March 5, 2016

India’s popularity among low cost mobile manufacturers like Xiaomi, OnePlus and others is big enough to make the country their highest priority. The main reason for this surge is, among many other things, the fact that Indians prefer prepaid connections more than post paid. While the lucrative recharge offers make prepaid a better option for cost sensitive con-sumers, what this translates to the low cost mobile manufacturers is a market free from telco-subsidised iPhones and other high-end phones.

India’s popularity among low cost mobile manufacturers like Xiaomi, OnePlus and others is big enough to make the country their highest priority. The main reason for this surge is, among many other things, the fact that Indians prefer prepaid connections more than post paid. While the lucrative recharge offers make prepaid a better option for cost sensitive con-sumers, what this translates to the low cost mobile manufacturers is a market free from telco-subsidised iPhones and other high-end phones.

Indians have too much love for prepaid and it is only going to grow stronger. This is in con-trast to developed markets where unlocked gsm phones barely have a market. In developed countries like UK and US, telcos heavily subsidise high end mobiles to acquire long term subscribers in a bid to recover the amount through the course of the term. These connections typically come with a two year contract, with a monthly rental that help make the business profitable. Most customers in these countries do not seem to mind as long as they get their brand new high end smartphones. This is a long shot in India where even postpaid consumers pay a premium price for flagship devices.

It does raise the question though – are you better off using a prepaid connection or would a postpaid arrangement serve you better? Like any other question like this one, the answer does, to some extent, depend on who you are and what are your needs. Surely, you can not work with a prepaid connection if you work in Sales. However, there is a large group of mobile users who are happy with mobile internet and barely even make calls.

For anyone looking to have more control over their bills and a more clearer understanding of their usage, Prepaid is still the way to go. Convenience wise, however, postpaid remains the choice to make especially now that most telcos offer auto debit of monthly bills. It sure will be interesting to see if Indian telcos will start offering US style contracts here and how that’ll change preference.

Tags:

Business,

Earnings,

economy,

investments,

Profits

February 20, 2016

Traditional assets consist of stocks, bonds, or money. Individuals capitalize in such products with the expectation of capital appreciation, surplus on the original investment, and earnings on interest. For many years, people have been limited to financing only these asset products.

Traditional assets consist of stocks, bonds, or money. Individuals capitalize in such products with the expectation of capital appreciation, surplus on the original investment, and earnings on interest. For many years, people have been limited to financing only these asset products.

Alternative investments have created a broader field for individuals to capitalize in. This type of investment relies upon asset classes that have little to no correlation with more traditional forms of ventures.

Types of Alternate Financing

Private equity: there are a greater number of private corporations than there are public ones. These private companies tend to take on investor capital. Private equity firms are essentially ones that raise the necessary funds from a variety of investors. These resources will then be placed with favorable private corporations. The money is then returned to investors once an IPO or acquisition has taken place.

Venture capital: this is a division of private equity. Here the investment takes place among companies that are just beginning, before they have had a chance to grow. Venture capital firms gather funds from various groups. They then disperse these reserves to a variety of companies that are just starting out. This type of financing is usually more of a gamble. In the event that these start-up corporations succeed, however, the investors can expect an impressive return of their capital.

Hedge funds: these funds consist of a compilation of several investments. These are then placed in a variety of schemes and assets. The difference between hedge funds and private equity is that hedge funds will also place ventures with public companies. There is also more liquidity offered with hedge funds. This way investors have more access to their money and can withdraw it with greater ease. Some of the more typical hedge fund strategies are distressed investments, arbitrage, and macro-trends.

Advantages of Alternate Financing

The inclusion of alternative financing asset classes in a portfolio will greatly increase its diversification. This is because they have very little or no association with more traditional asset classes such as stocks. This means that your investments are less likely to be affected by the performance of the stock market. Thus, the inclusion of this type of investment reduces the overall volatility of the portfolio.

Alternatively, this type of investment has a good correlation with inflation. This property ensures that it serves well as a hedge against inflation. This indicates that it would provide a solid return rate on a long-term investment.

In certain instances, alternate investments can actually produce greater returns than traditional investment. One of the advantages afforded to this non-traditional form of investment is the wider range of financing opportunities. The investors can choose to invest in both public and private corporations. They also face less constraints and are subject to fewer regulations. This can result in better returns subsequent to long-term performances.

Typically, these types of investments have always been considered more of a risk than stocks, bonds, or cash. It is, however, this increased gamble that can ensure that the return against the venture is also impressive.

Tags:

Assets,

Cash Flow,

economy,

Equity,

financial planning,

investments,

money,

stock

February 16, 2016

It may surprise many to know that nearly eighty percent people who go for forex trading burn their fingers badly before deciding to quit trading of forex currencies. So, you’ll need to be extremely careful when trading forex, lest you should also fall in the category of those who failed. The causes of failure are many, though some of those are common among those who failed. Despite this abnormally high failure rate, forex trading presents the opportunity of making considerable sums of money. Nevertheless, it is quite challenging to become successful trader. It demands plenty of hard work, dedication and appropriate learning. Some traders at XFR Financial fail to devote the required amount of time and the type of hard work it necessarily requires for being successful. Forex trading is not the way of making money for you if you aren’t willing to invest the time and hard work it entails.

It may surprise many to know that nearly eighty percent people who go for forex trading burn their fingers badly before deciding to quit trading of forex currencies. So, you’ll need to be extremely careful when trading forex, lest you should also fall in the category of those who failed. The causes of failure are many, though some of those are common among those who failed. Despite this abnormally high failure rate, forex trading presents the opportunity of making considerable sums of money. Nevertheless, it is quite challenging to become successful trader. It demands plenty of hard work, dedication and appropriate learning. Some traders at XFR Financial fail to devote the required amount of time and the type of hard work it necessarily requires for being successful. Forex trading is not the way of making money for you if you aren’t willing to invest the time and hard work it entails.

Essential Qualities of any successful trader

Here, hard work implies studying and learning various aspects of trading for being a successful trader at XFR Financial. You can’t take this type of trading as a hobby. Consider this like any other professional job that needs to be taken seriously. It should be pointed out here that during the early stages you should aim at learning the tricks of trade and not at making money easily and quickly. You should know it is a very volatile market. So, instead of experimenting and killing time, you need to understand its fundamentals and gain confidence before entering this market. Make sure to draw your plan and stick to that. You are most likely to become successful in due course of time provided you continue to consistently put in hard work.

Money Management through XFR Financial

The two most important things that you have to learn include managing your funds and emotions. One of the most important factors causing most traders to fail is lack of control over emotions like greed and fear. Often, after having suffered financial loss in the market, traders start believing that they have the capability of making the market reimburse the loss they suffered. This type of approach frequently causes them further losses and they fail miserably. Managing your funds or remaining financially disciplined is another essential feature for becoming a successful forex trader and you’ll find XFR Financial helpful in this regard.

Financial discipline simply means setting firm limits for your trades as per the volume of finances available with you. The plan should be to gain money without undue exposure to risks. This limit for good traders is up to two percent, though a number of traders stretch it up to 10% of their finances. You should understand that a significant advantage of exercising financial discipline is that you are always left with some money for trading the next day or in future because you don’t lose all that money in making a few trades on the same day.

If you take care to follow the above mentioned steps given by XFR Financial, you are most likely to succeed in your efforts of making decent amount of money through forex trading. You should understand that it takes time to become successful. You would know there are no short cuts to become successful in any profession and forex trading is no exception. You should continue to be disciplined at all times and don’t try escaping hard work if you like to be a successful trader by making considerable gains through this form of trading.

Tags:

Business,

Currency Trading,

economy,

Foreign Exchange,

Forex,

investments,

Trading

February 12, 2016

Coin collecting is an interesting hobby pursued by many across the world. If you’re a lover of history or rare artifacts than coin collecting is for you and a good start could be with junk silver.

Coin collecting is an interesting hobby pursued by many across the world. If you’re a lover of history or rare artifacts than coin collecting is for you and a good start could be with junk silver.

Coin collecting refers to collecting coins ranging over many eras and made of different materials. Each coin tells a story in itself. The imprints on the coin signify an important event or a phase of a ruler. Some people also collect coins mainly to systematically study the evolution of modern day currency. Such systematic coin collecting is referred to as numismatics.

While coin collection is informative and engaging, there’s also a good monetary value attached to it. Many coin collectors also have gold and silver coins. Coins in the past that were silver in color had a component of actual silver in them. For example, dimes produced pre-1965 have 90% @0.07 oz of silver. This silver in today’s market will sell for over $2! Such coins containing silver in them are referred to as junk silver coins since they do not have any real historic value attached to them but provide monetary benefit to the coin bearer. Similarly, there are gold coins as well.

HowTo Begin

Coin collecting is not as difficult as it might appear. There are many places where coins are traded and to begin with, you can just purchase a few of them. You can follow the following steps to kick start your own collection of coins.

Figure out what kind of collection you wish to make – historic? Time series? Artistic?

Based on your interest, start reading up on what kind of coins you want to collect. Not knowing enough can mean that you don’t know the value of the coin even if it’s in front of you.

Look for places that offer coins for sale. Visit coin stores around and look them up on the internet. It is advisable; however, to not buy a coin without seeing it first.

Read up well about the coin, its historic or artistic importance, the era of usage etc. This will help you better understand the value of the coin.

You can also begin with simple roll of dimes and create a collection of all dimes year over year. This is a simple way to begin teaching coin collection to children. It is also a good motivator for beginners.Once you have a few coins, you can begin trading them for a coin you might find more interesting to add to your collection.

There are few tips that can prove very helpful in the coin collection process:

• Have patience – Coin collecting requires looking through many coins to find the one you want

• Set goals – Setting goals keeps you motivated and focused

• Seek help – Don’t shy away from seeking help from a professional or an experienced collector for advice.

Conclusion

Coin collecting is both a hobby and an investment. The value of the coins grows over years and rare coins can be sold any day. Coin collecting can be practiced over very long periods of time and can even be passed on generation after generation – building bonds and creating memories.

Tags:

Assets,

Business,

economy,

gold,

investments,

Precious Metals,

Silver

January 2, 2016

Charting is very important in any form of trading in the financial market. It ensures that trade is carried out analytically. Charting technique is also used in Binary options’ trading. Anyone who wants to trade forex and make a good sum of money must make use of charting techniques. Thus, a decent knowledge of charting techniques is very essential if you must succeed as a forex trader. Trading binary options can serve as your sole means of income and employment and yield enough for your sustenance if you know how to make use of charting techniques.

For you to be able to chart in binary option, you must have thorough knowledge of charting technique. This article talks about candle stick charting technique and how you can use your knowledge of candle charting techniques to trade profitably.

What are Candle stick charts?

What are Candle stick charts?

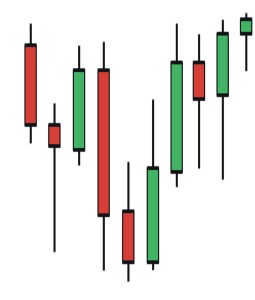

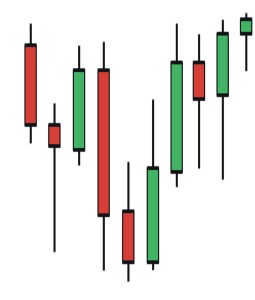

Candlestick chart are made up of collection of candle sticks. Every one of the candlesticks stands for a price action for a particular time period as shown in the example below. Our example illustrates the daily price action for EUR/USD currency pairs for 10 days trading time period.

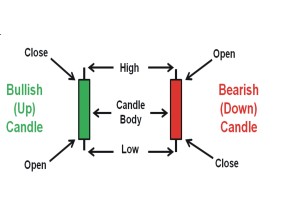

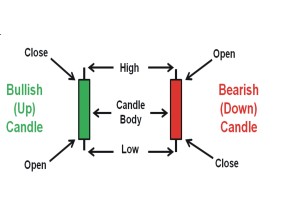

Candlestick chart colours

Each candle stick of the candlestick chart is colored. The color depends on whether there is a rise or fall in price action between its opening or closing time. The widespread color used for a rise in price also known as the bullish (up) candles is the green color while the most frequently used color for a fall in price also known as a bearish (down) candles are the black and red colors.

The coloring system makes it easier to see in an instance if there is rise or fall in price action on any particular day. It also lets us know the degree of rise or fall of the price action for ach particular day. Apart from providing this information, the candlestick chart also offers the trader a few more aid to successful trading.

The candle stick tells the trader the open price; the high and low price and the close price also known as the (OHLC) for each specific time period. This varies a bit. It depends on if the candle is bullish (up) or Bearish (Down)

Why Candle Stick chart is very effective

Why Candle Stick chart is very effective

The candlestick chart provides more information than the basic chart. It is made up of nodes which indicate either the opening time or the closing time of a unit. It can as well tell the trader if the time period is positive or negative. Red color on the candle chart shows negative while green color on the other hand indicates positive time period. Candle stick charting is an excellent and highly effective binary options trading technique.

To be successful in binary option trading with candle stick chart, you need to understand that the Binary options trading with candle stick method is completely different to trading with other trading options like the Forex or commodity market or stock market trading.

Candlestick Charting gives you a good start

Binary option trading is very good but unless you make good predictions, you won’t be able to make money with binary option. This is exactly what the candle stick chart will do for you. The candlestick charting is a good help to traders both those who are new in binary trading and experienced traders. It can help experienced traders to make a fresh start. It thus helps you to make use of the modern charting technique for trading. Candle stick charting as well possess a number of the best tools of technical analysis. With candlestick charting you can also make use of a few mathematical tools like the moving averages or stochastic.

Candlestick Charting is a stepping stone for successful trading

Take your time to learn and understand chart candlestick patterns. It is the most helpful analysis. It offers a trader some secrets to successful trading like a multiple indicator system, a price indicator system for supply and demand, a successful trading skill in addition to a system that evens out a risk.

A good number of the trading signals obtained by these systems have been established to be roughly 80% to 100% precise and correct. It is not all trading platform that has the software used in candlestick analysis. Thus, you can decide to choose charting software that can be used to track the unit you are trading on.

Why software is essential in binary Option trading

Trading binary option does not require buying and selling. A good number of traders of Binary option are of the opinion that binary option trading is much more different from trading from other platforms. The one most significant part of binary option trading is the trader’s ability to predict price movement of a specific equity. The use of software in trading comes in handy here. It assists the trader to make predictions of price actions.

Tags:

Business,

Currency,

economy,

Foreign Exchange,

Forex,

investments,

money,

stock,

Trading

India’s popularity among low cost mobile manufacturers like Xiaomi, OnePlus and others is big enough to make the country their highest priority. The main reason for this surge is, among many other things, the fact that Indians prefer prepaid connections more than post paid. While the lucrative recharge offers make prepaid a better option for cost sensitive con-sumers, what this translates to the low cost mobile manufacturers is a market free from telco-subsidised iPhones and other high-end phones.

India’s popularity among low cost mobile manufacturers like Xiaomi, OnePlus and others is big enough to make the country their highest priority. The main reason for this surge is, among many other things, the fact that Indians prefer prepaid connections more than post paid. While the lucrative recharge offers make prepaid a better option for cost sensitive con-sumers, what this translates to the low cost mobile manufacturers is a market free from telco-subsidised iPhones and other high-end phones.

Recent Comments