Hands up if you’ve got your tax act together! What? No hands up? Well then, grab a seat and listen up!

The State and Federal governments have set up certain due dates for filing or e-filing your taxes. To some, understanding taxes and meeting tax deadlines is the first among many horrifying aspects of filing tax returns. But once you understand when and what needs to be filed, it will be the first big step you’ve taken towards de-horrifying the process of tax filing and returns.

April 15th is a big date to remember. Not only must you file your taxes by this day but you also need to pay an estimate of any taxes due. 11.59 pm on that day is the deadline. Miss that and you’ll need to request an extension from the IRS. And even if you do request an extension, remember you still need to pay the taxes you owe.

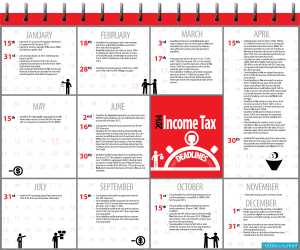

In addition to that big date, there are several due dates to keep in mind depending on your status – whether you’re individual tax payer, a business (S corporation, C Corporation or LLC) or a charity. The infographic below will help you keep a track of those dates. Remember, if a filing date falls on a weekend or a national holiday, the date will be moved forward to the next working day. It’s important not to miss these dates because if there’s one thing you don’t want, is the IRS on your back, right?

What happens if you don’t meet the deadline?

Brace yourself! This is the next horrifying part of filing taxes. A lot. A lot of bad things can happen if you don’t meet that deadline. For one thing, the fee for not filing is a lot harsher than it is for late filing. In addition, there are penalties which you can check out on the IRS website.

What Not to Forget

You’d be surprised at the common mistakes people make when filing their taxes. Before you send those papers to the IRS double check whether you’ve:

• Put a stamp on the envelope

• Signed the documents (Don’t laugh. It happens more often than you’d think)

• Included the social security numbers of their children and adult dependents

• Annual limits and tax tables can change from year to year. Make sure you’re using the right.

If you run a small business, there’s a never-ending string of dates that you have to keep in mind. Make entries in your PDAs, your laptop and any other devices you use to keep your appointments to help you stay on top of things.

What to Remember

Remember to take advantage of tax deductions. These may change from year to year as well and I sometimes suspect it is in the IRS’s best interests to confuse us folks! It may help to hire professional accounting firms whose job it is to prepare and file your returns while maximizing your earnings. Firms, like 1800accountant, designate a personal accountant to your case and offer 24/7 access the whole year round. It’s worth looking into such services and enjoy the peace of mind that comes from knowing you’ve got your taxes taken care of and managed to make some tax savings. Now that’s what I’m talking about.

Recent Comments