In the UK the Archbishop of the Church of England has struck out at pay day lenders calling them “morally wrong”. Unfortunately after bashing the pay day loan industry it transpired that the Church had invested over $7 billion of its pension funds in a company which had then supported a pay day lender. Indirectly therefore the Church had invested in a pay day lender! The very industry it regarded as sinful. It seems they were suitably embarrassed.

In the UK the Archbishop of the Church of England has struck out at pay day lenders calling them “morally wrong”. Unfortunately after bashing the pay day loan industry it transpired that the Church had invested over $7 billion of its pension funds in a company which had then supported a pay day lender. Indirectly therefore the Church had invested in a pay day lender! The very industry it regarded as sinful. It seems they were suitably embarrassed.

In response to the Archbishop’s attack the pay day lender in question, Wonga, who is also a pay day loan provider in Canada (see www.Wonga.ca), created and released a very clever, tongue in cheek, advertisement based on the 10 commandments – the Wonga version is the 10 commitments. The aim of the advert is to better educate people when interpreting the Church’s comments about pay day lenders. It sets out the promises the company makes to its borrowers and highlights the fact Wonga is a responsible lender. Probably the Church is a little unhappy that the debate and the new advertising campaign has certainly given the lender even more publicity – the adverts have of course been reported upon by the media thus resulting in free advertising and increased publicity for the company.

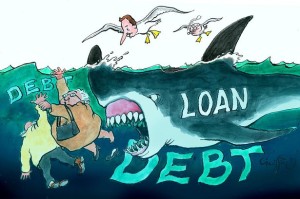

Further, far from sounding like the loan shark the Church has tried to portray pay day lenders as, the Wonga advert pretty much agrees with what the Church has had to say on the issue of pay day lending. The lender stated it was transparent about the price of its loans, carried out thorough credit checks and froze interest after two months to protect defaulting customers. It also said that it welcomed competition.

The pay day loan industry in the UK is not regulated like it is in Canada. Many politicians, charities and other organisations are calling for regulation but do not have the solution – the Archbishop is at least trying to push forward an idea. He is proposing that Credit Unions work from church premises to offer similar loans at lower interest rates – his idea is to push pay day lenders out of the market. This certainly sounds like a challenge. For a start he wants to find church members to volunteer as staff at the branches. This may be a big hurdle in terms of attracting customers. The average church goer probably does not reflect the average pay day loan customer. No one wants to be judged when taking out a loan.

A recent study indicated that the average age of a church goer was 61. Anglican leaders have warned that the Church of England will cease to exist in 20 years because elderly worshippers will die. As a result of this the Church presently has an urgent national recruitment drive to attract more members.

Just recently the Rt Rev Paul Butler, Bishop of Southwell and Nottingham stated that teachers should not illustrate math lessons with examples of “profit and loss”, or encourage children to save in order to buy bikes or toys Instead, lessons should focus on the math involved in giving donations to charity, saving for an overseas project, or even “tithing” – giving 10 per cent of one’s income to the Church.

When the Church is making statements like this you have to wonder whether it is the Credit Union/pay day loan “solution” is one part of its necessary recruitment drive. Pay day loan providers want profit, the Church wants people in seats: both have their own agenda.

Although the Rt Rev Paul Butler might not think it important, educating children about profit and loss and savings is all part of money management. This is vital in today’s society – Surely it is better money management which will reduce the need and desire for pay day loans.

Recent Comments