June 3, 2019

It’s undeniable that the construction industry is booming. Over the past years, the demand for construction services is continuously growing, making it one of the most lucrative industries today. For this reason, many entrepreneurs venture into the world of the construction industry. If you’re one of the many, then you know that you need construction business loans to survive in a cutthroat environment.

It’s undeniable that the construction industry is booming. Over the past years, the demand for construction services is continuously growing, making it one of the most lucrative industries today. For this reason, many entrepreneurs venture into the world of the construction industry. If you’re one of the many, then you know that you need construction business loans to survive in a cutthroat environment.

The best way to keep your business afloat in the midst of heavy competition is to secure financing and aggressively market your business. With that said, here are four innovative ways to do so:

1. Be a Part of an Industry Association

Industry associations usually have resource hubs where contractors can network and make quality connections that will eventually lead to success. This is especially true since building relationships and making connections are important in the construction industry. Additionally, members are often allowed to advertise or market their services at low or no cost.

2. Remember Your Existing Clients and Leads

Contractors are often caught up with everyday business operations that they tend to overlook the simplest marketing strategy: following up your current leads and clients. Failing to follow up on current leads means you’re possibly missing out on great business opportunities. Likewise, you should also contact customers a few months after doing business with them. Check in and ask them if you can help them with anything. A simple call or email would suffice. When customers are happy with your service, it can lead to more business and you can even ask for referrals.

3. List Your Business in Online Directories

When a potential customer searches for the best construction company in the area, search engines often show you online directories rather than individual websites. One way to market your construction business is to list it in online directories. When listing your business, include your name, address, contact number, business hours, etc. and leave no detail behind. The details you include can affect your ranking in the directory, so make sure to double check everything. Check your online listing regularly to answer questions and respond to customer feedback.

4. Be Specific When Advertising Your Business

It’s easy to be overwhelmed when advertising your business. Some entrepreneurs list every single service they offer in their ads, but this strategy can actually backfire. Telling your target market that you can do everything can actually be boring and it can even scare customers away. The most effective way is to advertise your skills one at a time. By advertising in small fractions, you can keep your target customers engaged, which increased the likelihood of them availing the services you offer.

The Best Construction Business Loans for Your Business

When running a construction business, you need working capital to stay afloat in a competitive industry. SMB Compass offers construction business loans for businesses throughout the United States. Our trusted financial advisors can help answer the questions you have in mind. Feel free to call us (888) 853-8922 or email us at info@smbcompass.com to know more.

Tags:

Business,

Business Loans,

Capital,

economy,

financial planning,

investments,

Law,

Legal,

money

October 21, 2017

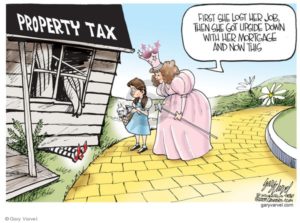

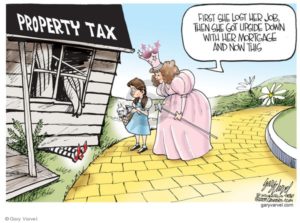

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

October 19, 2017

With so many startup companies, the competition is fierce. It doesn’t matter what field you’re in. It’s likely that there are many other entrepreneurs in your niche. The trick is finding a way to make your company stand out above the rest. For some companies, that means working with a startup accelerator.

With so many startup companies, the competition is fierce. It doesn’t matter what field you’re in. It’s likely that there are many other entrepreneurs in your niche. The trick is finding a way to make your company stand out above the rest. For some companies, that means working with a startup accelerator.

What is it?

A startup accelerator is an experience that supports the growth of an early company. To accomplish this growth, they provide education, mentoring, and financing. They give you a way to build your company from the ground up. The accelerator only lasts for a certain amount of time; it’s a rapid growth process. While the time period might be short, you can see a great deal of growth in the process. In only a few months, you can see the same growth that you would expect in years of hard work.

Start-up accelerators work for almost any type of industry you can imagine. For example, new insurance companies can benefit from Insurance accelerators. An insurance accelerator would specifically focus on growing a start-up insurance company. Meanwhile, a new clothing brand could find an appropriate accelerator to give them intense growth. There’s something for every company.

What makes them so special?

There are many different ways to cultivate a start-up. However, an accelerator is particularly effective. There are a few reasons for this. For one, there’s the fixed time frame. Instead of having an open-ended agreement with no true end date, you have a set time frame. It’s easier to analyze your results and predict your company’s future when you have strict time frame. You get results, and you get them before your time is up.

There’s also the fact that an accelerator uses mentorship to get results. Unlike crowd-funding campaigns and other types of investors, accelerators give you advice. While that advice helps your company in the present, it also helps your company in the future. You can learn invaluable business skills through mentorship. Additionally, you can gain insight into your industry and use that insight for years to come.

Finally, accelerators are cohort-based. For years, educators have seen the benefits of an education cohort-based environment. Those same benefits translate to business education. Being part of a larger group is a great way to grow your company.

Do accelerators really work?

While the concept of accelerators is sound, it’s important to ask yourself if they really work. It seems so, considering that many entrepreneurs would be happy to relive the experience. About 90% of entrepreneurs in a survey said that they would do the accelerator program again. Similarly, 95% of them said that the accelerator was worth equity stake that they lost. The time and equity lost in an accelerator program seems well-worth the gain.

An accelerator program might not be the right option for everyone. However, it could be the right option for your company. If you’re looking for a way to gain insight and knowledge while gaining momentum in your business, an accelerator is a great option. You could see huge business growth in only a short time.

Tags:

Business Insurance,

Capital,

Coverages,

economy,

insurance,

investments,

Law,

Legal,

money,

Returns

March 25, 2017

The right thing to know – The world we live in is full of risks and insecurities. Families, individuals, businesses, assets and properties are exposed to numerous types and certain levels of high risks. These definitely include the risk of health, life, property, assets, etc. We know that it’s difficult to prevent these risks, especially sudden miss happenings so the financial world has taken the responsibility to protect business and individuals against losses by compensating them with finance. Therefore, insurance is required with the full pace that eliminates or reduces the loss caused by any risk.

The right thing to know – The world we live in is full of risks and insecurities. Families, individuals, businesses, assets and properties are exposed to numerous types and certain levels of high risks. These definitely include the risk of health, life, property, assets, etc. We know that it’s difficult to prevent these risks, especially sudden miss happenings so the financial world has taken the responsibility to protect business and individuals against losses by compensating them with finance. Therefore, insurance is required with the full pace that eliminates or reduces the loss caused by any risk.

When we talk about health insurance, the first thing that comes to our mind is ‘Grandparents’. Ever thought health is such an important thing, especially when it’s about growing age. Sometimes, we initially don’t take a risk of traveling with them to abroad; we suffer from a fear of bad health. But every time this tact can’t be followed rather we need to find some solution for this. The best and relevant to this is – Super Visa Health Insurance.

Now, what exactly is Super Visa?

Super visa is a long term multiple entry visa for both grandparents and parents of Canadian citizens or permanent residents. They can stay up to maximum 2 years in Canada for every visit. This is valid up to 10 years. However, a regular multiple entry visa is also valid up to 10 years; but you can stay for 6 months only for every visit.

Eligibility for Super Visa

Super Visa is for grandparents and parents for Canadian citizens or permanent residents. Apparently, the grandparent or parent must be admissible to Canada and meet all the terms and conditions. Read on:

- The applicant need to show Canadian medical insurance that meets the basic requirements and also covers then for minimum 1 year.

- The applicant needs a letter of finance support from their grandchild or child in Canada, who earns the minimum required income.

- Private medical insurance proof is required for the minimum time slot of one year with a copy of Canadian insurance company that covers hospitalization, repatriation, and health care and provides a minimum coverage of the certain amount, also is valid for the entry in Canada.

- A copy of employment insurance pay stubs for grandchild or child.

Importance Generated

Although, the procedure can be little different if a grandparent or a parent is from another country, therefore, a visa is strictly required to enter Canada as a visitor. Health Insurance plays a key role in Super Visa, so make sure this is not ignored.

Validity for Super Visa

The maximum validity for Super Visa is 10 years, or it can be an addition to one month prior if the passport expires (whichever is earlier). Within this time Super Visa holders can stay up to two years.

On That Note

We truly know, how important is health insurance in today’s life, especially for our parents and grandparents. Therefore, in every limit, we need to make sure that this insurance is taken care.

Tags:

Coverage,

economy,

financial planning,

Health Insurance,

insurance,

investments,

Law,

Legal,

Medical Insurance,

Returns

January 30, 2013

Over the last several years, the emphasis on mis-sold PPI has risen, rapidly. With increased numbers of people making PPI complaints, banks have to reimburse people left, right and centre for their own misdoings due to mis-selling payment protection insurance.

Over the last several years, the emphasis on mis-sold PPI has risen, rapidly. With increased numbers of people making PPI complaints, banks have to reimburse people left, right and centre for their own misdoings due to mis-selling payment protection insurance.

PPI is an optional policy that can be added on to a number of financial agreements, to help protect the borrower, should their circumstances change. Loan, mortgage and credit card protection are all eligible for this additional insurance that ensures payments are met in the event of redundancy or debilitating illness. With the economic climate the way it is at the moment, the threat of redundancy is a very real concept – if you were to take out a loan, you may feel the need to protect yourself just in case of this eventuality.

The problem is that in many cases, banks sold the policy to people that didn’t want, need or even know about it and this is why the rise in PPI has continued to skyrocket.

The recent decision by the financial watchdog, the FSA, has played a huge part in the PPI complaint boom. Last year, they instructed banks to write letters to known victims of mis-sold PPI, with between 4 and 12million in total expected to be sent to people all over the UK .

If you are one of these millions who have had, or are due to have, a letter through their letterbox, it can be the chance you need to claim back money that is rightfully yours. Don’t just throw it out, thinking of it as junk. If it’s a legit letter from your bank or finance provider, chances are you may be eligible for a claim and should bite the bit and go for it. The director the FSA thinks that only 10% of people who are written to will actually take the opportunity to claim, which is such a shame when there is billions to be paid out to people nationwide.

Last year, £1.9bn was paid out to successful PPI claimants , with the total redress looking like £13bn as of January 2013 . Industry insiders predict this value to so much as double to more than £25bn in reality , if all those eligible take the initiative to claim.

As the months go by, more and more people are claiming, with the volume of PPI complaints skyrocketing. At the moment, the banks are seeing approximately 100,000 claims sent to them each month , whilst the FOS has employed a staggering 1000 extra caseworkers to work solely on PPI cases . Whilst a number of these claims may be false or frivolous, many are genuine claims made by people who have been mis-sold PPI and you could be one of them.

With the British Bankers Association pushing for a deadline in PPI complaints, as soon as spring 2014, now is the time to claim your PPI payments if you haven’t done so already. After all, what have you got to lose?

Tags:

Coverage,

Financial Panning,

investments,

Law,

Legal,

money

It’s undeniable that the construction industry is booming. Over the past years, the demand for construction services is continuously growing, making it one of the most lucrative industries today. For this reason, many entrepreneurs venture into the world of the construction industry. If you’re one of the many, then you know that you need construction business loans to survive in a cutthroat environment.

It’s undeniable that the construction industry is booming. Over the past years, the demand for construction services is continuously growing, making it one of the most lucrative industries today. For this reason, many entrepreneurs venture into the world of the construction industry. If you’re one of the many, then you know that you need construction business loans to survive in a cutthroat environment.

Recent Comments