Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

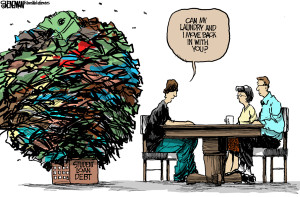

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Recent Comments