February 12, 2018

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

5 key advantages of ULIPs over all conventional life insurance policies:

Identify the right blend of investment

Picking the market entities in the right blend often depends on your investment risk appetite. For those of you that are low-risk takers, investing in debt funds is a good ploy. Likewise the moderate risk-takers can invest in balanced funds, while the high-risk bearers can think of equity funds. Balanced funds are a good option lying between equity funds and debt funds. You’ll be able to switch funds once you gain considerable market outlook.

Investment Flexibility

With an ULIP, you’ll gain the right to invest your entire premium value besides gaining opportunities to allocate additional amounts on the policy. Other investment plans don’t yield so much of flexibility. Depending on your risk appetite and your financial profile, you may choose between these two investment strategies:

Life-Stage Strategy: The years remaining towards your policy maturity and your age help in asset allocation.

Self-Managed Strategy: Your fund choice helps in allocating your money. This option safeguards the financial future of your child even when you aren’t there.

Long term investment

ULIPs prove to be a great option for fulfilling long-term investment goals e.g. launching a start-up, buying your new car, and buying a property. ULIPs are designed to yield more returns and that too for a longer duration; they owe this power to their compounding nature. Even if you decide on quitting the ULIP policies after a period of 5 years, you’ll be amazed to see how much more you’ve saved than what you’d see with other investment options. Your money will grow with a much greater momentum and for a longer duration than how you usually see it grow in your savings bank or with your fixed deposits. All you need to do is to determine the amount of investment with the help of an online premium calculator.

Life coverage

Life insurance companies are only known to offer ULIPs in the form of a product. Besides yielding financial protection, ULIPs are known to fulfill your investment needs. Compared to a term plan, the life cover attached to ULIPs may be smaller but they do come with life cover. When it comes to fulfilling your financial goals in the long run, ULIPs constitute a strong investment opportunity. Prior to investing in ULIPs, you must check out the performance of all individual funds in great details. This is likely to provide more insight into investment options with quality returns.

Tax Rebates

Tax benefits aren’t always attached to investment option that you come across in the market. ULIPs come with a combination of tax benefits and life coverage. Under section 80C of the Income Tax Act, you’ll be entitled to receive tax rebates on all paid up premiums. Likewise, all of the payouts that you receive are entitled to tax exemption under section 10D. Besides seeing your money grow, you’ll be happy with how much you’ll save in the end.

Tags:

banks,

Debts,

Financial Assistance,

Funds,

Income Tax,

insurance,

investments,

money,

personal finance,

Premiums,

Stocks

March 12, 2014

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

Instead of buying a new TV or going on a clothes shopping spree, it’s often much wiser for Americans to concentrate any tax refund money on improving their financial standing overall. Perhaps the best method for doing this, in a number of ways, is to pay down outstanding debt of almost any kind. This will have the dual purpose of both reducing the cost of monthly payments faced for having such balances outstanding, but also improving their credit scores. Usually, it’s the wisest idea to pay off the debt that comes with the highest interest rate (usually credit card balances) because of the ways in which big rates can tack on additional debt in a shorter period of time. The larger the refund, the more substantially debt can be cut, and thus the pressure on a household budget can be reduced.

What about consumers who don’t have big debts?

Of course, not everyone has thousands of dollars worth of credit card bills to deal with, or might be constrained by parts of mortgage or auto loan agreements which state they cannot pay them off before a certain date. For those people, it might be wise to simply put a tax refund into savings, instead. This, though, can be approached in a number of different ways. It could be used to build emergency savings, in the event of a problem that arises down the road, or they could simply put them into retirement accounts that will help to secure their financial futures.

For those who haven’t yet filed their returns but want to maximize their refunds, it might be wise to speak with a tax professional who may be able to help identify some potential deductions that could help to increase the amount of money they receive back from the IRS.

Tags:

budgeting,

economy,

financial planning,

Income Tax,

investments,

money,

tax,

Tax Returns

February 7, 2014

Hands up if you’ve got your tax act together! What? No hands up? Well then, grab a seat and listen up!

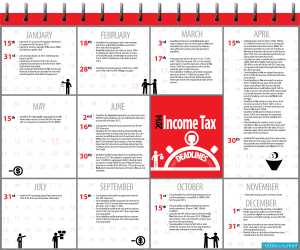

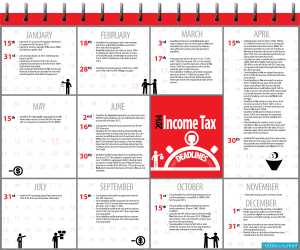

The State and Federal governments have set up certain due dates for filing or e-filing your taxes. To some, understanding taxes and meeting tax deadlines is the first among many horrifying aspects of filing tax returns. But once you understand when and what needs to be filed, it will be the first big step you’ve taken towards de-horrifying the process of tax filing and returns.

April 15th is a big date to remember. Not only must you file your taxes by this day but you also need to pay an estimate of any taxes due. 11.59 pm on that day is the deadline. Miss that and you’ll need to request an extension from the IRS. And even if you do request an extension, remember you still need to pay the taxes you owe.

In addition to that big date, there are several due dates to keep in mind depending on your status – whether you’re individual tax payer, a business (S corporation, C Corporation or LLC) or a charity. The infographic below will help you keep a track of those dates. Remember, if a filing date falls on a weekend or a national holiday, the date will be moved forward to the next working day. It’s important not to miss these dates because if there’s one thing you don’t want, is the IRS on your back, right?

What happens if you don’t meet the deadline?

Brace yourself! This is the next horrifying part of filing taxes. A lot. A lot of bad things can happen if you don’t meet that deadline. For one thing, the fee for not filing is a lot harsher than it is for late filing. In addition, there are penalties which you can check out on the IRS website.

What Not to Forget

You’d be surprised at the common mistakes people make when filing their taxes. Before you send those papers to the IRS double check whether you’ve:

• Put a stamp on the envelope

• Signed the documents (Don’t laugh. It happens more often than you’d think)

• Included the social security numbers of their children and adult dependents

• Annual limits and tax tables can change from year to year. Make sure you’re using the right.

If you run a small business, there’s a never-ending string of dates that you have to keep in mind. Make entries in your PDAs, your laptop and any other devices you use to keep your appointments to help you stay on top of things.

What to Remember

Remember to take advantage of tax deductions. These may change from year to year as well and I sometimes suspect it is in the IRS’s best interests to confuse us folks! It may help to hire professional accounting firms whose job it is to prepare and file your returns while maximizing your earnings. Firms, like 1800accountant, designate a personal accountant to your case and offer 24/7 access the whole year round. It’s worth looking into such services and enjoy the peace of mind that comes from knowing you’ve got your taxes taken care of and managed to make some tax savings. Now that’s what I’m talking about.

Tags:

budgeting,

economy,

Income Tax,

money,

tax

March 6, 2012

Filing taxes is one of the most stressful financial transactions that most people do in a typical year. Small mistakes on this document could potentially cost a taxpayer thousands of dollars, making it imperative to complete it correctly and accurately. Follow these tips around tax time to make sure that you and your money are protected.

Filing taxes is one of the most stressful financial transactions that most people do in a typical year. Small mistakes on this document could potentially cost a taxpayer thousands of dollars, making it imperative to complete it correctly and accurately. Follow these tips around tax time to make sure that you and your money are protected.

DO consider a Professional Tax Service or Software Program

The federal tax code is longer than the Encyclopedia Britannica, making it extremely difficult for one person to completely master. Professional tax preparers do nothing but study tax code, and many have teams of professionals that can work together to prepare more complicated returns.

At the very least, a tax preparing software program will reduce the tax code down into a series of easier to answer questions. These programs are usually developed by hundreds of professionals who are each an expert in their own area of tax law. Preparing a return with one of these programs is a lot easier than doing it on your own.

DON’T Forget to Include Your Children’s Social Security Numbers

Believe it or not, this is one of the most common errors that taxpayers make. Each child that you claim as a dependent must have a Social Security number in order to be considered eligible for credits and deductions. This is to reduce fraud by taxpayers claiming non-existent children as dependents in order to get more deductions.

DO Make a Copy of Your Return and all of the Accompanying Documentation

Obviously, tax returns get lost in the mail or lost at the IRS office, but the most important reason to keep copies isn’t to replace something that gets lost. A variety of government and civilian applications require a person to submit copies of their tax returns. Everything from student aid applications to mortgage applications require an applicant to submit copies of their tax return.

DON’T Wait Until the Last Minute to File Your Taxes

The IRS will start issuing refund checks as soon it starts to receive tax returns. As the returns start to pile up, however, there will be delays in refund checks. If you’re expecting a refund, get your tax return in early.

Even if you have to pay more taxes, waiting until the deadline can get you in trouble. Many people assume that just because they file later they are delaying their payment, but you can file early and send in a payment later. In fact, there are programs to pay off your tax bill past the deadline, but you have to apply early in order to be accepted into the best ones.

DO Look For Deductions and Credits

While this may seem obvious, nearly twenty percent of taxpayers just fill out the 1040EZ form. It is estimated that about half of these taxpayers would receive a higher refund by filling out the so-called “long form” or 1040 A. By using a tax professional or computer software program, it will be a lot easier to look for these deductions.

Be prepared by gathering paperwork for the most common deductions. Have receipts for any mortgage interest that has been paid, child care expenses, and charitable contributions. Also save receipts from activities such as purchasing a home, attending college, and making major purchases.

DON’T lie or fudge numbers. Nearly a quarter of Americans admit to cheating on their taxes at some point in their lives, but few people realize the consequences if they get caught. People who are caught cheating on their taxes will pay high penalty fees, interest, and in extreme cases they can even face jail time.

If you are unable to pay the taxes you owe, look at the programs the IRS has set up for distressed taxpayers. These programs allow people to make payments on their tax debt over several months or years instead of making a lump sum payment all at once.

Filing your taxes can be stressful, but there are many different options available to make this as easy as possible. As you get your return together for 2011, make a list of items that are difficult to find or figure out so that you will be better prepared for next year.

Kathleen Ison is a freelance writer and a mother of two teenagers. They have been wanting to buy a car for a while but they know very little about the taxes and additional costs associated with purchasing a car.

Tags:

budgeting,

Finance Management,

financial planning,

income,

Income Tax,

personal finance,

tax,

Tax Return

February 8, 2012

There are as many as 5 tax solutions that can keep the taxmen at bay in case you have failed to make the IRS tax payments. Here we will discuss about 2 of the much sought after tax debt relief options. You can think about opting for the tax debt help solution that will match your current financial requirements best. The first one is known as the Installment Agreement. Let us find in details what income tax debt solution it actually is how this particular tax debt settlement plan works.

There are as many as 5 tax solutions that can keep the taxmen at bay in case you have failed to make the IRS tax payments. Here we will discuss about 2 of the much sought after tax debt relief options. You can think about opting for the tax debt help solution that will match your current financial requirements best. The first one is known as the Installment Agreement. Let us find in details what income tax debt solution it actually is how this particular tax debt settlement plan works.

Installment Agreement

In Installment Agreement, you agree upon a monthly payment plan that will enable you to pay your pending tax debt to the IRS in reasonable amount. It is more or less like availing a loan and then paying off the debt in easy and realistic monthly payment plan.

Who qualifies for Installment Agreement plan?

If you owe less than USD$25,000 but you are financially stable. However, at the moment you are not being able to shell out all the money to the IRS but you intend to do so in due course, you are eligible for this type of plan.

The second tax debt relief option is known as Lump Sum IRS plan. In this you are required to pay off a lump sum to the Internal Revenue Service. The amount you pay also includes the penalties and the interests that have piled up over time.

You can either take this tax solution to completion on your own or you can seek help of an experienced tax consultant who will take care of the negotiation between you and the Internal Revenue Services.

How will you locate the right tax professional?

The tax professional you are planning to hire is required to be a Certified Public Accountant, a tax attorney, or an Enrolled Agent. Generally speaking, it is said that if you owe taxes to the IRS that is between USD$10,000 and USD$25,000, you can tackle the issue on your own. But if the amount you owe to the IRS is greater than USD$25,000, it is best to seek help of an expert in this field as mentioned above.

Tags:

budgeting,

financial planning,

income,

Income Tax,

personal finance,

tax

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

Recent Comments