October 21, 2017

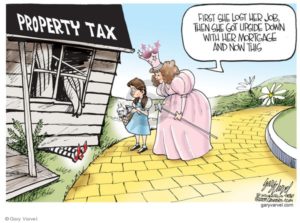

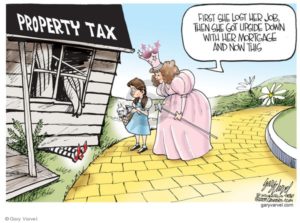

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

June 16, 2017

It can be difficult to make the decision to file bankruptcy because most people are afraid of the unknowns associated with actually filing a bankruptcy claim and becoming insolvent. It’s scary to think that you could lose your house or your car, or any other valuable asset you have, and so a lot of people put off filing for bankruptcy for as long as possible; unfortunately, this usually only perpetuates the situation. What’s more, some people finally make the decision to file for bankruptcy and then find out they don’t actually qualify for it. It’s important to get the facts straight so you can decide what is right for you. Once you do make the decision to file for bankruptcy, you’ll want to start working toward the rest of your life.

It can be difficult to make the decision to file bankruptcy because most people are afraid of the unknowns associated with actually filing a bankruptcy claim and becoming insolvent. It’s scary to think that you could lose your house or your car, or any other valuable asset you have, and so a lot of people put off filing for bankruptcy for as long as possible; unfortunately, this usually only perpetuates the situation. What’s more, some people finally make the decision to file for bankruptcy and then find out they don’t actually qualify for it. It’s important to get the facts straight so you can decide what is right for you. Once you do make the decision to file for bankruptcy, you’ll want to start working toward the rest of your life.

Get Passed the Shame

There is no shame in reaching out to a Licenced Insolvency Trustee to discuss the option of bankruptcy. Once you have discussed your options and it is decided that you will file for bankruptcy, your credit counsellor can help you determine how to move forward. They will talk you through what the next few weeks, months or even years may look like for you in terms of your financial standings, and you can start to put together a plan to get back on your feet.

Work Toward Goals

Now that the bankruptcy has been filed, it can seem overwhelming to think that you need to start rebuilding your financial status. It’s important to have a list of things you want to work toward; for example, make a long term plan for holding a credit card again. Make a short term plan of building a savings account for yourself so you can cushion unforeseen financial issues in the future.

Talk to Your Family

Part of declaring bankruptcy is that you’ll need to attend some kind of counselling sessions; it will be important to your claim that you do this. What’s more, you should have a frank and honest conversation about your finances with your closest family members so they can understand what is happening to you and perhaps can help you. At the very least, having someone to talk to about what is going on can help you deal with it.

Don’t Give Up

Some people think that filing for bankruptcy is the end of the world. It is just a process by which you can hit the refresh button on your finances – in its simplest terms. Good and honest people often find themselves having to file for a bankruptcy because their finances have gotten out of their control. It doesn’t mean you are a bad person or you don’t deserve to have anything ever again. A series of bad choices or circumstances got you here, but you don’t have to stay in that place.

If you aren’t sure if bankruptcy is right for you, consult a Licensed Insolvency Trustee and they will walk you through the criteria and help you determine if you need to file a bankruptcy claim. While it seems like it’s very unfortunate, you will be able to get through it with the help of your credit counselor.

Tags:

Bankruptcy,

banks,

budgeting,

credit,

Debts,

economy,

financial planning,

money

February 8, 2015

Filing for bankruptcy is a drastic step in regaining your financial health, and the impacts are long-lasting. It is not something to be done lightly, or without weighing out all of your available options. If you are drowning in debt, however, bankruptcy can be a valuable first step in rebuilding your financial future.

Filing for bankruptcy is a drastic step in regaining your financial health, and the impacts are long-lasting. It is not something to be done lightly, or without weighing out all of your available options. If you are drowning in debt, however, bankruptcy can be a valuable first step in rebuilding your financial future.

GetFreeOfBills.com notes that bankruptcy comes in two forms: Chapter 7 and Chapter 13. While Chapter 7 allows you to discharge most debts, Chapter 13 requires you to follow a structured plan to repay your debts under more favorable terms. Depending on the amount of disposable income you have, you might be required to file Chapter 13. Regardless of which type you file, however, the pros and cons are generally the same.

Pros

- Clean slate: A bankruptcy provides a clean slate. It effectively resets your credit to zero, except for the debts that cannot be discharged such as student loans, recent back taxes, and child support. It provides you with the opportunity to stop making costly payments and provides you with more money to live on each month.

- Opportunity to rebuild: Some people believe that bankruptcy prevents you from ever having credit again, but this is not the case. Many people manage to build new lines of credit shortly after their bankruptcy, and it gets easier as time passes. While it is true that bankruptcy remains on your credit report for 10 years, its effects gradually lessen.

- Stopping adverse collections actions: If you are being hounded by creditors, facing foreclosure, or afraid that your wages will be garnished, bankruptcy can be a psychological relief. When you file for bankruptcy, you will receive an automatic stay from the court. This forces your creditors to cease all adverse collections activities against you. If you have a bankruptcy attorney, he or she will also act as a shield, handling creditors on your behalf.

- Exemption laws: Your home and car are generally exempt from bankruptcy, as long as you continue to meet your payment obligations. You are also entitled to a cash value for personal possessions. If you have a significant number of luxury possessions, you might be required to sell some, but the exemptions are generally high enough to let most people keep their personal items.

- Job protection: Although some employers will not hire applicants with a bankruptcy on their credit report, the job you already have is protected. It is illegal for an employee to be fired for declaring bankruptcy.

Cons

- Damaged credit: Bankruptcy is a major hit on your credit report. In the immediate aftermath of the bankruptcy, you might be unable to get any new credit at all. Although it usually does not take long to get new offers, you will fall into a high risk category for lenders. Expect to pay interest rates that are significantly higher than the ones you had prior to your bankruptcy. However, if you are in the position of filing for bankruptcy, your credit is probably already damaged. Some people find that the credit hit is much less significant than they anticipated.

- Filing costs: Filing for bankruptcy typically costs a few hundred dollars, depending on your location. Attorney’s fees are billed on top of that. However, in most cases you can make a payment arrangement if you can prove that paying a lump sum would present a financial hardship.

- Embarrassment: Although it is surprisingly common, filing for bankruptcy still carries a certain stigma. Some people worry that their loved ones will find out and ultimately think less of them for their decision. However, bankruptcy typically comes at the end of a long journey through mounting debt. Most people understand that sometimes life happens, and do not judge their friends and relatives for making a tough financial decision. Besides, having your home foreclosed or your car repossessed is not exactly a less embarrassing option. When taken seriously and only as a last resort, bankruptcy can actually be the smartest choice for some situations.

- Exempted debts: Some debts cannot be discharged in a bankruptcy, including recent back taxes, child support, and student loans. In addition, most people choose to keep their mortgage and car loan, if applicable. However, discharging your other debts will create more available money each month, which can then be diverted toward paying your remaining obligations.

Bankruptcy is not for everyone, but it is the best solution for many people. Attorney David M. Often of Get Free of Bills understands the complex decision-making process that is involved in determining whether bankruptcy is the right choice for you. Contact his office today for professional advice on how to proceed along your journey to financial freedom.

Tags:

Bankruptcy,

Bankruptcy Laws,

budgeting,

Credit Card,

Credit Card Debt,

Debts,

Financial Panning,

Laws,

money

March 12, 2012

People under severe financial problems are naturally in distress. They are frustrated and desperate especially when creditors are beginning to pressure them into settling their debts. In worst situations, when the chances of finding money to pay off the debt becomes almost impossible, the easiest way out for many is filing for bankruptcy.

People under severe financial problems are naturally in distress. They are frustrated and desperate especially when creditors are beginning to pressure them into settling their debts. In worst situations, when the chances of finding money to pay off the debt becomes almost impossible, the easiest way out for many is filing for bankruptcy.

However, is filing for bankruptcy the best solution? To know the answer, let us look into bankruptcy and its implications.

Filing for Bankruptcy: When?

Generally, a person in debt should file for bankruptcy only if and when he has exhausted every possible means to come up with a compromise agreement with his creditor and has failed in his efforts.

What Happens After Bankruptcy is Filed?

Upon filing for bankruptcy, the creditors will be notified immediately about it. The debtor can then expect that the unsecured creditors will cease from going after him for the settlement of his debts.

What follows after is that a trustee will be appointed to take charge of the bankruptcy case. The trustee’s job is to make sure that debtor will really pay his creditors. To facilitate payment of the debts, the trustee will sell most of the debtor’s assets. It will also be the trustee’s responsibility to make sure that when the time comes that the debtor will have sufficient income later, the debtor will begin to pay part of his income to the repayment of his debts.

Another responsibility of the trustee includes looking into the financial affairs and transactions of the debtor to see if he has transferred some of his money or properties a third party. His aim is to recover those so it can be used to reconcile all the debtors’ financial obligations.

When a person files for bankruptcy, an agency will keep a permanent record of the bankruptcy, and this record is accessible by the public for a certain amount of fee.

Under normal circumstances, bankruptcy lasts for at least 3 years, but this can also be extended.

What Happens Next?

Filing for bankruptcy is only the beginning of a long and tiresome process. Here are some of the things that will happen right after the filing of bankruptcy:

- Every time a debtor moves to a new place or address, he has to inform the trustee about the move and give him the new address;

- This is also applies when changing names such as when getting married, getting remarried, after a divorce. The trustee has to be informed about the new name;

- When traveling abroad, the debtor has to secure a written permission from the trustee. There are situations when a debtor will be required to surrender his travel documents such as passport or visa to the trustee;

- Any changes in income and assets during bankruptcy must also be communicated to the trustee.

In conclusion, filing for bankruptcy is not good as it will have a negative impact on a person’s credit record and history. It will also take a very long time to repair a credit record. So before finally deciding to file for a bankruptcy, think about all the consequences first. Of course to some it’s the only option left, and there is life after bankruptcy.

Tags:

Bankruptcy,

Bankruptcy Laws,

finance,

Finance & Law,

financial planning,

Law

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

Recent Comments