April 13, 2018

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

Whichever level you are at, there are several factors that will determine how much you budget for a new home. These factors include;

• Your earning– It could be your personal earning, or yours and that of your spouse if you plan to jointly buy a home.

• The Location of your home – Where exactly do you want to live? Some estates are more expensive than others.

• The size of your dream home- This may also include the size of the house as well as the land on which the house will sit on.

• How long you want to pay for it – If you want credit for a shorter time, then you may have to choose a cheaper home and vice versa.

After considering these factors, then it is time to come up with a real budget for your home. Remember that it is your own home, a treasure for yourself to take pride and find comfort in. Therefore, take time to budget for the best. Below are basic steps towards getting a perfect budget for your home:

1. Get informed

Be sure to visit a real estate and property development company, to get the available options in terms of different properties available in the market and their value as they have a better understanding.

2. Timing

Decide the exact day that you want to move to your new home. Do not wish for a particular time span when you want to move to the new home, say like in the next three months, but rather set a specified target date.

3. Calculate how much you can afford

Use a mortgage calculator to determine exactly how much you can afford to pay monthly.

If you are cost sharing a mortgage;

• Open a money market account or an alternative of a high-interest savings account. Ensure the Federal Deposit Insurance Corporation guarantees your money.

• For every month, deposit the total money (two halves if you are two) to the savings account monthly. Deposit the money until the date for moving in is due. Spend the money to pay for your new home.

4. Reduce your spending

In order to do this, you need to be realistic by spending less than you earn. Make a plan and stick to it. For example, you may realize that you don’t need to live in that two bedroom apartment especially if you don’t have kids. Therefore moving to a one bedroom apartment may save up to around 30% of your expenses which you could channel towards home ownership.

5. Increase your earnings

While most people believe in spending less to save, I think working that extra job is a sure way of increasing your savings. Take up any money making opportunity that comes your way. You could also opt to get a second job as a side hustle to top up your main source of income.

Conclusion

To succeed in owning a new home, you may have to forego some expenses, however small they may seem. These may include your daily cup of coffee which may cost $5 but accumulates to $150 in a month.

As much as you are looking towards owning the best home, be careful so that you do not strain so much that you will have to compromise on basic needs such as food.

While owning a home may seem a hard process that requires a lot of sacrifices, at the end of the day, it is worth it, so go for it!

Tags:

budgeting,

Debts,

financial planning,

home loans,

Interest Rates,

money,

Mortgages,

personal finance,

real estate,

savings

March 9, 2018

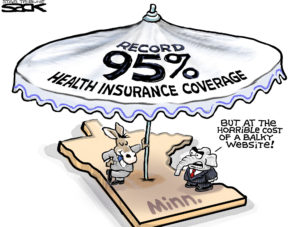

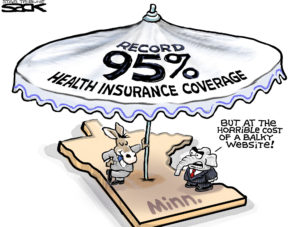

In this time of rising medical inflation, investing in a medical insurance policy has become the need of the hour. The benefits of a health care plan indeed out weigh the cost. Many individuals, therefore, invest in a health care policy to enjoy financial protection in case of a medical emergency.

In this time of rising medical inflation, investing in a medical insurance policy has become the need of the hour. The benefits of a health care plan indeed out weigh the cost. Many individuals, therefore, invest in a health care policy to enjoy financial protection in case of a medical emergency.

You may either opt for a reimbursement of the medical expenses incurred by you, or you may file a cashless claim. Though the procedure for filing a claim is quick and hassle-free, sometimes it may get rejected.

Following are six major reasons why your health insurance claim may be denied.

1. Providing inaccurate or incomplete details

One of the reasons for denial of the claim is a failure to furnish complete or accurate details. These details may pertain to your health condition, pre-existing conditions, or nature of employment, among others. Since these factors are crucial in helping the insurance provider to determine your eligibility and premium, they may deny the claim if they find out that crucial information has been withheld or if facts have been misrepresented.

2. Seeking claims for exclusions

Most medical health insurance plans come with a list of diseases and ailments that are beyond the scope of coverage. Making a claim for any conditions or ailments in the exclusion list will fail to qualify for coverage and hence the claim will be rejected.

3. Making a claim during the waiting period

Waiting period refers to the specified time frame that you must wait for, before beginning to enjoy benefits of the policy. This is the period during which pre-specified illnesses are not covered by your policy. Hence, making any health insurance claim during the waiting period will result in it being rejected.

4. Admission to a non-network hospital

Insurance companies have a network list of hospitals. In order to avail of a cashless facility, it is imperative to get admitted at any of the hospitals in the insurer’s network. The insurance provider may reject your cashless claim in an event that you are admitted to a non-network hospital. In such a case, however, you may seek reimbursement of the hospital expenses incurred by you. You may submit the original bills, medical reports, and fill the claim form while seeking reimbursement.

5. Claims made on lapsed policies

Your policy may stand lapsed in case you have failed to make premium payment before the due date. Making a claim once your policy has lapsed will mostly result in denial of the filed claims. It is, therefore, necessary to make timely payment of your medical health insurance premiums in order to enjoy uninterrupted benefits of your health policy.

6. Failure to notify the insurer within the stipulated time frame

Your medical health insurance policy states the period within which you must inform the insurance provider of your hospitalization. If the claim has not been brought to the notice of the insurer within the time frame stipulated in the terms and conditions of the policy document, the insurance claim will be rejected. You may, therefore, submit the insurance claim request within the time frame. You may also submit the original hospital bills as well as post-hospitalization expenses if any.

A medical health insurance claim denial may threaten your financial security and the ability to receive medical care. It is, therefore, necessary to identify the possible causes of rejection. Once you are well aware of the possible causes of claim denial, you may follow the guidelines to ensure that your claims are honored.

Tags:

budgeting,

Claims,

Coverage,

economy,

Financial Assistance,

Health Insurance,

Insurance policies,

investments,

Mediclaims,

money,

personal finance,

Premiums,

Returns

March 8, 2018

It’s always a stressful situation whenever you’re bombarded with numerous financial responsibilities at the same time – you know, those instances when your house bills, children’s tuition fee bills, business expenses are piling up on you. This kind of situation might force you to seek for immediate financial refuge, and in this context, a personal loan might just be the most comfortable solution for you to take. There’s nothing wrong in acquiring for a personal loan – that’s your decision and if you, think that this is the only way you can resolve all our financial woes, by all means, go ahead and file for one! However, if this is your first time to apply for a personal loan, there are certain things which you should avoid to make sure that your entire personal loan experience will be hassle-free.

It’s always a stressful situation whenever you’re bombarded with numerous financial responsibilities at the same time – you know, those instances when your house bills, children’s tuition fee bills, business expenses are piling up on you. This kind of situation might force you to seek for immediate financial refuge, and in this context, a personal loan might just be the most comfortable solution for you to take. There’s nothing wrong in acquiring for a personal loan – that’s your decision and if you, think that this is the only way you can resolve all our financial woes, by all means, go ahead and file for one! However, if this is your first time to apply for a personal loan, there are certain things which you should avoid to make sure that your entire personal loan experience will be hassle-free.

Applying for a personal loan requires your time. It entails a lot of processes which you’re required to go through. The entire process is something that you should be careful since it will require resources from you. And to ensure that this process will go as smoothly as possible, stray away from committing any of these mistakes:

● You don’t have the clarity for the purpose of the loan: You might be enticed to apply for a personal loan because it doesn’t require rigorous background checking and it only requires minimal requirements from you. If these are the sole reasons pushing you to get a personal loan, you’re doing it all wrong. You should get a personal loan because you have an immediate financial need – you might be financing your sibling’s studies abroad or you might be saving up for a business. Whatever it is, you should have a clear picture of where the money will be spent on. Sure, personal loans might have low interest rates but you’re still paying more than what you’ve borrowed, that’s why you should be very keen on how and where you should spend your borrowed money.

● You don’t consider your repayment capacity: Once you’ve decided to apply for a personal loan, the only thing you might have in mind is how you will spend your borrowed money. This is normal, and there’s, nothing wrong with that notion but you should also remember that in this process, you’re a borrower and you’re expected to pay a certain amount to your lender. You should think first if you can actually repay the amount you’ve borrowed within the time frame given to you. Don’t borrow an amount which will require you to have significant adjustments in your life. Instead, opt for an amount which you’re confident in repaying from your monthly income.

● You approach too many lenders: While it’s always good to look for possible lenders which you can acquire personal loans, going overboard with this might have negative effects on your credit score. This happens because whenever you approach too many lenders in a short span of time, all of these queries will gradually reduce your credit score. In the eyes of banks and other credit company, you’re now considered as a credit hungry person and that’s not a good thing. Banks and other companies might have the assumption that you don’t know how to manage your finances that’s why you ended up asking help from too many lenders, and this might hinder you from securing approval for your loans in the future.

● You don’t disclose existing loan details: Remember the quote that says, “Honesty is the best policy”? Yep, this one’s still applicable in the financial context. The moment you talk with your lender about your personal loan application, be honest in informing the other party if you have existing loans. This is important because by doing so, you’re giving the lender more reasons to trust you (so it’ll also be easier for them to trust you with their money), and you can make negotiations with your lender regarding your repayment terms to ensure that you can still manage to pay all of your loans on time. But if you decide to mum this information to yourself, you might end up paying higher interest rates or worse, your loan application might be disapproved once the lender learns about this information from other sources.

● You don’t read through the fine print: Not everyone has the patience and the willingness to read through a document which consists of, let’s say, five pages of texts. Yes, it’s something that requires too much time and focus but if you’ve decided to apply for a personal loan in the coming days, you should be able to change your mindset. You should know how important it is to read whatever documents you and the lender might share throughout the entire process. Once you’re handed with any document, take the time to thoroughly read everything – and not just skim through it – and make sure that you understand everything that was written there. If you see terms or charges which are unclear to you, never be hesitant to ask your lender. You might trust the lender but all of your agreements will boil down to your signature, being used in the supporting documents.

● You don’t check your credit report: Your credit report plays a vital role in the approval or disapproval of your personal loan. Since personal loans do not require any collateral before the lender can allow you to borrow a certain amount of money, your credit report might be one of the strongest determinative factors for a lender’s decision. This will be an evidence of whether you have a good credit standing and if you still have enough finances to pay for another loan. If you want your personal loans to be approved, religiously check your credit report and get necessary corrections if needed. You don’t want to check your credit score the moment you apply for a loan as this might delay the entire process, check this for LendingKey reviews.

If the concept of personal loan is still new to you, you might have endless questions of how this works. While personal loans can give you the financial salvation you need right now, you should also be careful in managing it because failure to do so might damage your financial standing in the long run. Since you know what mistakes to avoid when getting a personal loan, you’re now a step closer to securing that seal of approval for your personal loan application!

Tags:

budgeting,

Debts,

economy,

financial planning,

Interest Rates,

loans,

personal finance

February 12, 2018

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

5 key advantages of ULIPs over all conventional life insurance policies:

Identify the right blend of investment

Picking the market entities in the right blend often depends on your investment risk appetite. For those of you that are low-risk takers, investing in debt funds is a good ploy. Likewise the moderate risk-takers can invest in balanced funds, while the high-risk bearers can think of equity funds. Balanced funds are a good option lying between equity funds and debt funds. You’ll be able to switch funds once you gain considerable market outlook.

Investment Flexibility

With an ULIP, you’ll gain the right to invest your entire premium value besides gaining opportunities to allocate additional amounts on the policy. Other investment plans don’t yield so much of flexibility. Depending on your risk appetite and your financial profile, you may choose between these two investment strategies:

Life-Stage Strategy: The years remaining towards your policy maturity and your age help in asset allocation.

Self-Managed Strategy: Your fund choice helps in allocating your money. This option safeguards the financial future of your child even when you aren’t there.

Long term investment

ULIPs prove to be a great option for fulfilling long-term investment goals e.g. launching a start-up, buying your new car, and buying a property. ULIPs are designed to yield more returns and that too for a longer duration; they owe this power to their compounding nature. Even if you decide on quitting the ULIP policies after a period of 5 years, you’ll be amazed to see how much more you’ve saved than what you’d see with other investment options. Your money will grow with a much greater momentum and for a longer duration than how you usually see it grow in your savings bank or with your fixed deposits. All you need to do is to determine the amount of investment with the help of an online premium calculator.

Life coverage

Life insurance companies are only known to offer ULIPs in the form of a product. Besides yielding financial protection, ULIPs are known to fulfill your investment needs. Compared to a term plan, the life cover attached to ULIPs may be smaller but they do come with life cover. When it comes to fulfilling your financial goals in the long run, ULIPs constitute a strong investment opportunity. Prior to investing in ULIPs, you must check out the performance of all individual funds in great details. This is likely to provide more insight into investment options with quality returns.

Tax Rebates

Tax benefits aren’t always attached to investment option that you come across in the market. ULIPs come with a combination of tax benefits and life coverage. Under section 80C of the Income Tax Act, you’ll be entitled to receive tax rebates on all paid up premiums. Likewise, all of the payouts that you receive are entitled to tax exemption under section 10D. Besides seeing your money grow, you’ll be happy with how much you’ll save in the end.

Tags:

banks,

Debts,

Financial Assistance,

Funds,

Income Tax,

insurance,

investments,

money,

personal finance,

Premiums,

Stocks

January 27, 2018

Irrespective of an ever-changing economic climate, some currency pairs will always be more appealing than others. This is because popularity and size of the market dictate what pairs are frequently traded. High liquidity and low spreads attract a higher number of traders.

Irrespective of an ever-changing economic climate, some currency pairs will always be more appealing than others. This is because popularity and size of the market dictate what pairs are frequently traded. High liquidity and low spreads attract a higher number of traders.

The G10 are the world’s most liquid currencies. These are the US dollar, the euro, the Japanese yen, the British pound, the Swiss franc, the Australian dollar, the New Zealand dollar and Canadian dollar, the Swedish krona and the Norwegian krona. Traders regularly buy and sell these currencies, making them the most traded currencies in the world. From here, let’s consider the best currency pair to trade.

EUR/USD

As you might expect, the trading of the world’s two largest currencies would be popular, as a result of its stability and liquidity. It’s a safe bet particularly for beginners, the pair is unaffected by other trades and is not considered volatile. The predictable nature of the way this pair trades, benefits strategists and newcomers alike. The high levels of liquidity mean that this pair often has a tight spread, meaning low trading costs. These low spreads can be taken advantage of by scalpers.

GBP/USD

The aforementioned benefits of EUR/USD are also relevant for GBP/USD. It is liquid, relatively stable and predictable, although slightly less so than EUR/USD. Generally speaking, the similarities continue for performance, the two pairs tend to move in a similar manner, although Brexit developments can impact on this GBP/USD, which have made it more unpredictable than the euro over the past year or so. Beginners are usually advised to not trade both GDP/USD and EUR/USD simultaneously.

Risk Off Sentiment

When market sentiment is negative, investors tend to seek safety in currencies which are traditionally seen as safe havens. The two main safe haven currencies are the Swiss Franc (CHF) and the Japanese yen (JPY). Therefore, when considering which currency pairs are the best to trade, it is also worth considering the trading environment that you are trading in. If it is a risk off environment, where the market is responding negatively to a particular event, then USD/CHF and USD/ JPY could be the best to trade. You could expect USD/CHF and USD/JPY to move lower when investors are searching for safe havens.

Commodity Currencies

Commodity currencies are currencies that move in line with the world’s primary commodity prices. They are Australian dollar, New Zealand dollar and the Canadian dollar. They co-move with a particular commodity price because of these countries heavy dependency on the export of a certain raw material for income. If you are interested in commodity prices, the currencies could be the best to trade.

Which broker?

There are many different currency pairs to trade, depending on your personal preferences and interests. There are also many different brokers through which to chose to trade. However, it is important to choose a broker which provides first rate pricing and execution.

Vantage FX is an award winning Australian broker. It is a true ECN broker meaning that its pricing is inline with that of top institutions and it receives liquidity from the likes of JP Morgan, HSBC, Citibank and RBS to name but a few. Execution at Vantage FX is among the best in the industry meaning you have best chance of making your trade a winning trade.

Tags:

Business,

economy,

financial planning,

income,

investments,

money,

Trade,

Trading

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

Recent Comments