February 12, 2019

It used to be that graduating students with large amounts of student loan debt were told to forget purchasing a home until after they’d paid down their debt. Still others were told to wait until they’d built up years of work history, delaying the initial purchase of a home for years. Today, however, more and more millennials are finding it possible to qualify for a mortgage while paying off student loan debt. How?

It used to be that graduating students with large amounts of student loan debt were told to forget purchasing a home until after they’d paid down their debt. Still others were told to wait until they’d built up years of work history, delaying the initial purchase of a home for years. Today, however, more and more millennials are finding it possible to qualify for a mortgage while paying off student loan debt. How?

They Have Good Credit

Credit scores range anywhere from 350 to 850, with anything below 600 considered a poor score. Most mortgage lending programs, even those that are federally funded for first-time buyers, look for scores of at least 620. Those with excellent credit, above about 750, will stand an even higher chance of securing a mortgage with student loan debt.

If your credit score may be an issue, follow these steps to move toward improving it:

● Check your score – you can’t fix your score unless you know what it is. Examine your report and notify the credit bureau of any errors immediately.

● Address any delinquencies – it’s important you address delinquencies immediately. If possible, pay the account off entirely.

● Set up auto-pay – setting up auto-pay features for all your debts will ensure each payment is made on time. Building a lengthening history of paying every debt on time each month makes you much more attractive to lenders.

● Avoid applying for new credit that may go unused – applications are typically a ding on your credit, so even if you don’t intend to use the upper limits of a new card, it may hurt your score.

● Don’t close paid accounts – credit cards you’ve paid off can positively affect your credit score. If you are not using all of your available credit, open, empty credit cards can be helpful.

They Have a Lower Debt-to-Income Ratio

Debt-to-income (DTI) ratio is calculated as your monthly debt payments compared to your monthly income. If you are paying off a student loan in addition to credit card debt, you’ll need a relatively high monthly income to offset the amount of debt you’re carrying. Lenders will focus on your debt-to-income ratio to determine if you can afford another debt – your mortgage – in addition to what you’re already carrying. Paying off credit cards or student loans and maximizing your earning potential can help on both fronts.

You can also consider consolidating debt with a personal loan. If you have a great deal of credit card debt, you likely have a variety of higher interest rates. A personal loan is a stable debt rather than revolving debt like a credit card, and reflects positively on your credit history. You’ll likely receive a lower rate in addition to freeing up available credit.

They’ve Secured Employment in Their Field

Lenders will consider your employment history to determine if you have the steady income required to continue to make mortgage payments. If you’ve recently graduated, you may not have the recommended two years of steady employment. However, underwriters will often consider a move from college straight into gainful employment in your chosen field a substitute for part of your employment history.

They’ve Refinanced or Restructured Student Loans

When lenders look at your debt-to-income ratio, student loans are among the debts they’ll consider. If your payments are unwieldy, consider applying for an income-driven repayment plan through the U.S. Department of Education. These plans consider your income and often provide a lower payment than the typical graduated repayment program. If your income increases, you can increase your repayment to ensure you continue to pay down your loans.

Another solution that can lower your monthly payments is refinancing your student loans. Loans refinanced through banks or other institutions typically carry lower interest rates and lower monthly payments than the original federal loans. As with other loans, you’ll need to consider your creditworthiness, income, and debt-to-income ratio.

They’ve Qualified for Down Payment Assistance

Though the traditional down payment is 20% or more, several programs exist to reduce your down payment in order to speed up the homebuying process for those with student loan and other debt. For example, FHA loans by the Federal Housing Authority offer a much lower percentage – 3.5% for those with credit scores in the 600s and above, and 10% for those in the 500s. HomeReady loans targeted at first-time home buyers offer even lower down payment terms of around 3%.

Find a lender that works with these and other first-time home buyer and down payment assistance programs. Many lenders do not offer zero down payment, but still offer a variety of other loan types that could meet your needs. Obviously, if you have the means to provide a 20% down payment, you’ll lower the principal on your loan, but these assistance programs can put buying your first home within your grasp.

Today’s millennials with student debt are qualifying for mortgages, and chances are, you can too. Overall, pay close attention to your credit score and making your payments on time. Keep your other debt low, and ask your lender about assistance programs that may be available to you. Finally, if you’re in the market for a home, get pre-approved first to see just how much home you can afford. Then, if you find the home of your dreams, you’ll know you can move forward, even while you’re paying off your student loan debt.

Information is provided by Sammamish Mortgage, a Premiere Mortgage Company in Pacific Northwest including WA, ID, OR, CO.

Tags:

budgeting,

Debts,

economy,

financial planning,

Interest Rates,

loans,

money,

Mortgages,

personal finance,

student loans

December 18, 2018

Owning a home is one of the biggest dreams of almost every adult, especially when they have a family. Mortgage arrangements come in handy to make this desire a reality. Nevertheless, homeowners are left with another big question on their minds: What strategies can I employ to pay off my mortgage as quickly as possible? Well, it is natural to want to be free of any debt commitments, and to know that you own your home and that no one has a claim on it. This is because owning a home will allow you to work on other financial goals, like saving for retirement, saving for your children’s education, and so on.

Owning a home is one of the biggest dreams of almost every adult, especially when they have a family. Mortgage arrangements come in handy to make this desire a reality. Nevertheless, homeowners are left with another big question on their minds: What strategies can I employ to pay off my mortgage as quickly as possible? Well, it is natural to want to be free of any debt commitments, and to know that you own your home and that no one has a claim on it. This is because owning a home will allow you to work on other financial goals, like saving for retirement, saving for your children’s education, and so on.

Paying off your mortgage in a shorter period is not too difficult or unachievable, but it calls for slight adjustments in your payment plan, or changing a few things in your mortgage terms. Here are some things you can do:

Increase the frequency of your regular repayments

The normal terms are monthly payments, but you can choose bi-weekly or weekly payments. Such an arrangement will significantly enable you to save on interest and it will set you free from mortgage sooner than if you only do it monthly. The goal is to make more monthly payments each year without realizing it.

Go for the shortest amortization period and the biggest repayment amount you can afford

Opting for a larger monthly payment, which means it will be paid off quicker, will cause you to consider it as a budget item, thereby shaving several years off your mortgage. While still clearing out your mortgage, a good and consistent mortgage repayment history will enhance your credit score, because mortgage is one of the trade lines (credit accounts) that contributes to your score. You can work with experts to boost your credit score to access more credit at better rates. You need not look further than https://www.boostcredit101.com/ to boost your score and find more advice.

Increase your monthly payment amount when possible

If you have had a mortgage for some time, you have most likely set a plan to make uniform payments each month. It is time you consider increasing the amount, if you can manage. Additionally, if you have experienced an increase in your income, be it from a new job, a pay raise, or any other source, it would be prudent to increase your mortgage payment with the increased income.

Pay lump sum amounts

Mortgage arrangements come with some privileges or additional options that the borrower can use to their advantage. For example, any chance to make lump sum payments should be utilized, especially an annual lump sum payment, against the mortgage. Based on the options you choose for your mortgage, you can pay amounts equal to 10%, 15%, or 20% of the initial principal figure of your mortgage at any time for each year of the mortgage term.

Diversify your mortgage

You need to weigh the various options and choose the mortgage arrangement that offers savings and flexibility.

Conclusion

It is such a relief to pay off your mortgage as fast as possible; thus, you need to work out how to save on other things and repay your mortgage in larger, more frequent payments. Also, you should do lump sum payments when possible.

Tags:

Debts,

economy,

Interest Rates,

loans,

money,

mortgage real estate,

Mortgages,

personal finance,

real estate

December 17, 2018

Over the past few years, Liverpool has been hailed as a buy-to-let property gold mine. It has low initial costs compared to other UK cities and a growing demand for rental accommodation. Considerable investments from both the private and public sector have been boosting the city’s economy.

Over the past few years, Liverpool has been hailed as a buy-to-let property gold mine. It has low initial costs compared to other UK cities and a growing demand for rental accommodation. Considerable investments from both the private and public sector have been boosting the city’s economy.

Liverpool’s affordable property prices are a huge draw for potential investors. With house prices in Liverpool considerably less than the UK average, developers and investors have been making the most of opportunities in the city. The average UK house price is £215,000 with the cost in Liverpool only £117,000. These low house prices allow investors to get far more for their money compared to other areas like London and Cambridge. Investors have been discovering that for the price of an apartment in London, they could by a couple of comparable quality properties in Liverpool. Prices of property in Liverpool are also on the rise. These increasing house prices are an excellent indicator for investors whose property is worth far more than they paid.

Liverpool has been attracting investors from around the world. With its strong trading history, famous football clubs, and of course, the Beatles, it’s definitely on people’s radar. Investors from the USA, to China to Saudi Arabia are all looking to this northern city as a possible location to expand their portfolio. Developers from overseas are also purchasing land in Liverpool, and working with the city to create new properties. A citywide targeted development strategy has improved areas of Liverpool that were once derelict or underdeveloped. This increased investment has been creating lucrative new opportunities for investors.

Buying off plan is another popular option with investors. Guaranteed rental yields mean that investors see income as soon as the development completes, without having to deal with tenants themselves. Access to new off plan developments is highly sought after, with plans for modern skyscrapers, apartment buildings and purpose-built student accommodation pending. The city’s borders are expanding. Unused land is being snapped up by developers for new projects around the city.

Liverpool has a high average rental yield, with some properties offering returns of up to 8%. This assured income from property is highly beneficial for investors who are generating income while their investment increases in value. It also allows investors to hold on to property, with rental income paying for the investment in years. Properties by RW Invest have rental yields of 7-8% on stunning luxury apartments in the city. High quality, modern apartments with options for furniture and high-end fittings are perfect for buy-to-let investors. Developments like Azure residence, with apartments from £94,950 and Tobacco Wharf with flats from £84,995 both, offer a generous 7% yield.

A recent study showed that 13.8 tenants were trying to get each new rental that becomes available. With such a competitive environment and so much demand, tenants are sometimes willing to spend a little bit more for a city location or a beautiful apartment. With buying their first home still unattainable for many young people. It was recently reported that 44% of private tenants were not expecting to buy in the long term. Improving job prospects are attracting more and more people to live in Liverpool city centre. These are often looking for rental accommodation that is close to the city centre or excellent transport links.

The increasing demand for rental properties and the option of long-term tenants are all factors in Liverpool’s reputation as a buy to let hotspot. With low prices, a growing economy and new developments continually popping up, Liverpool is continuing to attract savvy buy-to-let investors.

Tags:

Apartments,

Assets,

economy,

Financial Assistance,

investments,

mortgage,

Property,

real estate

April 13, 2018

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

Whichever level you are at, there are several factors that will determine how much you budget for a new home. These factors include;

• Your earning– It could be your personal earning, or yours and that of your spouse if you plan to jointly buy a home.

• The Location of your home – Where exactly do you want to live? Some estates are more expensive than others.

• The size of your dream home- This may also include the size of the house as well as the land on which the house will sit on.

• How long you want to pay for it – If you want credit for a shorter time, then you may have to choose a cheaper home and vice versa.

After considering these factors, then it is time to come up with a real budget for your home. Remember that it is your own home, a treasure for yourself to take pride and find comfort in. Therefore, take time to budget for the best. Below are basic steps towards getting a perfect budget for your home:

1. Get informed

Be sure to visit a real estate and property development company, to get the available options in terms of different properties available in the market and their value as they have a better understanding.

2. Timing

Decide the exact day that you want to move to your new home. Do not wish for a particular time span when you want to move to the new home, say like in the next three months, but rather set a specified target date.

3. Calculate how much you can afford

Use a mortgage calculator to determine exactly how much you can afford to pay monthly.

If you are cost sharing a mortgage;

• Open a money market account or an alternative of a high-interest savings account. Ensure the Federal Deposit Insurance Corporation guarantees your money.

• For every month, deposit the total money (two halves if you are two) to the savings account monthly. Deposit the money until the date for moving in is due. Spend the money to pay for your new home.

4. Reduce your spending

In order to do this, you need to be realistic by spending less than you earn. Make a plan and stick to it. For example, you may realize that you don’t need to live in that two bedroom apartment especially if you don’t have kids. Therefore moving to a one bedroom apartment may save up to around 30% of your expenses which you could channel towards home ownership.

5. Increase your earnings

While most people believe in spending less to save, I think working that extra job is a sure way of increasing your savings. Take up any money making opportunity that comes your way. You could also opt to get a second job as a side hustle to top up your main source of income.

Conclusion

To succeed in owning a new home, you may have to forego some expenses, however small they may seem. These may include your daily cup of coffee which may cost $5 but accumulates to $150 in a month.

As much as you are looking towards owning the best home, be careful so that you do not strain so much that you will have to compromise on basic needs such as food.

While owning a home may seem a hard process that requires a lot of sacrifices, at the end of the day, it is worth it, so go for it!

Tags:

budgeting,

Debts,

financial planning,

home loans,

Interest Rates,

money,

Mortgages,

personal finance,

real estate,

savings

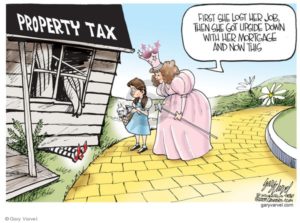

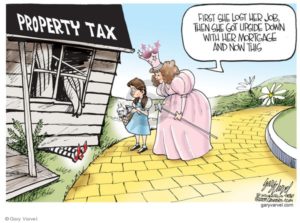

October 21, 2017

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

It used to be that graduating students with large amounts of student loan debt were told to forget purchasing a home until after they’d paid down their debt. Still others were told to wait until they’d built up years of work history, delaying the initial purchase of a home for years. Today, however, more and more millennials are finding it possible to qualify for a mortgage while paying off student loan debt. How?

It used to be that graduating students with large amounts of student loan debt were told to forget purchasing a home until after they’d paid down their debt. Still others were told to wait until they’d built up years of work history, delaying the initial purchase of a home for years. Today, however, more and more millennials are finding it possible to qualify for a mortgage while paying off student loan debt. How?

Recent Comments