January 20, 2018

On January 14, you must have seen the skies filled with colorful kites soaring high up. Makar Sankranti falls on the day when the sun leaves the tropic of Cancer towards the tropic of Capricorn, which is called Makar in India.

On January 14, you must have seen the skies filled with colorful kites soaring high up. Makar Sankranti falls on the day when the sun leaves the tropic of Cancer towards the tropic of Capricorn, which is called Makar in India.

In other parts of the country, this festival is referred to as Poush Sankranti, Pongal, and Uttarayan. Farmers celebrate this day as it marks the end of the winter and ushers in the harvesting season.

Significance of kite flying on Makar Sankranti

Sankranti means movement and kite flying represents the thankful attitude of humans for this movement. It also has a scientific significance. As the sun commences its journey towards the tropic of Capricorn, it emanates useful rays. When you fly kites on this day, you expose yourself to the beneficial sunrays that have medicinal advantages.

Although Makar Sankranti is over, it is essential that you know about several important lessons this auspicious festival teaches as these teachings may prove to be beneficial during financial planning. Listed below are six important lessons this festival teaches you.

1. Be ready for movement

When you undertake investment planning, you have to understand that it is not a static one-time procedure but requires constant movement. You need to continuously monitor the performance of your long-term investments and make modifications when necessary. Additionally, you need to review and analyze market conditions to identify good opportunities that offer economic advantages to your investment portfolio. When you consider different financial instruments, it is crucial you consider your investment objectives to make the right decisions. This customization of your investment portfolio is comparable to personalizing your kite that has the perfect string which allows it to soar high in the clear skies.

2. Keep your eyes on your portfolio

When you fly your kite on Makar Sankranti, it is important to keep your eyes on it at all times. You must always be aware of how your kite is flying and in which direction. Similarly, prudent financial planning requires that you keep an eye on the performance of your investment portfolio. The performance of the various financial instruments must be in line with your short, medium, and long-term goals.

3. Maintain flexibility

As you fly your kite, you need the string to be kept flexible. This allows your kite to continue soaring amidst gusts of strong winds. This is true even with your short-term and long-term investments. Their performance will not always be the same and there may be ups and downs. Furthermore, the investment environment is not always conducive because conditions are never perfect. There is a possibility that your portfolio may be in the red. You need to ride out the difficult times and remain patient. It is crucial you are flexible and willing to bear temporary losses in the short-term to reap long-term benefits. However, you must never lose sight of your investment objectives and make modifications that become necessary under changing environments.

4. Adequate safety

To ensure you do not injure yourself, you cover your fingers with tapes and bandages while flying a kite. Similarly, you need to ensure adequate security when investing in any financial product. You must protect your investments from significant market conditions.

5. Remain invested

When you fly your kite on Makar Sankranti, you stand the entire day to make gains. Similarly, when you invest in different financial instruments, it is important to remain invested for a longer period. It is said that time in the market is better than timing the market. Therefore, to maximize your gains through investments, it is recommended you hold these for a longer time.

6. Strike the right balance

During winters, days are short and nights are long and vice versa during the summers. However, on Makar Sankranti, the day and night are of an equal length. Just like that, when you invest, you must aim for the right balance between your risks and returns. You must choose financial products that suit your risk appetite while delivering decent returns on your investments.

Striking the right balance between risk and return requires adequate research and effective planning. You need to study the market conditions and understand the features of different financial instruments. This may not be an easy task especially if you are new to investing or have no experience in conducting such analyses.

Through the proprietary ARQ investment engine in Angel Wealth’s mobile application, you can achieve this balance. This engine uses algorithms and quants to analyze a billion data points and offers recommendations that suit your financial objectives and risk appetite. There is no human intervention in the entire procedure ensuring the recommendations are completely unbiased.

Download the Angel Wealth mobile app and apply the lessons learned from Makar Sankranti into practice.

Tags:

banking,

budgeting,

economy,

financial planning,

Funding,

investments,

money,

Mutual Funds,

personal finance,

savings

October 21, 2017

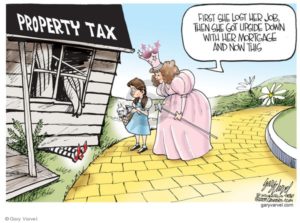

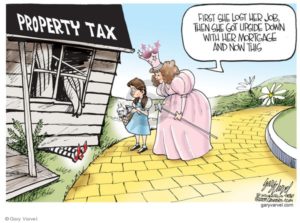

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

July 26, 2017

Equity-linked saving schemes, or ELSS, are essentially close ended mutual fund schemes that offer tax benefits under the section 80C of the Income Tax Act, which means that you can reduce your tax liability. Such funds do not have any restriction on number of shares issued. They are diversified thereby allocating capital in a variety of assets in a way that reduces exposure to risk thereby mitigating loss schemes offered through mutual funds.

Equity-linked saving schemes, or ELSS, are essentially close ended mutual fund schemes that offer tax benefits under the section 80C of the Income Tax Act, which means that you can reduce your tax liability. Such funds do not have any restriction on number of shares issued. They are diversified thereby allocating capital in a variety of assets in a way that reduces exposure to risk thereby mitigating loss schemes offered through mutual funds.

The unique feature of this scheme is that one can avail a maximum deduction of Rs. 1.5 lakh invested into these funds from his/her income during a financial year. This in turn, would help in saving tax of up to Rs. 46,350/- (if one falls in the highest income slab) during a financial year. ELSS also offers greater liquidity as the lock in period in these funds is only 3 years in comparison to PPF which has lock in period of 15 years. Further, by choosing for the ‘Dividend Payout’ option in the ELSS, investors can receive tax free dividends from their investment prior to the maturity of the scheme. Thus, these funds are efficient tax saving investments with the least lock in period and a superior performance track record.

This is a hugely underappreciated advantage of investing in an equity-linked saving schemes. Many prefer instruments such as Public Provident Fund, life insurance policies that are comparatively long term instruments where the primary goal of investing is either safeguarding your loved ones after you are no more or in the case of PPF whereby the idea to save for retirement.

While one can look at ELSS purely from a tax saving perspective of saving taxes, they can also serve as investments towards long term goals. The equity element in ELSS allows investors to systematically create wealth in the long run.

Tags:

Cash Flow,

Debts,

economy,

Funding,

investments,

money,

Mutual Funds,

personal finance,

tax

May 6, 2017

If you are financially stable and successful in your life then you can go ahead and gamble some money away. Below are some ideas where can you wager your money on, as well as some top ways of earning more money. However, people always argue that these are not the right ways of obtaining more cash.

If you are financially stable and successful in your life then you can go ahead and gamble some money away. Below are some ideas where can you wager your money on, as well as some top ways of earning more money. However, people always argue that these are not the right ways of obtaining more cash.

Different countries do have different tax structures for this income and your service charges will be more than your normal earnings taxes, so the deductions will take a higher portion of your total profit. The reason behind this taxation is that you have put less effort & thus got more money. But also here there is a high chance of losing everything. Means this is a game of no risk no gain.

Below I have listed 3 ways you can do this:

Earning money from lottery: If you are a huge fan of winning the lottery, that means you want to earn big. However, there is no assurance whether you will definitely get the money or not. Many people have lost their entire savings by investing in lottery tickets and yet they didn’t get anything.

Earning scope in casinos: Many night clubs do have casinos inside them & youngsters are very interested in clubbing, roulette and poker. This is nowadays one of the best & most popular mediums for refreshments. In casinos the winning stake can be huge if you know what are you doing, otherwise you might end as a big looser.

Earning by involving in sports betting: Many people in this world are into betting and there are many renowned betting sites like the ones listed on BettingTop10, where people can indulge in their favorite sports odds. Some are even earning few extra bucks but you have to be aware of the fact that there are many scammers all around, so you need to go for the correct one after doing your home research.

For me I am a simple family guy who doesn’t like clubbing a lot & I am always finding my refreshments in my family. I am not very rich, but yet I feel financially established. I have never tried the above mentioned ways of making money so I can’t be of much help if you would like to give them a go, but as a financial blogger I like to cover all sides of financing and all alternative ways of earning money.

I am very proud that you all are loving my blog & also sharing your valuable feedback. So, I’m looking forward to seeing your feedback for this post also. Finally, these money earning ideas in 2017 have included few nontraditional ways of earning money. But ultimately remember to work hard & then expect higher gains.

Tags:

Cash Flow,

Earnings,

economy,

income,

investments,

money,

tax

April 14, 2017

Holiday plans are often spontaneous and happen when you’re desperately in need of a break from the monotony of your life. Suppose you are planning a family vacation when your spouse or kids have holidays but your funds are a bit tied up. Should you postpone your vacation till you have the money? Absolutely not! Instead of being disheartened by thinking that you do not have sufficient funds at the moment, you can simply plan a vacation with a personal loan.

Holiday plans are often spontaneous and happen when you’re desperately in need of a break from the monotony of your life. Suppose you are planning a family vacation when your spouse or kids have holidays but your funds are a bit tied up. Should you postpone your vacation till you have the money? Absolutely not! Instead of being disheartened by thinking that you do not have sufficient funds at the moment, you can simply plan a vacation with a personal loan.

You can finance your travel smartly by availing a personal loan. Based on your credit history& income source, the eligibility and amount will be determined and accordingly the tenure and repayment conditions for the loan will be laid out. Salaried individuals find it easier to avail personal loans as compared to self-employed businessmen. However, if you have filed tax returns & all company documents are in place, even self-employed individuals can avail a personal loan without providing collateral.

An online personal loan is extremely easy to avail and rarely require any form of collateral. If you meet the eligibility criteria set by the lending institutions and have the necessary documentation in place, there is a definite chance your application will get an approval. In fact, these days online personal loans can be completely paperless with online submission of scanned id and residence proof.

How do personal loans compare with credit card EMIs? There are tax benefits for personal loans. You can claim income tax benefit under Section 24 on personal loan which offers an overall interest benefit of 1.5 lacs for tax exemption. In addition, extending your credit card to finance your travel is not a good idea as they have predefined credit limits that may not suffice the amount you need for your travel.

Tags:

budgeting,

Debts,

loans,

money,

personal finance,

savings,

tax

On January 14, you must have seen the skies filled with colorful kites soaring high up. Makar Sankranti falls on the day when the sun leaves the tropic of Cancer towards the tropic of Capricorn, which is called Makar in India.

On January 14, you must have seen the skies filled with colorful kites soaring high up. Makar Sankranti falls on the day when the sun leaves the tropic of Cancer towards the tropic of Capricorn, which is called Makar in India.

Recent Comments