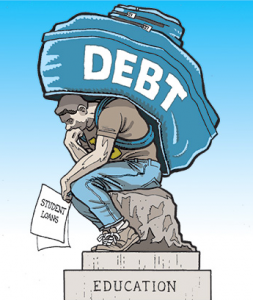

Student loans, if not properly managed, can become a burden that devastates a young professional out of college. Defaulting on payments can ruin a burgeoning credit rating, and an inability to pay the loan at all can lead to years of bankruptcy. Any loan is a risk, and long term loans can have a draining effect on an individual. The question then is how to avoid potentially costly debt as the cost of higher education continues to rapidly increase?

Student loans, if not properly managed, can become a burden that devastates a young professional out of college. Defaulting on payments can ruin a burgeoning credit rating, and an inability to pay the loan at all can lead to years of bankruptcy. Any loan is a risk, and long term loans can have a draining effect on an individual. The question then is how to avoid potentially costly debt as the cost of higher education continues to rapidly increase?

Take Only What You Need

Avoid excess debt by calculating exactly how much you need to borrow in order to complete your schooling. By avoiding excess debt, you can keep the amount owed low and thus payments will be smaller and more manageable. Being frugal for four years can be the difference between good credit and defaulting.

Budget

A defined budget both during and after college can be beneficial in avoiding defaulting on payments. By maintaining the habit of operating within your means, and evaluating your income as such that you can make your payments and lead a normal life, you will know exactly how much you are paying and to what ahead of time. By sticking to a budget you will never accidentally miss a payment, while at the same time saving enough to cover any emergencies that have not been accounted for.

Credit Cards

As a general rule you do not want to stack debt upon debt. A common occurrence in today’s world is the living from month to month on the back of credit card debt, hoping that the next month will be the month where you finally “Catch up.” Credit cards are a money sink, the high amount of interest makes paying off the debt exceptionally hard, and missing a single payment can increase the interest. By accruing credit card debt, student loans become harder to pay, and more of your monthly income gets consumed in interest payments. Credit cards should be avoided as often as possible.

Be Timely and Maintain Records

Do not leave payments to the last minute. Stay on top of your debt, note all the payments, and keep track of what is owed. Maintaining an understanding of your debt is imperative if you intend to pay it off. Slacking off or avoiding keeping records can leave you at a loss when you need that information the most. Questions about when money was paid or received can go a long way toward avoiding a credit score mishap.

Keep Your Lender Informed

Changes in address and phone number can occur quite frequently. It is not enough to simply notify your local post office of the address change. By keeping your lender informed you will avoid possible missed payments due to a mailing error. Small errors can have large repercussions and it is wise, even if occasionally inconvenient to stay ahead of the curve when dealing with your personal finances and the parties involved with your fiscal well being.

Seek Help if Necessary

Admitting to financial problems is often shameful and difficult. The inability to pay one’s bills in a given month can create a cascade effect that can affect one’s finances for years. Though it is difficult, when financial problems present themselves it is best to seek assistance from friends or family if possible in order to avoid problems in the future. If such assistance cannot be obtained inform your lender and see if anything can be done to help.

Construct a Plan

Constructing a financial plan can help assess where one stands and how to achieve financial freedom in the future. A financial plan should carefully measure ones income against one’s expenses, and through such evaluation weed out unnecessary expenses. The plan should convey a solid idea of when debts will be cleared, and should be regularly adjusted as salary and expenses either increase or decrease. Constructing such a plan takes dedication and requires individuals to maintain solid records and be willing to extricate themselves from activities or purchases that can have an adverse effect on their budget. A financial plan can be a valuable tool in overcoming the difficulties of dealing with debt as one enters the workforce.

One of the advantages of student loans is their ability to help create good credit for young adults beginning their lives independent from their parents. The difficulty arises from the lack of knowledge regarding debt and debt management. Asking most college graduates to deal with debt is like asking a child to run before it can crawl. There are no solid foundations in place that educate young adults in the proper methods for budgeting, planning, and debt management. Therefore the impetus is upon the individual to seek out and find the resources that will make him or her better prepared for life after college.

Recent Comments