation that compares to Apple. What company has the name recognition, branding, and carefully constructed image that Apple has built over the last decade of total technological dominance?

Recent Comments