February 27, 2014

Venturing into property investment can be exciting, volatile and daunting. It can also be very profitable. Ron Bakir is the CEO of HomeCorp, a large Australian urban planning company that has developed more than 1,500 residential lots across the country since its genesis in 2004. Using his wisdom, here are five reasons why you should purchase an investment property.

Venturing into property investment can be exciting, volatile and daunting. It can also be very profitable. Ron Bakir is the CEO of HomeCorp, a large Australian urban planning company that has developed more than 1,500 residential lots across the country since its genesis in 2004. Using his wisdom, here are five reasons why you should purchase an investment property.

Rental Income

One of the biggest benefits of getting into the property investment game is the receipt of rental income. Many property owners rent out their apartment, house or office space to tenants and then simply use the rent money to help pay off the mortgage. Remember to do the maths before you invest and ensure that you will receive an adequate amount of rental income to offset the cost. Ron Bakir and the team at HomeCorp also know the importance of creating supply where there is demand; is your property’s location popular with renters?

Diversification

If you’re a smart, dedicated investor, chances are that you have a diversified portfolio. This means investing your money in different asset classes, such as defensive instruments (fixed interest and cash) and growth instruments (property and shares). By doing this, you are minimising the risk that comes with investing. Think about it: if you have invested solely in shares and the market takes a dive, where does that leave you?

Freedom

Sometimes the simple things in life are the best. When you own an investment property, much like owning your own home, you are completely in control. You get to choose which type of property you will have, which tenants to lease to, what the property will look like and you can always move into the property yourself if need be. Unlike a homeowner, however, you receive the benefit of having tenants to help you make mortgage repayments instead of shouldering the entire burden alone.

Tax Benefits

Depending on your country’s tax system, there may be significant tax benefits if you purchase an investment property. Often, deductions can be claimed for expenses such as interest from any loans you paid, agent fees, depreciation, council rates, advertising, and repairs and maintenance. Ensure that you research this well in order to fully take advantage of any potential gains.

Appreciation

When you purchase something such as a car, over time it will naturally depreciate in value due to wear and tear. Similarly, the furniture and appliances within your investment property will decrease in worth as your tenants use them. Your property may even need repairs or renovations from time to time. The unique thing about property, however, is that it can increase its value or appreciate. This is, of course, if you have chosen your property wisely; if you’re in a property hotspot, your property’s value will skyrocket before you!

Will you be taking the plunge and investing in a property? Or are you a seasoned investor with tips to share? Share your thoughts now by commenting in the box below.

Tags:

economy,

Interest Rates,

investments,

loans,

money,

mortgage,

Property

February 9, 2014

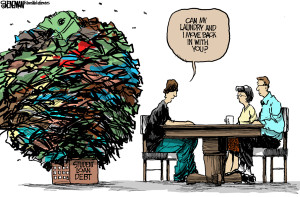

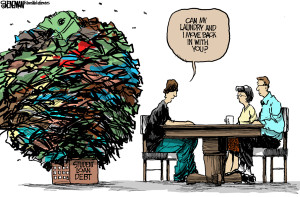

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

Education loan is one of the most popular and well-known types of funding programs just like a mortgage loan. Students who are not able to fund for their education from their own pocket would have to apply for an education loan in order to get the money they require for their education. Prominently, there are two different forms of student loans offered and those include Federal student loans and Private Student loans. Apart from these well known student loans, certain borrowers even choose a personal loan program or a secured loan for their educational need.

But, according to the financial need of the borrower, only federal student loans and private student loans are focused towards serving the purpose of providing financial assistance for the education of the borrower or his or her parents. A detailed analysis of each of these types is as follows.

Federal Student loans

Stafford loan, Perkins loan, PLUS loans, Consolidation loans etc. are the popular types of federal student loans. Of all the different federal student loans, the best pick of them all would be the Perkins loans due to lower costs and attractive benefits, but the number of Perkins loan that get offered to students per year is considerably less when compared to other types of federal student loans.

Subsidized Stafford loan and unsubsidized Stafford loan are the two types of Stafford loans. Both these types are available for undergraduate students and a graduate student would be able to apply only for an unsubsidized Stafford loan. Stafford loans are the second best type of federal student loans.

The difference between the two types is based on the interest rate charged during schooling wherein in the case of a subsidized Stafford loan; the interest rate charged on the loan when the student is studying would be paid by the Federal government whereas this is not the case with an unsubsidized Stafford loan, the interest rate charged while studying would be added up with the loan amount.

PLUS loan type of federal student loan can be obtained by the student as well as dependent parents. Of all the different federal student loan programs, the most used and applied federal student loan type is the Stafford loan. Minimum eligibility requirements, lower interest rate charges, minimum or no additional costs, flexible repayment terms make these loans the most beneficial of all.

Private student loans

Alternative student loan program is a highly risky option for a student. For those who want higher amount of cash to pay for their tuition fee and other miscellaneous expenses which may include books, laptop, stationeries, accommodation, transport etc. would find this option useful since they would be able to get higher loan amount.

With this benefit comes risk as well, since the interest rate charged on the loan would be very high. Lender would not be flexible in altering the repayment terms or any other terms of the loan, so the borrower would have no other option other than managing the risk. A good credit status is mandatory for the borrower to secure this particular loan, if not they would have to find help from a cosigner who possesses a strong financial background.

Tags:

budgeting,

debt,

financial planning,

money,

mortgage,

Students Loan

October 24, 2013

The recent proposal by UAE Central Bank to introduce a mortgage loan-to-value (LTV) cap – 75% for expats and 80% for UAE nationals – is one of the many measures that the government is working on to deter excessive borrowing, check the proliferation of cash buyers in the market who make up the majority of property purchasers in Dubai. Cash purchases have long since dominated Dubai’s real estate market – with cash-rich buyers usually acquiring properties to lease them out or sell them at an immediate profit – in contrast with end users who buy homes to live in.

The recent proposal by UAE Central Bank to introduce a mortgage loan-to-value (LTV) cap – 75% for expats and 80% for UAE nationals – is one of the many measures that the government is working on to deter excessive borrowing, check the proliferation of cash buyers in the market who make up the majority of property purchasers in Dubai. Cash purchases have long since dominated Dubai’s real estate market – with cash-rich buyers usually acquiring properties to lease them out or sell them at an immediate profit – in contrast with end users who buy homes to live in.

Today, with sale prices and rents accelerating, people looking to are looking for better value for money – not just lower interest rates, but terms and conditions and exit fees. Mortgage companies are also ensuring that clients are thoroughly vetted before lending to them. While further information regarding the mortgage cap is expected to be announced in the fourth quarter of this year, industry professionals have shown skepticism regarding the negative effects the decree may have on the real estate and mortgage industry. Hence, it is imperative that a balance is achieved between keeping mortgage opportunities attractive enough to encourage end users to buy Dubai property and at the same time act cautiously to keep speculators at bay.

In another turn of events, Dubai Islamic Bank (DIB) announced in August that it would offer UAE nationals mortgages worth 100% of their property’s value with regard to the Mohammad Bin Rashid Housing Establishment for a 25-year period. On a similar note, the government-owned Tourism Development and Investment Company partnered with Abu Dhabi Islamic Bank to offer investors 100% mortgages for luxury residences on Saadiyat Island.

This year also saw for the first time, home financing of select off-plan properties to non-residents who wish to buy a property in Dubai as a holiday home or simply invest in a second home. Mortgage providers have also been extra cautious, examining and checking all aspects of a customer’s credibility and that of the developer’s as well. However, with the number of off-plan property purchases on the decline as compared to figures before 2008, this doesn’t seem to be a cause for concern.

Throughout the course of his year, the government has made tenacious efforts to build checks and balances into the system and arm mortgage providers with the information they need to make sound lending decisions. A good example would be the recent proposal by the Dubai government to set up a judicial panel to oversee the liquidation of stalled property projects in the emirate. Such a move will offer investors a viable alternative to time consuming and expensive court procedures and enhance investor confidence.

At the end of the day, people like to invest in a market where they know their rights are protected. While there is no doubt that Dubai’s property market is maturing and the double-digit growth a reason to cheer, the 2008 downturn has surely taught us that slower and steadier progress is far better than faster, unsustainable growth.

Tags:

Home Finance,

Interest Rates,

loans,

mortgage,

Property

August 17, 2013

Refinancing is a great option that homeowners have especially when mortgage rates are lower than what they already have in place. Can refinancing a mortgage eliminate debt? The reality is that refinancing a mortgage cannot eliminate debt, although using a refinance to reduce debt can be a very successful financial strategy.

Refinancing is a great option that homeowners have especially when mortgage rates are lower than what they already have in place. Can refinancing a mortgage eliminate debt? The reality is that refinancing a mortgage cannot eliminate debt, although using a refinance to reduce debt can be a very successful financial strategy.

When refinancing, the homeowner is basically turning in the existing mortgage for a new loan. The new loan can have a different rate, a different term and a completely different program. Normally, borrowers will try to obtain a lower mortgage rate and/or a lower term, if possible. In most cases, the standard fixed rate mortgage is chosen even when refinancing from an adjustable rate mortgage. Fixed rate mortgages offers borrowers security by knowing that the same mortgage payment will be in place for the entire term of the loan.

Debt consolidation is often done when refinancing. By doing so, the borrower is combining the balances of other debt, such as credit cards, loans, etc., and adding it to the mortgage balance. While this increases the funds needed for the mortgage, the other debt is paid off at closing. The debt is not eliminated, it is simply moved to another debt vehicle which is the new mortgage.

Moving other debt to a new mortgage can only be done if the borrower has enough equity in the home. The homeowner must also qualify for the refinance according to the lenders guidelines. This type of loan is considered a cash-out refinance and will generally have a higher mortgage rate than a no cash out loan. The new mortgage will include the funds that are necessary to pay off the other debt. The debt amount is then part of the new mortgage and is paid as part of the the monthly mortgage payment for the full term of the loan.

By utilizing a debt consolidation refinance, many homeowners are able to free themselves of the burden of carrying an overabundance of debt that must be paid on a monthly basis. This debt usually carries a higher interest rate which can make multiple monthly payments uncomfortable. Adding these expenses to a refinance often results in a more cost effective budget for a homeowner because the total debt payment is usually reduced. The end result to the homeowners is typically a better monthly cash flow.

In order to reap the benefits of a debt consolidation through refinance, homeowners must make it a goal not to incur additional debt. With less debt, a homeowner’s financial stability will can often remain intact which leads to added security in case a hardship should arise. The savings recognized from a mortgage refinance can be accumulated or used in lieu of credit cards. This is the beginning of the path to financial freedom for many homeowners. However, incurring additional debt expenses after the refinance can lead a homeowner to repeating the process with multiple debt consolidation loans which, in the end, will not be cost effective.

Everyone dreams of the day when there will not longer be a mortgage payment to make. While it may seem so far away, time does move quickly and, with careful planning, it will be a reality faster than you think. Planning a refinance with debt consolidation will also help a homeowner reach their goals of eliminating overwhelming payments on a monthly basis.

Tags:

Debt Problems,

Debts,

economy,

financial planning,

Interest Rates,

Mortgages,

refinance

August 8, 2013

The Federal Housing Administration, also known as FHA, has been insuring mortgages since the 1930s. From the time of the Great Depression, the agency has assisted low to middle income consumers in their quest to purchase a home that, otherwise, they may not be able to afford. While FHA mortgages have a reputation of being more costly for the consumer, FHA also offers other perks that make these loans attractive. Here are 6 reasons an FHA mortgage may be the better choice:

The Federal Housing Administration, also known as FHA, has been insuring mortgages since the 1930s. From the time of the Great Depression, the agency has assisted low to middle income consumers in their quest to purchase a home that, otherwise, they may not be able to afford. While FHA mortgages have a reputation of being more costly for the consumer, FHA also offers other perks that make these loans attractive. Here are 6 reasons an FHA mortgage may be the better choice:

1. Credit

When using an FHA loan, the borrower is subjected to less stringent credit requirements. For automated underwriting approval, an FHA mortgage requires that a borrower have a minimum credit score of 620 and a maximum debt to income ratio of 43%. However, manual underwriting can take into consideration additional compensating factors that are used to strengthen a loan approval. In addition, FHA will also consider non-traditional sources of credit, such as cell phone and utility bills and payments.

2. Down Payment

FHA offers one of the lowest down payment mortgage programs available to consumers. With a down payment of 3.5%, an individual with a credit middle score of at least 620 and a debt to income ratio of no more than 43% can purchase a home.

3. Gift Funds or other sources

FHA mortgages allow the borrower to use gift funds that meet approval to help fund the loan. Gifts may come from a variety of sources, such as family, friends and employers. Many borrowers will also combine an FHA mortgage with funds from state or local housing initiatives that come in the form of low interest loans or bonds.

4. FHA Refinance

FHA mortgages offer an existing borrower an easy way to refinance through its FHA streamline refinance program with no cash out. With the streamline program, a borrower is not required to submit any documentation, a credit history is not required and an appraisal is not needed. FHA relies on the borrower’s current mortgage payment history which must be satisfactory. In addition, there must be a “net tangible benefit” when refinancing with the streamline. This means that the borrower must save a certain amount of money each month through the approved refinance. However, other situations could be considered a benefit, such as moving from an adjustable rate mortgage to a fixed rate mortgage.

5. Assumable

FHA mortgages are assumable, something that is not available with conventional loans. An assumable mortgage is one that a buyer can assume from the seller at the interest rate that the seller currently has. There are some stipulations that must also be met and the borrower must be approved in order for the assumed mortgage to be accepted. However, this is a definite perk for a home seller who holds an FHA mortgage.

6. Multiple Mortgage Programs

There are many different types of FHA mortgage programs available to home buyers. The FHA 203(k) is a type of mortgage that is used when there are repairs or maintenance issues that must be addressed when purchasing a home. FHA also offers sweat equity loans for home buyers who are interested in using their sweat equity towards their down payment. Manufactured housing loans are also available through FHA. Today, FHA’s energy efficient loans are also becoming a popular choice.

The type of loan that a home buyer chooses will always depend upon their needs and their goals. It is an individual decision that requires a home buyer to become educated about what is available to them. By doing so, a home buyer can become a successful homeowner for the long term.

Tags:

Assets,

Buying,

Home,

Interest Rates,

loan,

mortgage,

real estate

Venturing into property investment can be exciting, volatile and daunting. It can also be very profitable. Ron Bakir is the CEO of HomeCorp, a large Australian urban planning company that has developed more than 1,500 residential lots across the country since its genesis in 2004. Using his wisdom, here are five reasons why you should purchase an investment property.

Venturing into property investment can be exciting, volatile and daunting. It can also be very profitable. Ron Bakir is the CEO of HomeCorp, a large Australian urban planning company that has developed more than 1,500 residential lots across the country since its genesis in 2004. Using his wisdom, here are five reasons why you should purchase an investment property.

Recent Comments