August 8, 2017

Life is unpredictable!

Life is unpredictable!

Although we are all aware of this, very few people actually think about the uncertainty of life and take practical measures to protect their loved ones, in case their life unexpectedly comes to an end.

Such wise people usually buy a comprehensive insurance policy to secure their family’s financial future.

Have you decided to be among those who are always prepared for the uncertain future?

Buy a life insurance!

What to Consider Before Buying a Life Insurance?

Searching and buying the right insurance policy can become a daunting task. But, not when you know what things to consider while weighing different insurance policies at hand. To help you do that, here we are highlighting some of the key factors that need to be considered when it comes to buying a life insurance:

• Make Sure That the Company Is Reliable

The foremost thing to consider before you decide to buy insurance is the reliability of the company you are buying from. Ask around for references and always go for the company that enjoys a good reputation. You can also check the company’s social media page to read reviews. This is important because frauds by insurance companies are highly common. Often, buyers find out about the hidden terms and conditions with regard to charges and coverage after buying the insurance.

Therefore, to prevent yourself from becoming a victim of an insurance scam, make sure you do a detailed research and seek references and reviews before choosing an insurance company. The task is quite tedious, but it is worth making the effort.

• Assess Your Needs

One of the many benefits of finding a reliable company is that the insurance agent can really help you in evaluating and assessing your needs and then choosing an insurance policy accordingly, to cover all your specific needs. The process entails evaluating factors such as the number of dependants, family wealth and assets, and whether the family will be able to pay off any remaining debts and bear the cost of funeral services or not?

Your answers to all these questions will help decide what things are more important for you and how much coverage you really need. For example, for some people the most important thing is to make sure their children’s education does not get negatively affected in any scenario and they want it to be covered by the insurance policy. On the other hand, there are people who do not want their family to pay for their burial services.

• Compare Different Policies

Decide your needs based on what things are important for you. For example, if you only want to make sure that your family receives money to pay for your funeral, ask different companies for quotes for funeral insurance. But, if you want multiple factors to be covered, look for a comprehensive life insurance policy.

Also, never settle for the first company you come across. Always compare different aspects of various insurance policies to make sure you find the best or you will end up regretting it later. In addition to your needs, your financial status also plays an important role in choosing a life insurance policy.

Tags:

Claims,

Coverage,

economy,

insurance,

investments,

life insurance,

money,

Premiums,

Returns

June 28, 2017

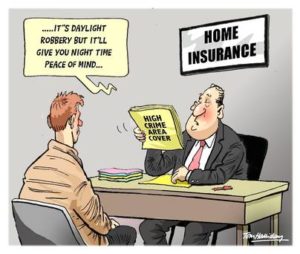

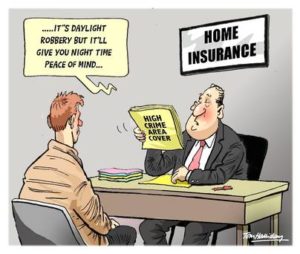

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Buying home insurance is a tricky task. With thousands of policy types and providers, it could be a daunting challenge. A lot of people make mistakes when buying a home insurance. Both the first-time and experienced home insurance buyers make mistakes. Those mistakes may cost them a lot in a long run, and they usually refer to two things. The first one is an inflated premium. The second mistake refers to the incomplete policy coverage. A low-cost policy quite often doesn’t cover all the things your home needs.

Whether you’re renewing or buying insurance for the first time, be aware of some mistakes. Below, you can find out about things to avoid and possible solutions.

Incorrect coverage amount

Most people choose a wrong coverage because they replace the real and market value of their home. Others are prone to overestimate the coverage amount. Those people identify home insurance with dwelling coverage. It pays in case of a damage caused by a covered danger like hail, storm, fire, and so on. The amount of dwelling coverage has an effect on limits for other coverages. For example, the limit for the contents coverage is set at 50%-70% of the dwelling coverage. So, how to evaluate the right dwelling coverage? There are various online home insurance calculators that address this issue.

Insufficient coverage for home rebuild

The majority of houses are not valued for insurance purpose. What would happen if those houses get destroyed beyond repair? The homeowners will not have enough insurance coverage to rebuild their homes.

How to avoid this mistake? It’s a good idea to hire a cost estimator who specializes in home replacement. You may also contact your contractor or a local builder. This is a cheaper option, but the assessment is not that precise as you get by a professional cost estimator. Once you’ve found out how much it costs to rebuild your house, you need to determine insurance coverage. Make sure to include all the valuables and improvements you have recently made.

Failing to look around

There are a lot of insurance providers and agencies today. They vary widely in how they estimate risk and how they determine the costs of home insurance. Some companies offer notably higher premiums than others. Don’t stop at the first insurance agency you run into. You should look around for the best deals instead. Try to find a quality yet affordable coverage that you are comfortable with.

Wrong deductible

Many people make mistake when setting the deductible. This is the amount of money that an insured pays before his/her insurance kicks in. This amount is paid toward a claim. Many insurance buyers set a wrong amount – either too high or too low. You can save a lot of money on your premiums by manipulating your deductible. As a rule of thumb, the lower the deductible, the higher the premium. But your finances could be left “askew” if the amount of deductible is too high. And if you are not able to come up with it when your home gets damaged by a disaster. You will pay more in premiums if the deductible is too low. Consult an insurance expert to hit the right balance.

As you can see, these issues are pretty complex. So even the most experienced insureds can make mistakes. Your best choice would be to consult an experienced insurance broker, though. Insurance brokers milton can help you get a quality home insurance products.

Tags:

Claims,

Coverage,

economy,

Finance Advisor,

Home Insurance,

insurance,

money,

personal finance,

Premiums,

Returns

April 20, 2016

The same health insurance policy can cost you differently at different life stages. We explain why this happens.

The same health insurance policy can cost you differently at different life stages. We explain why this happens.

Taking life insurance in today’s times of uncertainty is de rigueur for any responsible person. While lifestyle diseases and serious illnesses like cancer are on the rise, the world is also witnessing unprecedented acts of terrorism and natural disasters. All in all, life is quite unsafe all over the world. But while we can exercise no control over how the world behaves and affects us, we can certainly safeguard ourselves and our families with life and health insurance policies.

However, the timing of purchase is crucial: any financial planner and insurance advisor will tell you that the younger you are when you buy life and health insurance plans in India, the lower your premium payments will be. There is a curious correlation between one’s age and how affordable or expensive the insurance plans become. This correlation changes with:

The 20s: A person has a job with a modest income, possibly a first job. The policy holder has relatively lesser family responsibilities and can easily pay the health insurance policy premiums. A person in their 20s is also healthier and fitter than his older counterparts, so the chance of disease is lower. Also, insurers estimate a larger life span for the policy holder, hence the sum assured will be higher while the premium payments will be lower.

The 30s: By this time, a person is married and has a family, while also having a stable job. His income is also higher than in the previous decade, while his health profile may not be as good as earlier. Insurers anticipate that certain lifestyle diseases like diabetes and cardiac problems take root in this decade. Also, your profession and lifestyle can have a bearing on the premiums of your health insurance policy. If you are employed in a line of work that puts you in danger (such as the police force, fire brigade, mining and construction, etc.) the insurer will insist on a higher premium payment for you.

The 40s and 50s: Premiums on health insurance plans will be much higher as compared to those a person in his 20s would pay. Insurers anticipate a lower life expectancy for the customer at this stage, along with many varied expenses at home (children’s higher education, medical treatment costs for self and parents, home mortgage payments, etc.) and so, the premiums will be larger. Insurers will also insist on a detailed health profile to eliminate the possibility of unknown diseases, critical illnesses, disorders arising out of smoking and substance abuse, etc.

The 60s: Most insurers do not give health insurance policies in India to people who have crossed the age of 60 years. People in this age group have retired from active duty, hence they do not have an income from which they can pay their health premiums. Secondly, it is costlier to insure a person past the age of 60 because of a high incidence of poor health and diseases. Instead of taking individual health plans in their 60s, people in this age group should look at getting included in the family health plans of their children.

Tags:

Claims,

Coverage,

economy,

Health Insurance,

insurance,

investments,

money,

personal finance

March 10, 2016

When creating an overall financial portfolio, investors typically consider how to allocate assets into categories such as growth, income, and cash or cash equivalents. But, often they will tend to forget about something that, without it, could be detrimental to literally everything else that they’ve worked for. That is life insurance.

When creating an overall financial portfolio, investors typically consider how to allocate assets into categories such as growth, income, and cash or cash equivalents. But, often they will tend to forget about something that, without it, could be detrimental to literally everything else that they’ve worked for. That is life insurance.

Life insurance is, in many ways, one of the most essential elements in a financial portfolio. This is because it can provide protection for all of the other assets – especially in the case of the unexpected.

For example, in its most basic sense, life insurance is made to protect a surviving spouse or loved ones from the financial consequences of unpaid debt and / or ongoing living expenses should a primary income earner pass away.

But life insurance can also be used in other financial planning areas, too.

Using Life Insurance for Diversification

In addition to death benefit protection, there are many life insurance policies that will also provide policy holders with a way to protect their cash value from market volatility, as well as from the high cost of a long-term care need.

In other cases, cash value life insurance can also be used as a primary or a secondary financial vehicle for saving for a child’s or a grandchild’s future college education expenses – and oftentimes this can provide a much more flexible mechanism even than the 529 college savings plan.

Life Insurance as an Income Supplement

If structured in the proper manner, certain cash value life insurance policies today can also be set up to help policy holders in supplementing their retirement income on a tax-free basis. With all permanent life insurance policies, cash value is allowed to grow tax-deferred. This means that there are no taxes due on the gain on those funds until the time they are withdrawn.

In many cases, a life insurance policy owner will either borrow or withdraw their cash value for a variety of different needs. These can include paying off loans, funding the college expenses of a child or a grandchild, or even taking a nice vacation.

The money that is taken out as a loan will not be taxed to the policy holder – and, it can typically be borrowed at very low interest rates (usually quite a bit lower than that of a bank or other lender).

Over the past several years, many pre-retirees have been taking advantage of the many benefits that indexed universal life insurance (IUL) can provide. This is because the cash in these policies has the opportunity to increase based on market indexed linked growth, yet it is protected from downward market movements by being credited with a return of 0% in negative periods.

Cash can be borrowed tax-free in order to supplement retirement income – and, if the policy holder passes away, any unpaid loan balance will simply be charged against the death benefit that is paid out to the policy’s beneficiary.

Making Your Financial Plan Complete

In all, while life insurance should still be considered for its death benefit protection, it also has so much more to offer – and because of that, it should not be thought of as just a “stand alone” product, but rather as an important and essential piece of the overall financial planning puzzle.

When constructing your overall financial plan, it’s important to be sure that you have the right type and amount of life insurance coverage. This is because you don’t want to leave your loved ones short just in case of the unexpected.

When choosing your life insurance plan, know that not all policies are the same, so you want to be sure that you shop for the policy, the benefits, and the insurer that will be the best for you and your specific needs and goals.

An independent insurance advisor can help you to fit the coverage to your plan, as versus the other way around. By working with many different life insurance carriers, going with an independent agency will allow you to shop in an unbiased manner while putting all of the pieces together when you’re ready to move forward.

Tags:

budgeting,

Claims,

Coverage,

economy,

financial planning,

insurance,

investments,

life insurance

January 25, 2016

What is life insurance?

What is life insurance?

One of the key concepts of life insurance is that it can pay any dependents you have a cash lump sum or regular payouts upon your death. It has been designed as a way of providing you with a level of reassurance that those who are dependent on you are looked after should you no longer be around.

Of course, the amount of money that will be paid out depends on the amount of cover that you purchase. You may also make decisions as to how it will be paid out and whether the money is earmarked to cover particular payments such as rent or a mortgage.

There are a couple of main types:

– The term life insurance policy runs over a fixed period, and will only pay out should you die within that period. No lump sum is redeemable at the conclusion of a term policy.

– The whole-of-life policy pays out irrespective of when you die.

What is not covered?

Life insurance does not cover disability or illness. The majority of policies have exclusions. As an example, if your death is cause by alcohol or drug abuse, there is no cover.

Should you have a particularly serious health problem when the cover is taken out, this may also be excluded from payout.

Are you in need of it?

If you have dependents – a partner who is dependent on your income, school aged children, et cetera – if you die, a life insurance policy may provide for them.

If you are unable to rely on governmental help for your family – perhaps the amount is too small – then life insurance becomes a necessity.

Who does not need it?

Your partner may earn enough income for your family to be comfortable, or you may be single, in which case, life insurance may not be required.

How much does life insurance cost?

Life insurance can be good value. Depending on your circumstances, a few pence each day can be plenty enough to provide your family with financial protection. In fact, on average, 100k life cover for a period of 10 years, for those who do not smoke and are aged 54 years, works out at less than £1 a day.

Nevertheless, monthly payments, which are also referred to as premiums, can and do vary. Thus, it’s wise policy to shop around and to find out precisely what will be covered given the amount that you are paying.

There are a number of factors that impact the amount you will pay for life insurance. That includes the policy length, the amount you wish to cover, your current health status, your current age, whether you smoke, and your current lifestyle.

As an example, a younger person who is less likely to die on account of a medical condition will enjoy a cheaper life insurance policy than otherwise.

Do you already have life insurance?

You may have an employee package which includes something called “death in service” benefits. In which case, this covers you for a certain multiple of your income and as such, you may not be in need of any life insurance.

You do need assess whether this policy will provide enough cover in the event of your death or whether you should opt for additional cover.

Do keep in mind that if you no longer work for this employer, you will lose your coverage under this policy.

Consider other forms of insurance

Life insurance will cover a worst-case scenario, though you should also consider other matters such as bill payments and your mortgage if you are unable to work due to injury or illness.

You may benefit from income protection insurance. Income protection insurance provides for regular payments if you are unable to work on account of injury or illness.

Perhaps instead you need critical illness insurance. Critical illness insurance provides you with a lump sum which is tax-free should you be diagnosed with a serious illness that is under the provision of your policy.

Think also about payment protection insurance, which is a policy that will help you to maintain any regular payments if you are unable to work – maybe because you are ill, you’ve suffered an accident, or you have been made redundant.

You might be in need of short term protection insurance. This is a solution which provides short term insurance cover that can help you to pay for any essential outgoings if you are unable to work for any reason.

Tags:

budgeting,

Claims,

Coverage,

economy,

insurance,

investments,

life insurance,

money,

Returns

Recent Comments