February 7, 2017

You have finally decided to take the vacation that you were planning since ages. Or perhaps,you have just got promoted and there is a business trip that needs to be undertaken as part of training. More often than not, such trips would entail traveling abroad. In either case, getting a travel insurance cover for your trip is a must. It will ensure that you are safeguarded against any accident or mishap that may occur during the trip.

You have finally decided to take the vacation that you were planning since ages. Or perhaps,you have just got promoted and there is a business trip that needs to be undertaken as part of training. More often than not, such trips would entail traveling abroad. In either case, getting a travel insurance cover for your trip is a must. It will ensure that you are safeguarded against any accident or mishap that may occur during the trip.

When you undertake a trip through a travel company, often you would be given the option to buy travel insurance. In case you are traveling on your own, you would be presented with the option of travel insurance too while booking flight tickets. In both cases, you would be informed about the travel insurance premium that would be incurred. Ever wondered how this premium amount is calculated? What are the factors that come into play in finalizing the premium figure? Read on to find out how much your travel insurance cost.

There is a multitude of factors that determine the travel insurance premium. The thing here is, insurance cover cannot be generic. Every individual has unique needs that necessitate a customized insurance cover resulting in varying premiums. Generally speaking, the factors can be broadly classified into the following –

The level of coverage determines the degree of protection you would be entitled to during your travel. This is something that needs to be decided by a careful examination of risks involved during your trip. First of all, you need to check the country you are visiting. You should check how safe it is. For instance, if you are traveling to a country that is not politically stable or is embroiled in a civil war, your travel premium is going to increase significantly. On the other hand, if you are traveling to a country that scores high in the security domain, you travel insurance will cost you less.

- Nature and/or length of the trip

Next, the nature of the trip is also something that determines the travel premium. A business trip is likely to cost you less since the risk factor is low. On the contrary, if you are undertaking an adventure trip that involves activities like bungee jumping or skydiving, you would need to pay more. Additionally, the trip duration also needs to be given a thought. If you are going to travel to the same place, say thrice during the year. It will be a good idea to get an annual policy at a reduced travel premium.

- Type of coverage i.e. Individual or Group

In case you are traveling alone, it’s pretty obvious that it will cost you less. In the case you are accompanied by yourfamily, you should opt for a group travel insurance rather than getting individual coverage to save money.

Lastly, one of the most important factors is age. Your travel insurance premium will be significantly lower if you are younger. This is because you are less prone to health related risks. Typically, insurance providers have separate plans for senior citizens and require medical check-up.

With the understanding of these pointers, you should get a fair idea of the cost associated with your travel insurance.

For more information on travel insurance policy Click Here

Tags:

Business,

insurance,

investments,

money,

Travel Insurance

February 13, 2015

Are you worried about the upcoming tax season? Are you just dreading getting all of your documents in order and calculating costs, expenses, and other financial details? When deadlines inch closer and closer, and you are not equipped with financial expertise, you want help, and you want it fast. There is nothing worse than being unprepared for the onslaught of tax returns and documentation that comes at the end of the year. For your preparation of financial statements in Calgary, you need the best of the best. Whether you have business needs, or require individualized assistance, highly qualified, professional accounting services can help you every step of the way. Fortunately, there are reputable services and staffers waiting to guide you through every step of the year-end process

Are you worried about the upcoming tax season? Are you just dreading getting all of your documents in order and calculating costs, expenses, and other financial details? When deadlines inch closer and closer, and you are not equipped with financial expertise, you want help, and you want it fast. There is nothing worse than being unprepared for the onslaught of tax returns and documentation that comes at the end of the year. For your preparation of financial statements in Calgary, you need the best of the best. Whether you have business needs, or require individualized assistance, highly qualified, professional accounting services can help you every step of the way. Fortunately, there are reputable services and staffers waiting to guide you through every step of the year-end process

Prep With The Best

With a professional accounting services company, you can rest assured knowing that the most highly-qualified and skilled experts are working with you and for you. These employees know how to sufficiently prepare and plan all of the aspects of annual bookkeeping, so they can provide top-performing assistance. With a wealth of knowledge, including expertise in the Canadian Income Tax Act and its obligations and regulations, businesses and individuals trust these professional accountants to handle all of their tax needs. With all of the required paperwork and actions, not to mention the national rules for filing taxes, things can seem overwhelming. Do yourself and everyone else a favor and trust the experts to walk you through every detail.

Trusted And Reliable Assistance

While dealing with the final preparations for tax filing is a concern for both people and businesses, there is also the financial planning that needs to go into next year. Reliable accountant specialists can work with you to develop a strategy that will guarantee a maximum investment return for you, as well as minimize added expenses and headaches. They have the trusted expertise you are looking for when handling the preparation of financial statements. With so much paperwork and documentation to locate, organize, and submit, why not depend on someone whose main focus is just that? Entrusting your financial statements with someone who has the certifications and appropriate training will help you secure your monetary assets and financial well-being. These benefits can set you on a path to financial stability for years to come.

Efficiency for Everyone

Finally, these accountants can be a wonderful advantage to anyone. Business owners use these professional services for all of their financial organizing tasks, such as keeping logs and records orderly and accurate. Individuals who employ these services for their particular financial circumstances no longer fret tax season, for they are armed with an experienced and qualified tax expert. It is about time that you enjoyed the ease, convenience, and reliability of such professionals.

Tags:

Business,

Capital,

economy,

Financial Accounting,

money,

Tax Filing

November 19, 2014

Self-employed workers may be extremely focused and have an entrepreneurial spirit that will lead to business success but they are also notorious for being disorganized when it comes to paperwork. It really is not possible to be an excellent businessperson and an office administrator. Unfortunately, administration is the backbone of every business and it absolutely must be carried out on time and accurately for a business to maximize its profits.

Self-employed workers may be extremely focused and have an entrepreneurial spirit that will lead to business success but they are also notorious for being disorganized when it comes to paperwork. It really is not possible to be an excellent businessperson and an office administrator. Unfortunately, administration is the backbone of every business and it absolutely must be carried out on time and accurately for a business to maximize its profits.

Many self-employed workers or contractors actually find the financial side of their business intimidating and confusing. There are so many ways to set up a company and manage its finances, and many rules concerning the filing of company accounts and record-keeping.

A small business whose financial side is not managed correctly may find that it loses money and this can hit profit margins hard. Sometimes money is lost simply because a business forgets to invoice for work carried out, or because it undercharges. Suppliers and subcontractors will rarely chase up a late invoice.

Ask any accountant and they will tell stories about entrepreneurs who have months of receipts and invoices piled on their desk, check payments with no details of what the payment was for and receipts of funds into their bank accounts with no note of why they were paid. Couple this with the need to file tax returns correctly and on time and the result is an extremely chaotic office that acts as an anchor weighing down the whole business.

Taxation is one of the most complex areas for any size of business and keeping accurate records of all set-up and ongoing costs is vital to allow you to submit an accurate tax return after your first year of trading. Poorly-managed accounts often result in paying more tax than you should – you cannot claim expenses if you lose your paperwork.

Many employee benefits are tax-deductible such as life insurance and pensions. In fact, all HSA contributions are tax-deductible. Self-employed workers can also deduct from their tax bill the cost of disability and dental insurance premiums along with legal and liability cover. Few self-employed workers manage to claim all these expenses correctly.

Efficient business finance management requires both time and excellent organizational skills. There are several areas of financial administration where self-employed workers repeatedly fail, such as chasing invoices, pricing services and keeping up with tax matters. It’s especially easy to fall behind and get into debt when taking part in an MLM. Check out mlm scam reports to see how you could be in danger of losing lots of money if you aren’t careful.

Fortunately, there are many accountants that offer specific tax advice for contractors and some provide business administration as well as accountancy services. These are called umbrella companies and they provide a way for contractors and self-employed workers to receive help from qualified accountants with the financial and tax aspects of running their business.

An umbrella company essentially acts as an operating company for an entrepreneur, contractor or small business. The umbrella company manages all business finances from daily accounting and administration tasks through to the filing of annual accounts and management reports. The umbrella company manages all the accounts and pays you a salary so that you can focus on what you do best – running a great business.

Tags:

Cash Flow,

economy,

Freelancing,

money,

personal finance,

tax

March 12, 2014

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

While there are still a number of consumers who have not filed their tax returns for the year at this point, there nonetheless remain millions who have turned in these documents and are anxiously awaiting what they hope will be sizable refunds. However, not all of them will necessarily know how best to spend those funds once they receive them, so it might be wise to look into a few ways to spend that money wisely.

Instead of buying a new TV or going on a clothes shopping spree, it’s often much wiser for Americans to concentrate any tax refund money on improving their financial standing overall. Perhaps the best method for doing this, in a number of ways, is to pay down outstanding debt of almost any kind. This will have the dual purpose of both reducing the cost of monthly payments faced for having such balances outstanding, but also improving their credit scores. Usually, it’s the wisest idea to pay off the debt that comes with the highest interest rate (usually credit card balances) because of the ways in which big rates can tack on additional debt in a shorter period of time. The larger the refund, the more substantially debt can be cut, and thus the pressure on a household budget can be reduced.

What about consumers who don’t have big debts?

Of course, not everyone has thousands of dollars worth of credit card bills to deal with, or might be constrained by parts of mortgage or auto loan agreements which state they cannot pay them off before a certain date. For those people, it might be wise to simply put a tax refund into savings, instead. This, though, can be approached in a number of different ways. It could be used to build emergency savings, in the event of a problem that arises down the road, or they could simply put them into retirement accounts that will help to secure their financial futures.

For those who haven’t yet filed their returns but want to maximize their refunds, it might be wise to speak with a tax professional who may be able to help identify some potential deductions that could help to increase the amount of money they receive back from the IRS.

Tags:

budgeting,

economy,

financial planning,

Income Tax,

investments,

money,

tax,

Tax Returns

February 7, 2014

Hands up if you’ve got your tax act together! What? No hands up? Well then, grab a seat and listen up!

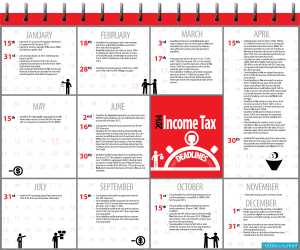

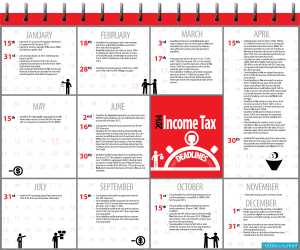

The State and Federal governments have set up certain due dates for filing or e-filing your taxes. To some, understanding taxes and meeting tax deadlines is the first among many horrifying aspects of filing tax returns. But once you understand when and what needs to be filed, it will be the first big step you’ve taken towards de-horrifying the process of tax filing and returns.

April 15th is a big date to remember. Not only must you file your taxes by this day but you also need to pay an estimate of any taxes due. 11.59 pm on that day is the deadline. Miss that and you’ll need to request an extension from the IRS. And even if you do request an extension, remember you still need to pay the taxes you owe.

In addition to that big date, there are several due dates to keep in mind depending on your status – whether you’re individual tax payer, a business (S corporation, C Corporation or LLC) or a charity. The infographic below will help you keep a track of those dates. Remember, if a filing date falls on a weekend or a national holiday, the date will be moved forward to the next working day. It’s important not to miss these dates because if there’s one thing you don’t want, is the IRS on your back, right?

What happens if you don’t meet the deadline?

Brace yourself! This is the next horrifying part of filing taxes. A lot. A lot of bad things can happen if you don’t meet that deadline. For one thing, the fee for not filing is a lot harsher than it is for late filing. In addition, there are penalties which you can check out on the IRS website.

What Not to Forget

You’d be surprised at the common mistakes people make when filing their taxes. Before you send those papers to the IRS double check whether you’ve:

• Put a stamp on the envelope

• Signed the documents (Don’t laugh. It happens more often than you’d think)

• Included the social security numbers of their children and adult dependents

• Annual limits and tax tables can change from year to year. Make sure you’re using the right.

If you run a small business, there’s a never-ending string of dates that you have to keep in mind. Make entries in your PDAs, your laptop and any other devices you use to keep your appointments to help you stay on top of things.

What to Remember

Remember to take advantage of tax deductions. These may change from year to year as well and I sometimes suspect it is in the IRS’s best interests to confuse us folks! It may help to hire professional accounting firms whose job it is to prepare and file your returns while maximizing your earnings. Firms, like 1800accountant, designate a personal accountant to your case and offer 24/7 access the whole year round. It’s worth looking into such services and enjoy the peace of mind that comes from knowing you’ve got your taxes taken care of and managed to make some tax savings. Now that’s what I’m talking about.

Tags:

budgeting,

economy,

Income Tax,

money,

tax

You have finally decided to take the vacation that you were planning since ages. Or perhaps,you have just got promoted and there is a business trip that needs to be undertaken as part of training. More often than not, such trips would entail traveling abroad. In either case, getting a travel insurance cover for your trip is a must. It will ensure that you are safeguarded against any accident or mishap that may occur during the trip.

You have finally decided to take the vacation that you were planning since ages. Or perhaps,you have just got promoted and there is a business trip that needs to be undertaken as part of training. More often than not, such trips would entail traveling abroad. In either case, getting a travel insurance cover for your trip is a must. It will ensure that you are safeguarded against any accident or mishap that may occur during the trip.

Recent Comments