August 20, 2017

The Internet has revolutionized modern lifestyles. You may use various online facilities like booking cabs, flights, movie tickets, and grocery shopping. Several individuals also find their life partners online.

The Internet has revolutionized modern lifestyles. You may use various online facilities like booking cabs, flights, movie tickets, and grocery shopping. Several individuals also find their life partners online.

The primary reason for the increasing popularity of the Internet is its convenience. This same convenience is also available if you choose to avail of an insurance policy online. Here are five advantages of opting for insurance policies online.

1. Lower costs

When you avail of a term insurance plan online, you eliminate the need for agents and brokers. This reduces the expense for the insurance company. In addition, the entire online procedure is paperless, which further reduces the cost for the insurer. These costs savings are beneficial in reducing the premium you pay for purchasing the insurance plan.

2. Informed decisions

Online platforms allow you to compare different types of life insurance policies offered by various insurers. You may compare the terms and conditions, premium amount, and other features of the policies. Furthermore, you may refer to the reviews and comments given by past users. This allows you to make an informed decision while acquiring insurance coverage.

3. Automated services

An online platform not only expedites the process but also enables efficient and quick servicing. You may easily download product brochures, procure estimates from various insurance companies, pay the renewal premiums, and track your payments online. This ensures you do not have to depend on anybody and the entire procedure is quick and hassle-free.

4. Efficient online assistance

Most insurance companies offer live chat assistance to help you understand more about the different policies. You may also call their helpline numbers to resolve your queries and clarify all your doubts. Once you have made your decision, you may either choose to complete the procedure online or request a meeting. The insurance company will send a representative to help you complete the procedure.

5. Customization

These days, several insurance companies offer customized products to suit the distinct requirements of individual buyers. When you opt to apply for a term plan online, you may compare different offerings and choose the plan that suits your preferences. You may also pay the premium online on a monthly, quarterly, bi-annually, or an annual basis as per your financial situation.

Availing of an insurance policy online is a cost-efficient and quick option. Insurance companies understand the benefits of this distribution channel and offer special products covering different types of insurance policies. By opting for the online platform, you may avail of the best term insurance plan in India from the comfort of your home or office.

Tags:

budgeting,

Coverage,

economy,

insurance,

investments,

life insurance,

personal finance,

Premiums,

Returns

August 8, 2017

Life is unpredictable!

Life is unpredictable!

Although we are all aware of this, very few people actually think about the uncertainty of life and take practical measures to protect their loved ones, in case their life unexpectedly comes to an end.

Such wise people usually buy a comprehensive insurance policy to secure their family’s financial future.

Have you decided to be among those who are always prepared for the uncertain future?

Buy a life insurance!

What to Consider Before Buying a Life Insurance?

Searching and buying the right insurance policy can become a daunting task. But, not when you know what things to consider while weighing different insurance policies at hand. To help you do that, here we are highlighting some of the key factors that need to be considered when it comes to buying a life insurance:

• Make Sure That the Company Is Reliable

The foremost thing to consider before you decide to buy insurance is the reliability of the company you are buying from. Ask around for references and always go for the company that enjoys a good reputation. You can also check the company’s social media page to read reviews. This is important because frauds by insurance companies are highly common. Often, buyers find out about the hidden terms and conditions with regard to charges and coverage after buying the insurance.

Therefore, to prevent yourself from becoming a victim of an insurance scam, make sure you do a detailed research and seek references and reviews before choosing an insurance company. The task is quite tedious, but it is worth making the effort.

• Assess Your Needs

One of the many benefits of finding a reliable company is that the insurance agent can really help you in evaluating and assessing your needs and then choosing an insurance policy accordingly, to cover all your specific needs. The process entails evaluating factors such as the number of dependants, family wealth and assets, and whether the family will be able to pay off any remaining debts and bear the cost of funeral services or not?

Your answers to all these questions will help decide what things are more important for you and how much coverage you really need. For example, for some people the most important thing is to make sure their children’s education does not get negatively affected in any scenario and they want it to be covered by the insurance policy. On the other hand, there are people who do not want their family to pay for their burial services.

• Compare Different Policies

Decide your needs based on what things are important for you. For example, if you only want to make sure that your family receives money to pay for your funeral, ask different companies for quotes for funeral insurance. But, if you want multiple factors to be covered, look for a comprehensive life insurance policy.

Also, never settle for the first company you come across. Always compare different aspects of various insurance policies to make sure you find the best or you will end up regretting it later. In addition to your needs, your financial status also plays an important role in choosing a life insurance policy.

Tags:

Claims,

Coverage,

economy,

insurance,

investments,

life insurance,

money,

Premiums,

Returns

June 28, 2017

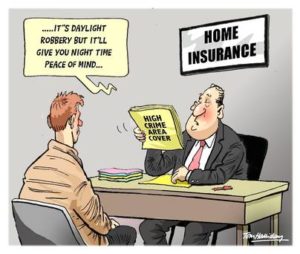

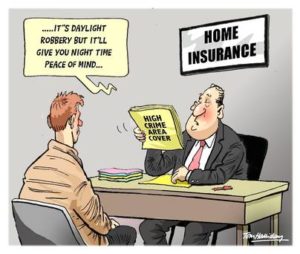

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Whether you’re renewing or buying insurance for the first time, be aware of some mistakes. Below, you can find out about things to avoid and possible solutions.

Incorrect coverage amount

Most people choose a wrong coverage because they replace the real and market value of their home. Others are prone to overestimate the coverage amount. Those people identify home insurance with dwelling coverage. It pays in case of a damage caused by a covered danger like hail, storm, fire, and so on. The amount of dwelling coverage has an effect on limits for other coverages. For example, the limit for the contents coverage is set at 50%-70% of the dwelling coverage. So, how to evaluate the right dwelling coverage? There are various online home insurance calculators that address this issue.

Insufficient coverage for home rebuild

The majority of houses are not valued for insurance purpose. What would happen if those houses get destroyed beyond repair? The homeowners will not have enough insurance coverage to rebuild their homes.

How to avoid this mistake? It’s a good idea to hire a cost estimator who specializes in home replacement. You may also contact your contractor or a local builder. This is a cheaper option, but the assessment is not that precise as you get by a professional cost estimator. Once you’ve found out how much it costs to rebuild your house, you need to determine insurance coverage. Make sure to include all the valuables and improvements you have recently made.

Failing to look around

There are a lot of insurance providers and agencies today. They vary widely in how they estimate risk and how they determine the costs of home insurance. Some companies offer notably higher premiums than others. Don’t stop at the first insurance agency you run into. You should look around for the best deals instead. Try to find a quality yet affordable coverage that you are comfortable with.

Wrong deductible

Many people make mistake when setting the deductible. This is the amount of money that an insured pays before his/her insurance kicks in. This amount is paid toward a claim. Many insurance buyers set a wrong amount – either too high or too low. You can save a lot of money on your premiums by manipulating your deductible. As a rule of thumb, the lower the deductible, the higher the premium. But your finances could be left “askew” if the amount of deductible is too high. And if you are not able to come up with it when your home gets damaged by a disaster. You will pay more in premiums if the deductible is too low. Consult an insurance expert to hit the right balance.

As you can see, these issues are pretty complex. So even the most experienced insureds can make mistakes. Your best choice would be to consult an experienced insurance broker, though. Insurance brokers milton can help you get a quality home insurance products.

Tags:

Claims,

Coverage,

economy,

Finance Advisor,

Home Insurance,

insurance,

money,

personal finance,

Premiums,

Returns

April 27, 2017

Despite all the precautions you take, injuries can and will happen in the workplace. They may be rare, or uncomfortably frequent, but it’s always a good idea to ensure you have a knowledgeable professional attorney at your side for when these issues occur.

Despite all the precautions you take, injuries can and will happen in the workplace. They may be rare, or uncomfortably frequent, but it’s always a good idea to ensure you have a knowledgeable professional attorney at your side for when these issues occur.

Filing for claims, dealing with insurance companies, and weeding through the paperwork can be a tasking matter, so having an attorney trained in this area is essential to avoid mistakes. Having their professional guidance can ensure your business no unneeded loss and help improve the quality if safety for your employees.

What are all the ways an injury attorney can help your business? I’ve listed a few of the common benefits hiring an attorney can bring your business. They may vary depending on the nature of your industry.

1. You’ll save money in the long run. Insurance agencies are excellent at they do, and they’ll weave the situation to fit their needs. Your business will be the one shelling out the big bucks for a claim, but an attorney can make sure you’re not giving more than is needed.

2. A better understanding of the weak safety areas. An injury lawyer can go over the problem with you and help you come up with a solution. One of the most common workplace accidents result in brain injuries, and your attorney will be able to help you navigate your options.

3. If the case goes to court, you’ll be well protected. Many small businesses falter and end up suffering from serious setbacks if an injury case goes to court because they don’t have the knowledge or resources to get through the situation.

4. An extensive knowledge of medical professionals and solutions. Unlock the doors to all the answers you’ll need about the law surround injuries, and get expert advice on where to send your employees suffering from a work-related accident. An attorney can help you learn and improve the general functionality of the workplace.

5. Less stress on you and more time for managing the work. Since all of the bills and paperwork around an accident will be handled by your attorney, you can return your focus to what you do best. Your job. No one enjoys being weighed down with confusing paperwork.

If this is the direction you want to take for your business, it’s important to do your research before an attorney. Ask family, friends, or others in your industry about which firms they turn to. Host an interview before making the final decision to get a feel for their personality. Remember, this person will become a part of your team, so make sure they fit.

Once you have met with the lawyer, make sure to ask them questions that will give you insight to how they plan on handling cases with you in the future. What is their strategy? What sort of professional history do they have?

Tags:

Attorney,

Business,

insurance,

investments,

Law,

Legal Issues,

money

April 15, 2017

There have been lawsuits filed in the past that suggest something rather scary for your company. If you make the decision to not employ applicants at your firm who have a past history of criminal violations, you stand to face charges of discrimination, based on race and other factors. This protocol is due to guidelines that are in place by the EEOC or the Equal Employment Opportunity Commission. According to tritoncanada.ca, you can’t just turn people away because of unrelated criminal records.

There have been lawsuits filed in the past that suggest something rather scary for your company. If you make the decision to not employ applicants at your firm who have a past history of criminal violations, you stand to face charges of discrimination, based on race and other factors. This protocol is due to guidelines that are in place by the EEOC or the Equal Employment Opportunity Commission. According to tritoncanada.ca, you can’t just turn people away because of unrelated criminal records.

You Need to Consider All Factors

For example, if your company deals in stocking auto parts at a warehouse, you can’t turn an applicant with a record for insurance fraud from fifteen years ago away from the opportunity. According to the commission, you aren’t allowed to turn people away based on the fact that they have a history. Instead, you are required to evaluate that record and see if the offenses they committed have an effect on their ability to perform their job duties correctly, or if the safety of the other employees at the firm is in danger.

Racial Discrimination Suits Could Arise

It is a well-known fact by now that over 70% of employers in the US run checks on potential job applicants’ criminal records. The number of people with such records in the USA has been rising over the years at the same time. Those individuals who have a criminal record without being convicted of a crime, an arrest can lead to a black mark on the record. Many of the people with such records have never committed a violent crime and have never spent time in jail. Employers tend to generalize everyone with a criminal record as being a threat to safety, which is blatant discrimination.

The case gets even trickier when you consider the statistics for arrests and convictions in the US. Black people are imprisoned six times as white people in the country. A company can be sued for racial discrimination if they turn away people with criminal records. You are allowed to use a background test in your business, of course, but you have to consider factors in this check including the type of crime committed, how relevant it is to the job, and how long it has been since the applicant’s last offense.

Explanations Need to be Made and Received

Even after all this is considered, and you still can’t hire the applicant, you have to explain to the person in writing why you couldn’t hire them. This cause needs a satisfactory explanation of why their criminal history makes them unfit. The law firm must give you a chance to explain yourself and prove you can perform well on the job at hand.

If you have a criminal record that shows a violent crime being committed, it’s one of the only times they can immediately reject an application. In recent years, a conviction for malicious and intentional assault and battery would indicate a red flag, for example.

Tags:

Business,

insurance,

investments,

money,

Risks

The Internet has revolutionized modern lifestyles. You may use various online facilities like booking cabs, flights, movie tickets, and grocery shopping. Several individuals also find their life partners online.

The Internet has revolutionized modern lifestyles. You may use various online facilities like booking cabs, flights, movie tickets, and grocery shopping. Several individuals also find their life partners online.

Recent Comments