March 9, 2018

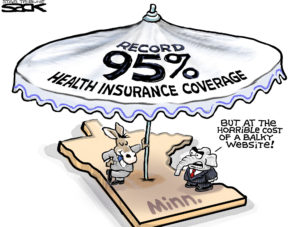

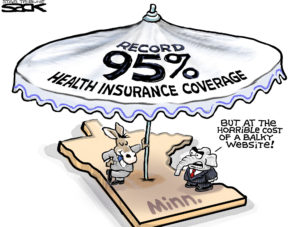

In this time of rising medical inflation, investing in a medical insurance policy has become the need of the hour. The benefits of a health care plan indeed out weigh the cost. Many individuals, therefore, invest in a health care policy to enjoy financial protection in case of a medical emergency.

In this time of rising medical inflation, investing in a medical insurance policy has become the need of the hour. The benefits of a health care plan indeed out weigh the cost. Many individuals, therefore, invest in a health care policy to enjoy financial protection in case of a medical emergency.

You may either opt for a reimbursement of the medical expenses incurred by you, or you may file a cashless claim. Though the procedure for filing a claim is quick and hassle-free, sometimes it may get rejected.

Following are six major reasons why your health insurance claim may be denied.

1. Providing inaccurate or incomplete details

One of the reasons for denial of the claim is a failure to furnish complete or accurate details. These details may pertain to your health condition, pre-existing conditions, or nature of employment, among others. Since these factors are crucial in helping the insurance provider to determine your eligibility and premium, they may deny the claim if they find out that crucial information has been withheld or if facts have been misrepresented.

2. Seeking claims for exclusions

Most medical health insurance plans come with a list of diseases and ailments that are beyond the scope of coverage. Making a claim for any conditions or ailments in the exclusion list will fail to qualify for coverage and hence the claim will be rejected.

3. Making a claim during the waiting period

Waiting period refers to the specified time frame that you must wait for, before beginning to enjoy benefits of the policy. This is the period during which pre-specified illnesses are not covered by your policy. Hence, making any health insurance claim during the waiting period will result in it being rejected.

4. Admission to a non-network hospital

Insurance companies have a network list of hospitals. In order to avail of a cashless facility, it is imperative to get admitted at any of the hospitals in the insurer’s network. The insurance provider may reject your cashless claim in an event that you are admitted to a non-network hospital. In such a case, however, you may seek reimbursement of the hospital expenses incurred by you. You may submit the original bills, medical reports, and fill the claim form while seeking reimbursement.

5. Claims made on lapsed policies

Your policy may stand lapsed in case you have failed to make premium payment before the due date. Making a claim once your policy has lapsed will mostly result in denial of the filed claims. It is, therefore, necessary to make timely payment of your medical health insurance premiums in order to enjoy uninterrupted benefits of your health policy.

6. Failure to notify the insurer within the stipulated time frame

Your medical health insurance policy states the period within which you must inform the insurance provider of your hospitalization. If the claim has not been brought to the notice of the insurer within the time frame stipulated in the terms and conditions of the policy document, the insurance claim will be rejected. You may, therefore, submit the insurance claim request within the time frame. You may also submit the original hospital bills as well as post-hospitalization expenses if any.

A medical health insurance claim denial may threaten your financial security and the ability to receive medical care. It is, therefore, necessary to identify the possible causes of rejection. Once you are well aware of the possible causes of claim denial, you may follow the guidelines to ensure that your claims are honored.

Tags:

budgeting,

Claims,

Coverage,

economy,

Financial Assistance,

Health Insurance,

Insurance policies,

investments,

Mediclaims,

money,

personal finance,

Premiums,

Returns

March 8, 2018

It’s always a stressful situation whenever you’re bombarded with numerous financial responsibilities at the same time – you know, those instances when your house bills, children’s tuition fee bills, business expenses are piling up on you. This kind of situation might force you to seek for immediate financial refuge, and in this context, a personal loan might just be the most comfortable solution for you to take. There’s nothing wrong in acquiring for a personal loan – that’s your decision and if you, think that this is the only way you can resolve all our financial woes, by all means, go ahead and file for one! However, if this is your first time to apply for a personal loan, there are certain things which you should avoid to make sure that your entire personal loan experience will be hassle-free.

It’s always a stressful situation whenever you’re bombarded with numerous financial responsibilities at the same time – you know, those instances when your house bills, children’s tuition fee bills, business expenses are piling up on you. This kind of situation might force you to seek for immediate financial refuge, and in this context, a personal loan might just be the most comfortable solution for you to take. There’s nothing wrong in acquiring for a personal loan – that’s your decision and if you, think that this is the only way you can resolve all our financial woes, by all means, go ahead and file for one! However, if this is your first time to apply for a personal loan, there are certain things which you should avoid to make sure that your entire personal loan experience will be hassle-free.

Applying for a personal loan requires your time. It entails a lot of processes which you’re required to go through. The entire process is something that you should be careful since it will require resources from you. And to ensure that this process will go as smoothly as possible, stray away from committing any of these mistakes:

● You don’t have the clarity for the purpose of the loan: You might be enticed to apply for a personal loan because it doesn’t require rigorous background checking and it only requires minimal requirements from you. If these are the sole reasons pushing you to get a personal loan, you’re doing it all wrong. You should get a personal loan because you have an immediate financial need – you might be financing your sibling’s studies abroad or you might be saving up for a business. Whatever it is, you should have a clear picture of where the money will be spent on. Sure, personal loans might have low interest rates but you’re still paying more than what you’ve borrowed, that’s why you should be very keen on how and where you should spend your borrowed money.

● You don’t consider your repayment capacity: Once you’ve decided to apply for a personal loan, the only thing you might have in mind is how you will spend your borrowed money. This is normal, and there’s, nothing wrong with that notion but you should also remember that in this process, you’re a borrower and you’re expected to pay a certain amount to your lender. You should think first if you can actually repay the amount you’ve borrowed within the time frame given to you. Don’t borrow an amount which will require you to have significant adjustments in your life. Instead, opt for an amount which you’re confident in repaying from your monthly income.

● You approach too many lenders: While it’s always good to look for possible lenders which you can acquire personal loans, going overboard with this might have negative effects on your credit score. This happens because whenever you approach too many lenders in a short span of time, all of these queries will gradually reduce your credit score. In the eyes of banks and other credit company, you’re now considered as a credit hungry person and that’s not a good thing. Banks and other companies might have the assumption that you don’t know how to manage your finances that’s why you ended up asking help from too many lenders, and this might hinder you from securing approval for your loans in the future.

● You don’t disclose existing loan details: Remember the quote that says, “Honesty is the best policy”? Yep, this one’s still applicable in the financial context. The moment you talk with your lender about your personal loan application, be honest in informing the other party if you have existing loans. This is important because by doing so, you’re giving the lender more reasons to trust you (so it’ll also be easier for them to trust you with their money), and you can make negotiations with your lender regarding your repayment terms to ensure that you can still manage to pay all of your loans on time. But if you decide to mum this information to yourself, you might end up paying higher interest rates or worse, your loan application might be disapproved once the lender learns about this information from other sources.

● You don’t read through the fine print: Not everyone has the patience and the willingness to read through a document which consists of, let’s say, five pages of texts. Yes, it’s something that requires too much time and focus but if you’ve decided to apply for a personal loan in the coming days, you should be able to change your mindset. You should know how important it is to read whatever documents you and the lender might share throughout the entire process. Once you’re handed with any document, take the time to thoroughly read everything – and not just skim through it – and make sure that you understand everything that was written there. If you see terms or charges which are unclear to you, never be hesitant to ask your lender. You might trust the lender but all of your agreements will boil down to your signature, being used in the supporting documents.

● You don’t check your credit report: Your credit report plays a vital role in the approval or disapproval of your personal loan. Since personal loans do not require any collateral before the lender can allow you to borrow a certain amount of money, your credit report might be one of the strongest determinative factors for a lender’s decision. This will be an evidence of whether you have a good credit standing and if you still have enough finances to pay for another loan. If you want your personal loans to be approved, religiously check your credit report and get necessary corrections if needed. You don’t want to check your credit score the moment you apply for a loan as this might delay the entire process, check this for LendingKey reviews.

If the concept of personal loan is still new to you, you might have endless questions of how this works. While personal loans can give you the financial salvation you need right now, you should also be careful in managing it because failure to do so might damage your financial standing in the long run. Since you know what mistakes to avoid when getting a personal loan, you’re now a step closer to securing that seal of approval for your personal loan application!

Tags:

budgeting,

Debts,

economy,

financial planning,

Interest Rates,

loans,

personal finance

February 12, 2018

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

The money market will provide you with investment instruments like ULIPs that come with a fair combination of investment and life coverage at once. The premium that you pay for ULIPs are segregated into 2 parts; one portion goes towards investment instruments present in the money market, while the other one goes towards meeting your risk coverage on life. There are a few inherent benefits attached to ULIPs.

5 key advantages of ULIPs over all conventional life insurance policies:

Identify the right blend of investment

Picking the market entities in the right blend often depends on your investment risk appetite. For those of you that are low-risk takers, investing in debt funds is a good ploy. Likewise the moderate risk-takers can invest in balanced funds, while the high-risk bearers can think of equity funds. Balanced funds are a good option lying between equity funds and debt funds. You’ll be able to switch funds once you gain considerable market outlook.

Investment Flexibility

With an ULIP, you’ll gain the right to invest your entire premium value besides gaining opportunities to allocate additional amounts on the policy. Other investment plans don’t yield so much of flexibility. Depending on your risk appetite and your financial profile, you may choose between these two investment strategies:

Life-Stage Strategy: The years remaining towards your policy maturity and your age help in asset allocation.

Self-Managed Strategy: Your fund choice helps in allocating your money. This option safeguards the financial future of your child even when you aren’t there.

Long term investment

ULIPs prove to be a great option for fulfilling long-term investment goals e.g. launching a start-up, buying your new car, and buying a property. ULIPs are designed to yield more returns and that too for a longer duration; they owe this power to their compounding nature. Even if you decide on quitting the ULIP policies after a period of 5 years, you’ll be amazed to see how much more you’ve saved than what you’d see with other investment options. Your money will grow with a much greater momentum and for a longer duration than how you usually see it grow in your savings bank or with your fixed deposits. All you need to do is to determine the amount of investment with the help of an online premium calculator.

Life coverage

Life insurance companies are only known to offer ULIPs in the form of a product. Besides yielding financial protection, ULIPs are known to fulfill your investment needs. Compared to a term plan, the life cover attached to ULIPs may be smaller but they do come with life cover. When it comes to fulfilling your financial goals in the long run, ULIPs constitute a strong investment opportunity. Prior to investing in ULIPs, you must check out the performance of all individual funds in great details. This is likely to provide more insight into investment options with quality returns.

Tax Rebates

Tax benefits aren’t always attached to investment option that you come across in the market. ULIPs come with a combination of tax benefits and life coverage. Under section 80C of the Income Tax Act, you’ll be entitled to receive tax rebates on all paid up premiums. Likewise, all of the payouts that you receive are entitled to tax exemption under section 10D. Besides seeing your money grow, you’ll be happy with how much you’ll save in the end.

Tags:

banks,

Debts,

Financial Assistance,

Funds,

Income Tax,

insurance,

investments,

money,

personal finance,

Premiums,

Stocks

January 20, 2018

On January 14, you must have seen the skies filled with colorful kites soaring high up. Makar Sankranti falls on the day when the sun leaves the tropic of Cancer towards the tropic of Capricorn, which is called Makar in India.

On January 14, you must have seen the skies filled with colorful kites soaring high up. Makar Sankranti falls on the day when the sun leaves the tropic of Cancer towards the tropic of Capricorn, which is called Makar in India.

In other parts of the country, this festival is referred to as Poush Sankranti, Pongal, and Uttarayan. Farmers celebrate this day as it marks the end of the winter and ushers in the harvesting season.

Significance of kite flying on Makar Sankranti

Sankranti means movement and kite flying represents the thankful attitude of humans for this movement. It also has a scientific significance. As the sun commences its journey towards the tropic of Capricorn, it emanates useful rays. When you fly kites on this day, you expose yourself to the beneficial sunrays that have medicinal advantages.

Although Makar Sankranti is over, it is essential that you know about several important lessons this auspicious festival teaches as these teachings may prove to be beneficial during financial planning. Listed below are six important lessons this festival teaches you.

1. Be ready for movement

When you undertake investment planning, you have to understand that it is not a static one-time procedure but requires constant movement. You need to continuously monitor the performance of your long-term investments and make modifications when necessary. Additionally, you need to review and analyze market conditions to identify good opportunities that offer economic advantages to your investment portfolio. When you consider different financial instruments, it is crucial you consider your investment objectives to make the right decisions. This customization of your investment portfolio is comparable to personalizing your kite that has the perfect string which allows it to soar high in the clear skies.

2. Keep your eyes on your portfolio

When you fly your kite on Makar Sankranti, it is important to keep your eyes on it at all times. You must always be aware of how your kite is flying and in which direction. Similarly, prudent financial planning requires that you keep an eye on the performance of your investment portfolio. The performance of the various financial instruments must be in line with your short, medium, and long-term goals.

3. Maintain flexibility

As you fly your kite, you need the string to be kept flexible. This allows your kite to continue soaring amidst gusts of strong winds. This is true even with your short-term and long-term investments. Their performance will not always be the same and there may be ups and downs. Furthermore, the investment environment is not always conducive because conditions are never perfect. There is a possibility that your portfolio may be in the red. You need to ride out the difficult times and remain patient. It is crucial you are flexible and willing to bear temporary losses in the short-term to reap long-term benefits. However, you must never lose sight of your investment objectives and make modifications that become necessary under changing environments.

4. Adequate safety

To ensure you do not injure yourself, you cover your fingers with tapes and bandages while flying a kite. Similarly, you need to ensure adequate security when investing in any financial product. You must protect your investments from significant market conditions.

5. Remain invested

When you fly your kite on Makar Sankranti, you stand the entire day to make gains. Similarly, when you invest in different financial instruments, it is important to remain invested for a longer period. It is said that time in the market is better than timing the market. Therefore, to maximize your gains through investments, it is recommended you hold these for a longer time.

6. Strike the right balance

During winters, days are short and nights are long and vice versa during the summers. However, on Makar Sankranti, the day and night are of an equal length. Just like that, when you invest, you must aim for the right balance between your risks and returns. You must choose financial products that suit your risk appetite while delivering decent returns on your investments.

Striking the right balance between risk and return requires adequate research and effective planning. You need to study the market conditions and understand the features of different financial instruments. This may not be an easy task especially if you are new to investing or have no experience in conducting such analyses.

Through the proprietary ARQ investment engine in Angel Wealth’s mobile application, you can achieve this balance. This engine uses algorithms and quants to analyze a billion data points and offers recommendations that suit your financial objectives and risk appetite. There is no human intervention in the entire procedure ensuring the recommendations are completely unbiased.

Download the Angel Wealth mobile app and apply the lessons learned from Makar Sankranti into practice.

Tags:

banking,

budgeting,

economy,

financial planning,

Funding,

investments,

money,

Mutual Funds,

personal finance,

savings

January 10, 2018

Exchange Traded Funds (ETFs) are a great way to build an effective retirement portfolio through your Roth IRA or IRA contributions due to their low expense ratios. ETFs offer investors exposure to a diverse set of assets. They are currently one of the fastest growing investment products in the world due to the low expense ratio and their high diversification. ETFs can be traded through virtually every big-name brokerage available. Brokerages oftentimes will partner with ETF providers to offer free-commission on ETF trading, which helps you save even more money on expenses!

Exchange Traded Funds (ETFs) are a great way to build an effective retirement portfolio through your Roth IRA or IRA contributions due to their low expense ratios. ETFs offer investors exposure to a diverse set of assets. They are currently one of the fastest growing investment products in the world due to the low expense ratio and their high diversification. ETFs can be traded through virtually every big-name brokerage available. Brokerages oftentimes will partner with ETF providers to offer free-commission on ETF trading, which helps you save even more money on expenses!

ETFs are effectively mutual funds, but trade like any other stocks. When you purchase a single ETF share, you gain access to an entire index such as the S&P 500 or the Dow 30. Or, investors can purchase market segments (e.g., financial, industrial or healthcare sectors) within a given country. Thus, making them a highly efficient investment tool. The substantial growth in the ETF market has led to a number of new, distinct ETF products such as the MSCI All Country World Minimum Volatility Index or the Dow Jones EPAC Select Dividend Index. The Dow Jones EPAC Select Dividend Index provides great dividend growth income and that can be reinvested or used as cash flow for other investment products.

Here are main benefits in investing in ETFs:

1. Flexibility: With a number of distinct indexes and options, individuals with retirement accounts can trade commission-free AND can obtain exposure to countries all over the world. If you choose, investors are able to gain exposure to the entire world if you sure please. In addition, ETFs offer the flexibility to be traded as a stock for a market price.

2. Cost Efficiency: ETFs based on indexes are in one transaction that trade all components of the underlying index. Investors are usually not charged any entry or exit fees and management fees are substantially lower than mutual funds. For example, ETFs expense ratio are usually around 0.1 – 0.8% whereas mutual funds are about 1.40%

3. Transparency: ETFs are transparent due to the fact that they list on regulated markets and track transparent indices. The ETFs are traded through the day and there are highly competitive bid/ask prices provided by market makers ensuring ample liquidity.

ETFs are really a simple form of mutual funds and can be used in a variety of ways. If you start investing early in a set of 3-4 mutual funds that offer differentiating diversification, you will be in a great position for retirement. Investors should set aside a predetermined amount of capital each month to purchase ETFs. Given their low expense ratios and flexibility, investors can sleep well at night knowing that their money is being put to good use and is generating income while they are enjoying life.

ETFs are not a guaranteed investment. Be patient with the market and continue to purchase additional ETF shares regardless. The old saying is: “I would prefer my time in the market rather than timing the market.”

Millionaire Mob is a former investment banker that hopes to offer fair value on Wall Street while traveling the world. I enjoy helping others in achieving financial freedom whether that is through dividend growth investing, passive income techniques or travel rewards strategies.

Tags:

budgeting,

economy,

financial planning,

investments,

money,

personal finance,

Retirement,

savings

In this time of rising medical inflation, investing in a medical insurance policy has become the need of the hour. The benefits of a health care plan indeed out weigh the cost. Many individuals, therefore, invest in a health care policy to enjoy financial protection in case of a medical emergency.

In this time of rising medical inflation, investing in a medical insurance policy has become the need of the hour. The benefits of a health care plan indeed out weigh the cost. Many individuals, therefore, invest in a health care policy to enjoy financial protection in case of a medical emergency.

Recent Comments