October 17, 2015

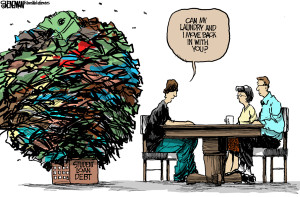

You may be at a stage of commencement of your graduation degree, but possessing a huge burden of student loan in your head. With unemployment rates increasing day by day, students’ loan are getting tough for repayment. Now, here are few methods through which students can get out of the debt burden situation.

You may be at a stage of commencement of your graduation degree, but possessing a huge burden of student loan in your head. With unemployment rates increasing day by day, students’ loan are getting tough for repayment. Now, here are few methods through which students can get out of the debt burden situation.

Student Mindset: A recent study shows that, individuals between the age of 18 and 34 are very careless about their spending habits. They admit on their own that they are unnecessary spending on items that are really not required by them. As college students mostly stay on a limited budget, after their graduation, they can easily maintain the same lifestyle by controlling themselves properly. They can manage their working lifestyles by staying with roommates by sharing apartments, old cars can be kept for longer period of time, and expenditure can be controlled on eating out or shopping. If you get into an expensive lifestyle just after you finish your graduation, it will be very difficult to manage your spending habits.

Retirement Accounts: Make sure that you are contributing sufficient amount in your retirement accounts when you have started a new job. Roth IRA can be a good choice for you to save your money for retirement as well as not get debt burdened. The sum of money which is being accumulated in your retirement account can be withdrawn at any point of time, in case of emergency. These amounts always remain penalty or tax free if you withdraw them at any point of time.

Create and Stay within Budget: Creating a budget helps you to maintain your lifestyle just within your means. You must include savings for meeting your short term goals like purchasing a home or spending a vacation. According to debt review, you must not forget your long term goals like retirement. You can track your expenses through offline records or by online tracking sites or mobile apps.

Take Care of Your Credit: You must keep a thorough watch with your credits. You should make sure that you are repaying your loan within the scheduled time. If you want a good credit score, try to close your credit cards which are not very necessary. This will surely decrease your credit history and will improve your score.

Prioritize Higher Interest Rates: Try to keep a priority list of repaying your interests and higher interests must be paid at first. When an individual joins a job, he might be possessing student loans at first but gradually his loans may increase. Now, you must know how to prioritize the repayments by paying off your loans one by one starting with higher interest ones.

Loan Repayment Options: Students can repay loans with various options either directly to the Federal Government or through some guarantors. Loans can also be decreased with some income based repayment. With some extended repayment plans, you can extend your repayment for a period of about 25 years but in this case you must have an outstanding amount of $30k or more. This plan holds suitable for situations where your income is unstable or low.

Never Default: Try not to default your repayments in whatever case it may be. If you miss any single repayment, it can hurt your credit very badly. The Government can easily confiscate your tax refunds, if you default any repayment.

Learn properly the ways to protect your tax refunds by defending yourself from lawsuits. If students can adopt skills for managing their money properly, they will surely come out of their debt burden very easily. They must learn to control their financial situation by their own so that they do not face tough times in future.

Tags:

Burden,

Debt Problems,

Debts,

economy,

loans,

money,

personal finance,

Students Loan

February 9, 2014

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Tags:

budgeting,

debt,

financial planning,

money,

mortgage,

Students Loan

June 23, 2012

Having a difficult time paying off your student debt while in college? Let’s face it, paying off debts while you’re still studying is not that easy. For one, you have no regular source of income. But then again, there are still other options available.

Having a difficult time paying off your student debt while in college? Let’s face it, paying off debts while you’re still studying is not that easy. For one, you have no regular source of income. But then again, there are still other options available.

Just remember that when you have an existing student loan, the interest would accumulate through years if you are unable to pay them off on time. This would further increase your financial burden so as much as possible, you have to pay off your debts on time or even earlier.

Here are some tips on how to pay off your college student debt:

1. Save money. First, you really have to save money in order to pay for your loan. For instance, you can save at least ten percent of your weekly allowance or income so that by the end of the year, you have enough money to pay off a portion of your student loan. Try to find means on how to stretch your money. Avoid spending on things you don’t really need such as brand new clothes and skip eating in expensive restaurants or fast food chains. Be practical when it comes to money.

2. Find a part time job. You can also look for a part time job while studying so you can save money to pay off your debt. There are jobs you can try online such as freelance writing, pay per click advertising, blogging, online tutorials, and more. You can start doing work from home so you can save on time and travel expenses. You can also apply as a student assistant in your university. Some universities would give discounted tuition fees and monthly allowance for student assistants.

3. Pay quarterly interest for your student loan. If for instance, you use unsubsidized loan, you can pay the interest every quarter. This will enable you to minimize the amount of interest which you will pay when you graduate. It’s like saving your money for the future. In subsidized loans, the loan would start to accumulate interest especially if it takes longer for you to finish college. Paying the quarterly interest allows you to pay the interest on the original loan amount, which in turn, helps you save money.

4. Look for other sources of income. You can also pay off your student debt by looking for other sources of income. If you can’t get a part time job for example, you can opt to conduct garage sales or other income-generating projects to help you earn money.

These are just some of the things you can do to pay off your student debt. If you are able to pay off your debt as early as possible, it will be to your advantage.

Tags:

budgeting,

debt,

economy,

financial planning,

loans,

money,

personal finance,

Students Loan

You may be at a stage of commencement of your graduation degree, but possessing a huge burden of student loan in your head. With unemployment rates increasing day by day, students’ loan are getting tough for repayment. Now, here are few methods through which students can get out of the debt burden situation.

You may be at a stage of commencement of your graduation degree, but possessing a huge burden of student loan in your head. With unemployment rates increasing day by day, students’ loan are getting tough for repayment. Now, here are few methods through which students can get out of the debt burden situation.

Recent Comments