November 18, 2019

Are you frustrated by the amount of money you spend buying businesses checks? Have you been looking for ways to save on these expenses? Then I am glad you’re reading this post.

Are you frustrated by the amount of money you spend buying businesses checks? Have you been looking for ways to save on these expenses? Then I am glad you’re reading this post.

With the ever-rising cost of doing business, you’d want to ensure that every penny counts. One way of doing that is making sure that you spend the least amount on checks.

The ever-tightening budgets leave no room for unnecessary expenses and motivate businesses to find favorable deals. This includes reconsidering your way of ordering checks.

Here you’ll find our tips to help you save money when buying checks. Read on and learn more.

Avoid Buying Checks from Banks

While banks offer an easy and convenient way to get more checks, it is probably the last place you should go. As with many things today, you’re likely to pay extra dollars for the convenience when you order checks from a bank. Thus the need to explore other options.

Though paper checks are losing in popularity, some people still use them for paying rent as well as other payments. Not all merchants accept credit cards or electronic payments.

As of 2012, 18 billion checks were written in the US alone. This is according to Federal Reserve.

Banks will charge $20 or even more for a box of checks. You can save up to 50 percent when you buy checks from online printers.

Don’t know how? I’ll explain it.

It is important to understand that banks do not print checks themselves. Banks are in the business of savings and checking accounts, credit cards, loans and digital banking.

Banks hire large scale printers to print your checks. Remember the printing companies are in the business of making a profit out of your order, banks feel they need to make money for the time they spent acting as middlemen between their customers and the printer.

Therefore, when you order your checks from a bank, they will be marked twice before reaching you.

Besides, due to the high costs of processing checks, banks do not want their customers to write checks. Banks would rather see their customers use other methods of payments such as electronic payments.

The high prices of checks from banks are meant to push consumers to depend more on online payments over written checks.

Order Your Checks Online

Ordering checks online is a great way to save money when buying checks. But don’t worry. Checks from online printers are just as good as those offered by banks.

According to Check Payment Systems Associations, all reputable companies produce checks that met the industry standards so that banks and other merchants can accept them.

With online printers, you are assured of fast business checks delivery in a secure and easy process.

Security is Key

If you are going to spend more on a check, it should be because it comes with more security features. Check payment is a method prone to a lot of fraud.

The main reason that makes some businesses shy away from buying business checks online is security concerns. Most of them consider ordering checks from banks safe while ordering online risky. But this is not always the case.

This can only be true if you’re ordering your checks from non-reputable websites. Reputable check websites are just as secure and safe as banks.

In fact, most online check websites use the same printers like the one used by the banks, only that they eliminate the middleman to make it less costly for you.

Therefore, conduct due diligence before deciding to buy your checks from a particular website.

You can do this by looking at the padlock icon available at the right-hand side of your check, just below the “amount’’ box.

If the check contains this icon, it is an indication that it has been approved by the Check Payments Systems Association, an association left with the responsibility of ensuring the security of checks.

CPSA will not give this symbol to check printers that haven’t included a minimum number of security features to protect consumers from altered or duplicate checks.

Checks bought online can even be more secure than those obtained from banks. Some check printers give consumers the opportunity of buying checks with extra security features, such as micro printing, thermocon imaging and chemically reactive paper.

While you might be charged an extra fee for these features, but considering the level of security that comes with, it is worth it.

Before ordering checks online, be sure to understand the process, including the amount of time it will take before you get your check.

Tags:

banks,

budgeting,

Business,

expenses,

money,

savings

February 12, 2018

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

5 key advantages of ULIPs over all conventional life insurance policies:

Identify the right blend of investment

Picking the market entities in the right blend often depends on your investment risk appetite. For those of you that are low-risk takers, investing in debt funds is a good ploy. Likewise the moderate risk-takers can invest in balanced funds, while the high-risk bearers can think of equity funds. Balanced funds are a good option lying between equity funds and debt funds. You’ll be able to switch funds once you gain considerable market outlook.

Investment Flexibility

With an ULIP, you’ll gain the right to invest your entire premium value besides gaining opportunities to allocate additional amounts on the policy. Other investment plans don’t yield so much of flexibility. Depending on your risk appetite and your financial profile, you may choose between these two investment strategies:

Life-Stage Strategy: The years remaining towards your policy maturity and your age help in asset allocation.

Self-Managed Strategy: Your fund choice helps in allocating your money. This option safeguards the financial future of your child even when you aren’t there.

Long term investment

ULIPs prove to be a great option for fulfilling long-term investment goals e.g. launching a start-up, buying your new car, and buying a property. ULIPs are designed to yield more returns and that too for a longer duration; they owe this power to their compounding nature. Even if you decide on quitting the ULIP policies after a period of 5 years, you’ll be amazed to see how much more you’ve saved than what you’d see with other investment options. Your money will grow with a much greater momentum and for a longer duration than how you usually see it grow in your savings bank or with your fixed deposits. All you need to do is to determine the amount of investment with the help of an online premium calculator.

Life coverage

Life insurance companies are only known to offer ULIPs in the form of a product. Besides yielding financial protection, ULIPs are known to fulfill your investment needs. Compared to a term plan, the life cover attached to ULIPs may be smaller but they do come with life cover. When it comes to fulfilling your financial goals in the long run, ULIPs constitute a strong investment opportunity. Prior to investing in ULIPs, you must check out the performance of all individual funds in great details. This is likely to provide more insight into investment options with quality returns.

Tax Rebates

Tax benefits aren’t always attached to investment option that you come across in the market. ULIPs come with a combination of tax benefits and life coverage. Under section 80C of the Income Tax Act, you’ll be entitled to receive tax rebates on all paid up premiums. Likewise, all of the payouts that you receive are entitled to tax exemption under section 10D. Besides seeing your money grow, you’ll be happy with how much you’ll save in the end.

Tags:

banks,

Debts,

Financial Assistance,

Funds,

Income Tax,

insurance,

investments,

money,

personal finance,

Premiums,

Stocks

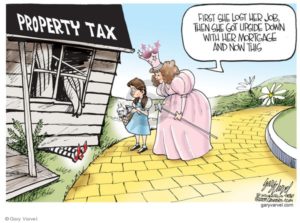

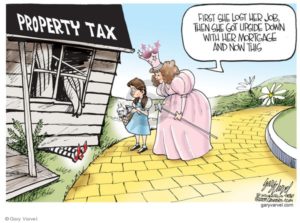

October 21, 2017

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

June 16, 2017

It can be difficult to make the decision to file bankruptcy because most people are afraid of the unknowns associated with actually filing a bankruptcy claim and becoming insolvent. It’s scary to think that you could lose your house or your car, or any other valuable asset you have, and so a lot of people put off filing for bankruptcy for as long as possible; unfortunately, this usually only perpetuates the situation. What’s more, some people finally make the decision to file for bankruptcy and then find out they don’t actually qualify for it. It’s important to get the facts straight so you can decide what is right for you. Once you do make the decision to file for bankruptcy, you’ll want to start working toward the rest of your life.

It can be difficult to make the decision to file bankruptcy because most people are afraid of the unknowns associated with actually filing a bankruptcy claim and becoming insolvent. It’s scary to think that you could lose your house or your car, or any other valuable asset you have, and so a lot of people put off filing for bankruptcy for as long as possible; unfortunately, this usually only perpetuates the situation. What’s more, some people finally make the decision to file for bankruptcy and then find out they don’t actually qualify for it. It’s important to get the facts straight so you can decide what is right for you. Once you do make the decision to file for bankruptcy, you’ll want to start working toward the rest of your life.

Get Passed the Shame

There is no shame in reaching out to a Licenced Insolvency Trustee to discuss the option of bankruptcy. Once you have discussed your options and it is decided that you will file for bankruptcy, your credit counsellor can help you determine how to move forward. They will talk you through what the next few weeks, months or even years may look like for you in terms of your financial standings, and you can start to put together a plan to get back on your feet.

Work Toward Goals

Now that the bankruptcy has been filed, it can seem overwhelming to think that you need to start rebuilding your financial status. It’s important to have a list of things you want to work toward; for example, make a long term plan for holding a credit card again. Make a short term plan of building a savings account for yourself so you can cushion unforeseen financial issues in the future.

Talk to Your Family

Part of declaring bankruptcy is that you’ll need to attend some kind of counselling sessions; it will be important to your claim that you do this. What’s more, you should have a frank and honest conversation about your finances with your closest family members so they can understand what is happening to you and perhaps can help you. At the very least, having someone to talk to about what is going on can help you deal with it.

Don’t Give Up

Some people think that filing for bankruptcy is the end of the world. It is just a process by which you can hit the refresh button on your finances – in its simplest terms. Good and honest people often find themselves having to file for a bankruptcy because their finances have gotten out of their control. It doesn’t mean you are a bad person or you don’t deserve to have anything ever again. A series of bad choices or circumstances got you here, but you don’t have to stay in that place.

If you aren’t sure if bankruptcy is right for you, consult a Licensed Insolvency Trustee and they will walk you through the criteria and help you determine if you need to file a bankruptcy claim. While it seems like it’s very unfortunate, you will be able to get through it with the help of your credit counselor.

Tags:

Bankruptcy,

banks,

budgeting,

credit,

Debts,

economy,

financial planning,

money

August 27, 2015

In a sharp contrast with your domestic bank accounts, your offshore banking service will provide you with the option of choosing currencies to be held in your accounts. It’s really a valuable feature for all your offshore accounts as it provides you with the option of maintaining funds in a different currency than your domestic one. It’s of great help when the domestic currency is likely to get depreciated. It’s important for you to identify the factors that drive exchange rates. You must also understand the effects of maintaining your account with various currencies. Your deposits may yield considerable interest when you pick certain currencies for holding currencies. It might even contribute towards foreign tax liability. Depending on exchange rates and fee structure, you might need to bear the expense of exchanging currencies for making withdrawals and deposits.

In a sharp contrast with your domestic bank accounts, your offshore banking service will provide you with the option of choosing currencies to be held in your accounts. It’s really a valuable feature for all your offshore accounts as it provides you with the option of maintaining funds in a different currency than your domestic one. It’s of great help when the domestic currency is likely to get depreciated. It’s important for you to identify the factors that drive exchange rates. You must also understand the effects of maintaining your account with various currencies. Your deposits may yield considerable interest when you pick certain currencies for holding currencies. It might even contribute towards foreign tax liability. Depending on exchange rates and fee structure, you might need to bear the expense of exchanging currencies for making withdrawals and deposits.

Depositing with your Offshore Bank

International wire transfers are very effective in funding offshore bank accounts. Systems that make it easier for you to perform free electronic fund transfers through domestic banks prevent international money transfers. Sending or receiving funds compel you to pay your banks for international wire transfers. In comparison, it seems much simpler to opt for a wire transfer. Banks charge different amounts for wire transfers; that’s why it’s important for you to check out various deals. You have only a few good alternatives. Jurisdictions in foreign countries don’t allow you to accept domestic checks. It’s not a practical idea to carry funds on your own.

Withdrawing from your Offshore Account

In order to turn their services more convenient to users, a number of options to withdraw funds have been introduced by offshore banks. You may be allowed to access funds worldwide by any offshore banking concern that provides you with an ATM or debit card. You might need to bear a certain amount as fees for using international ATMs. That’s why it is essential for you to check out fees before opting for this method. These fees may even be minimized when you withdraw bigger amounts of cash for a single time.

Checking accounts are even allowed by a few offshore banks. A good number of customers don’t prefer this method as it demands a high degree of confidentiality. When you draw checks on foreign accounts, you may experience certain problems regarding their acceptance at foreign outlets.

You may consider using two accounts simultaneously – one could be your domestic account and the other one could be the offshore one. Offshore banking funds worth higher amounts can thus be transferred to your domestic account, so that you may access them easily. By following this method, you may actually ensure more security and privacy besides availing the convenience of services offered by local banks.

Tags:

Banking Services,

banks,

Currency,

economy,

financial planning,

Financial Services,

Funds,

investments,

loans,

money

Are you frustrated by the amount of money you spend buying businesses checks? Have you been looking for ways to save on these expenses? Then I am glad you’re reading this post.

Are you frustrated by the amount of money you spend buying businesses checks? Have you been looking for ways to save on these expenses? Then I am glad you’re reading this post.

Recent Comments