December 18, 2018

Owning a home is one of the biggest dreams of almost every adult, especially when they have a family. Mortgage arrangements come in handy to make this desire a reality. Nevertheless, homeowners are left with another big question on their minds: What strategies can I employ to pay off my mortgage as quickly as possible? Well, it is natural to want to be free of any debt commitments, and to know that you own your home and that no one has a claim on it. This is because owning a home will allow you to work on other financial goals, like saving for retirement, saving for your children’s education, and so on.

Owning a home is one of the biggest dreams of almost every adult, especially when they have a family. Mortgage arrangements come in handy to make this desire a reality. Nevertheless, homeowners are left with another big question on their minds: What strategies can I employ to pay off my mortgage as quickly as possible? Well, it is natural to want to be free of any debt commitments, and to know that you own your home and that no one has a claim on it. This is because owning a home will allow you to work on other financial goals, like saving for retirement, saving for your children’s education, and so on.

Paying off your mortgage in a shorter period is not too difficult or unachievable, but it calls for slight adjustments in your payment plan, or changing a few things in your mortgage terms. Here are some things you can do:

Increase the frequency of your regular repayments

The normal terms are monthly payments, but you can choose bi-weekly or weekly payments. Such an arrangement will significantly enable you to save on interest and it will set you free from mortgage sooner than if you only do it monthly. The goal is to make more monthly payments each year without realizing it.

Go for the shortest amortization period and the biggest repayment amount you can afford

Opting for a larger monthly payment, which means it will be paid off quicker, will cause you to consider it as a budget item, thereby shaving several years off your mortgage. While still clearing out your mortgage, a good and consistent mortgage repayment history will enhance your credit score, because mortgage is one of the trade lines (credit accounts) that contributes to your score. You can work with experts to boost your credit score to access more credit at better rates. You need not look further than https://www.boostcredit101.com/ to boost your score and find more advice.

Increase your monthly payment amount when possible

If you have had a mortgage for some time, you have most likely set a plan to make uniform payments each month. It is time you consider increasing the amount, if you can manage. Additionally, if you have experienced an increase in your income, be it from a new job, a pay raise, or any other source, it would be prudent to increase your mortgage payment with the increased income.

Pay lump sum amounts

Mortgage arrangements come with some privileges or additional options that the borrower can use to their advantage. For example, any chance to make lump sum payments should be utilized, especially an annual lump sum payment, against the mortgage. Based on the options you choose for your mortgage, you can pay amounts equal to 10%, 15%, or 20% of the initial principal figure of your mortgage at any time for each year of the mortgage term.

Diversify your mortgage

You need to weigh the various options and choose the mortgage arrangement that offers savings and flexibility.

Conclusion

It is such a relief to pay off your mortgage as fast as possible; thus, you need to work out how to save on other things and repay your mortgage in larger, more frequent payments. Also, you should do lump sum payments when possible.

Tags:

Debts,

economy,

Interest Rates,

loans,

money,

mortgage real estate,

Mortgages,

personal finance,

real estate

April 13, 2018

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

You dream of owning a great home to suit your taste and needs. However, this may have to cost you quite a lot of money. It therefore means that there will be alterations in your current spending or savings. Well, the way you will budget for a new home is dependent on several factors. It will depend on whether you are planning to own the first home, meaning you want to move from a rented house to your own home, or if you want to move from a first house to a dream home.

Whichever level you are at, there are several factors that will determine how much you budget for a new home. These factors include;

• Your earning– It could be your personal earning, or yours and that of your spouse if you plan to jointly buy a home.

• The Location of your home – Where exactly do you want to live? Some estates are more expensive than others.

• The size of your dream home- This may also include the size of the house as well as the land on which the house will sit on.

• How long you want to pay for it – If you want credit for a shorter time, then you may have to choose a cheaper home and vice versa.

After considering these factors, then it is time to come up with a real budget for your home. Remember that it is your own home, a treasure for yourself to take pride and find comfort in. Therefore, take time to budget for the best. Below are basic steps towards getting a perfect budget for your home:

1. Get informed

Be sure to visit a real estate and property development company, to get the available options in terms of different properties available in the market and their value as they have a better understanding.

2. Timing

Decide the exact day that you want to move to your new home. Do not wish for a particular time span when you want to move to the new home, say like in the next three months, but rather set a specified target date.

3. Calculate how much you can afford

Use a mortgage calculator to determine exactly how much you can afford to pay monthly.

If you are cost sharing a mortgage;

• Open a money market account or an alternative of a high-interest savings account. Ensure the Federal Deposit Insurance Corporation guarantees your money.

• For every month, deposit the total money (two halves if you are two) to the savings account monthly. Deposit the money until the date for moving in is due. Spend the money to pay for your new home.

4. Reduce your spending

In order to do this, you need to be realistic by spending less than you earn. Make a plan and stick to it. For example, you may realize that you don’t need to live in that two bedroom apartment especially if you don’t have kids. Therefore moving to a one bedroom apartment may save up to around 30% of your expenses which you could channel towards home ownership.

5. Increase your earnings

While most people believe in spending less to save, I think working that extra job is a sure way of increasing your savings. Take up any money making opportunity that comes your way. You could also opt to get a second job as a side hustle to top up your main source of income.

Conclusion

To succeed in owning a new home, you may have to forego some expenses, however small they may seem. These may include your daily cup of coffee which may cost $5 but accumulates to $150 in a month.

As much as you are looking towards owning the best home, be careful so that you do not strain so much that you will have to compromise on basic needs such as food.

While owning a home may seem a hard process that requires a lot of sacrifices, at the end of the day, it is worth it, so go for it!

Tags:

budgeting,

Debts,

financial planning,

home loans,

Interest Rates,

money,

Mortgages,

personal finance,

real estate,

savings

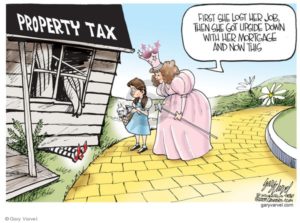

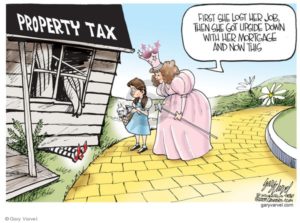

October 21, 2017

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

October 20, 2017

We always try to increase our assets. If we are earning more than we also save more. Sometimes we are investing in gold; we are purchasing new bonds even we are investing in stock market. But I have observed that people love to purchase new land or will increase their property. Here a real estate agency takes place.

We always try to increase our assets. If we are earning more than we also save more. Sometimes we are investing in gold; we are purchasing new bonds even we are investing in stock market. But I have observed that people love to purchase new land or will increase their property. Here a real estate agency takes place.

Now many business houses expanding their business in real estate so we are finding more real estate projects everywhere. Even these real estate agencies are giving more offers to their clients. Every country has their different real estate laws. While choosing your real estate company you can take guidance from your financial advisor regarding where to go & how. Following are the points which you need to keep in mind & I am sure these points will help you.

1. Market reputation

While choosing your real estate agency for new apartment or property you need to check what market reputation your agency has. If that real estate company is very new in the market try to avoid those companies. Go with the experienced one.

2. Previous completed projects

When you will select the experienced agency then check their previous completed projects. Check how many clients they have got for the same. Is all their created properties have been sold or not. If possible go to that completed projects & check how those are.

3. Take existing clients feedback

When you will visit to the live completed projects try to talk with their existing clients who has purchased from that real estate agency. Existing customers can give the actual views about their business because they have experienced their created properties.

4. About their competitors

Every business does have their competitors. Real estate business does have more competitors in terms of this. So, check your agencies competitors, if they are also big then go for this company. It means your agency do have some good position in this field.

5. Your specifications

While searching for your property you can set your specifications or expectations earlier. This will help your real estate agency to find the ideal property or apartment for you. If you want beach properties then specify your requirements. Here I can strike an example, recently I have visited Florida, USA & there I have found many rich beach side properties like Icon south beach, Aria on the bay, Santa maria brickell, Icon brickell etc. If you are the citizen of Florida & looking for beach property then you can search in this manner. I am sure you will get the ideal one as per your needs. In the same way you can search in the other countries also.

Before concluding the matter would like to tell you that think twice before you just jump for any real estate company because this would be a long term investment for you & the investment amount is also huge here. So, take proper assistance from your financial advisor & then go ahead. These real estate investments not only increase our property/assets it also includes more comfort in our life if your property or apartments are like that. Finally good luck from my end I hope these information will help you somewhere.

Tags:

Assets,

economy,

Financial Assistance,

investments,

Laws,

money,

Mortgages,

Property,

real estate

September 5, 2017

People underestimate the importance of property investments within estate planning until it’s too late. Estate planning is your declaration after you pass away. You may not want your family to receive money and other assets you intended for your wife and children. Molly McCollough found out how essential property investment within estate planning is the hard way.

People underestimate the importance of property investments within estate planning until it’s too late. Estate planning is your declaration after you pass away. You may not want your family to receive money and other assets you intended for your wife and children. Molly McCollough found out how essential property investment within estate planning is the hard way.

Meet Molly

Molly McCollough is a 54 year old woman who is the founder of Theature Company. Molly thought she and her husband has everything figured out. They never thought they needed life insurance or a strategy for financial planning because they were married and didn’t have children, so everything would be left to Molly. After her husband, Joe died, Molly found out being his wife didn’t carry much weight in collecting his estate.

The Issue

Molly’s husband didn’t have a will, and the money he left behind was in a foreign bank account that did not have her name on it. Because Molly’s name was not on any of the accounts, she didn’t have access to anything.

Molly was afraid and mourning the death of her husband. Molly needed to figure out a way to gain access to his estate before his family tried to claim any part of the estate. Molly felt her husband was hiding secrets, and she didn’t know where to turn or who she could trust.

Molly said, “There’s just something about death and greed and money and long-buried resentment that bubbles to the surface when there’s any substantial inheritance. It tears families apart. People lie and steal and cheat.” In her situation, she was right. Joe’s family did just what Molly hoped they wouldn’t. They came and took all of his estate and left her with nothing. Inheritance drama is something no one wants to deal with and it can cause years of frustration, and put a rift between families.

Life insurance, financial planning, and estate planning are things you need to discuss with your partner before it’s too late. Make sure you and your partner have a will whether you have children or not. If these things are not in place before you pass away, the state will do what they see fit, and most of the time, it’s not what you wanted.

The Solution

At Unified Lawyers, we work tirelessly to help people who don’t understand wills, trusts, estate planning, and similar assets. We understand the urgency in these situations and always put our best foot forward. We are not a traditional law firm. We believe in helping people instead of collecting a check. All our fees and costs are straightforward so each of our clients know how every cent of their money was spent. We are here to help you get your situation resolved.

Tags:

Assets,

Business,

economy,

financial planning,

home loans,

Interest Rates,

investments,

money,

Mortgages,

Property,

real estate

Owning a home is one of the biggest dreams of almost every adult, especially when they have a family. Mortgage arrangements come in handy to make this desire a reality. Nevertheless, homeowners are left with another big question on their minds: What strategies can I employ to pay off my mortgage as quickly as possible? Well, it is natural to want to be free of any debt commitments, and to know that you own your home and that no one has a claim on it. This is because owning a home will allow you to work on other financial goals, like saving for retirement, saving for your children’s education, and so on.

Owning a home is one of the biggest dreams of almost every adult, especially when they have a family. Mortgage arrangements come in handy to make this desire a reality. Nevertheless, homeowners are left with another big question on their minds: What strategies can I employ to pay off my mortgage as quickly as possible? Well, it is natural to want to be free of any debt commitments, and to know that you own your home and that no one has a claim on it. This is because owning a home will allow you to work on other financial goals, like saving for retirement, saving for your children’s education, and so on.

Recent Comments