January 27, 2018

Irrespective of an ever-changing economic climate, some currency pairs will always be more appealing than others. This is because popularity and size of the market dictate what pairs are frequently traded. High liquidity and low spreads attract a higher number of traders.

Irrespective of an ever-changing economic climate, some currency pairs will always be more appealing than others. This is because popularity and size of the market dictate what pairs are frequently traded. High liquidity and low spreads attract a higher number of traders.

The G10 are the world’s most liquid currencies. These are the US dollar, the euro, the Japanese yen, the British pound, the Swiss franc, the Australian dollar, the New Zealand dollar and Canadian dollar, the Swedish krona and the Norwegian krona. Traders regularly buy and sell these currencies, making them the most traded currencies in the world. From here, let’s consider the best currency pair to trade.

EUR/USD

As you might expect, the trading of the world’s two largest currencies would be popular, as a result of its stability and liquidity. It’s a safe bet particularly for beginners, the pair is unaffected by other trades and is not considered volatile. The predictable nature of the way this pair trades, benefits strategists and newcomers alike. The high levels of liquidity mean that this pair often has a tight spread, meaning low trading costs. These low spreads can be taken advantage of by scalpers.

GBP/USD

The aforementioned benefits of EUR/USD are also relevant for GBP/USD. It is liquid, relatively stable and predictable, although slightly less so than EUR/USD. Generally speaking, the similarities continue for performance, the two pairs tend to move in a similar manner, although Brexit developments can impact on this GBP/USD, which have made it more unpredictable than the euro over the past year or so. Beginners are usually advised to not trade both GDP/USD and EUR/USD simultaneously.

Risk Off Sentiment

When market sentiment is negative, investors tend to seek safety in currencies which are traditionally seen as safe havens. The two main safe haven currencies are the Swiss Franc (CHF) and the Japanese yen (JPY). Therefore, when considering which currency pairs are the best to trade, it is also worth considering the trading environment that you are trading in. If it is a risk off environment, where the market is responding negatively to a particular event, then USD/CHF and USD/ JPY could be the best to trade. You could expect USD/CHF and USD/JPY to move lower when investors are searching for safe havens.

Commodity Currencies

Commodity currencies are currencies that move in line with the world’s primary commodity prices. They are Australian dollar, New Zealand dollar and the Canadian dollar. They co-move with a particular commodity price because of these countries heavy dependency on the export of a certain raw material for income. If you are interested in commodity prices, the currencies could be the best to trade.

Which broker?

There are many different currency pairs to trade, depending on your personal preferences and interests. There are also many different brokers through which to chose to trade. However, it is important to choose a broker which provides first rate pricing and execution.

Vantage FX is an award winning Australian broker. It is a true ECN broker meaning that its pricing is inline with that of top institutions and it receives liquidity from the likes of JP Morgan, HSBC, Citibank and RBS to name but a few. Execution at Vantage FX is among the best in the industry meaning you have best chance of making your trade a winning trade.

Tags:

Business,

economy,

financial planning,

income,

investments,

money,

Trade,

Trading

January 25, 2018

Banks and a limited number of high street forex brokers ruled the remittance market until the turn of the last century, giving individuals and small businesses little to no value for money. Now, just about everyone can get access to competitive exchange rates, mainly because a number of companies specialize in this realm alone. How, though, do you select the right money transfer company?

Banks and a limited number of high street forex brokers ruled the remittance market until the turn of the last century, giving individuals and small businesses little to no value for money. Now, just about everyone can get access to competitive exchange rates, mainly because a number of companies specialize in this realm alone. How, though, do you select the right money transfer company?

Supported Currencies and Countries

What good is a money transfer company if it does not support your desired currencies or countries? Start by determining if the company you shortlist supports both the countries and currencies in question. For example, while Transfer Wise and World First support most countries and currencies, Azimo lets you register only from a European country, and InstaReM operates mainly in Australasia.

Cost Effectiveness

Do not get carried away by great exchange rates because how much you pay as fees also requires your attention. An easy way to determine the most cost-effective alternative is to look at how much money the recipient will receive at the end of the transfer.

Transfer Methods and Speed

Transfers to bank accounts can take one to seven working days, depending on where you live, the destination country, and the company you select. If you’re in a hurry to send money overseas, a better bet is to look for companies that operate out of physical locations or have tie-ups with agents. Some companies that allow transfers to cash pickup locations include Azimo, Western Union, and MoneyGram. Bear in mind that these transfers tend to cost more than transfers to bank accounts.

Payment Methods

Just about every overseas money transfer company lets you pay through bank account transfers. Some let you pay using debit and credit cards. You can also find companies that accept payments via region specific methods such as ACH, SOFORT, and POLi.

Trustworthiness

An easy way to determine if a company is trustworthy is to check if it is registered with and regulated by relevant regulatory bodies. Depending on where the company is based out of, it may be registered with the UK Financial Conduct Authority (FCA), the U.S. Financial Crimes Enforcement Network (FinCEN), the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), or the Australian Securities and Investments Commission (ASIC).

Keeping Track

Once you initiate a transfer, keeping track of its progress should be simple. Good money transfer companies let you track your transfers through their websites or through apps designed for mobile devices.

Customer Service

The top players provide local phone support in different countries. Online support is easier to find, through email or chat. Since you might need to contact customer service now and again, select a company that rates well on this front. Turning to platforms such as Trustpilot and Feefo gives you easy means to determine how previous customers feel about the companies you shortlist.

Conclusion

There is no single overseas money transfer company that works equally well for everyone, given the varied requirements. To narrow down on one that suits your best, pay attention to aspects such as cost and speed as well as transfer and payment methods.

Tags:

budgeting,

Business,

economy,

financial planning,

Forex,

money,

tax,

Trading

November 29, 2017

Cloud Computing: Revolutionizing Construction Techniques

Cloud Computing: Revolutionizing Construction Techniques

Cloud computing is truly a game-changer; just consider these five revolutionary cloud computing applications. It’s possible to cut tens of thousands from traditional operations by reducing time necessary in regard to bureaucratic management, and costs associated with information technology.

On a job-site, the right cloud solutions can get everybody “on the same page” more quickly, provide for remote monitoring, clock-in/clock-out procedures, and information provision. Managers of a given site can more cohesively lead their workers, and those funding a given project can watch its progress in real time.

Beyond convenience and complication reduction in operations, many financing construction projects are becoming increasingly interested in problem prevention. There are many situations where a tiny change like a halt in building could have stopped a much bigger, costly problem from happening.

With the cloud, such close monitoring is more realistically feasible than it’s likely ever been. When you add to that positive political trends in reference to the construction market, such innovation presents itself as a nearly essential component of modern building endeavors.

Today, there is hope on the horizon—there is light at the end of the tunnel! Brexit last year heralded in global change, and was swiftly followed by a political administrative change in the United States that is, and provided nothing politically untoward happens, will continue to be, very good for construction.

Additional Cost-Saving Solutions

If you’re looking for discount sleeper trucks, at https://www.mylittlesalesman.com/find/sleeper-semi-trucks-i2c55f0m0, you can find a fine inventory of them—according to the site: “…you’ll find new and used sleeper trucks for sale that offer comfort and have as many axles as you need to comfortably haul any type of cargo…”

With a sleeper truck you can cut down transit times when shipping specific materials, which in turn cuts down operational costs. Cloud computing solutions can help you identify areas of operations where a tweak here or there could substantively reduce costs.

There are always places where you can conserve assets and optimize your business. Always. Sometimes optimization involves acquisition of newer software solutions, sometimes it means liquidation of antiquated tech. What’s sure regardless of purchase or sale is that there’s something you can do.

Look at your regular contracted jobs at the present time. What kind of jobs characterize the majority of operations? What are common problems which occur when you’re pursuing these jobs, and how can you prepare for those problems in advance? Conservation of time is the next best thing to the conservation of money.

Time And Money

When technology solutions can save you time with minimal invasive bureaucratic rearranging, that’s a cost-effective optimization. Additionally, it can be that which provides you increased competitiveness against other construction groups who have yet to incorporate this technological upgrade.

Look at cost-savings in terms of time. How much is one hour of production worth to your company? $1,000? $10,000? $100,000? If you can save just ten hours a month through more smooth operations via technology, at these numbers you’re cutting expenses by a minimum of $120,000 a year. If you’re saving ten hours at $100k a month, you’re saving $1.2 million annually.

Little costs add up. You can be “nickel-and-dimed” to bankruptcy, if you’re not careful of this trend. At the same time, you can use such techniques to increase profit gradually over time. Attention to detail is key.

So sit down and consider the costs of operation right now, identify where you can upgrade things, and take steps to facilitate those upgrades. Little changes can produce big savings, so be diligent to conserve all that is available to you.

Tags:

Assets,

Business,

Costing,

expenses,

Financial Assistance,

investments,

money,

Property,

real estate

October 21, 2017

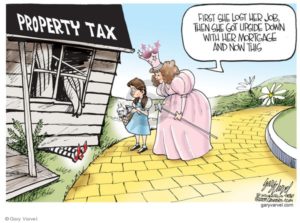

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

It is the duty of every citizen to pay taxes to the government so as to aid with national and regional developmental objectives. It’s a crime not to pay your taxes and you could face a jail term if you knowingly or unknowingly fail to make your tax payments. If you own property, whether residential or commercial, you have to make regular payments to your local and federal government in the form of property taxes. The amount you pay as property tax depends on the size and value of your property with those with large property investments paying more taxes for their property. However, the tax man may make errors when determining the value of your home and you could end up paying more than you should in taxes. If you feel that you are paying more taxes than is necessary, there are a few things that you can do to solve the situation and here are some of them.

1. Visit your local tax office.

The first step in rectifying your tax situation is to visit your local tax office. Once at the tax office, inquire to find out the valuation of your property as per their recent analysis. If you have issues with their valuation, inquire to find out what one needs to do to file an appeal. If there are fees to be paid and forms to be filled, let them tell you how much you should pay and the where you can find the tax appeal forms. It is important to do everything according to the law as deviations reduce your chances of getting your tax appeal approved.

2. Get independent appraisal.

You should hire an independent appraiser to determine the value of your home for your tax appeal. Your property may have depreciated in value from the last time the taxman assessed it and an independent appraisal will help you determine by how much. Such professionals are not free and you will have to pay for their services. The upside is that you will be able to determine the true value of your home for your tax appeal.

3. Limit outdoor construction.

Outdoor structures increase the value of a home and as a result, you will have to pay more taxes for your property. Such structures include garages, carports and outdoor shades. If you want to lower your taxes, you should, therefore, strive to limit the outdoor structures in your home or at least wait until after the next property assessment by the taxman.

4. Check with your neighbors.

If the homes in your neighborhood are the same, then you and your neighbors should be paying similar taxes for your property. You should, therefore, check with your neighbors to find out how much taxes they are paying for their homes. If you find any disparities, raise that issue with your local tax agency.

Conclusion.

Paying taxes is very important but if you find yourself experiencing difficulties in paying them and your other bills, you should consider filing for Bankruptcy in Toronto.

Tags:

Bankruptcy,

banks,

Financial Assistance,

investments,

Law,

Legal,

money,

Mortgages,

Property,

real estate

October 20, 2017

We always try to increase our assets. If we are earning more than we also save more. Sometimes we are investing in gold; we are purchasing new bonds even we are investing in stock market. But I have observed that people love to purchase new land or will increase their property. Here a real estate agency takes place.

We always try to increase our assets. If we are earning more than we also save more. Sometimes we are investing in gold; we are purchasing new bonds even we are investing in stock market. But I have observed that people love to purchase new land or will increase their property. Here a real estate agency takes place.

Now many business houses expanding their business in real estate so we are finding more real estate projects everywhere. Even these real estate agencies are giving more offers to their clients. Every country has their different real estate laws. While choosing your real estate company you can take guidance from your financial advisor regarding where to go & how. Following are the points which you need to keep in mind & I am sure these points will help you.

1. Market reputation

While choosing your real estate agency for new apartment or property you need to check what market reputation your agency has. If that real estate company is very new in the market try to avoid those companies. Go with the experienced one.

2. Previous completed projects

When you will select the experienced agency then check their previous completed projects. Check how many clients they have got for the same. Is all their created properties have been sold or not. If possible go to that completed projects & check how those are.

3. Take existing clients feedback

When you will visit to the live completed projects try to talk with their existing clients who has purchased from that real estate agency. Existing customers can give the actual views about their business because they have experienced their created properties.

4. About their competitors

Every business does have their competitors. Real estate business does have more competitors in terms of this. So, check your agencies competitors, if they are also big then go for this company. It means your agency do have some good position in this field.

5. Your specifications

While searching for your property you can set your specifications or expectations earlier. This will help your real estate agency to find the ideal property or apartment for you. If you want beach properties then specify your requirements. Here I can strike an example, recently I have visited Florida, USA & there I have found many rich beach side properties like Icon south beach, Aria on the bay, Santa maria brickell, Icon brickell etc. If you are the citizen of Florida & looking for beach property then you can search in this manner. I am sure you will get the ideal one as per your needs. In the same way you can search in the other countries also.

Before concluding the matter would like to tell you that think twice before you just jump for any real estate company because this would be a long term investment for you & the investment amount is also huge here. So, take proper assistance from your financial advisor & then go ahead. These real estate investments not only increase our property/assets it also includes more comfort in our life if your property or apartments are like that. Finally good luck from my end I hope these information will help you somewhere.

Tags:

Assets,

economy,

Financial Assistance,

investments,

Laws,

money,

Mortgages,

Property,

real estate

Irrespective of an ever-changing economic climate, some currency pairs will always be more appealing than others. This is because popularity and size of the market dictate what pairs are frequently traded. High liquidity and low spreads attract a higher number of traders.

Irrespective of an ever-changing economic climate, some currency pairs will always be more appealing than others. This is because popularity and size of the market dictate what pairs are frequently traded. High liquidity and low spreads attract a higher number of traders.

Recent Comments