November 19, 2014

Self-employed workers may be extremely focused and have an entrepreneurial spirit that will lead to business success but they are also notorious for being disorganized when it comes to paperwork. It really is not possible to be an excellent businessperson and an office administrator. Unfortunately, administration is the backbone of every business and it absolutely must be carried out on time and accurately for a business to maximize its profits.

Self-employed workers may be extremely focused and have an entrepreneurial spirit that will lead to business success but they are also notorious for being disorganized when it comes to paperwork. It really is not possible to be an excellent businessperson and an office administrator. Unfortunately, administration is the backbone of every business and it absolutely must be carried out on time and accurately for a business to maximize its profits.

Many self-employed workers or contractors actually find the financial side of their business intimidating and confusing. There are so many ways to set up a company and manage its finances, and many rules concerning the filing of company accounts and record-keeping.

A small business whose financial side is not managed correctly may find that it loses money and this can hit profit margins hard. Sometimes money is lost simply because a business forgets to invoice for work carried out, or because it undercharges. Suppliers and subcontractors will rarely chase up a late invoice.

Ask any accountant and they will tell stories about entrepreneurs who have months of receipts and invoices piled on their desk, check payments with no details of what the payment was for and receipts of funds into their bank accounts with no note of why they were paid. Couple this with the need to file tax returns correctly and on time and the result is an extremely chaotic office that acts as an anchor weighing down the whole business.

Taxation is one of the most complex areas for any size of business and keeping accurate records of all set-up and ongoing costs is vital to allow you to submit an accurate tax return after your first year of trading. Poorly-managed accounts often result in paying more tax than you should – you cannot claim expenses if you lose your paperwork.

Many employee benefits are tax-deductible such as life insurance and pensions. In fact, all HSA contributions are tax-deductible. Self-employed workers can also deduct from their tax bill the cost of disability and dental insurance premiums along with legal and liability cover. Few self-employed workers manage to claim all these expenses correctly.

Efficient business finance management requires both time and excellent organizational skills. There are several areas of financial administration where self-employed workers repeatedly fail, such as chasing invoices, pricing services and keeping up with tax matters. It’s especially easy to fall behind and get into debt when taking part in an MLM. Check out mlm scam reports to see how you could be in danger of losing lots of money if you aren’t careful.

Fortunately, there are many accountants that offer specific tax advice for contractors and some provide business administration as well as accountancy services. These are called umbrella companies and they provide a way for contractors and self-employed workers to receive help from qualified accountants with the financial and tax aspects of running their business.

An umbrella company essentially acts as an operating company for an entrepreneur, contractor or small business. The umbrella company manages all business finances from daily accounting and administration tasks through to the filing of annual accounts and management reports. The umbrella company manages all the accounts and pays you a salary so that you can focus on what you do best – running a great business.

Tags:

Cash Flow,

economy,

Freelancing,

money,

personal finance,

tax

March 12, 2014

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

Instead of buying a new TV or going on a clothes shopping spree, it’s often much wiser for Americans to concentrate any tax refund money on improving their financial standing overall. Perhaps the best method for doing this, in a number of ways, is to pay down outstanding debt of almost any kind. This will have the dual purpose of both reducing the cost of monthly payments faced for having such balances outstanding, but also improving their credit scores. Usually, it’s the wisest idea to pay off the debt that comes with the highest interest rate (usually credit card balances) because of the ways in which big rates can tack on additional debt in a shorter period of time. The larger the refund, the more substantially debt can be cut, and thus the pressure on a household budget can be reduced.

What about consumers who don’t have big debts?

Of course, not everyone has thousands of dollars worth of credit card bills to deal with, or might be constrained by parts of mortgage or auto loan agreements which state they cannot pay them off before a certain date. For those people, it might be wise to simply put a tax refund into savings, instead. This, though, can be approached in a number of different ways. It could be used to build emergency savings, in the event of a problem that arises down the road, or they could simply put them into retirement accounts that will help to secure their financial futures.

For those who haven’t yet filed their returns but want to maximize their refunds, it might be wise to speak with a tax professional who may be able to help identify some potential deductions that could help to increase the amount of money they receive back from the IRS.

Tags:

budgeting,

economy,

financial planning,

Income Tax,

investments,

money,

tax,

Tax Returns

February 7, 2014

Hands up if you’ve got your tax act together! What? No hands up? Well then, grab a seat and listen up!

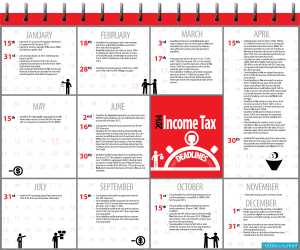

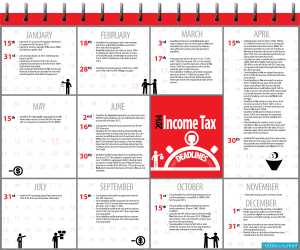

The State and Federal governments have set up certain due dates for filing or e-filing your taxes. To some, understanding taxes and meeting tax deadlines is the first among many horrifying aspects of filing tax returns. But once you understand when and what needs to be filed, it will be the first big step you’ve taken towards de-horrifying the process of tax filing and returns.

April 15th is a big date to remember. Not only must you file your taxes by this day but you also need to pay an estimate of any taxes due. 11.59 pm on that day is the deadline. Miss that and you’ll need to request an extension from the IRS. And even if you do request an extension, remember you still need to pay the taxes you owe.

In addition to that big date, there are several due dates to keep in mind depending on your status – whether you’re individual tax payer, a business (S corporation, C Corporation or LLC) or a charity. The infographic below will help you keep a track of those dates. Remember, if a filing date falls on a weekend or a national holiday, the date will be moved forward to the next working day. It’s important not to miss these dates because if there’s one thing you don’t want, is the IRS on your back, right?

What happens if you don’t meet the deadline?

Brace yourself! This is the next horrifying part of filing taxes. A lot. A lot of bad things can happen if you don’t meet that deadline. For one thing, the fee for not filing is a lot harsher than it is for late filing. In addition, there are penalties which you can check out on the IRS website.

What Not to Forget

You’d be surprised at the common mistakes people make when filing their taxes. Before you send those papers to the IRS double check whether you’ve:

• Put a stamp on the envelope

• Signed the documents (Don’t laugh. It happens more often than you’d think)

• Included the social security numbers of their children and adult dependents

• Annual limits and tax tables can change from year to year. Make sure you’re using the right.

If you run a small business, there’s a never-ending string of dates that you have to keep in mind. Make entries in your PDAs, your laptop and any other devices you use to keep your appointments to help you stay on top of things.

What to Remember

Remember to take advantage of tax deductions. These may change from year to year as well and I sometimes suspect it is in the IRS’s best interests to confuse us folks! It may help to hire professional accounting firms whose job it is to prepare and file your returns while maximizing your earnings. Firms, like 1800accountant, designate a personal accountant to your case and offer 24/7 access the whole year round. It’s worth looking into such services and enjoy the peace of mind that comes from knowing you’ve got your taxes taken care of and managed to make some tax savings. Now that’s what I’m talking about.

Tags:

budgeting,

economy,

Income Tax,

money,

tax

November 25, 2013

Many sole traders make the move to limited company status because they believe it will make them more desirable to new clients, or perhaps because they think they can save on tax in the long run. For a small limited company however, understanding how tax works is vital – and tax matters can be extremely confusing! All limited companies, both large and small, need to be up-to-date on current tax matters, as the consequences can – and often are – costly.

Many sole traders make the move to limited company status because they believe it will make them more desirable to new clients, or perhaps because they think they can save on tax in the long run. For a small limited company however, understanding how tax works is vital – and tax matters can be extremely confusing! All limited companies, both large and small, need to be up-to-date on current tax matters, as the consequences can – and often are – costly.

Limited companies don’t use the same self assessment tax return system as other businesses and self-employed individuals. All limited companies, both large and small, are subject to annual corporation tax.

This means the company does its own corporation tax self assessment – i.e. it calculates the amount of tax it must pay itself using a company tax return. The methods and deadlines are different to those used elsewhere.

The most common tax issues faced by a small limited company

It’s important to remember that once a company has applied for and been given limited company status, it is now a separate legal entity from its owner, irrespective of how many staff it employs or who is a shareholder. Everyone, even the sole director/shareholder, is an employee and the company the employer. What this means in terms of tax is that all the money the company earns belongs to the company and not its owner: from now on, any money taken out of earnings must be noted (and justified) as salary or expenses, and comes under scrutiny from HMRC.

Many small limited companies end up having to pay excess tax because the owner simply takes money out of the company without understanding the tax implications. The company can pay its director in three ways: as salary, to pay back money borrowed or spent on company costs (expenses), or as dividends on the shares the director holds in the company. Getting the mixture of salary and dividends right can reduce a company’s tax bill; get it wrong and it can go the other way.

All limited companies must pay corporation tax by the 1st of January of the year after the trading year, i.e. on 1/1/2014 for trading between 1 April 2012 and 31 March 2013. It must also file a corporation tax return (CT600) each year to HMRC, 12 months after the year end at the latest. Limited companies who fail to file their CT600s or send it too late are subject to hefty fines.

A small piece of legislation known as IR35 has also caused many small limited companies problems since coming into effect. This is when a company takes on a project for a client and takes on the status (however short-term) of an employee. Rather than pay the ’employer’s’ National Insurance on the full cost of what they paid out, the small limited company makes a ‘deemed payment’ to HMRC. This is the opposite of how it works for sole traders.

Where to get advice

Calculating taxes as a limited company is complex and can be both challenging and time-consuming. There are companies that specialise in tax management that small limited companies can turn to for advice in this field, whether a company needs help filling out its corporation tax return or with IR35 forms for employees. An umbrella company can help a small limited company with all aspects of tax and payroll and as qualified experts in all tax matters, can save time and money in the long run.

Tags:

Currency,

economy,

Employee. Financial Advisor,

financial planning,

investments,

money,

Salaries,

savings,

tax

June 25, 2013

We pay many different types of tax during our lives. What this means is that there is the potential to claim back tax in many different ways. Your tax rebate will be dependent upon what types of tax you have overpaid on, and this will inform the process (or processes) you need to take in order to claim it back.

We pay many different types of tax during our lives. What this means is that there is the potential to claim back tax in many different ways. Your tax rebate will be dependent upon what types of tax you have overpaid on, and this will inform the process (or processes) you need to take in order to claim it back.

Healthcare Professionals

If you work as a healthcare professional you can claim tax back for your uniform, including the costs of washing or for purchasing shoes and tights. You can also claim tax back if you require specialist equipment for your job. The only proviso is that the clothes and equipment you claim for must be for work use only, and must not already be being offset by your employer.

Mileage and Travel Expenses

Another form of tax which can be claimed back is for mileage and travel expenses. If you require a vehicle for your job you can claim tax relief which will help to offset the cost of running your vehicle. As a legitimate business expense, this is something which everyone is entitled to, and a tax rebate of this nature can be very helpful for anyone who regularly travels for work related purposes. For more information about claiming back your travel expenses as a tax rebate, visit www.taxrebateservices.co.uk.

Tax Relief for Teachers

Teachers can claim tax back for a number of different reasons. If, for example, you have been required to pay fees to a professional body such as the NUT, you can claim part of these fees back as tax relief.

Teachers can also claim tax back in the same way that healthcare professionals can, if they require the use of specialist clothing or equipment for their jobs. Tax relief can also be claimed if this clothing requires laundering which is outside of the remit of normal clothes washing procedures. But this can only be claimed if the clothing in question bears your employer’s logo.

Other Types of Professional Tax Rebate Claims

There are many different types of professionals who can claim tax back according to the requirements of their job. These include:

- Mechanics

- Construction Workers

- Non Resident Landlords

For more information about whether or not you can claim back tax according to your profession, it’s always important to get the advice of a regulatory body, or from a professional tax rebate service provider.

Tags:

Deduction,

economy,

financial planning,

income,

Rebate,

tax

Self-employed workers may be extremely focused and have an entrepreneurial spirit that will lead to business success but they are also notorious for being disorganized when it comes to paperwork. It really is not possible to be an excellent businessperson and an office administrator. Unfortunately, administration is the backbone of every business and it absolutely must be carried out on time and accurately for a business to maximize its profits.

Self-employed workers may be extremely focused and have an entrepreneurial spirit that will lead to business success but they are also notorious for being disorganized when it comes to paperwork. It really is not possible to be an excellent businessperson and an office administrator. Unfortunately, administration is the backbone of every business and it absolutely must be carried out on time and accurately for a business to maximize its profits.

Recent Comments