March 11, 2014

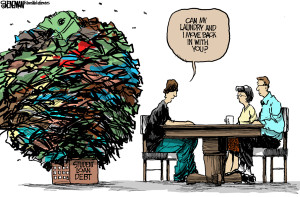

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

Checking essential registration

You must be aware that several agencies operate without proper licensure. Either they do not have the registration at all, or they have an invalid document. Working with dubious services can land you in deep troubles you do not want. Many identity theft services do rounds in the debt market. You can identify them by the unrealistic claims. It is impossible for a company to make a person debt-free within one week. You cannot just make thousands of dollars in debt disappear overnight! Money is not an illusory magic trick! It is the realest thing in defining a society. You need to be superbly realistic in facing money issues. Never forget to discuss the consequences and penalties of missing an installment. Always ask whether the service can provide their verifiable registration number. Follow this approach even when you apply online.

Identifying the right service

Of course, a company can facilitate consolidation within a week. It requires efforts, but a well-connected service can easily accomplish the task. Call the customer service in verifying whether they have the necessary systemic contacts. Check if they maintain stable connections with the bank and credit card services. The debt relief service must negotiate your consolidation with lenders. You may follow the official protocol of bankruptcy. Many services also offer consolidation on a one-to-one basis, without filing a bankruptcy claim. You have two claim options, the chapter 7 and the chapter 13. Discuss the appropriateness of both parameters with the debt rescue customer support.

Convenient loan provisions

The relief service essentially arranges the most convenient loan package. However, you need to verify whether the assigned conditions are compatible with your personal finance. Start with checking your monthly budget balance sheet. You can also use amazing online accounting resources to develop a balance sheet. See whether the credit repair agency has the necessary tools such as debt calculator and budget balance sheet. They may or may not have it. You can find many free online software solutions for the purpose. You must check the loan interest rate total value. Services also levy additional fees on the final amount. Inquire to interpret the exact amount you need to allocate every month for repayment.

You must find a service with the most helpful attitude. Their genuine helpfulness must reflect in different aspects of their service. See if they can adjust the service fees with the loan monthly installments. Understandably, it is extremely difficult for you to pay in lump-sum at the first. The convenient payment packages simplify things. The company should be able to present a clear blueprint of debt freedom. However, you may need to make some personal adjustments. Consider shifting to a debit card or a secured credit card. These can effectively assist in managing your credit bills. You do not even receive a bill with the debit card purchases. However, you need to look up legal options for certain specific loans that do not fall under the bankruptcy plea even.

Tags:

budgeting,

credit,

Credit Card,

debt,

debt freedom,

economy,

financial planning

February 9, 2014

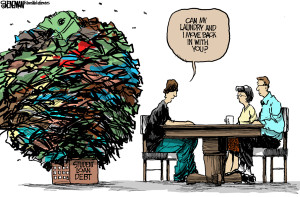

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Tags:

budgeting,

debt,

financial planning,

money,

mortgage,

Students Loan

May 14, 2013

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Obtaining loans involves so many factors that it can seem to be a complex job for you. However, if you can get the details on loans and the basics of obtaining a loan, it may not seem as complex as it had seemed previously. Obtaining cheap personal loans is not much different than obtaining the regular personal loans. The only difference in case of the cheap personal loans is that these are rare and so you may have to do extensive research to find one. The qualifying criteria for obtaining one such loan are the same.

Cheap personal loans

Cheap personal loans like that of the ordinary personal loans are of two types. One is the unsecured form of personal loan and the other is the secured form of personal loan. The unsecured personal loans are the ones in which you are not required to keep any collateral. Thus, the interest rates on such loans are high in comparison. Visit following news http://www.prlog.org/11911362-bad-credit-personal-loans-up-to-5000-now-available.html for more information.

On the other hand, in case of the secured loans you need collateral and as the security is high, the interest rate charged is comparatively low.

Taking out a cheap personal loan

In order to obtain a cheap personal loan, you will be required to:

- Have good credit rating – Cheap personal loans will have to be the ones which have low rate of interest. So, it is extremely important for you to have good credit rating like a good credit score and clean credit report. That can help you obtain a loan with really low interest rate. That is the only way you can obtain a low cost loan.

- Have low debt to income ratio – If you have low debt to income ratio, it can help you in getting a loan at low rate or a cheap personal loan. Debt to income ratio is the percentage with regards to the amount you make towards debt payment against your gross income per month.

- Have high affordability – You need to have high affordability so that you can get the best and cheap personal loans. If you have high affordability, the lenders consider that you may easily be able to pay down the loan. Therefore, the interest rate charged may be low too.

- Have high rate of income – High affordability is related to high rate of income, so, it so obvious that if you have high income, it becomes easier for you to obtain a cheap personal loan.

Usage of the cheap personal loans

Such personal loans can be beneficial if you are planning to make a big purchase or may be even pay down your debts. You can use one such loan to even repair your car or for the purpose of home improvement or may be consolidate your debts. There are various options and you can choose from any one of those options as per your needs and affordability.

However, as there are numerous offers even if you are getting cheap offers, it is important for you to make sure that you are obtaining one that you can make payments on. Read here for more information.

Tags:

debt,

economy,

financial planning,

Interest Rates,

loans,

money

May 8, 2013

Your credit card, while serving as a powerful tool for all your financial needs, can lead you to a world of trouble if you don’t use it the right way. Credit cardholders must avoid getting trapped in a deep hole called debt. However, they often find it hard to consider the immense amount of expenses, especially if a bank already gave them enough credit to just charge these costs. Moreover, this powerful financial tool can oftentimes be considered as the worst form of finance because of the fact that incurred debts are classified as unsecured. Also, they carry an interest rate that is higher than a home or car loan. Compared to other types of loans such as home mortgage or student loan, credit card debts are not tax deductible.

Your credit card, while serving as a powerful tool for all your financial needs, can lead you to a world of trouble if you don’t use it the right way. Credit cardholders must avoid getting trapped in a deep hole called debt. However, they often find it hard to consider the immense amount of expenses, especially if a bank already gave them enough credit to just charge these costs. Moreover, this powerful financial tool can oftentimes be considered as the worst form of finance because of the fact that incurred debts are classified as unsecured. Also, they carry an interest rate that is higher than a home or car loan. Compared to other types of loans such as home mortgage or student loan, credit card debts are not tax deductible.

If you have a credit card, you don’t want to use it on certain things or events that could definitely spell disaster on your financial and economic standing. In fact, many experts say that you should not use it in these situations:

- Paying for your college tuition. Using the credit card while in college is never good to begin with, because of the consequences that doing so may bring. Many college graduates have experienced dealing with credit card debt during their time at school, and their financial woes continue to pile up as they advance in age. For one, upon graduation from college, you might not be able to find a job at the soonest possible time, which would make it hard for you to earn income to pay off your credit card debt.

- Paying for your wedding costs. In such a prolific event like a wedding, planning is a key priority. Saving for years with your soon-to-be wife or husband for the significant day is a very important way if you want it to be extra special and start your married life on the right track. However, you shouldn’t use your credit card in financing your wedding costs, as this will backfire, causing you newlyweds to deal with debt during your first few years of marriage.

- Going on a vacation spree. If you are planning for a vacation, it is best that you save on cash money for your out-of-pocket expenses rather than using your credit card all throughout your out-of-state or out-of-country trip. Financing your trips through the use of your credit card will just create a mountain of debt upon your return.

- Paying for your medical expenses. Dealing with the costs of your medical treatment can be very daunting, but that does not mean you should resort to using your credit card to finance them. Some health providers offer rate adjustments and payment plans that might be suitable for you.

Using your credit card is still important, but using at frequently and as a means of covering much of your finances is not good at all. Next time you encounter the abovementioned situations, think twice before dealing with your finances. Use your credit card in moderation, or suffer consequences along the way.

Tags:

credit,

Credit Card,

Credit Card Debt,

debt,

economy,

financial planning,

money

March 26, 2013

Being mortgage free is the paradise that all mortgage holders are looking for, and thousands of people every year decide to over pay on their mortgage to help them achieve this goal. Whether this overpayment is a lump sum, or one or two extra payments over the course of a year, reducing your mortgage will help you to save later on in life.

Being mortgage free is the paradise that all mortgage holders are looking for, and thousands of people every year decide to over pay on their mortgage to help them achieve this goal. Whether this overpayment is a lump sum, or one or two extra payments over the course of a year, reducing your mortgage will help you to save later on in life.

However, does the notion of paying off your mortgage early distract you from putting money away in a savings account? At the end of the day, what is a better position to be in – mortgage free with no savings, or savings and a hefty mortgage? Let’s take a look at the pros and cons of paying or your mortgage, or saving the money instead.

Savings

Before you make a decision about whether or not to save or spend, first consider whether you have enough of a savings fund to build on. In order to cover any emergencies, it’s always recommended that you have at least four to six months’ worth of savings in the bank. Even if you do have a decent amount of money to fall back on, that still doesn’t mean that you should spend it on paying off your mortgage, or clearing a decent chunk of it at least.

Before using this money to pay off your mortgage, consider paying off any other debts you have, like credit cards or other financing debts. These expenditures will typically have higher rates of interest, meaning you’ll be saving yourself money in the long run if you pay these amounts off. Only then should you consider paying off your mortgage with your savings. There could be early-repayment penalties if you decide to clear some of your mortgage, so always seek the advice of your m

Making Sense Of It All

In order to choose saving your money over paying off your mortgage, your savings account would have to offer better interest rates compared to the money you would save reducing your mortgage debt in the long run. If we take a look at the best mortgage deals verses the current interest rates across the typical high street savings accounts, saving your money wouldn’t be advisable.

As interest rates are very low at the moment, you’ll certainly be paying more interest on your mortgage repayments compared to the money you would save with your savings account. Getting an ISA savings account is key if you want to avoid income tax on savings interest, but again, what you are able to save in a savings account must also be compared to what you would knock off your mortgage in the long run.

If you are able to make monthly overpayments on your mortgage, then you could find that you’re making quite a saving on your debt. Over a typical 25 year mortgage, a homeowner could save over £8,000 just by making an extra £50 payment every month, based on a £150,000 mortgage. Furthermore, the more you can pay off on top of your monthly repayments, the more you’ll save!

Tags:

debt,

financial planning,

Home Loan,

Interest Rates,

money,

mortgage

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

The overwhelming credit burden requires effective resolution. However, the debt aspects are so complicated that it is often confusing to understand even where you stand at the debt status. The monthly bills keep on coming, and the numbers seem like huge burdens on your mind. The risk entailed in a debt crisis involves all things you hold dear. The vacuum of unpaid dues threatens to take your home, car, and subsequently the job. Many debtors are already without a job. The situation is even more drastic for them than the average homeowner. However, debt is also a great equalizer. Everyone facing it feels the same haunting vulnerability. You need to overcome the distress via a suitable solution. Look up a credible debt relief agency for the purpose.

Recent Comments