September 23, 2015

If you are finding it difficult to pay back your debts, you may be able to apply for temporary financial hardship. This would mean that your payment arrangement changes for a few months and the type of assistance may vary between creditors.

If you are finding it difficult to pay back your debts, you may be able to apply for temporary financial hardship. This would mean that your payment arrangement changes for a few months and the type of assistance may vary between creditors.

So what exactly is financial hardship and who can qualify?

An individual that is unable to meet their repayments and unable to pay for the bare necessities is considered to be in financial hardship. Such provisions that a person cannot support either for himself/herself, family or dependents can be:

- Food

- Accommodation

- Clothing

- Medical expenses

- Education and other basic necessities

Creditors will examine your inability to pay basic bills on your current income. These are all lumped together as living expenses, but if you find yourself struggling to pay any one of these you may qualify. Having this information available when you call your creditors is generally a good idea.

Most creditors will want to know why you are having this financial hardship. If you have been made redundant, had your hours cut, had to take leave from work due to illness, etc., you should be prepared to send them paperwork confirming your financial situation.

Factors that led to financial hardships

- Tragedy in the family

- Serious illness that it drained your resources

- Injury that caused an inability to work

If you have lost a home, are having medical difficulties, or are going through a time of family emergency you may also be able to apply. Medical trouble can be a real problem with the inability to work when you are accruing larger medical bills. This means that if you find yourself needing to have extensive surgery, are injured on the job and you find yourself with unexpected expenses such as child care, you may be eligible.

Generally the creditors will want to know that your situation is temporary. If you have lost your job that means you must be on the look-out of a new job. They may ask you to estimate how long you anticipate needing assistance and only offer you help for that time period. However, you may be able to ring them up again and extend the terms of your agreement. There are only a limited number of times that one is able to apply for temporary hardship assistance and if you’re financial difficulties are more permanent,you may need to look for a long term debt management option.

Each creditor has different criteria and assesses the client’s whole situation with a financial statement of position plus looking at their circumstances as to why they can’t afford to pay their debts. During financial hardship you may be able to get your payments reduced or stopped temporarily. This will assist you to get back on your feet and pay your debts back in a timelier manner.

All requests for hardship must be responded to within 21 days by your creditors. This means that you will know within the month if your application has been successful or not. If your application is rejected or requires more proof, the company must tell you why otherwise you may be able to file a dispute with the Financial Ombudsman Service. Confirming the agreement in writing can save you a lot of time and money later as well.

If you want to know more in how to go about this; and if you are not sure of approaching the creditors, you can check the website www.debtcutter.com.au as they provide a number of fact sheets to guide people through applying for a financial hardship.

Tags:

budgeting,

Debt Problems,

economy,

financial advice,

financial planning,

money,

savings

January 21, 2015

Just as the name implies, a short term debt financing stands out as a financing form that involves a financial obligation a company has to fulfil in a shorter period of time when compared with regular financing options. In most situations we are talking about a maximum of 2 years, although 1 year financing is usually offered.

Just as the name implies, a short term debt financing stands out as a financing form that involves a financial obligation a company has to fulfil in a shorter period of time when compared with regular financing options. In most situations we are talking about a maximum of 2 years, although 1 year financing is usually offered.

Many companies opt for short term debt financing because of the fact that they want to have more working capital available or it is possible to need more money as day-to-day operations need more cash. Cyclical operation conditions or companies that are faced with international trade need such financing in various situations.

According to Today’s Growth Consultant Reviews, there are 4 types of short term debt financing that you can consider:

This is basically an instant credit extension offered by the lending institution. As a company gets the overdraft agreement, it can transmit or draw down cash from the account beyond the balance that is available. Credit amount will always depend on overdraft limits that are negotiated with banks. In this case the advantage is that you will only take out as much as you need for the operation activity when it is necessary.

A credit letter is basically a letter that comes from the bank and guarantees payments towards sellers. Sellers are guaranteed that amounts will be received during credit period. In this situation the advantage is that the company is usually going to be offered a better overall credit term when dealing with a supplier.

These are loans that have to be repaid in a short period of time, together with the associated interested. This is a loan that is not revolving and usually has a completely fixed repayment period. A company can use it in order to gain more liquidity as working capitals are lower or are necessary (for instance, for paying creditors or buying stocks).

This document will bind a party to pay an amount of money at a fixed rate to the secondary party at a specific date. In most cases this is a bill that appears when dealing with international trade. Exporters can grant a credit for the importer for the goods shipped with an exchange bill for the amount.

Short Term Debt Financing Qualification

In order to receive such financing you do not need to think about formal qualifying criteria. Usually, the company needs to hold a stronger business case that supports business viability and owner capital. A supplier can offer a short term credit for the purchases in order to enhance competitiveness. The bank will offer overdrafts and short term loans in order to earn an interest and build client relationships. To put it simply, if the company is transparent in operations and financials, there is a strong possibility that such financing would be offered.

Tags:

budgeting,

credit,

debt,

Debt Problems,

economy,

financial planning,

money,

personal finance

December 17, 2014

According to recent reports, India’s GDP grew up by 5% in the financial year, 2012-2013, which was the lowest since the last decade. It seems that the 2008 recession still looms large on the daily lives of the Indians. While the lawmakers are there to take larger and bigger decisions about the nation’s GDP, the common man can’t do much about macro-economic indicators. As we’re about to step into 2015, we need to organize our finances and revisit, learn and imbibe some timeless personal finance lessons from the maestro Warren Buffet so that we can overcome the financial shocks that may be in store for us in 2015.

According to recent reports, India’s GDP grew up by 5% in the financial year, 2012-2013, which was the lowest since the last decade. It seems that the 2008 recession still looms large on the daily lives of the Indians. While the lawmakers are there to take larger and bigger decisions about the nation’s GDP, the common man can’t do much about macro-economic indicators. As we’re about to step into 2015, we need to organize our finances and revisit, learn and imbibe some timeless personal finance lessons from the maestro Warren Buffet so that we can overcome the financial shocks that may be in store for us in 2015.

1. Review 2014 before you start: Before taking any step, start off with a review of 2014. How did you fare? What points did you miss? Which financial tasks are still pending? Where did you commit some of the biggest blunders? Were all your investments on track? By evaluating your strengths and weaknesses that you’ve portrayed in 2014, you will easily be able to deduce the steps that you need to take to improve your finances. Write down everything in points so that you don’t forget anything while planning for 2015.

2. Create a frugal budget: Budgeting is a basic but important tool. When you know what you earned and where your money went, you can be aware of your current financial situation. Often times, when your expenses are high, a large part is accounted by all those unexpected and unplanned expenses like entertainment, eating out, coffee shop bills, which are difficult to control and restrain. So, you should first know the excess outgo and then analyse the spending habits so that you can limit each expense. Live within your means and check yourself whenever you see that you’re outdoing your budget.

3. Spend wisely and live thriftily: Warren Buffet says that if you buy things that you don’t need, soon you will find yourself sell things that you need. Most of us suffer from the urge to splurge and most often we justify our expenses using the pretext of special occasions, lifestyle, family emotions and even smart decisions. Most marketing companies understand this urge and they try to exploit by giving us offers on products. Unhealthy carbonated drinks are sold with promises of adventure, youthfulness and happiness. You may also take the example of EMI options on expensive smartphone. Little do they understand that through the EMI option, people tend to pay more in the long run.

4. Save money for the financial odds: Remember that someone is sitting under the shade today as someone planted a tree long time ago. All of us are aware of the fact that saving money is important to have a better future. But it is indeed an alarming fact to observe that most of us don’t even save enough money for the emergencies. This happens due to our extremely myopic view of our personal financial condition. Today, instant gratification matters more than saving for tomorrow. In fact, saving is considered as sacrifice by most people. Follow the “pay yourself first” principle. Set aside some money for your future.

5. Plan for the long term and be patient: No matter how great are your talents and effort, there are some things that just take time. Can you ever produce a baby in one month by getting nine women pregnant at the same time? Money is also a part of nature and it can’t grow overnight. However, we always overestimate money that we can make in a year and underestimate what we can make in 10 years. People should make money by staying invested for the long-term instead of dancing in and dancing out of the portfolios and changing them constantly. According to India’s growth, you can benefit only if you invest for long term and stop panicking for short-term fluctuations. Based on your risk appetite and financial goals, make a diversified portfolio. Pick right financial instruments recommended by your financial advisor.

6. Borrow within your limit: Remember that you can never become rich by living on borrowed money. Initially people think that borrowing is manageable and to later on repay the previous borrowings, they take out yet more loans like the debt consolidation loans. This is more like fighting-fire-with-fire approach towards debt reduction. Borrowing should never be done without an objective assessment of future cash flow and other financial needs. Have a solid plan to pay the debt back and not become its slave.

A debt-free life is indeed the best life. In spite of knowing this, there are many who hardly take the required steps to stay on the right track. If you’re not willing to spend a life immersed in debt, take into account the above mentioned financial tips by Warren Buffet.

Tags:

budgeting,

Debt Consolidation,

debt freedom,

Debt Problems,

economy,

financial planning,

investments,

money savings

August 17, 2013

Refinancing is a great option that homeowners have especially when mortgage rates are lower than what they already have in place. Can refinancing a mortgage eliminate debt? The reality is that refinancing a mortgage cannot eliminate debt, although using a refinance to reduce debt can be a very successful financial strategy.

Refinancing is a great option that homeowners have especially when mortgage rates are lower than what they already have in place. Can refinancing a mortgage eliminate debt? The reality is that refinancing a mortgage cannot eliminate debt, although using a refinance to reduce debt can be a very successful financial strategy.

When refinancing, the homeowner is basically turning in the existing mortgage for a new loan. The new loan can have a different rate, a different term and a completely different program. Normally, borrowers will try to obtain a lower mortgage rate and/or a lower term, if possible. In most cases, the standard fixed rate mortgage is chosen even when refinancing from an adjustable rate mortgage. Fixed rate mortgages offers borrowers security by knowing that the same mortgage payment will be in place for the entire term of the loan.

Debt consolidation is often done when refinancing. By doing so, the borrower is combining the balances of other debt, such as credit cards, loans, etc., and adding it to the mortgage balance. While this increases the funds needed for the mortgage, the other debt is paid off at closing. The debt is not eliminated, it is simply moved to another debt vehicle which is the new mortgage.

Moving other debt to a new mortgage can only be done if the borrower has enough equity in the home. The homeowner must also qualify for the refinance according to the lenders guidelines. This type of loan is considered a cash-out refinance and will generally have a higher mortgage rate than a no cash out loan. The new mortgage will include the funds that are necessary to pay off the other debt. The debt amount is then part of the new mortgage and is paid as part of the the monthly mortgage payment for the full term of the loan.

By utilizing a debt consolidation refinance, many homeowners are able to free themselves of the burden of carrying an overabundance of debt that must be paid on a monthly basis. This debt usually carries a higher interest rate which can make multiple monthly payments uncomfortable. Adding these expenses to a refinance often results in a more cost effective budget for a homeowner because the total debt payment is usually reduced. The end result to the homeowners is typically a better monthly cash flow.

In order to reap the benefits of a debt consolidation through refinance, homeowners must make it a goal not to incur additional debt. With less debt, a homeowner’s financial stability will can often remain intact which leads to added security in case a hardship should arise. The savings recognized from a mortgage refinance can be accumulated or used in lieu of credit cards. This is the beginning of the path to financial freedom for many homeowners. However, incurring additional debt expenses after the refinance can lead a homeowner to repeating the process with multiple debt consolidation loans which, in the end, will not be cost effective.

Everyone dreams of the day when there will not longer be a mortgage payment to make. While it may seem so far away, time does move quickly and, with careful planning, it will be a reality faster than you think. Planning a refinance with debt consolidation will also help a homeowner reach their goals of eliminating overwhelming payments on a monthly basis.

Tags:

Debt Problems,

Debts,

economy,

financial planning,

Interest Rates,

Mortgages,

refinance

May 12, 2013

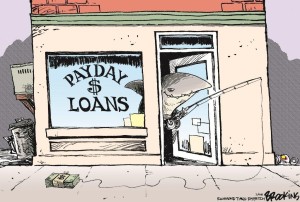

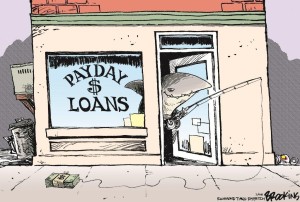

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

The payday loans are the short term personal financial solutions consuming a very short amount. The maximum amount cab be borrowed from this source is $600 only. Nevertheless, the small grant can be sufficient to make an investment. You must get surprised and ask that how can this be a possible idea! Well, this can be a possible idea if you just work a little hard and carry on the work smartly. In fact, you can make investment with the payday solutions and easily generate money as a side income besides your job. Here you get toe detailed discussion in the following:

Making investment with the payday loan :

The following ways can be adopted to make investments with the payday loan:

Joint venture investment : there are some business projects which offer joint venture investment plans to the people. There, you will need to invest a partial amount. And after the profit generation, that will be distributed among the investors according to their investment balance. So, you can certainly generate some money with these businesses. For more information you can visit http://www.prnewswire.com/news-releases/offering-2500-bad-credit-personal-loans-for-borrower-in-financial-trouble-175015681.html

Stock market investment : the stock market investments are very famous business idea in the world. But, not all the companies are reliable. You will need to make investment on the company which is generating profit constantly and which in on the track. In this way, you can make your stock investment. Basically, this is a profitable business, if you can choose to pick the right company for you. Nevertheless, the risks are always there. But, you will need to carry on with the risk if you want to gain something. So, you can get the idea of making investment on the stock market.

Online entrepreneur : the online world offers people with a lot of facility to generate a lot of money. Today, many people are expecting to generate a lot of money with online business. You can certainly make investment with the online sources by being an online entrepreneur. You can choose to purchase a domain and start your own website to generate money. Or, there are a various internet marketing ideas available which can be easily adoptable by you. So, in this way, you can generate a lot of money. In fact, you will not need to carry on with the business as a side income. Rather, you can build up your career with this. And a payday loan is enough to start up the business.

FOREX investment : you can make investments on FOREX trading as well. In fact, the FOREX trading is the one which has a look like stock market. But, this stock market exists in the virtual world. Many people are generating a lot of money with the FOREX trading. But, the risks are also existing in this filed. Nevertheless, it is up to you how you handle the business. If you can get to a bit smart, you can certainly generate a lot with it. Read here for more information.

Tags:

Debt Problems,

financial planning,

Interest Rates,

investments,

loans,

money,

Payday Loans

If you are finding it difficult to pay back your debts, you may be able to apply for temporary financial hardship. This would mean that your payment arrangement changes for a few months and the type of assistance may vary between creditors.

If you are finding it difficult to pay back your debts, you may be able to apply for temporary financial hardship. This would mean that your payment arrangement changes for a few months and the type of assistance may vary between creditors.

Recent Comments