July 16, 2013

Purchasing your first home together can be almost as exciting as your wedding day. If you’ve made that first major purchase together before tying the knot, you may have already built up some equity in your home that can be used for repairs and renovations. Whether you plan on using a home equity loan to put an addition on your home or undertake maintenance on your existing home, here are a few things you should know before enquiring about a home equity loan.

Purchasing your first home together can be almost as exciting as your wedding day. If you’ve made that first major purchase together before tying the knot, you may have already built up some equity in your home that can be used for repairs and renovations. Whether you plan on using a home equity loan to put an addition on your home or undertake maintenance on your existing home, here are a few things you should know before enquiring about a home equity loan.

Get Appraised (And Know How to Calculate Your Equity)

When determining your home equity, you will first need to have your home appraised to determine its current fair market value. Once appraised, take your home’s fair market value and subtract the amount of money you still owe on your mortgage. For example, let’s say you bought your house for $250,000. Having paid $50,000 as a down payment, your mortgage is now $200,000.

Fast forward to the future when you decide you want to apply for a home equity loan. At that time, you have paid off $125,000 of your mortgage. After an appraisal, you discover that the new market value of your home has risen in value to $300,000. Since you have paid off $125,000 of your mortgage, you still owe $75,000.

$200,000 – $125,000 = $75,000

Take your new fair market price of your home and subtract what you still owe on your mortgage, giving you the amount of money you qualify for your home equity loan, $175,000.

$300,000 – $75,000 = $225,000

This is the total equity available. A bank will typically lend 70-80% of the total equity available.Now that you understand home equity, you have two main options: You can either get a Home Equity Loan (HEL) or a Home Equity Line of Credit (HELOC).

Option 1: The Home Equity Loan

Also known as a “second mortgage,” a HEL gives you a lump sum of cash with a fixed rate of interest. You will have fixed monthly payments for a fixed amount of time, normally between 5 and 15 years. A huge benefit to this option is you won’t be surprised by fluctuating interest rates.Some people use their HEL to help pay off their student loans or credit card bills upon discovering that their HEL interest rate is lower than their student loan and credit card rates. This isn’t always the case. Your HEL rate might not be lower than your other rates, but it is worth your time to determine whether your HEL can assist you with your newly-combined household finances, as well as home improvement projects.

The Home Equity Line Of Credit

A HELOC is a credit line given to you by a lender. You have a maximum amount that you can borrow and are given blank checks or a debit or credit card that allows you to withdrawal from those funds. This allows you to borrow what you need when you need it, instead of taking out one lump sum. You don’t have to withdraw the maximum amount. This just means that the amount of money you are paying interest on has the potential of being significantly lower than your determined equity. Keep in mind that there may be transaction fees each time you withdrawal money. Help from Uncle Sam

The IRS Publication 936, “Home Mortgage Interest Deduction,” offers some helpful advice to newlyweds with home equity loans at tax time. It states that joint tax filers can deduct the interest paid on a maximum $100,000 in home equity loans. The maximum is cut in half if the married couple files separately. Keep in mind, this is a maximum and chances are you will not get to deduct near that amount. This deduction also only applies to home equity loans taken out for home improvement purposes.

Remember

Armed with some knowledge beforehand, you can decide which home equity loan option is best for you and your home – and the vision you have in mind for it.

This post was written by Holly Wolf of Conestoga Bank. Conestoga Bank has serviced Philadelphia and the surrounding regions for 120+ years.

This publication does not constitute legal, accounting or other professional advice. Although it is intended to be accurate, neither the publisher nor any other party assumes liability for loss or damage due to reliance on this material.

Tags:

Debts,

home loans,

Interest Rates,

money,

personal finance

May 14, 2013

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Cheap personal loans

Cheap personal loans like that of the ordinary personal loans are of two types. One is the unsecured form of personal loan and the other is the secured form of personal loan. The unsecured personal loans are the ones in which you are not required to keep any collateral. Thus, the interest rates on such loans are high in comparison. Visit following news http://www.prlog.org/11911362-bad-credit-personal-loans-up-to-5000-now-available.html for more information.

On the other hand, in case of the secured loans you need collateral and as the security is high, the interest rate charged is comparatively low.

Taking out a cheap personal loan

In order to obtain a cheap personal loan, you will be required to:

- Have good credit rating – Cheap personal loans will have to be the ones which have low rate of interest. So, it is extremely important for you to have good credit rating like a good credit score and clean credit report. That can help you obtain a loan with really low interest rate. That is the only way you can obtain a low cost loan.

- Have low debt to income ratio – If you have low debt to income ratio, it can help you in getting a loan at low rate or a cheap personal loan. Debt to income ratio is the percentage with regards to the amount you make towards debt payment against your gross income per month.

- Have high affordability – You need to have high affordability so that you can get the best and cheap personal loans. If you have high affordability, the lenders consider that you may easily be able to pay down the loan. Therefore, the interest rate charged may be low too.

- Have high rate of income – High affordability is related to high rate of income, so, it so obvious that if you have high income, it becomes easier for you to obtain a cheap personal loan.

Usage of the cheap personal loans

Such personal loans can be beneficial if you are planning to make a big purchase or may be even pay down your debts. You can use one such loan to even repair your car or for the purpose of home improvement or may be consolidate your debts. There are various options and you can choose from any one of those options as per your needs and affordability.

However, as there are numerous offers even if you are getting cheap offers, it is important for you to make sure that you are obtaining one that you can make payments on. Read here for more information.

Tags:

debt,

economy,

financial planning,

Interest Rates,

loans,

money

May 12, 2013

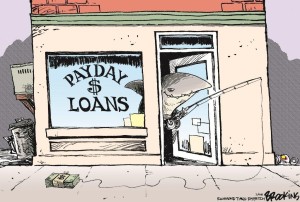

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

Making investment with the payday loan :

The following ways can be adopted to make investments with the payday loan:

Joint venture investment : there are some business projects which offer joint venture investment plans to the people. There, you will need to invest a partial amount. And after the profit generation, that will be distributed among the investors according to their investment balance. So, you can certainly generate some money with these businesses. For more information you can visit http://www.prnewswire.com/news-releases/offering-2500-bad-credit-personal-loans-for-borrower-in-financial-trouble-175015681.html

Stock market investment : the stock market investments are very famous business idea in the world. But, not all the companies are reliable. You will need to make investment on the company which is generating profit constantly and which in on the track. In this way, you can make your stock investment. Basically, this is a profitable business, if you can choose to pick the right company for you. Nevertheless, the risks are always there. But, you will need to carry on with the risk if you want to gain something. So, you can get the idea of making investment on the stock market.

Online entrepreneur : the online world offers people with a lot of facility to generate a lot of money. Today, many people are expecting to generate a lot of money with online business. You can certainly make investment with the online sources by being an online entrepreneur. You can choose to purchase a domain and start your own website to generate money. Or, there are a various internet marketing ideas available which can be easily adoptable by you. So, in this way, you can generate a lot of money. In fact, you will not need to carry on with the business as a side income. Rather, you can build up your career with this. And a payday loan is enough to start up the business.

FOREX investment : you can make investments on FOREX trading as well. In fact, the FOREX trading is the one which has a look like stock market. But, this stock market exists in the virtual world. Many people are generating a lot of money with the FOREX trading. But, the risks are also existing in this filed. Nevertheless, it is up to you how you handle the business. If you can get to a bit smart, you can certainly generate a lot with it. Read here for more information.

Tags:

Debt Problems,

financial planning,

Interest Rates,

investments,

loans,

money,

Payday Loans

March 26, 2013

Being mortgage free is the paradise that all mortgage holders are looking for, and thousands of people every year decide to over pay on their mortgage to help them achieve this goal. Whether this overpayment is a lump sum, or one or two extra payments over the course of a year, reducing your mortgage will help you to save later on in life.

Being mortgage free is the paradise that all mortgage holders are looking for, and thousands of people every year decide to over pay on their mortgage to help them achieve this goal. Whether this overpayment is a lump sum, or one or two extra payments over the course of a year, reducing your mortgage will help you to save later on in life.

However, does the notion of paying off your mortgage early distract you from putting money away in a savings account? At the end of the day, what is a better position to be in – mortgage free with no savings, or savings and a hefty mortgage? Let’s take a look at the pros and cons of paying or your mortgage, or saving the money instead.

Savings

Before you make a decision about whether or not to save or spend, first consider whether you have enough of a savings fund to build on. In order to cover any emergencies, it’s always recommended that you have at least four to six months’ worth of savings in the bank. Even if you do have a decent amount of money to fall back on, that still doesn’t mean that you should spend it on paying off your mortgage, or clearing a decent chunk of it at least.

Before using this money to pay off your mortgage, consider paying off any other debts you have, like credit cards or other financing debts. These expenditures will typically have higher rates of interest, meaning you’ll be saving yourself money in the long run if you pay these amounts off. Only then should you consider paying off your mortgage with your savings. There could be early-repayment penalties if you decide to clear some of your mortgage, so always seek the advice of your m

Making Sense Of It All

In order to choose saving your money over paying off your mortgage, your savings account would have to offer better interest rates compared to the money you would save reducing your mortgage debt in the long run. If we take a look at the best mortgage deals verses the current interest rates across the typical high street savings accounts, saving your money wouldn’t be advisable.

As interest rates are very low at the moment, you’ll certainly be paying more interest on your mortgage repayments compared to the money you would save with your savings account. Getting an ISA savings account is key if you want to avoid income tax on savings interest, but again, what you are able to save in a savings account must also be compared to what you would knock off your mortgage in the long run.

If you are able to make monthly overpayments on your mortgage, then you could find that you’re making quite a saving on your debt. Over a typical 25 year mortgage, a homeowner could save over £8,000 just by making an extra £50 payment every month, based on a £150,000 mortgage. Furthermore, the more you can pay off on top of your monthly repayments, the more you’ll save!

Tags:

debt,

financial planning,

Home Loan,

Interest Rates,

money,

mortgage

March 6, 2013

A credit card is a form of loan, albeit one involving more flexible terms and smaller sums of money than a personal loan or a mortgage. However, like other types of loans, credit cards also have interest rates. You need to understand more about how interest rates work, and how they will affect you and your finances, before taking out a credit card.

A credit card is a form of loan, albeit one involving more flexible terms and smaller sums of money than a personal loan or a mortgage. However, like other types of loans, credit cards also have interest rates. You need to understand more about how interest rates work, and how they will affect you and your finances, before taking out a credit card.

Why interest rates can be confusing

At the moment, credit card issuers can choose one of 14 different methods for charging interest. These methods involve calculating interest in different ways. So, if you have two credit cards which seem to have the same interest rates and you use them in exactly the same way, one could cost you more because the provider has decided to use a different method to work out that interest.

APR

Another reason why interest rates are confusing is because the industry uses acronyms such as APR to talk about interest. APR (Annual Percentage Rate) is a standard way to work out the cost of credit, taking into account the interest rate and any other charges. This rate shows you how much it will cost to borrow money over the course of a year.

It should be the case that credit cards with lower APRs give you the best deal, but it doesn’t always work out that way. This is because many cards start and stop charging interest on transactions at different times. However, most lenders offer a ‘typical APR’ when advertising credit cards. This is because when you apply for a credit card, you may be offered a rate based on your credit history and personal circumstances. According to a Guardian factsheet, banks only have to offer their advertised APR or a better rate to 66% of potential customers.

When interest rates will affect you

If you pay your balance off in full every month, you probably won’t need to worry about interest rates. However, interest rates will affect you if:

You only make minimum payments off your total balance every month

You pay anything less than the full balance each month

You use your credit card to take money out of a cash machine

If you meet any of these criteria, you should be looking to find the lowest interest rates when carrying out a credit card comparison. If you do your research and take the time to work out how much a credit card will cost you in the long term, you are likely to end up with a good deal and a way of borrowing money that suits you.

Tags:

credit,

Credit Card,

debt,

financial planning,

Interest Rates,

money,

Rates

Purchasing your first home together can be almost as exciting as your wedding day. If you’ve made that first major purchase together before tying the knot, you may have already built up some equity in your home that can be used for repairs and renovations. Whether you plan on using a home equity loan to put an addition on your home or undertake maintenance on your existing home, here are a few things you should know before enquiring about a home equity loan.

Purchasing your first home together can be almost as exciting as your wedding day. If you’ve made that first major purchase together before tying the knot, you may have already built up some equity in your home that can be used for repairs and renovations. Whether you plan on using a home equity loan to put an addition on your home or undertake maintenance on your existing home, here are a few things you should know before enquiring about a home equity loan.

Recent Comments