September 21, 2016

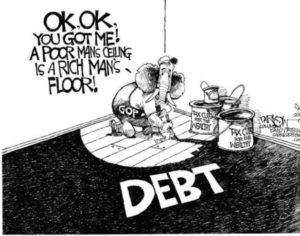

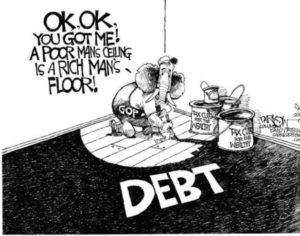

On a study made on debt, households are found more tensed in repaying their home debt. Home loan problems are found in almost all houses. However, since the problems are common in all section of people, there are solutions for everyone as well. That is, there are same types of home loans available for everyone, but the rate of interest depends on your income and the property you are buying. The real estate boon and people wanting to live in better areas with better facilities led to an increase in the various home loan policies.

On a study made on debt, households are found more tensed in repaying their home debt. Home loan problems are found in almost all houses. However, since the problems are common in all section of people, there are solutions for everyone as well. That is, there are same types of home loans available for everyone, but the rate of interest depends on your income and the property you are buying. The real estate boon and people wanting to live in better areas with better facilities led to an increase in the various home loan policies.

Have a well cut out blueprint

Creating a strong financial plan may help you to prevent falling in debt. It is like giving a blueprint to you. The realistic goals in you may help in paying off the debts that you may come across suddenly. Save for the future and set yourself a goal to reduce the excess payment if you are in debt. A proper budget may help you to attain this blueprint. The huge increase in cost of house furnishings and important miscellaneous expenses, this is essentially needed for the earning members. Save from your regular earnings and a part of savings.

Amalgamate your loans

If you are currently overpowered by debt and have no easy alternative to pay them back, then the only way is to consolidate your loans. This will make the management easier. This will also help you to know the exact amount, as in how much you are paying for your debt. Consolidation of debts brings debt smaller as it is more constructive and helpful in saving for the future repayment as well. Consolidation also sets in with a lower interest rate and hence, this will lower your total budget. The interest rate keeps on changing this will also be advantageous for your repayment.

Have an emergency person

To go through with consolidation, the person whose help you will need is the guidance of an expert. He may suggest you with the different schemes and schedules that have been regulated. These regulations are often beneficiary as they may lead you to help in repaying a lesser amount. The experts are aware of the rates that can be imposed on the total amount of debt. This will also help you to make an understanding about the total amount you need to save for your pay off. Consolidating experts may also help you in evading few home debts as there are such schedules. Home debts are started off interest free and have low rates presently. You can check out websites and click here to get the information.

Choose an authorized firm

Make sure to work with federally licensed firms to maintain legitimacy. When you are sharing your debt problems to any agencies, you are actually giving them your financial details. In this case you need to be aware about their legal expanse. This will only help you in reaching your financial goals. Home debts are such that often make people depressed from within and this can be avoided if you essentially have an authentic and licensed company to help you in managing your debts.

Tags:

Debt Problems,

economy,

financial planning,

loans,

money

September 20, 2016

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

Well, no one knows how debt can ruin your life. With the help of home equity, you have the liberty to stay on top of debts. Falling in debt is something, which you have always tried to avoid. Now, if you cannot, then there must be some mistakes with the monetary service, you have. Well, with the help of reliable experts and their proper guidance, it will be easier for you to handle the debts and to stay right at the top of your success ladder. All you have to do is just get in touch with the reputed experts, and try to procure their help for good. Once you are through with it, it will be easier for you to get rid of debt, once and for all.

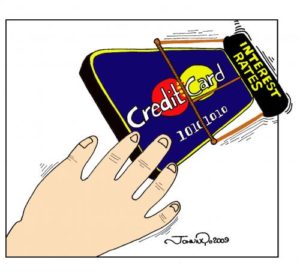

Taking control of your cards

Credit cards are sure going to offer you with the lucrative options of buying products, without carrying cash. Well, it becomes difficult, as you have to be aware of the reputed packages, over here. Moreover, when you are using credit cards, you are not aware of the money you are spending on it. Therefore, at the end of each month, when the generated bill reaches your address, you feel like facing some problems with it. With the help of reliable experts, you can be out of this problem.

Controlling the usage of cards

To get rid of credit card debts, you are most welcome to take help o home equity services. You will not just get the feeling of taking control of credit cards, but your auto loans are other forms of debts, with the help of this package. Using the home equity loans for debt consolidation is likely to enjoy lower interest rates, which are flexible and not static. All you need to do is just make single payment on a monthly basis, and you have the liberty to consolidate your debt.

Some services to work into

Now, you must be thinking about the reasons to choose debt consolidated forums through home equity loans. Well, you are about to pay less every month. You just need to lower your current monthly payment, and it will lower your interest rates, automatically. Moreover, you have the right to make simple payment, once. Here, the experts are going to combine the high interest debts and turn them into one fixed payment ratio, on each monthly basis. You will further enjoy peace of mind, with experts to be your help.

Simplify your life with ease

With the help of home equity, you have all the liberty to simplify your life, and enjoy it without facing any problem or hustle. You will further get into the path of brighter side around here, by managing your current debts. You have the liberty to borrow any money, from $25,000 to even $150,000. It solely depends on the loan package you are willing to choose. However, make sure to check out the amount first and see if you can repay it back, on time.

If you are struggling with credit card debt issues then it’s better to seek for credit card consolidation loans first. It will help you in making things better for you and you can go ahead with peace of mind.

Tags:

credit,

Credit Cards,

Debts,

Interest Rates,

loans,

money

September 16, 2016

Personal loan interest rates are not as low as home or education loan interest rates. So if there was a way to get a personal loan on rates lower than what are actually available, it can significantly help reduce the interest burden on the borrower.

Personal loan interest rates are not as low as home or education loan interest rates. So if there was a way to get a personal loan on rates lower than what are actually available, it can significantly help reduce the interest burden on the borrower.

There is indeed a way to reduce the interest rates on personal loans. This way is to take a loan against your fixed deposits. There are quite a few benefits of this. First of all, you don’t have to liquidate your deposits. Second is that generally, personal loan eligibility is dependent on your credit history, current income and ability to repay the loan. But in case of loan against FD, the lender won’t bother much about your credit history as he already has your fixed deposit as collateral.

The biggest benefit of loan against FDs is the lower rate of interest. Personal loan interest rates can easily exceed 15%. But a loan taken against fixed deposit charge interest rate that is just 3-4% more than the rate of fixed deposit. And this can significantly reduce your EMIs.

Let’s take an example.

Suppose you need Rs 3 lac as loan. You have a FD (earning 8% interest) but you don’t want to liquidate. So you decide to take a loan against it. Your lender is giving your regular personal loan at 16%. But as soon as you show intent to borrow against FD, the rates reduce to 11%. How does it impact your EMI given the repayment period is 3 years?

Your normal personal loan EMI will be Rs 10,547.

Your EMI for loan against FD will be Rs 9822.

Though this difference of few hundreds might look small, it can give you significant savings over the 3 year period. Calculations show that you can save more than Rs 26,000 in lower interest costs.

Do not forget that in case of default in loan repayment, the lender can foreclose your deposit to recover the outstanding amount. So do consider taking a loan against FD, if you want to lower your EMIs and also don’t want to liquidate your savings.

Tags:

budgeting,

car title loans,

cash,

Debts,

economy,

Interest Rates,

loans,

money,

Retirement Savings

September 15, 2016

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

You can get a home loan at 10%, education loan at 11% and a car loan at 13%. But when it comes to personal loan, lenders charge a higher rate (like 16% or even more). Why personal loans attract higher interest rates?

Personal loans are unsecured form of loans. This means that lenders do not have any recourse on any security in case the borrow defaults. As a result, lenders give personal loans at higher interest rates to compensate themselves for higher default risk that they are taking.

So how do lenders decide what rate to charge from different personal loan customers?

Everything for lenders boils down to a simple concept, higher the risk, higher the interest rate. So from a borrower who is considered safe, lenders will charge lower interest rates.

There are several factors that are used to assess the risk – current income, income stability, profession, age, existing loan EMIs, past loan repayment history, etc.

So if you are in a stable job, have a good income and do not have too many existing loans, the lender will lend to you at a lower interest rate as you are considered a safe borrower with lower default risk. However, if you have too many loan EMIs and have not be regular in your repayments, then you will be considered a risky borrower and lender will increase interest rate at which personal loan will be give to you.

Your past loan repayment history, as depicted by your credit score plays a major role in your risk assessment. So if you are unsure about your perceived riskiness as a borrower, to get in touch with lenders to understand the interest rate ranges that are applicable to different types of borrowers. Once you know the possible interest rates, you can use personal loan EMI calculators to find out much you EMI will be.

Tags:

budgeting,

Debts,

loans,

money,

personal finance,

savings

September 7, 2016

This article was wrote by US Business Funding, a company that provides Small Business Loans, Working Lines of Credit, Equipment Financing and much more.

This article was wrote by US Business Funding, a company that provides Small Business Loans, Working Lines of Credit, Equipment Financing and much more.

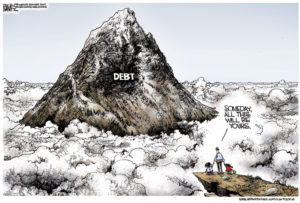

Whether it’s the shopper obligation on Visas, understudy advances or a home loan, a great many people get themselves weighed around obligation eventually in the shopper’s lives. This can have us working employments we detest just to compensate the debts and stay up our minds above water. It is by figuring out how to kill obligation quick you can discharge this weight and expel a portion of the anxiety from your fancy life.

Today this article will demonstrate how to kill your obligations as quick as would be prudent utilizing the Method of Stacking.

Stop New Debt Creation

The vast majority doesn’t get preparing in taking care of cash and live inside their methods. In case you’re in the red then you’re likely any of these individuals and it’s a great opportunity to chomp the truth projectile. It will be difficult to escape obligation except you reorient your money related propensities at this moment.

You should persevere against every one of the advertisers attempting to take away your well-deserved cash or offering simple account. You needn’t bother with more stuff that will make you cheerful. What you actually need is monetary genuine feelings of serenity.

So stop using your Visas or cut them up. This is literal. Placed them in holder of liquid and pile them in the cooler. At that point when there’s a chance to expend, you have sufficient energy to defrost (the owner and the charge cards) and truly choose in the event that you require that buy.

Interest Rate Ranking Your Debts

Make a rundown of everything of your obligations with sums and the loan fee. The most astounding loan fee ought to be the best for this is the thing that you’ll settle first. Settling your high intrigue obligation is the way to the method of stacking and paying off obligation as quick as could reasonably be expected.

Premium is a capable weapon and right now the bank or other monetary organizations are utilizing it against you. Intrigue fundamentally builds the sum you have to pay back and frequently we’re totally ignorant of the amount of that.

For instance, on the off chance that you have $10,000 Visa obligation at a 20% interest where you expend a base installment of $200 per month, this means that you will wind up spending 9 years 8 months to settle the genuine measure of about $21,680 incorporating $11,680 of interest!

Lower Your Rates of Interest

You can regularly bring down your charge card financing costs by doing an equalization exchange. This implies moving your Master Card to another lending company and that they will bring down the loan fee to take your company or business. Search around and attempt to take the least financing cost for the unbelievable longest possible term (ideally until it’s settled totally).

Simply ensure you’re perusing the terms and circumstances painstakingly so you will not get hurt by the fresh bank in different ways. Until you’ve completed this you may now arrange your rundown of obligation again if some stuff has changed.

Spending Plan:Creating a Strategy

This is the place we enhance your money related regulator from the first step. Take a bit of sheet of paper then record your salary after duty and every one of the costs that you consume. This will incorporate the base installments on your every obligation.

Take a gander at your costs and afterward rank them all together of significance to you. Take a gander at the things on the base of your rundown and choose whether you would rather have gander or be fiscally steady. The goal is to make a Spending Plan that is strategic, where your costs are below your salary.

You likewise choose the amount you will spend on every part of your whole life. You may apportion sums for rent, basic supplies, eating out, purchasing garments and different exercises however understand that once you have spent your designated cash there’s no plunging into different territories. It additionally has some good times,say that you can spend on what you like and an Emergency Account in the event that your auto separates and so forth.

You likewise need to incorporate into your Spending Plan that is very strategic as additional sum you are going to utilize to settle your obligations. Can you bear the cost of $20 per week? $50? $100? $200 or even more? It’s essential that you take a sensible number which you can focus on every week without fall flat and now this is Repayment Stacking of yours.

Repayment Schedule Creation

The initial segment of the method of stacking is to protect the base installment on each and every obligation you have. At whatever period you miss an installment, you cause charges and these include rapidly. This additionally incorporates making the base installment on the obligation with the most astounding loan cost.

At that point for the obligation with the most noteworthy loan cost (your Aim Debt) you are going to include the repayment stacking from your Plan of Strategic Spending. You should apply this Repayment Stacking and the base installment until that obligation is forked over the required funds.

As your formal least installment diminishes you say that additional sum to your Repayment Stacking. So like your base reimbursement drops your Repayment Stacking increments similarly. This will compose how quick you settle the Debt Target by adding much further to the reimbursements that you are making.

Progress Reward

You need to monitor your Debt Target so you will be able to see your improvement along the process. You can likewise settle on points of reference that you are going to rejoice and compensate yourself. A prize doesn’t need to cost cash however in the events that it does then it originates from your already distributed Plan of Strategic Spending.

This is a critical stride as it is going to keep your inspiration going just when you sense your self-control blurring. Much the same as you’ve prepared yourself to wash your hands and shower.Also, you can prepare yourself to deal with your cash. Feel awesome that you’re currently in going the 10% to 20% of individuals who are really dependable with cash.

Results Compounding

When you settle your Debt Target you have colossal festival and salute yourself. At that point you move your Repayment Stacking (which incorporates the past least installment also) to the following obligation with the most elevated loan fee. This turns into the new Debt Target that you are utilizing your Repayment Stacking sum in addition to the base installment for a new obligation.

This is the reason the Method of Stacking is so strong and capable. As you reduction an obligation you really expand your Repayment Stacking sum. This implies the second obligation will get settled off considerably speedier, the third significantly quicker than that, thus on thus on unless you are totally obligation free.

Be Kind to Yourself

Amid this procedure your resolution will be tried numerous times. Perhaps you’ll have a crisis like your auto separating or the necessity to go for a wiped out relative. The essential thing is not to hurl your lovely hands in despondency while backtracking to your past propensities.

Life will try your dedication to your fresh mindful cash state of mind and it’s dependent upon you how will you react. At the point when things turn out badly (and I promise they are) you have to disregard it and get yourself back to the track. Show sympathy when you coincidentally review your Plan of Strategic Spending and choose to improve one week from now.

The Method of Stacking is an effective apparatus however it’s dependent upon you whether or not you utilize it. On the off chance that you truly need comes about then get a hard copy of this article instantly and begin getting through the strides. It’s just by the choice you make at this moment that you won’t regret that an obligation free forthcoming and carry on with a monetarily mindful life.

Pay Debts Fast from a Low Income

When you initially began understanding this post, you may have trusted where it counts that obligation free living is for other individuals however not for you. This conviction was truly the main thing that was keeping you away from escaping obligation.

In any case, I trust eventually along the way you went to the acknowledgment that you can’t stay where you are at this moment without surrendering some of your greatest dreams and that in actuality (as in the inverse of disavowal you may have been living in as of recently) you need to roll out an improvement.

You now have every one of the apparatuses readily available to figure out how to improve a financial plan, get insane with sparing cash, and winning more cash to toss at your obligation.

Presently I need to abandon you with a couple more stories to get you significantly more persuaded that you can pay off your obligation quick regardless of the fact that you’re beginning with a low pay.

Knowing these things that are not taught in schools will make your business financial management easier for it will be a blessing to pay debts with just simple tips and techniques. All you have to do is to follow these tips and start paying your debs so that your business financial health will never be endangered again.

Tags:

budgeting,

Cashflow,

credit,

Debts,

financial planning,

money

On a study made on debt, households are found more tensed in repaying their home debt. Home loan problems are found in almost all houses. However, since the problems are common in all section of people, there are solutions for everyone as well. That is, there are same types of home loans available for everyone, but the rate of interest depends on your income and the property you are buying. The real estate boon and people wanting to live in better areas with better facilities led to an increase in the various home loan policies.

On a study made on debt, households are found more tensed in repaying their home debt. Home loan problems are found in almost all houses. However, since the problems are common in all section of people, there are solutions for everyone as well. That is, there are same types of home loans available for everyone, but the rate of interest depends on your income and the property you are buying. The real estate boon and people wanting to live in better areas with better facilities led to an increase in the various home loan policies.

Recent Comments